In recent years, monetary policy has been extremely accommodative, flooding financial markets with capital. This propelled asset valuations to near all-time highs and exacerbated vulnerabilities in asset prices. Several central banks across the globe have raised policy rates in response to inflation concerns, with the US Federal Reserve expected to follow suit in coming months. In this piece, we examine how rising US policy rates have impacted US risk assets historically and consider how assets may react today. Ultimately, tighter financial conditions may cap the upside potential for risk assets, such as equities and credit. Within these two asset classes, the risks are particularly pronounced in growth stocks and investment-grade (IG) corporate bonds.

Tighter Financial Conditions, Flatter Yield Curve

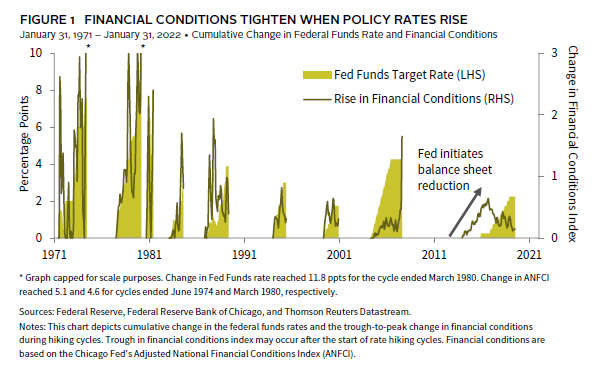

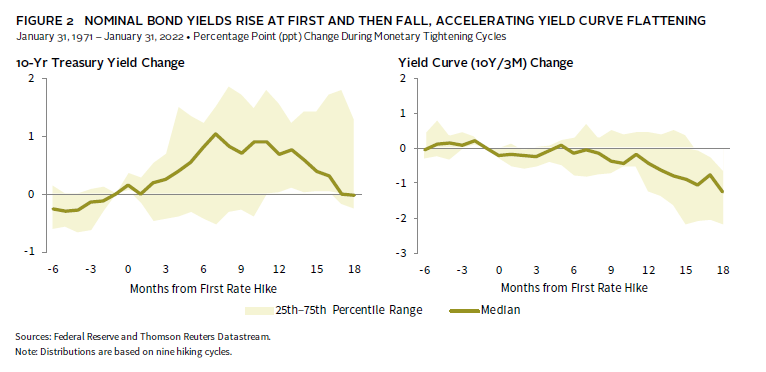

Rising policy rates typically lead to tighter financial conditions. One notable effect of tighter monetary policy is that it has historically caused the Treasury yield curve to flatten. This typically happens in two phases. First, rising policy rates put upward pressure on the “real yield” component of nominal Treasury yields, which has already started happening. Rising real yields have historically caused the long end of the nominal yield curve (ten-year to 30-year) to rise initially. Based on the average experience over the past nine policy rate rising cycles, nominal ten-year yields rose by about 100 basis points over the course of six months, which implies that current nominal yields would move up into the 2.5%–3.0% range over some period of time. However, historically there has been a wide distribution of outcomes.

Second, tight financial conditions often eventually put downward pressure on breakeven inflation rates, the implied inflation expectation embedded in nominal bond yields. This is because rate hikes aim to reduce the flow of credit and prevent any overheating in the economy. Reduced inflation expectations would disproportionately push down nominal yields at the long end of the curve, flattening the yield curve.

This means that the yield curve will likely keep flattening as long as the Fed maintains a hawkish policy stance. These dynamics have important implications for risk asset performance.

Rising Policy Rates Tend to be a Headwind for Equity Valuations

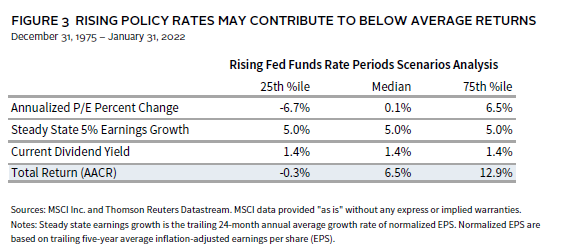

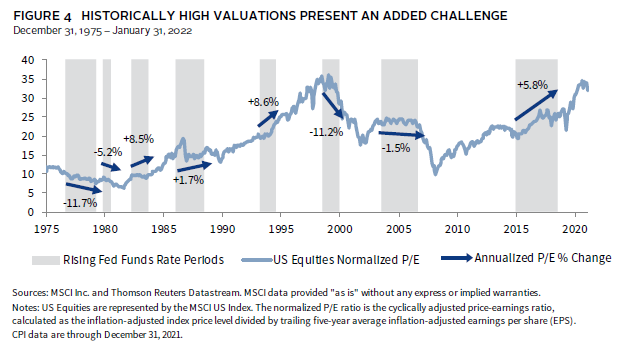

In a typical rising policy rates cycle, normalized price-earnings (P/E) ratios for US equities rise initially, but peak after the onset of tightening, often coinciding with the crest of the long end of the yield curve. We can combine historical P/E changes with recent trend earnings growth and the current dividend yield to get a sense of potential return outcomes in a tightening cycle for US stocks. For instance, if we take the median historical change in valuations, assume a steady earnings growth figure of 5%, and use the current dividend yield, the combination would suggest that equities would return 6.5% annualized.

In the two most recent tightening cycles—during the lead up to the 2007–09 global financial crisis and from 2015–19—stocks were able to digest rising rates well. Both periods featured economic expansions that supported revenues, and deregulation and tax cuts that led to profit margin improvement.

However, these experiences do not seem like good corollaries for today’s environment, given the backdrop of extremely expensive starting valuations, expectations for decelerating—albeit, above trend—economic growth, and margin pressures building. With that in mind, US equities may return less than their long-term average during this part of the cycle.

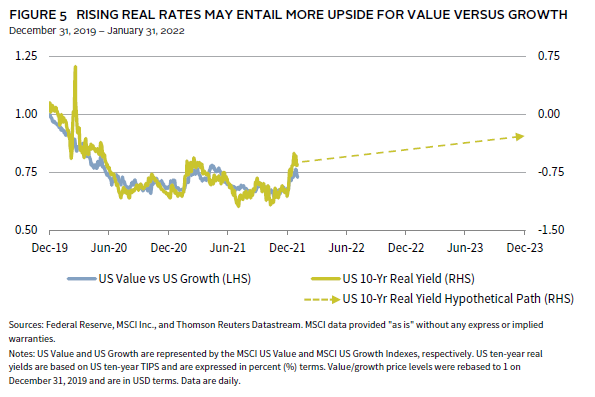

Within equities, investors may be able to enhance returns by avoiding speculative growth stocks and tilting toward both quality and value. Speculative growth stocks are the most sensitive to rising rates and often have no earnings or dividends to offset P/E declines. It appears these companies were oversold in January and could possibly continue to rebound; however, quality and value seem to have room to run versus growth. Quality stocks have generally outperformed amid central bank tightening historically—given strong and stable cash flows—though current high valuations present some risk. Meanwhile, value stocks remain historically cheap relative to growth stocks based on normalized P/E ratios. Further, if real rates continue to rise it may be supportive for value stocks to extend outperformance versus growth stocks.

Credit Yields May Rise as Policy Rates Move Higher

Within credit markets, investors should anticipate that tighter monetary conditions may cause credit yields to rise, which would lead to below-average price performance.

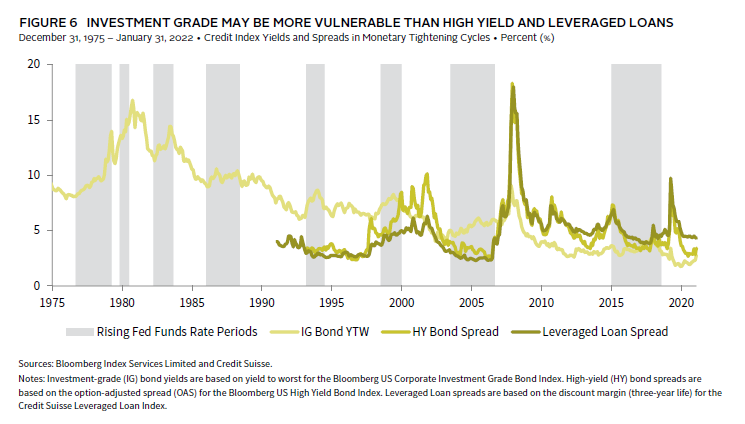

Credit assets that (1) are less sensitive to rising real risk-free rates and (2) offer a reasonable yield to offset price declines would be poised to outperform within the credit space. In this respect, IG corporate bonds seem uniquely vulnerable to tightening financial conditions as prices today are approximately 50% more sensitive to changes in yields than average, given all-time high durations, and paltry yields can do little to buffer price declines.[1]Data based on the Bloomberg US Corporate Bond Index for investment grade, the Bloomberg HY Corporate Bond Index for high yield, and the Credit Suisse Leveraged Loan Index for leveraged loans.

Prospects for high-yield (HY) corporate bonds are better than for IG bonds. This may seem counterintuitive given the higher-risk profile. However, HY bonds offer a 5.3% yield compared to 2.8% for IG bonds (this 1.9 times HY-to-IG yield ratio is above historical average). Further, a larger portion of the yield can be attributed to credit spreads for HY bonds (70%) than for IG (40%). Therefore, HY bonds are typically more vulnerable to credit risk (and relatedly to an economic downturn), but less sensitive to rising interest rates. Historical data supports this logic—HY bonds have outperformed IG bonds in four out of five Fed tightening cycles since 1986.

Leveraged loans may offer more interesting prospects than both IG bonds and HY bonds. Leveraged loans are floating rate instruments and are therefore less sensitive to rising yields than both IG bonds and HY bonds. Further, discount margins—the difference between a leveraged loan yield and the underlying risk-free rate—have typically widened by less than HY bond spreads in past tightening cycles. Finally, with current yields at 5.7%, interest earned could more than fully offset price declines, based on the average price decline in prior hiking cycles. The credit quality for the leveraged loan market has declined in recent years, but barring an economic downturn, leveraged loans could outperform both IG bonds and HY bonds.

Conclusion

To understand what may lie ahead, investors should consider past rate hiking cycles. Should inflation continue to come in above target, the Fed will remain pressured to tighten. Based on evidence from past rate hiking cycles, a faster pace of tightening may lead to a decline in P/E ratios for US equities broadly and further underperformance for growth stocks. Additionally, credit yields would likely continue rising, with IG bonds poised to underperform. Conversely, if inflation moderates on its own—for instance, as supply constraints resolve—it would likely mitigate some urgency for the Fed. A slower pace of policy rate rises would potentially be supportive for risk asset valuations broadly, assuming the growth outlook remains unchanged.

Joe Comras, Associate Investment Director, Investment Strategy

Footnotes