In this Edition:

- Europe focuses further on banking regulations

- Pending margin rules on uncleared swaps

- US banks appear to be heeding regulators’ advice on not lending to highly leveraged buyouts

New Regulations on the Horizon in Europe

US and global regulations start to converge

Europe has seen a significant amount of activity on the regulatory front. In many cases, the issues regulators are seeking to address will be familiar to investors as they mirror US regulatory initiatives. However, as one might expect, not all of the rules are harmonized, creating another complexity for entities that operate in multiple jurisdictions.

While some commentators believed that the European Union’s (EU’s) answer to the Volcker Rule might get sidelined given continued pressure from banks and home country regulators, the European Parliament is expected to consider the proposal in September 2015. EU regulators floated the proposed Regulation on Bank Structure (BSR) in early 2014.

Similar to the US Volcker Rule, BSR prohibits proprietary trading by banks and significantly limits banks’ ability to invest in alternative investment funds. However, unlike the US Volcker Rule, BSR targets large banks considered to be systemically important. Initial estimates suggest 30 groups with assets totaling €23.4 trillion will be regulated by BSR.

And while the top-line objectives of the proposed BSR are similar to the Volcker Rule, there are also some important differences. As an example, some commentators have pointed out that the proposed EU regulation applies trading restrictions not just to banking entities but even to bank-controlled private equity portfolio companies. Other notable areas that would be affected by the regulations include insurance company affiliates, long-term investment activity (as distinguished from short-term trading) of banks or affiliates, and receipt of carried interest. If the US experience is any guide, approval of BSR may trigger a round of divestments of business units and affiliates by affected banks.

For further discussion, please see the February 2015 edition of Quarterly Regulatory Update.

Continuing with the theme of convergence between US and global regulation, the Financial Stability Board (FSB) along with the International Organization of Securities Commissions issued an updated consultation document that defines criteria for designating asset managers and funds as systemically important. In the United States, defining systemically important entities in asset management has been an ongoing topic of discussion among regulators. The FSB document may provide some clues as to how the United States will define the group of managers and funds that will be subject to additional regulatory oversight and other requirements.

While it is unclear exactly how becoming designated as systemically important will impact asset managers, investors should be alert to the possibility that this class of managers will become hobbled relative to less-constrained firms. For private funds, the FSB’s proposed threshold for systemic importance is $400 billion in gross notional exposure.[1]Gross notional exposure is the sum of long and short exposures including the notional exposure of derivatives. Traditional funds, under the proposal, would qualify if they have either $30 billion in NAV plus 3 times balance sheet leverage or an absolute value of $100 billion in assets under management (AUM). FSB has also proposed an alternative AUM test based on gross assets under management that takes into account the dominance of the fund in the marketplace through the application of several tests.[2]The FSB proposes two tests for determining the impact of a fund on the marketplace: a substitutability test and a fire sale test. One relates to the proportion of daily trading volume a fund … Continue reading

The UK’s Financial Conduct Authority (FCA) has stepped up its focus on asset managers, including alternative funds. According to press reports earlier this year, the UK regulatory authority had more than 67 open investigations focused on alternative fund managers. Similar to US Securities and Exchange Commission activity, the FCA has indicated that it is concerned about fees and conflicts of interest. The UK regulator announced that it expects to undertake a study to determine whether the asset management industry is sufficiently competitive. In particular, the FCA cited the difficulty investors have in negotiating fees and concerns about fees/expenses that managers incur on behalf of their investors.

With the number of investigations rising, investors should expect an increased level of headline risk as managers adapt to a new level of scrutiny and potentially shifts in industry standards. In addition, the FCA’s competitive study of the asset management industry could be a springboard for further regulatory action.

Swaps Regulation

Could you be subject to new swaps margin rules?

The answer is … maybe. As background, the implementation of the US Dodd-Frank Wall Street Reform and Consumer Protection Act has resulted in significant changes to the swaps market. Traditionally, swaps were bilateral transactions, meaning that each party to the swap faced its counterparty directly, making each side of the swap subject to the risk of its respective counterparty. Now, regulators are encouraging central clearing of swaps. In a centrally cleared transaction, each party to the swap instead faces the central counterparty, a model regulators believe will reduce systemic risk.

Of course, not all swaps are available to be centrally cleared,[3]Part of the swaps regulatory regime requires that designated swaps be subject to clearing by a central counterparty. There is a regulatory approval process for moving a specific type of swap onto a … Continue reading leaving room for market participants to continue using bilateral agreements. Recently, regulators stepped up the pressure to move to central clearing by moving forward with revised proposals for rules requiring initial (sometimes) and variation (often) margin for bilateral swaps agreements. These margin rules for uncleared swaps are expected to be finalized this year and begin to take effect in September 2016.

Under the proposed rules, financial end users with more than $3 billion of average daily aggregate notional exposure would be required to post initial margin. All financial end users would be required to post variation margin daily (subject to a minimum transfer amount), with cash the only acceptable margin. The proposed rules contemplate regulators issuing a standardized table for margin calculation but also permitting swaps entities to develop their own models, which would be subject to regulatory sign-off. For now, the level of margin that will be required to support off-exchange swaps in the United States is unclear. However, the expectation has been that that capital costs for holding over-the-counter derivatives will exceed on-exchange requirements.[4]While US proposals have not been harmonized to those of international bodies, global regulators proposed initial margin ranging from 1% of notional exposure to 15% for equity- and commodity-based OTC … Continue reading For entities that become subject to these rules, a significant amount of operational infrastructure and collateral planning may be required to support bilateral swaps.

For further background on the CPO/CTA registration issue, please see the November 2014 edition of Quarterly Regulatory Update.

The new margin rules are focused on swaps between swap entities and other swap entities or “financial end users.” At first glance, it seems unlikely that the rules would apply to investment offices of nonprofits or similar entities. However, the proposed margin rules could apply to nonprofits or similar entities that have been required to register as Commodity Pool Operators (CPOs) or Commodity Trading Advisors (CTAs). Under the proposed regulations, “financial end users” subject to the margin rules include commodity pools, CPOs, CTAs, employee benefit plans, and insurance companies, among others. This leads to the conclusion that any nonprofit registered as a CPO would be subject to the proposed margin requirements. However, more recently enacted legislation[5]The Terrorism Risk Insurance Program Reauthorization Act of 2015 exempted some counterparties from Dodd-Frank’s margin requirements for uncleared swaps. made initial and variation margin requirements inapplicable to groups of users, with a focus on non-financial company end users. Commentators are not in agreement on how regulators will incorporate the exemptions in the new legislation into the final regulations.

This is a good example of how the developing regulatory regime may continue to increase operating costs and complexity for investors. The OTC margin rules have not been finalized and it seems likely that some elements of the rules will change before they become effective. This is especially the case because there are still significant elements of the rules (e.g., minimum level of notional exposure required for initial margin rules to apply, acceptable collateral types) that have not been harmonized with proposed global standards.

Stop Lending, It’s Too Risky! Part II

US banks appear to be heeding regulators’ concerns

For more on this topic, please see the August 2014 edition of Quarterly Regulatory Update.

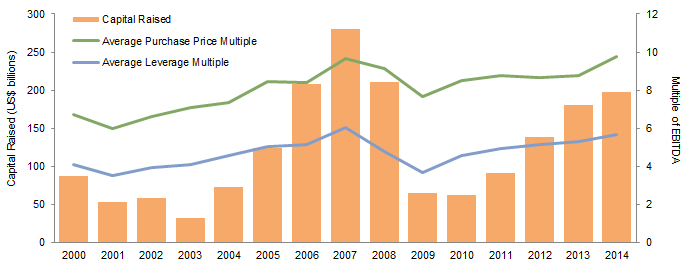

More than a year after regulators issued warnings, US banks appear to be heeding their regulators’ admonitions to avoid lending to highly leveraged buyouts. US regulators have been discouraging banks from lending to support takeover deals where the company’s debt would exceed 6.0 times EBITDA. Industry wide, purchase price and leverage multiples have been approaching 2007 peaks (Figure 1). Some commentators have pointed to this as the beginning of the end of an era of strong buyout returns, on a theory that the 6.0x financing limit will choke off debt finance and put a cap on prices. While it is true that in some well-publicized cases, US banks declined to provide financing to transactions that would have exceeded the 6.0x threshold, less leveraged opportunities in buyouts remain. In addition, the private debt fund segment continues to expand, seeking to fill some of the space left by retreating (and highly regulated) banks.

Sources: Cambridge Associates LLC, Dow Jones & Company, Inc., and Standard & Poor’s LCD.

Notes: Data for 2014 are as of December 31. Purchase price multiple is defined as enterprise value over EBITDA and leverage multiple is defined as net debt over EBITDA.

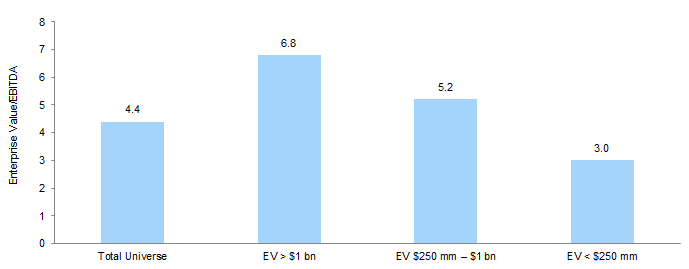

Many investors in the buyout markets have been focused on funds investing in smaller- or mid-market buyouts, capitalization segments that appear to offer more attractive valuations. Smaller enterprises remain relatively less levered than market averages and larger enterprises (Figure 2). However, these investments also tend to be made through relatively smaller funds, making it challenging for very large pools of capital to implement significant allocations to this subsector. And despite the relatively lower leverage levels for smaller buyouts, few would argue that this sector is attractively valued on an absolute basis today.

Figure 2. Average EBITDA Leverage Multiples at Acquisition of Private Equity–Owned Companies

As of December 31, 2013

Source: Cambridge Associates LLC.

Notes: Data were reported by investment managers to CA’s Private Investments Database. Outliers were identified and excluded.

For further information, please see Vish Ramaswami et al., “Alternative Credit Opportunities in Asia,” Cambridge Associates Research Note, April 2015.

Private debt funds, whether structured as private equity funds, hedge funds, or “hybrids,” continue to gain traction. These funds have been able to capitalize on the inability of US banks to lend for a variety of regulatory-driven reasons. Similarly, private capital “solutions” have a role to play globally as European markets seek to reduce reliance on bank financing and Asian markets too have a need for more debt capital than has been on offer from banks.

The Alternative Investment Management Association estimates that private debt funds manage more than $440 billion, with assets under management of US and European funds growing at a healthy rate over the last several years. In our conversations with credit managers, many cite regulatory-driven restrictions as a source of opportunity for future investments. While we have not seen an uptick in corporate defaults that would trigger a reloading of distressed debt portfolios, a growing list of managers is instead seeking to provide debt capital to geographic segments or markets (smaller and mid-sized businesses are a good example) where banks are unable to fill the void. European regulators have been encouraging the growth of alternative lending venues. Late last year, Irish authorities established a separate framework for dedicated lending funds. Meanwhile, the European Commission is developing a “European Long-Term Investment Fund” structure that is hoped to help boost the availability of non-bank funding in Europe.

Footnotes