To learn more about our investment framework for net zero investors, please see Simon Hallett and Sarah Edwards, “From Policy to Implementation: A Net Zero Playbook for Investors,” Cambridge Associates LLC, January 2023.

We focus on these areas as the largest equity-oriented investment opportunities. For a broader discussion of investment opportunities, please see Lydia Guett, “Climate Solutions Investing: Your Toolbox for Building a Diversified Investment Portfolio,” Cambridge Associates LLC, February 2023.

The transition to a low-carbon economy consistent with the 2015 Paris Agreement to limit global warming requires ambitious technological advancements and continued scaling of existing technologies. Such a massive economic transition by 2050, with meaningful progress by 2030, would be unprecedented but is not impossible, with adequate focus and funding. Indeed, significant progress has been made in some areas, especially in electrifying cars and decarbonizing the electrical grid.

In this edition of VantagePoint, we look at the progress in the energy transition to date and consider means for investors to both profit from and accelerate the transition across the risk/reward spectrum through investments in private equity (PE), venture capital (VC), infrastructure, public equities, and green metals. Investors looking to maximize impact should invest in strategies that lean into recent policy initiatives and specialized climate tech funds seeking to solve difficult challenges such as decarbonizing industry. Those looking for more stable returns will find an abundance of opportunity in infrastructure funds given soaring demand for renewable energy.[1]We use renewables and renewable energy interchangeably to reference technology to decarbonize the electrical grid.

Pockets of Momentum With More Innovation, Derisking, and Scaling Required

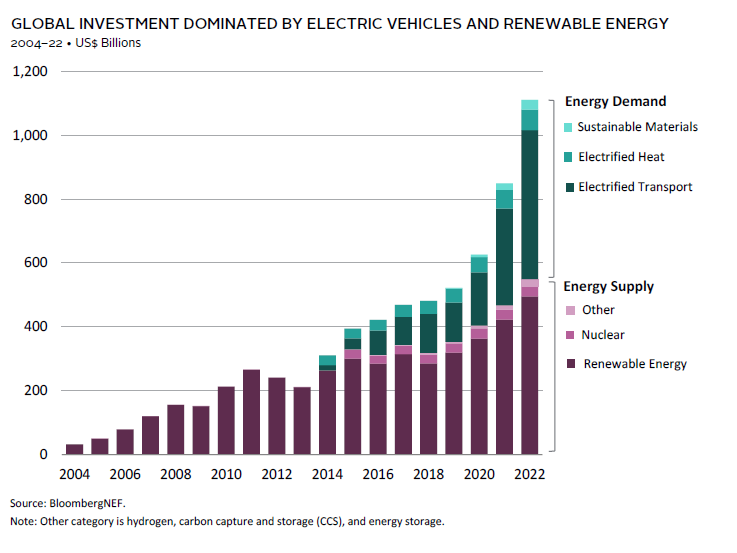

Spending on the energy transition totaled $1.1 trillion in 2022; a 31% increase over the prior year, but still well short of the scale required to meet net zero greenhouse gas (GHG) emissions targets by 2050. Investment amounts have been far smaller, as spending figures include sales of items, like electric vehicles (EVs) and heat pumps, as well as government investments. For example, China—where the government is a key player—accounts for roughly half of total spending ($546 billion), compared to just $141 billion and $180 billion in the United States and EU, respectively.

Nearly 90% of spending in 2022 was directed to renewable energy ($495 billion) and electrification of transportation ($466 billion, 83% of which is spending on passenger EVs). These segments have seen prices fall to levels competitive with some fossil fuel–heavy options, which has pushed up demand. Policy initiatives, such as the United States’ Inflation Reduction Act (IRA) and Europe’s Fit for 55 and Green Deal Industrial Plan, further improve economics for many energy transition technologies.

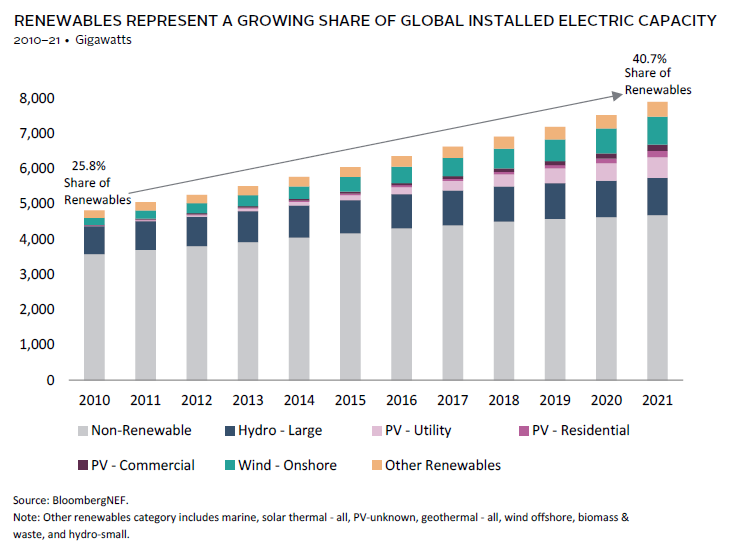

As economics have improved, corporate and consumer demand for lower-carbon products and services has increased, accelerating the transition in a virtuous cycle. Lazard estimates that before subsidies, the levelized costs of energy for utility-scale solar and onshore wind have decreased 83% and 63%, respectively, since 2009. As a result, renewables are taking market share over fossil fuels, as demand is broadening to include corporations—such as Amazon—that are increasingly purchasing clean power. With nearly 50% of new annual global electricity capacity coming from renewables, installed capacity is now roughly 40% renewable, driven by growth in utility-scale solar and onshore wind over the last decade.

Similarly, electric cars are becoming increasingly cost competitive with internal combustion vehicles. Although the sticker price for a comparable auto is higher for EVs, lower fuel and maintenance costs and potential subsidies make prices more comparable over time, while improved battery performance and growth in charging stations also boosts demand. It will take time to turn over the stock of vehicles, given EVs account for less than 2% of cars on the road globally. Still, EV sales are growing rapidly, with global EV market share increasing from less than 5% of new passenger vehicle sales in 2020 to 14% in 2022.

While meaningful progress has been made in critical areas, the pace of the transition has lagged ambitious objectives. For example, venture capitalist John Doerr keeps track of progress against a six-point plan for reducing emissions that he outlined in his book, Speed & Scale.[2]See https://speedandscale.com/tracker/ for annual updates on progress. Outside of autos and renewables, progress has fallen short of ambitious targets. Investments in hardware technology to solve the biggest problems—such as power storage, difficult-to-abate industries (e.g., steel and cement production), and commercial transportation (e.g., trucking and shipping)—remain in the development phase. Investment in hydrogen fuel cells, the source of much hope for greening transportation and industry, totaled less than 0.2% of energy transition spending last year, while areas like energy storage and carbon capture also attracted relatively few dollars.

Further advances must address numerous challenges and constraints. Key among them is access to metals needed for the green transition and bottlenecks in expanding the electrical grid globally. Decarbonizing the grid and electrifying as much heating, transportation, and industry as possible are central to a low-carbon future. While renewables are more competitive, further progress must overcome some hurdles. The electrical grid is already congested, interconnections face multiyear delays (averaging three to four years for US solar and ten years for UK onshore wind), and significant grid expansion is needed to meet swelling demand. Grid expansion requires planning for future electricity needs, allocating costs, and permitting, all of which present challenges. Interconnections to the grid are the most pressing issue in the near term. For example, in the United States, there is more energy capacity (2,020 gigawatts, mostly renewable) in the queue to be connected to the grid than is installed (1,250 gigawatts of power capacity, mostly non-renewable). These challenges also create opportunities for companies that can operate around or mitigate such constraints.

Opportunities for Investors

Investors can play the energy transition across private and public markets and have a variety of options in terms of fund return targets and liquidity. On the private side, climate tech VC funds target mid/high double-digit returns by focusing on early-stage companies in areas such as software, battery/storage technology (including recycling, management, etc.), commercial transportation, renewable fuels, and solutions for complex industrial challenges (e.g., cement and steel production). PE strategies with similar return targets will overlap in some of these areas but tend to focus on scalable, cash-generative businesses in areas such as renewable developers, grid enhancement (storage, efficiency/metering, etc.), and transportation plays (e.g., EV charging). Private infrastructure funds will sometimes overlap. For example, some smaller infra funds will invest in areas like scaling solar developers and EV infrastructure, given double-digit return targets, while larger funds with lower return targets may focus on acquiring contracted power assets (and related storage plays). Public opportunities are varied and include managers that focus on a range of companies across the industrial, tech, utility, and mining sectors. There are also opportunities across both private and public markets to invest in the supply chain resilience of green metals—a critical component to the energy transition—with investments in recycling and new mining processes being examples.

We focus our discussion on the largest investment opportunity sets: private equity and venture capital (PE/VC), private infrastructure, and public equities, and highlight key investment considerations and opportunities.

PE/VC Investment Opportunities Will Continue to Scale, but Higher Global Rates are a Near-Term Headwind

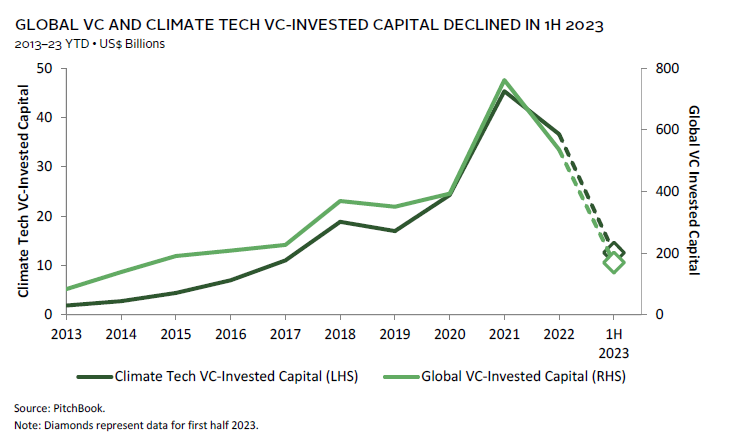

Close to $200 billion of climate-related private investments were made in 2022, roughly 2.5x the level three years prior and representing 12% of all private-market equity investments made in the year. Investment opportunities include both software and hardware, which tend to have different risk/return profiles. Software companies (e.g., building energy management, smart grid analytics, carbon accounting) have similar risk profiles to their non-climate tech peers and a quicker path to market. These strategies are more investable for generalist VC, growth equity, and buyout strategies, and therefore more competitive, often offering lower returns. In contrast, hardware climate technologies require dedicated expertise in the fields of technology, engineering, manufacturing, and project finance, but offer higher scalability and potential payoffs. De-risked sectors focused on the scaling of energy transition technologies (e.g., power generation, transmission, and transportation) continue to attract the bulk of the capital, while earlier-stage hardware targeting sectors that are harder to abate via electrification have seen a lower volume of investments.

Despite their riskier profile, investments into climate tech hardware solutions have increased as the industry has evolved with strengthened technical and operating expertise and a network of climate tech peers that can take nascent technology from seed and early stage to more mature growth phases and deployment. Capital flow has accelerated to areas like battery/storage technologies and solar energy following targeted financial incentives in the United States and Europe and higher conventional energy prices. Investments also flowed to alternative battery chemistry technologies and battery recycling processes to reduce dependency on certain critical metals, such as lithium.

Further, policy incentives have improved the commercial viability and attractiveness of nascent and more expensive technologies—such as green hydrogen—leading to a rise in such investments. Green hydrogen start-ups are looking to produce lower-cost hydrogen at scale for multiple potential applications, including decarbonizing hard to abate industrial sectors (e.g., steel and cement production) and to provide long-duration energy storage to resolve renewable energy intermittency. The capital-intensive nature of many climate tech hardware solutions imply room for private capital ranging from VC to infrastructure, albeit requiring higher risk tolerance and patience for potentially longer holding periods.

Climate tech PE/VC is facing similar headwinds as the broad market in terms of slowing deal activity and exits, given the higher rates environment. Globally, first half 2023 VC climate tech–invested capital and deal count fell 31% and 38%, respectively, from first half 2022 levels, albeit less than the declines seen in broad VC over the same period (50% and 40%, respectively). Public market exits for climate tech companies in 2022 also fell alongside their peers, with the decline more marked for exits via special purpose acquisition companies (SPACs), which had been a preferred option for high revenue growth but negative earning tech companies. Another metric to monitor is valuations, which have diverged from their peers over the past two years. Valuation-to-revenue multiples for climate tech PE/VC deals stood at 9x and 22x, respectively, in 2022, versus 3x and 15x, respectively, for their broad market equivalents.

For more of this topic see Di Tang and Dan Baran, “Climate Tech’s Evolution: The Maturation to a Competitive, Returns-Focused Thematic Investment Sector,” Cambridge Associates LLC, February 2023.

Higher financing costs and elevated valuations may weigh on future round financings and exits in the near term, particularly for earlier-stage hardware climate tech companies that have a longer runway to profitability. However, overall investment activity should gradually recover as climate tech PE/VC funds look to deploy a significant amount of dry powder, estimated to total $37 billion as of the end of 2022. The opportunity set for climate tech PE/VC is also likely to broaden further, given tailwinds from positive policy shifts and demand/cost trends. More importantly, the manager landscape and performance of climate tech PE/VC funds today has improved meaningfully from the CleanTech 1.0 wave. Recent vintages have delivered comparable returns to their traditional PE/VC peers as managers’ technical knowledge and investment discipline strengthened, allowing for the generation of more sustainable and competitive returns to add value to investor portfolios.

Infrastructure is the Largest Sandbox but Beware Crowding in Some Corners

Energy transition–focused infrastructure funds offer investors a large opportunity set with varying expected returns that depend on factors such as capital intensity, development stage, and valuations.

Large funds often focus on existing renewable power assets with long-term revenue contracts in place, though some seek higher returns via greenfield projects. Returns for existing assets can be enhanced via scale and financial optimization. In comparison, smaller funds might take more operational or technology risk by investing in local developers or emerging areas like green hydrogen and battery storage, although others are focusing on existing technologies in carbon capture and sequestration that will benefit from increased IRA tax credits. Some managers focus on specific geographies and assets (e.g., solar), while others take a generalist infrastructure approach and blend exposure to energy transition assets with assets in digital infrastructure and transport. Finally, the definition of energy transition–related assets also varies, with some managers mixing in what are viewed as “transitional” assets in areas such as natural gas transportation and generation plays with renewable assets like wind and solar.

Infrastructure funds benefit from the investment scale needed to meet net zero goals, but face headwinds including rising competition for assets, higher financing costs, and difficulties with everything from supply chains (e.g., IRA requirements) to delays in grid connections. One result is that even some large infrastructure funds have broadened their focus from renewable power project development and operation to related plays like utility-scale storage and residential installation and financing. Investors looking at managers allocating in these markets should consider skill sets (including technical, regulatory, and financial), sourcing abilities, and public market trends, as some energy transition plays have struggled to perform (in part due to initial public offerings executed at high valuations).

Investors selecting among energy transition managers should also consider the potential risk/return of their targeted investments. The opportunity set for large funds investing in renewable power is considerable, given this market represents nearly $500 billion in annual spending versus biofuel investments, which are 1%–2% this amount. The flipside is that acquiring contracted renewable assets likely will generate more predictable returns but less potential upside than investments made by smaller infrastructure funds taking technology risk in areas like biofuels or carbon capture. Investors can improve their odds by identifying manager edges—such as technical and regulatory expertise—and flatten J-curves by looking for pipelines of approved projects with guaranteed grid access. Managers with experienced teams and diversified portfolios that invest across several areas may see smoother returns than those targeting areas with more technological risk like battery science or decarbonizing industry. Investors can also tap infrastructure investments via certain publicly traded plays but should take into consideration valuations and higher potential for volatility.

Public Equities Offer a Broad and Diverse Opportunity Set for Active Managers, but Watch the Valuations

Public equity managers focused on the energy transition typically cover a broad array of securities in businesses ranging from renewable utilities and renewable equipment to energy efficiency, advanced materials, software, agriculture, and the circular economy. The companies themselves may participate in a mix of activities but tend to meet some threshold of green revenues. Managers may also incorporate other environmental, social, and governance (ESG) considerations into their strategy.

Significant up-front capex costs for many clean technologies require scale to spread fixed costs over a wide swath of customers. Indeed, we are seeing consolidation in categories such as renewable manufacturers and infrastructure companies. At the same time, smaller companies have potential to be more innovative and may also be worth holding for high risk/high reward opportunities like battery storage. However, managers must consider the global competitive landscape as customers may view larger companies as steadier hands, often benefiting from diversified revenue streams, particularly when related to riskier technologies. Overall, we see room for winners and losers from this disruptive transition—a facet that can be exploited by talented active managers, including long/short strategies.

Another consideration when investing in public securities is that much of the industrial sector will need to adapt their business models over time to a low-carbon future. Managers that engage with portfolio companies to understand, support, and hold them accountable for realistic climate reduction strategies should unlock value in portfolio holdings over time. Further, equity strategies focused on industrial transformation (i.e., suppliers, enablers, or decarbonizing firms) have more of a value/cyclical orientation beneficial to style diversification in portfolios with high ESG requirements that tend to lean toward quality/growth exposure.

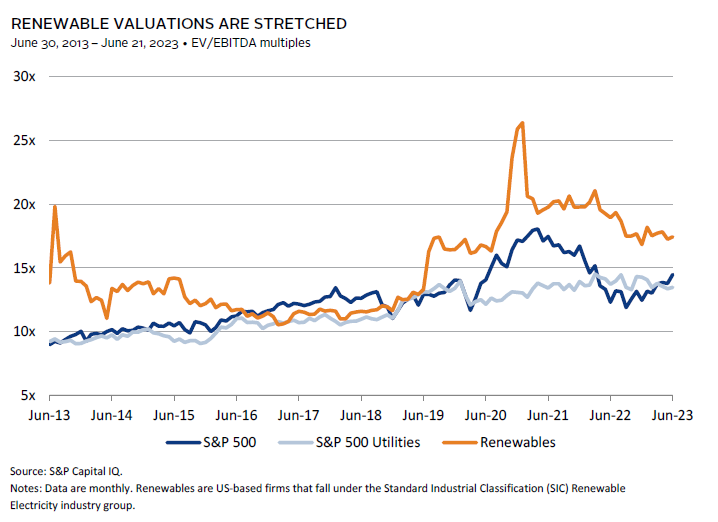

Like PE, performance in public equities addressing the energy transition has been volatile, with some indexes dramatically underperforming the broad market for a decade through 2020 before experiencing a year or two (depending on the index used) of explosive relative and absolute performance. Valuations for renewables remain elevated relative to utilities and the broad market, while more tech-oriented indexes (e.g., the Wilderhill Clean Energy Index) have negative aggregate earnings reflecting the risk of owning such securities, especially if the cost of capital remains elevated.

Green Metals: Tailwinds for Companies Invested in Supply Chain Resilience

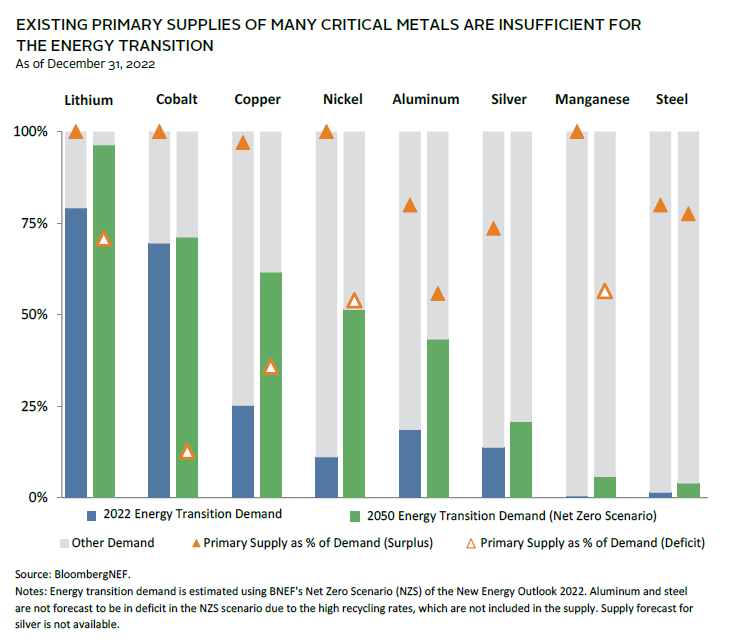

The energy transition will be accompanied by a structural increase in demand for certain critical metals, considering the intensity of their usage in renewable energy infrastructure and in the electrification of transport. Copper will see the highest growth in absolute volume, given its application across the value chain, from wind turbines and electricity grids to EVs, but lithium will see one of the sharpest rises in demand relative to current levels due to the dominance of lithium-ion batteries. Without new discoveries, BloombergNEF forecasts that the supply of many of these metals would fall short of the projected increase in demand, thereby increasing input costs to clean infrastructure and constraining newbuild projects.

While the heavy reliance on these green metals poses a risk to the energy transition, it also creates opportunities for investors. There are arguments already in place that the energy transition could drive a new commodities supercycle. However, there are several risks to consider to directly investing in these metals (either via commodity futures or natural resources equities) near term. Many of the transition metals are still predominantly used for industrial purposes and are sensitive to global economic cycles. For instance, prices of copper and nickel surged during the post-pandemic recovery phase and have moderated since, but not yet to cheap enough levels relative to history (in real terms) to mitigate further downside risks from slowing global growth. Demand for industrial metals may soften if China sees a secular shift from an industrial-led to a services-driven economy, while secondary supplies may increase with further investments into metals and battery recycling. The substitution effect would also spur innovations—such as alternative battery technologies—to reduce critical mineral dependency, as seen with Tesla and other major automakers’ switch to lithium iron phosphate batteries to mitigate high nickel and cobalt prices.

Another way to address the green metals theme is through investing in battery recycling and battery technologies, although these are earlier stage in nature and will require careful manager selection to identify potential industry winners. The response to price mechanics should also incentivize both start-ups and existing industry players to rethink traditional mining processes to reduce lead times and/or costs. We are seeing evidence of this today in the lithium market, where higher prices have encouraged investments into technologies such as direct lithium extraction from brine to boost production. An active strategy approach, either within private or public markets, could better help investors to identify sustainable green metals opportunities and add alpha over the broad market.

Conclusion

The energy transition involves a complex and dynamic set of changes in the way we do just about everything from activities as mundane as manufacturing steel and cement to heating buildings and transportation. While significant progress has been made in some quarters, considerable capital will be needed to fund the massive investment required over coming decades. The investment opportunities and the disruptive forces this evolution brings will create plenty of winners and losers that require investor focus. We expect investors with a deliberate and thoughtful plan to invest in the transition across the risk/reward spectrum will be rewarded.

Celia Dallas, Chief Investment Strategist

Wade O’Brien, Managing Director, Capital Markets Research

Vivian Gan, Associate Investment Director, Capital Markets Research

David Kautter and Kristin Roesch also contributed to this publication.

Index Disclosures

S&P 500 Index

The S&P 500 Index includes 500 leading companies and covers approximately 80% of available market capitalization.

S&P 500 Utilities Index

The S&P 500 Utilities Index consist of those companies included in the S&P 500 that are classified as members of the GICS® utilities sector.

Footnotes