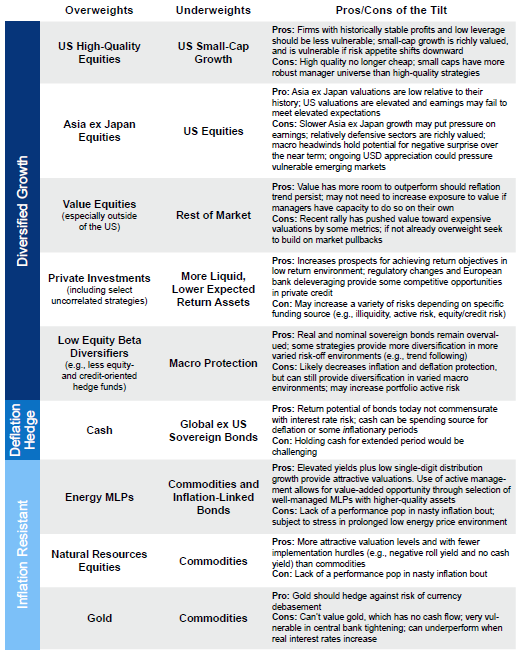

Advice in Brief

- The global economic acceleration that began last spring has strengthened, the global profit recession is over, and inflation is increasing, but remains at manageable levels. The environment is generally supportive for risk assets, but diversification is still needed, given myriad economic and geopolitical concerns.

- Given the sharp rally in global equities, we recommend rebalancing if you have not done so already. We remain neutral on global equities in aggregate, favoring Asia ex Japan relative to the United States. European equities may benefit this year, but after careful review we remain neutral.

- US Treasuries still offer a useful form of diversification. However, the long-term trend for yields is up, so strategic allocations need to be considered in that context.

- We no longer recommend overweighting TIPS relative to nominal bonds. Relative pricing now seems appropriate.

- The US dollar may continue its secular run, but we suspect that most of the appreciation of this cycle is behind us and recommend neutral positioning.

- Investments with the potential to earn returns competitive with equities, without a dependence on economic growth, are especially valuable diversifiers for portfolios. Such investments require skilled implementation and are not for everyone, as they involve headline and behavioral risks, but they deserve consideration.

Global reflation is picking up steam. The nascent global economic acceleration that began last spring has strengthened and expanded over the last year, the global profit recession has come to an end, and markets are back to climbing a wall of worries. The path of least resistance for risk assets in such environments is up. Since reaching their respective lows in early 2016, developed markets and emerging markets equities have returned over 30% in local terms, with emerging markets adding considerably more incremental return in most major currencies. Growth has been broad based—even Brazil appears to be coming out of recession. Sovereign yields have moved off the floor along with growth expectations and inflation. Markets have moved from pricing in secular stagnation to more robust growth and more normal inflation conditions. The investment climate appears steady for now, but the US economy has clearly moved into the late stages of this long, slow expansion and global political risks abound.

In this edition of VantagePoint, we review the progression of global reflationary moves and consider the investment implications for global equities, sovereign bonds, and the US dollar. We remain neutral on global equities as a whole, with our only tilt slightly favoring Asia ex Japan over US equities. Despite the rise in sovereign bond yields, we remain cautious about exposure and recommend incorporating other forms of diversification in portfolios. From a secular perspective, as many economies face deteriorating demographics and slowing productivity, exposure to investments that offer attractive returns, competitive with equities but less reliant on economic growth, can be additive to portfolios. Such investments are not without risk, but offer exposure to uncorrelated risks that pay competitive premiums. We explore some ideas that fit this description, while noting that skilled execution and a tolerance for some headline risk are required.

From Stagnation to Reflation

Please see Kevin Rosenbaum, “Is the United States Set for a Spike in Inflation?,” CA Answers, February 28, 2017.

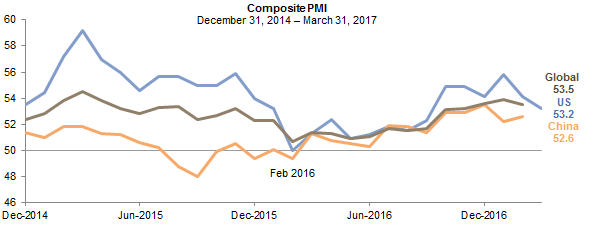

What a difference a year makes. From late 2015 through early 2016, the global economy was gripped by deflationary fears, weighing heavily on emerging markets and commodities. In contrast, 2017 has begun with good prospects for reflation amid business activity indicators that are firmly back in expansionary territory across most developed and emerging markets. The general rise in commodity prices, improvement in employment conditions, and reduction in global excess capacity have lifted investor concerns over deflation. Indeed, some investors have become concerned that inflation is now the greater worry. Our read on the situation is that inflation is picking up from very low levels, primarily driven by commodity prices that are flattered by a low base effect. Absent a resurgence in commodity price appreciation, inflation is likely to remain tame as the base effect of low beginning point commodity prices phases out of the headline numbers. However, inflation risk is now skewed to the upside, particularly in the United States, which is further along in the economic cycle than most major economies.

Sources: J.P. Morgan, Markit Economics, and Thomson Reuters Datastream.

Notes: Composite PMI includes both manufacturing and services PMI surveys. A reading above 50 implies expansion of activity while a reading below 50 implies contraction in activity. Data are monthly. China and Global PMI data as of February 2017.

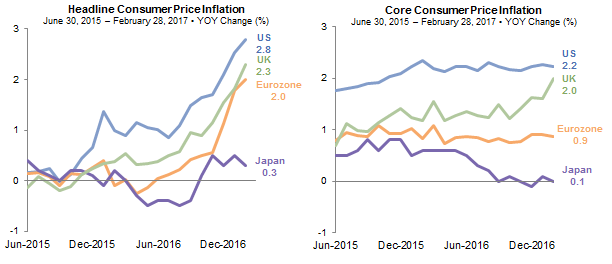

The difference between headline and core inflation, which excludes food and energy, reveals the transitory nature of inflation in most economies. Prospects for slightly higher core inflation should be expected in the Eurozone, presuming employment conditions continue to improve and GDP growth remains above potential, as expected. The United States is seeing the highest rate of core consumer price inflation but, as measured, consumer price inflation remains relatively tame. Purchase price inflation in China has increased significantly in concert with a falling trade-weighted RMB. While further weakness in the RMB may be forthcoming, the pace of decline is unlikely to be sustained. In contrast to past cycles, China’s inflation has been concentrated in mining products and other producer goods, which has been offset to some extent by weakness in consumer goods inflation, particularly food. While inflationary pressures may increase, China has begun tightening measures—particularly targeting real estate prices—and maintains capital controls to seek to stem the tide of outflows.

Sources: Thomson Reuters Datastream and US Department of Labor – Bureau of Labor Statistics.

Note: Data are monthly.

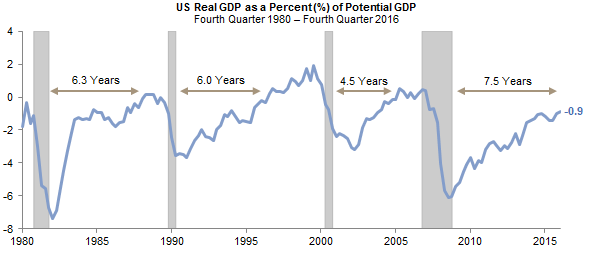

Among major economies, the United States appears at the highest risk of an inflation overshoot relative to what markets are pricing in, as it is in the late stages of the economic cycle—the phase of the cycle when the labor market gets tighter, input costs start to rise, and inflationary pressures prompt central banks to tighten and slow growth. A significant increase in demand today, perhaps brought about by the Trump administration’s plans to cut income taxes and increase infrastructure spending, could ignite inflation and/or result in the Federal Reserve raising rates at an accelerated pace, which in turn would likely bring forward the next economic recession. Certainly corporate tax reform and a reduction in regulations could provide a boost to productivity, bringing supply and demand more in balance, particularly if these reforms result in an increase in business investment. But it is unclear at this point how these policies will be shaped and what the timing will be. Income tax cuts would have a relatively immediate effect on demand, while a pullback in regulations and increased business investment, even in the most effective circumstances, would take some time to translate to increased productivity. Even without policy developments, the economy is expanding well ahead of potential and the output gap is starting to close. While first quarter GDP growth appears soft (as it has been for seasonal reasons for the last eight years), real final demand (which excludes inventories, net exports, and government spending) is still growing at 2.5%.

There are two key distinctions between this cycle and previous ones. First, excess capacity and high inventories in commodities should keep most commodity prices relatively contained. Second, the slow-moving economic expansion has given investors little to worry about on the inflation front. This expansion is on pace to be one of the longest on record, as it has taken eight years of expansion to bring the economy within striking distance of its potential based on Congressional Budget Office estimates. However, economic slack is closing, the unemployment rate at 4.5% is quite low, and wage pressures are creeping up. Theories that labor slack is greater than reflected in this headline number due to a lower participation rate ignore the implications of an aging population and that those who have been out of the labor force for an extended period of time are generally less readily employable.

Sources: Federal Reserve Bank of St. Louis FRED database and US Congressional Budget Office.

Notes: Shaded areas represent US recession periods. Data are quarterly.

For further discussion, please see “Outlook 2017: A Break in the Clouds,” Cambridge Associates Research Report, 2016.

Overall, economic growth is strengthening globally and inflation is increasing, but remains at manageable levels. Credit conditions remain supportive of growth, as interest expenses are still well covered by income levels, although this affordability bears watching as interest rates increase. The global economic revival should not be overstated. Growth expectations are moderate, not strong. The IMF expects global economic growth of 3.4% this year, up from 3.1% last year, but still below the 3.7% average annual growth since 2009. In short, the environment is generally supportive for risk assets, but diversification is still needed, given a myriad of economic and geopolitical concerns.

Neutral on Global Equities

Given these generally supportive conditions, we remain neutral on equities in aggregate. However, given how much they have appreciated over the last year, we recommend rebalancing (particularly more expensive US equities) if you have not done so already. Within equities we are keeping close to neutral allocations, recommending a modest overweight to Asia ex Japan funded by US equity allocations. We considered overweighting Eurozone equities once again, as economic growth and earnings have shown some upside surprise, while prices have been constrained by politics. If political outcomes are more favorable than anticipated, equity markets could rally, unwinding risk premiums that have weighed on the market. After some deliberation, we remain neutral.

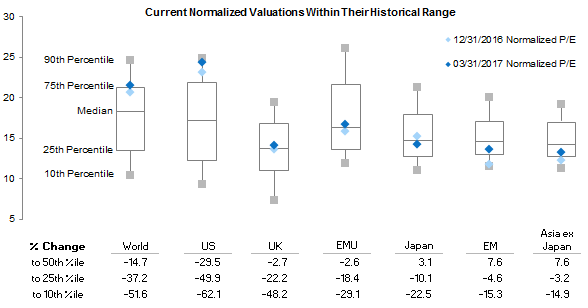

Among major equity regions, US equities are the only market with pricey valuations. Our composite normalized price-earnings metric crossed 20 in October 2013, and has moved in a narrow range of 20–23 since that time, returning a cumulative 41% (11% AACR) and outperforming other developed markets and emerging markets. Valuations have become even more stretched this year, and are approaching the top 10th percentile of historical valuations—an extreme that historically has meant long-term returns are more likely to disappoint. In the near term, a pullback from such lofty levels should be expected amid any disappointment, as the trajectory of the markets has been strong and the rally, extended.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: Composite normalized price-earnings (P/E) ratio is used for World, US, UK, and EMU. Return on equity (ROE)–adjusted P/E ratio is used for Japan, EM, and Asia ex Japan. The composite normalized P/E ratio is calculated by dividing the inflation-adjusted index price by the simple average of three normalized earnings metrics: ten-year average real earnings (i.e., Shiller earnings), trend-line earnings, and ROE-adjusted earnings. Observation periods begin: January 31, 1970, for World; December 31, 1969, for US and UK; April 30, 1998, for EMU; January 31, 2002, for Japan; September 30, 1995, for EM; and November 30, 1995, for Asia ex Japan.

Catalysts for such disappointment could easily be home grown as markets appear to be pricing in a reasonable boost to earnings from the Trump administration’s proposed fiscal policy agenda and a low probability of negative implications from protectionist policies. Throughout March, US equities moved in concert with the expectations for passage of the proposals. From this perspective, volatility should be expected. Despite a Republican majority in both houses of Congress, the party is divided on some key considerations and progress may be slower and less substantial than initially anticipated by markets. For example, bipartisan support will likely be required to pass comprehensive tax reform and some compromises will need to be made. Further, while deregulation can provide a boost to growth, not much can be done to peel back regulations until the government agencies responsible for them are more fully staffed. Equity markets may need to readjust expectations. In short, much of the positive outlook has been priced in to the market, so there is room for disappointment.

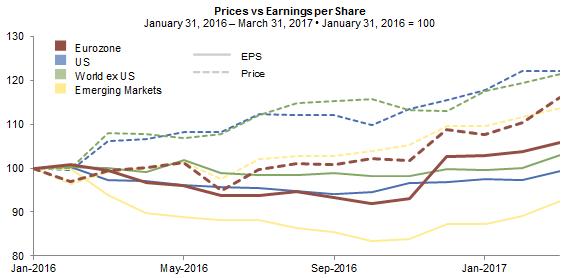

While US equities have risen ahead of expectations, so have equities generally, even as leadership has rotated since the start of last year. The Eurozone has been the exception. Prices have stayed more or less in line with earnings growth as the market has been held back by concerns over the future of the European Union in the wake of the Brexit vote and in the face of a slew of important elections this year and next. With the market focused on the French presidential election, a defeat of Marine Le Pen (the anti-EU, far right leader of the National Front) could cause Eurozone equities to rally strongly. However, betting on political outcomes is hazardous these days and the Eurozone market is not cheap enough to provide a reasonable margin of safety from our perspective. While centrist Emmanuel Macron is expected to defeat Le Pen in the second round (should they both move on as expected), and the polls may have the outcomes right this time, it is too premature to call the election, particularly with Le Pen’s loyal following, much unknown about Macron, and many undecided voters.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Even if Le Pen is elected, she would be highly unlikely to lead France out of the EU, as a supermajority in the National Assembly is required to change the constitution. However, risks in the Eurozone would remain elevated and investors would shift their focus to Italy, arguably the biggest risk in Europe. Elections must be held by May 2018 amid political instability following roughly a decade of low economic growth, high unemployment, and elevated debt levels.

Still, we recognize that global reflationary trends are supporting the Eurozone; unemployment rates, while still elevated, are coming down; and earnings growth is improving, albeit from very low levels. We will continue to monitor conditions in Europe, but for now we remain neutral. Earnings growth is tentative and driven by just a handful of cyclical sectors, and valuations are simply neutral, not cheap.

Please see the discussion on emerging markets in “Outlook 2017: A Break in the Clouds,” Cambridge Associates Research Report, 2016.

The cheapest markets today are the emerging markets. We continue to recommend a slight overweight to Asia ex Japan, which should benefit from expansion as local conditions and global trade improve. The risks to this position continue to be two-fold: China’s debt situation and potential USD strength that could challenge emerging markets. However, emerging markets have improved their financial strength since the “taper tantrum” in 2013, and have more capability to navigate through a period of higher US rates and a stronger US dollar.

Sovereign Bonds Better, But Not Great

Please see Aaron Costello, “Is the Bond Bull Market Over?” CA Answers, November 15, 2016.

For more discussion, please see the fourth quarter 2016 edition of VantagePoint, published October 17, 2016, as well as Gene Lohmeyer, “Befriend the Trend: An Overview of Managed Futures investing,” Cambridge Associates Research Report, 2014.

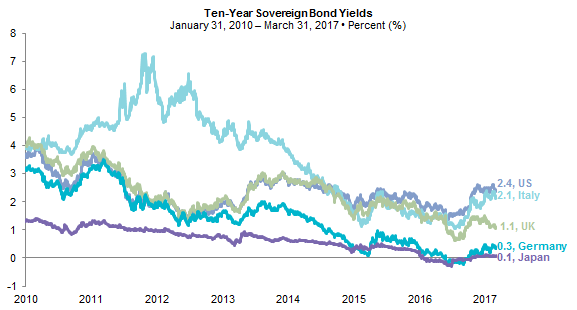

Global reflation has brought some relief to bond investors. The yield on the ten-year US Treasury increased 125 basis points (bps) from a secular low of 1.37% on July 5, 2016, before settling down at roughly 2.4%. While expected returns are not generous at this level and provide little compensation for inflation risk, valuations have just moved into our fair value range. Treasuries merit some allocation given the risks are less skewed to the downside than was the case just six months ago. Although we believe we have seen the cyclical and secular low in US Treasury yields, they still offer a useful form of diversification, as repeatedly demonstrated. Yields will not go up in a straight line and will continue to be influenced by the economic cycle. However, the long-term trend is up, so strategic allocations need to be considered in that context. We continue to recommend diversifying your diversifiers to include strategies like trend following and selective allocations to hedge funds with low correlation to equities and credit in times of stress.

Source: Thomson Reuters Datastream.

Note: Data are daily.

Sovereign yields elsewhere also have been pulled up, with ten-year German bunds moving out of negative nominal territory and UK yields now topping 1%. However, such bonds offer little value to investors (other than for liability matching purposes). Holding some cash in lieu of such bonds is sensible, particularly where the yield curve is relatively flat (e.g., German bunds) and the opportunity cost of holding cash is low.

While a dominant investment theme of the last couple of years has been one of monetary policy divergence between the United States and the Eurozone and Japan, we believe policy convergence is an evolving theme that is not fully priced in to the market. Given the Bank of England’s stance on remaining accommodative until there is more clarity on the economic effects of Brexit, and the continued absence of inflation approaching anywhere near Japanese targets, we expect this convergence to begin in the Eurozone. From a technical perspective, unless the European Central Bank (ECB) revises its existing rules, it will not be able to continue sovereign purchases in smaller countries by first quarter 2018. How long can the ECB continue to keep monetary policy at emergency levels when asset price inflation, particularly in real estate, is becoming an issue in places like Germany? The probability that the ECB will end quantitative easing and raise rates next year is increasing. Assuming global reflationary conditions continue, the ECB will likely begin setting expectations for further tapering and even rate normalization toward the end of this year. This should put some upward pressure on yields and would potentially begin to reduce demand for US Treasuries, which have seen a strong bid from yield-starved European investors. The obvious wildcards to this view are that political risks create significant demand for core sovereign bonds (pushing yields down regardless), commodity prices fall to a degree where they dampen headline inflation, and the tightening bias of the Fed proves to surprise more significantly than that of other major central banks.

A broader discussion of our rationale can be found in the second quarter 2016 edition of VantagePoint, published April 21, 2016.

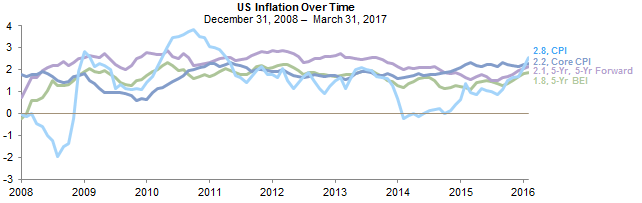

With higher inflation and still low nominal yields, do inflation-linked bonds offer better prospective returns? In March 2016, we recommended overweighting US TIPS relative to nominal bonds. At the time, headline inflation trailed core inflation and inflation expectations based on the breakeven inflation rate (the spread between nominal and real yields of the same maturity) was below core. We anticipated breakeven inflation would increase when headline inflation converged with core inflation, to the benefit of TIPS investors. This convergence has transpired, as headline inflation and inflation expectations have increased. With breakeven inflation now roughly at 2% for five-year and ten-year horizons, we no longer recommend overweighting TIPS relative to nominal bonds. As discussed, inflation may still surprise to the upside, but TIPS remain expensive in absolute terms at ultra-low yields and inflation expectations have reached more appropriate levels. Breakeven expectations in global inflation-linked bonds are also reasonable, even on the high side in the United Kingdom at nearly 3% based on ten-year yields. Inflation may well run ahead of expectations, but for now, relative pricing seems appropriate.

Sources: Federal Reserve Bank of St. Louis FRED Database, Thomson Reuters Datastream, and US Department of Labor – Bureau of Labor Statistics.

Note: CPI and Core CPI are year-over-year percent change. Five-year, five-year forward represents expectations for inflation for the five-year period five years from now. Five-year BEI represents the breakeven inflation rate derived from five-year Treasuries and TIPS.

Dollar Strength Past its Prime

For more discussion, please see Aaron Costello, “The Final Phase of USD Strength,” Cambridge Associates Chart Book, February 2017, and “What’s Next for the US Dollar?,” CA Answers, March 14, 2017.

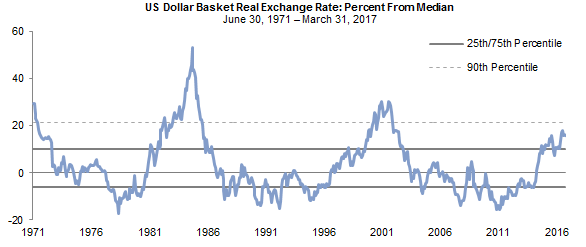

Developing monetary policy convergence naturally raises questions about the durability of the USD bull market that has been in force since August 2011. By historical measures, this cycle still has room to run. The two other major USD bull market cycles have seen the currency appreciate at least a year longer and 10%–15% higher than it has in the current 5.5-year cycle, which has seen nearly 40% appreciation on a real effective exchange rate basis. Further, even as the US dollar is overvalued, it historically has moved well into overvalued territory before reversing course. From the end of 2014, we have recommended that USD-based investors with meaningful (e.g., 20%+) foreign currency exposure hedge at least a portion of this risk. While the US dollar may well have more ground to cover before this cycle is over, we no longer recommend an overweight.

Sources: MSCI, Inc., and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: Real exchange rates are based on relative consumer prices. Historical median is calculated from July 1971 onward. The USD Basket is a weighted average of six currencies: the Australian dollar (10%), British pound (20%), Canadian dollar (10%), euro (30%), Japanese yen (20%), and Swiss franc (10%).

This advice pertained to developed market currencies, as the negative carry incurred in hedging emerging markets currencies can make such hedges too costly to implement. See the first quarter 2015 VantagePoint, published January 20, 2015.

For investors with reference currencies that were under pressure, our advice since the end of 2014 was to seek to overweight USD exposure either by decreasing currency hedging ratios or by increasing exposure to relatively attractively priced USD assets, such as US TIPS relative to global inflation-linked bonds, particularly to those issued by Eurozone sovereigns. Overweighting US TIPS relative to global inflation-linked bonds had two other benefits: the potential to pick up positive carry and to earn more on the inflation accrual with higher inflation in the United States. While US inflation is running hotter than most other issuers of developed markets inflation-linked bonds, the coupon differential has narrowed considerably.[1]For example, US TIPS offer a yield lift of only 40 bps relative to global inflation-linked bonds, which falls to only 18 bps if you exclude ultra-expensive UK linkers. For these reasons, we also no longer recommend overweighting US TIPS relative to their global peers.

These recommendations were initiated on an expectation for continued USD appreciation relative to other developed markets currencies on the back of monetary policy divergence and stronger US economic growth. Although, as noted, further upside to the US dollar is possible and likely to transpire before this cycle draws to a close, the currency is not too far from the very overvalued levels that have seen previous cycles turn. The strength of the US dollar ultimately depends on US fiscal and trade policies and any policy response by other governments. The proposed border adjustment tax included in the US House tax plan is expected to cause the US dollar to strengthen, potentially significantly.[2]While the House plan presumes that a border adjustment tax at a 20% rate would cause the US dollar to appreciate 25% over time, this may not transpire for many reasons. Most persuasive among these … Continue reading However, opposition in the Senate and from business leaders make its passage unlikely. Any bilateral protectionist moves would likely be narrowly focused and would not necessarily result in USD appreciation relative to major developed market currencies.

The final phase of USD strength may wait to arrive until the Fed reaches the end of its tightening cycle, which could be a couple years coming. At the same time, the divergence in monetary policy may be closing as inflation increases in the United Kingdom and European Union and economic growth in the latter appears to be strengthening. Given this uncertainty, we recommend keeping on strategic hedges, while taking profits on tactical positions that have paid quite handsomely over the cycle.

Diversifying Dependence on Economic Growth

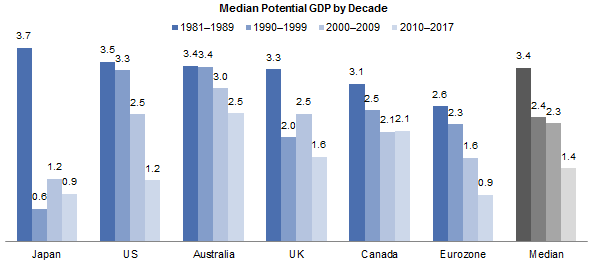

The current cyclical economic upswing should be taken in the context of secular challenges to economic growth. Productivity and demographics remain long-term challenges, with potential GDP contracting in most developed markets over recent decades. While the decline in productivity measures may be overstated, as improvements from technological developments are difficult to measure, the drop off has been considerable in many countries and is corroborated by the failure of non-residential fixed investment to accelerate as a percentage of GDP. Productivity can improve and is difficult to predict, but demographics will have an influence for some time absent liberal immigration policies, which are against the political tide today. Further, continued long-term leverage concerns in many economies (particularly if you consider unfunded retirement and health obligations) weigh on long-term growth prospects. As a result, investments with the potential to earn returns competitive with equities, without a dependence on economic growth, are especially valuable diversifiers for portfolios.

Sources: Oxford Economics and Thomson Reuters Datastream.

Note: Potential GDP is calculated as productivity growth plus labor force growth.

Such investments are varied, sometimes niche, and require skilled implementation. Many require some illiquidity, but may compensate by distributing income. Headline risk is also often a major consideration, so such investments are not for everyone. Potential investments are wide ranging and varied, including life insurance settlements, health care royalties, investment in insurance run-off businesses, and more. We continue to evaluate these opportunities, looking for best-in-class managers to participate in these strategies. We profile two of these strategies, life insurance settlements and pharmaceutical royalties, below.

Not Your Father’s Life Settlement Market. Life settlements are the sale of life insurance policies by the original owner to a third party. The third party becomes the new owner, is responsible for payment of premiums, and becomes the beneficiary. From an investor’s perspective, investments in pools of diversified, carefully selected life settlements provide the opportunity to earn net low- to mid-teens returns that are uncorrelated with typical portfolio exposures, having little if any sensitivity to economic conditions. For policyholders, the life settlement market provides a means for individuals to cash out of their policies at a value higher than the cash surrender value, but less than the net death benefit. Benefits to individuals can be significant based on reports from managers as well as independent academic research. One comprehensive study[3]Januario, Afonso V. and Naik, Marayan Y, “Testing for Adverse Selection in Life Settlements: The Secondary Market for Life Insurance Policies,” SSRN, July 23, 2014. found that, in aggregate, the 9,000 policyholders in their database received life settlements worth four times the cash surrender value. The life settlements market can benefit people who would otherwise surrender their policies or allow them to lapse. It can also benefit policyholders whose life insurance needs have changed.

The life settlements industry has evolved significantly since its early days. The 1980s viatical market that focused on the purchase of life insurance policies of AIDS patients and other terminally ill individuals with less than two years to live is now a relic. Today, the life settlement market has matured, is more regulated, and more transparent. Insureds accessing the life settlements market are typically over 65 years of age with life expectancies of more than a decade and are not terminally ill. The largest market is the United States, but life settlements also transact in Germany and the United Kingdom. Predatory practices—where promoters would encourage seniors to take out life insurance policies, only to surrender them for much less than market value so that they could be resold for full market value in the secondary market—are now rare. In the United States, all but eight states require at least a two-year waiting period between purchase and sale of life settlements, and ten states require a five-year waiting period.

Estimating longevity is a key determinant of returns and, as such, underwriting skill is critical, as is diversification. Portfolio managers can mitigate risk by diversifying across medical conditions, age of insured, policy vintage, life expectancy, insurance carrier, and policy size. The confidence interval of life expectancy increases considerably as the number of individual policies increases. For example, one study found that increasing a sample size from 100 to 400 individuals halved the error in a 95% confidence interval from roughly two months to one month.[4]Siegert, Paul and Kampa, Christopher, “The Effect of Life Settlement Portfolio Size on Longevity Risk,” SSRN, August 1, 2008. Even with such diversification benefits, underwriting skill is required, as consistent underestimation of longevity can materially hurt returns. Other potential risks include legal risks (e.g., chain of title, adhering to state regulations, potential policy fraud) and possibly premium financing risk, which can be avoided or mitigated by specialized managers.

While life settlement investments are largely uncorrelated with the economy, there is one indirect, but emerging correlation. Insurance companies historically have not been willing to increase premiums out of concern that doing so would hurt future business prospects. However, increases in premiums have recently become more common. One trigger that may be somewhat economically influenced is when insurance companies choose to raise premiums under threat of losing their credit rating following poor financial performance. Managers seek to mitigate this risk by reflecting the risk of premium increase as part of the underwriting process and by limiting their exposure to any one issuer.

Pharmaceutical Royalties. Investments in pharmaceutical royalties, or other synthetic royalties that link cash flow payments to pharmaceutical net sales, can provide low double-digit net returns to investors with limited correlation to equity and credit markets and general resilience to economic conditions. Pharmaceutical revenues have been increasing as prescription drug penetration has increased. According to the latest data from the Centers for Disease Control and Prevention, as of 2012, 59% of all US adults surveyed take prescription drugs, compared to 45% a decade earlier. Aging demographics support this trend, as 90% of US persons aged 65 and older take prescription drugs based on survey data, up from about 85% a decade earlier and well above the rate of the broader population. At the same time, global spending on health care has increased as a share of GDP. Health care spending has increased from 9% of GDP in 2000 to about 10% as of 2014.

Given the attention being paid to controlling health care costs in the United States, one critical risk to this strategy is the potential for the regulatory framework to change in a way that lowers pharmaceutical pricing. A bill introduced in Congress last fall would place transparency requirements on companies that increase prescription drug prices by more than 10% a year.[5]H.R. 6043, Fair Accountability and Innovative Research Drug Pricing Act of 2016, was introduced last September. The bill was co-sponsored by Senator John McCain (R-Arizona) and Representative Jan … Continue reading In addition, once a commissioner is confirmed for the Food & Drug Administration, the agency may speed up approval of generics, which would be expected to reduce pricing, but increase volume in that market. More broadly, as we go to press, following the failure of the Trump Administration to repeal and replace the Affordable Care Act, a number of states are reconsidering participation in Medicaid expansion. Such expansion may increase demand for approved drugs, but would also decrease net revenues after rebates are considered. Drugs with high efficacy rates and unique clinical advantages should continue to be well positioned to preserve purchasing power. Understanding pricing and volume dynamics are a critical part of underwriting.

Experienced managers with a deep understanding of the complex pharmaceutical market and strong financial and underwriting skills can mitigate price risks. Conservative and carefully evaluated revenue estimates and investment structures can improve outcomes, but investors should recognize that protections included in synthetic royalties often come at the expense of limits on upside return potential. Transactions are structured in a variety of ways. The simplest is a traditional royalty in which the manager buys all or part of a royalty contract from the intellectual property owner (e.g., biotech companies, hospitals, inventors, pharmaceutical companies, research institutes, universities). The transaction gives the purchaser the right to receive future royalty cash flows. Sellers will monetize their royalty licenses for a variety of reasons, including using proceeds to fund large capital projects, contribute proceeds to endowments, fund additional research, or offset operating deficits. Corporations, such as pharmaceutical and biotech firms, will sell royalty interests to fund research or sales and marketing of products either as a complementary source of financing that is non-dilutive or because they cannot otherwise gain access to capital. Traditional royalty contracts also provide protections in the case of insolvency of either party. US bankruptcy rules specifically exclude patent license agreements from bankruptcy proceedings, and require that royalty payments continue to be made even if the asset is sold to a new firm. In contrast to traditional royalties that are typically linked to established products and large investment-grade marketers, structured royalties often take the form of senior-secured loans issued against less proven products and/or small, non-investment-grade companies. In a downside scenario, poor management execution could result in royalty manager taking control of assets.

Clearly such investments are not without risk, but capturing risk premiums that are not as influenced by economic conditions is valuable. Successful implementation provides attractive expected returns and diversification for those that can afford to take some illiquidity, behavioral, and headline risk. Behavioral risks may assert themselves in a strong equity bull market, as the diversification properties also mean such investments won’t see as much upside as equity-oriented illiquid investments in such an environment.

Conclusion

As investors have come to recognize the improvement in economic conditions, risk assets in markets across the globe have rallied sharply. As such, we recommend rebalancing if you have not done so already. Macroeconomic conditions are supportive, but much hope has been priced in to the markets ahead of improvement in fundamentals. In the United States, markets are likely to continue to exhibit volatility as investors adjust their expectations for comprehensive corporate and individual tax cuts and infrastructure spending to pass, as achieving these goals will be challenging even with a Republican majority in both houses of Congress. We remain neutral on global equities, favoring emerging markets, particularly Asia ex Japan, relative to US equities. European equities may benefit this year if political risks diminish and earnings growth accelerates, but we remain neutral absent cheaper valuations. The US dollar may continue its secular run, but we suspect that most of the appreciation of this cycle has already occurred and recommend taking profits and moving to neutral positioning, as we appear to be entering the early stages of monetary policy convergence. We continue to evaluate opportunities to diversify diversifying assets given low yields have diminished sovereign bond appeal from a long-term perspective. For those investors able to take some illiquidity risk, a wide range of investment strategies with limited economic exposure offer competitive returns to equities. Such investments require skilled implementation and are not for everyone, as they involve headline and behavioral risks, but they are well worth consideration. ■

Footnotes