Executive Summary

- Cash held in long-term investment portfolios has trended upward in recent years, as has cash held outside the long-term portfolio. Given the severe liquidity constraints many institutions experienced enterprise-wide during the global financial crisis, a renewed willingness to maintain liquidity across the enterprise seems a natural reaction. However, holding excess liquidity has had a significant opportunity cost given very low cash yields and relatively high returns on longer-term assets.

- Institutions looking to optimize liquidity management across the enterprise should look to three fundamental building blocks: organizational structure, liquidity measurement, and structuring (determining the scale and nature of) the required liquidity.

- Organizational structure considerations include ensuring good communication across internal constituents, by formalizing communication between financial and investment functions, for example. Good board communication is also essential, especially in the case of separate investment and finance committees. Institutions should consider whether structural issues create incentives for less than optimal cash holdings across the enterprise.

- Liquidity measurement is an exercise in reviewing sources and uses of liquidity and articulating a comfortable target pool size to meet those needs. Analyses that could be conducted include assessing historical cash needs versus available cash balances, reviewing intermediate-term needs versus financial resources, or stress testing the capital structure.

- In structuring liquidity, institutions may wish to employ a multi-pool structure, with each sized appropriately and taking into account appropriate risk considerations. Institutions should scrutinize financial resources across the organization to ensure that the mix of assets is right. If some assets are invested alongside the long-term pool, addressing concerns staff may have about access to the assets is critical.

- Investing cash is a challenge in today’s environment, as yields remain quite low and regulatory pressures may be a drag on future returns. While we favor an approach to liquidity management that emphasizes high-quality, highly liquid assets in dedicated pools coupled with leveraging the LTIP for the investment of long-term capital, there are thoughtful institutions that include less liquid or riskier assets in short- or intermediate-term pools.

- With valuations shifting in many asset classes, now is a good time to revisit liquidity positioning throughout an enterprise. Achieving an appropriate level of liquidity will require the engagement of finance and investment functions, and should help institutions improve the use of their assets while enhancing financial flexibility.

Many institutions have found themselves with increasing levels of financial liquidity, and we routinely work with institutions seeking to take an integrated approach to managing these assets. In some cases, investment committees have been more willing to hold cash to meet anticipated needs or have been the recipients of significant cash distributions from private investment programs that have not yet been put back to work. In others, financial officers have built up operating reserves or other buffers outside of long-term pools. Separately, these decisions to increase institutional liquidity may make sense. But examining the combined impact of these decisions, one might ask: does the total make as much sense for the enterprise as the constituent parts? How can institutions determine their appropriate level of financial liquidity?

In this paper we share trends in liquidity creation at institutions and look at what’s behind them. We outline three building blocks to optimize liquidity management across an enterprise, providing several approaches to assessing liquidity needs holistically. We offer specific examples from US colleges and universities given the availability and breadth of data, though we believe that the lessons learned are broadly applicable. Finally, we discuss approaches to cash management in the current environment. (Spoiler alert: we have yet to unearth a magic bullet in cash.)

Trends in Liquidity

See also Tracy Filosa et al., “Are Your Reserves Long-Term Capital?,” Cambridge Associates Research Note, December 2015, for more on the enterprise implications of this approach.

Liquidity by definition is flexible, and identifying amounts and locations of liquidity within an enterprise is challenging. For this analysis we looked at liquidity in a holistic way—including the cash held within long-term investment pools (LTIPs); cash and equivalents held outside of the LTIP; and the overlapping space, where operating liquidity or surplus funds might be re-invested into a long-term pool.[1]The purpose of this paper is to help institutions determine an asset size and investment approach for liquid financial resources across the institution. This “liquidity” includes cash and … Continue reading

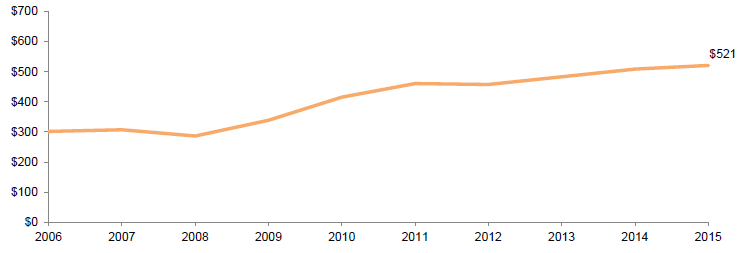

Today, cash levels held in LTIPs at institutions are somewhat above historical averages, having trended upward since 2010, although not as high as the spike in 2009 (Figure 1). However, cash held within LTIPs is only part of the story. Institutions should consider the availability of liquidity institution-wide, which requires looking at other pockets of liquid assets across the institution, as well as considering the availability of alternative sources of liquidity such as lines of credit that can provide a backstop to spending needs. Measuring cash held outside of the LTIP is challenging, as cash can reside in a number of pockets within an organization. However, as we estimate it, cash and equivalents excluding investments have risen significantly from 2008 lows (Figure 2).

Figure 1. Shifts in Cash Holdings in Long-Term Investment Portfolio

Years Ended June 30 • Distribution of Cash Allocations in Long-Term Investment Portfolio (%)

Source: Cambridge Associates Investment Pool Returns database.

Notes: Exhibit includes 70 private colleges and universities that reported asset allocation data for all 16 fiscal years. Negative cash allocations represent the use of leverage or derivatives.

Figure 2. Estimated Net Cash Holdings Outside of the Long-Term Investment Portfolio

Years Ended June 30 • US Dollar (millions)

Sources: Moody’s MFRA database and Cambridge Associates Investment Pool Returns database.

Notes: This analysis includes 45 private colleges and universities that reported data for all ten fiscal years. Estimated net cash holdings is calculated by subtracting the long-term investment portfolio market value in the Cambridge Associates’ Pool Returns database from the total cash and investments market value reported by Moody’s.

A difference exists, of course, between “cash” and “liquidity.” Not all of an institution’s reserves are necessarily held in cash-like instruments, especially where institutions have more reserves than necessary for near-term needs. And so while the previous metrics attempt to capture cash and equivalents available at the institutional level, a significant percentage of institutions have also been recycling excess liquidity into investments other than cash, whether in short- or intermediate-term assets or in longer-duration investments. Some institutions re-invest portions of their operating reserves into LTIPs. In fact, in our most recent survey of colleges and universities, nearly 38% of the 96 participating institutions invested at least a portion of their operating reserves in a long-term pool. Other institutions have also improved liquidity positioning through the use of what are often inexpensive lines of credit.

What’s Behind the Trend?

We see many reasons for this trend toward greater liquidity. Though some aspects of the global financial crisis of 2008 have faded from view, the financial scars remain visible on many market participants. This includes endowments, many of which have not recovered to pre-crisis asset levels in real terms, measured after spending. Many institutions experienced severe liquidity constraints in 2008, not only within the LTIP but enterprise-wide. Institutions simultaneously experiencing gating hedge funds, illiquid cash collateral pools, and slow-paying index funds within the LTIP also faced extraordinary calls on their liquidity outside of their investment pools. These calls included collateral calls on interest rate swaps, extra assets needed to support auction-rate securities, and higher demands for budget support given the specter of decreased annual giving and depleted endowment distributions. A renewed willingness to maintain liquidity across the enterprise would seem a natural reaction to all of this.

Beyond the historical experience, institutions are holding liquidity across the enterprise for a number of enterprise-specific reasons: to meet debt covenants or balloon payments, as reserves to advance strategic objectives, as “rainy day” funds, as spending buffers, and so on. Some institutions have raised cash ahead of a defined spending need rather than going into the debt markets. In some cases institutions that have relatively less depth of financial resources have focused on building up liquidity outside of long-term pools. This approach has allowed these institutions to husband resources in advance of major expenditures.

Institutions are not the only players placing a heightened value on liquidity. In early 2010, Moody’s released a comment highlighting its enhanced scrutiny of liquidity, including the development of a new liquidity worksheet and establishment of new liquidity ratios for higher education and other non-profit borrowers.[2]See “Moody’s New Liquidity Ratios Increase Transparency,” Moody’s Investor Services, March 2010. While Moody’s releases its liquidity ratios, it does not provide transparency into the … Continue reading This was followed by new ratings methodology guidance from Moody’s in 2011,[3]See “Rating Methodology US Not-for-Profit and Public Higher Education,” Moody’s Investors Services, August 26, 2011. which (not surprisingly) continues to emphasize financial flexibility in the form of multiple scoring metrics that focus on liquidity and flexibility. Of course, having sufficient liquidity to meet institutional needs is important. For institutions concerned with reducing financing costs and maintaining ratings, these changes also push in the direction of increased attention to their liquidity profile and perhaps managing to credit rating agencies’ metrics.

Is There Such a Thing as Too Much Liquidity?

Investing assets considered “reserves” with a longer-term pool should be done only after careful consideration of the benefits and risks, and with appropriate policies in place. For more on this, please see Tracy Filosa et al., “Are Your Reserves Long-Term Capital?,” Cambridge Associates Research Note, December 2015.

Flexibility is valuable, but should be considered in light of spending demands and opportunity costs. In hindsight, the 2009–15 period was largely good for risk assets despite heightened macroeconomic risks. Holding excess liquidity has had a significant opportunity cost given very low cash yields and relatively high returns on these longer-term assets. Institutions should look carefully at financial resources across the organization to ensure that the mix of assets is right. Where appropriate, increasing the dollars committed to longer-term pools is a way to grow the capital base and begin to address anticipated budget shortfalls.

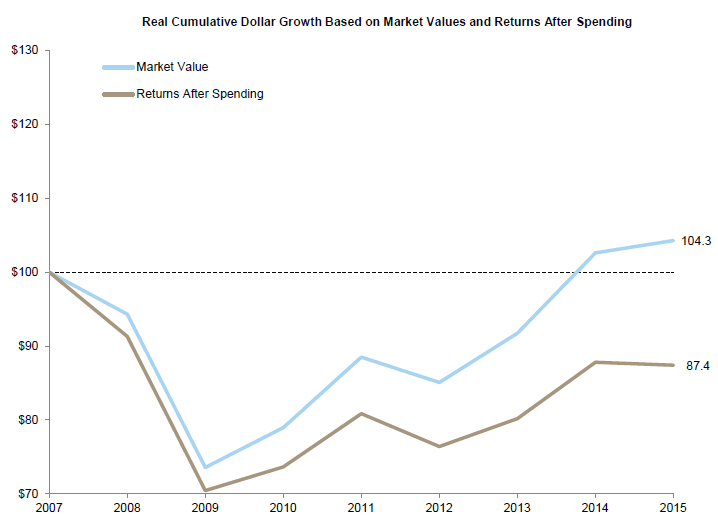

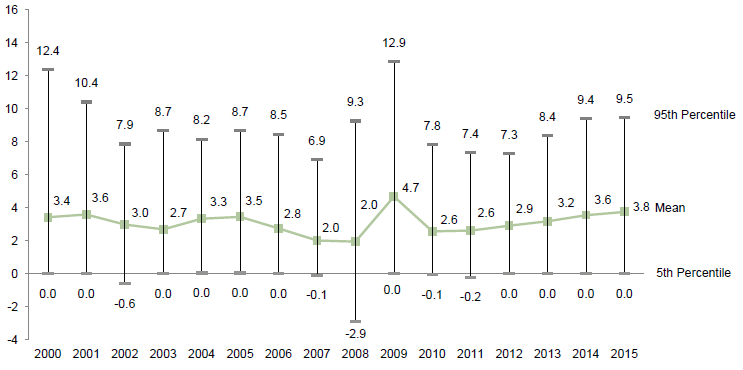

The real asset value of many endowments after spending (excluding gifts or other additions) remains below 2008 levels (Figure 3). This has created a push/pull for investors, with the fear of losing more ground weighing against the desire to step up the pressure on investable assets to rebuild the base. Determining that an appropriate amount of liquidity is available to the institution should give decision makers the confidence needed to take a truly long-term view when allocating LTIP assets.

Source: Cambridge Associates Investment Pool Returns database.

Notes: Exhibit includes 73 private colleges and universities that provided endowment market values, returns, and spending rates for each year. Growth based on endowment market value includes the impact of gifts and other additions whereas returns after spending do not.

Improving Liquidity Management Across the Enterprise

To improve liquidity management across the enterprise, institutions should look to three fundamental building blocks: organizational structure, liquidity measurement, and structuring (determining the scale and nature of) the required liquidity. In discussing each of these building blocks, we share examples of effective practices. The manner in which an institution addresses each area will necessarily depend on its governance, structure, and organizational complexity, but these examples should be a helpful starting point. Ultimately, the approach we outline attempts to answer a series of questions: Who is responsible for liquidity management? What are the intended uses (including time horizon)? And how is it managed?

Organizational Structure

Organizational structure issues can drive a build-up of fragmented liquidity at institutions with bits of cash in lots of different pockets. At many institutions, liquidity management functions are separate from the management of longer-term assets, with little communication between the functions. Improving information flow and understanding of objectives between the finance and investment functions is a precondition for success.

Who is responsible for liquidity management?

Organizational Structure Considerations

- Ensure good communication across internal constituents, among relevant Board Committees, and by sharing enterprise information broadly

- Consider whether structural issues create incentives for less than optimal cash holdings across the enterprise

Making sure the right lines of communication are open is a first step to addressing organizational concerns. Often, an institution’s finance or treasury operation is responsible for liquidity management across the organization, and a finance committee (separate from an investment committee) may provide oversight. Overlapping representation on these committees can be helpful to integrate finance and investment decisions. Overlap between the two oversight functions can also help ensure that institutional risk profile issues (including liquidity) are integrated into cash- and liquidity-management decisions.

Ensuring coordination between the chief financial officer (or equivalent) and those responsible for investment of long-term assets is another effective approach. With more institutions employing dedicated chief investment officers, communication between the investment and finance function needs to be formalized in some cases. Trends in fundraising can have a significant impact on the demands on existing institutional assets. In such cases, fundraising considerations and achievement data managed by the advancement division should be communicated to finance and investment functions. Effective regular reporting and open lines of communication across these functions within the organization are necessary to address liquidity management holistically.

Another organizational challenge is ensuring that all parties have the same expectations for management of financial assets. Investment committees often focus their attention on long-term pools; cash management outside of the pools may not even be within their charter. As liquidity grows outside of LTIP, addressing all financial assets cohesively becomes increasingly important, as these external (to LTIP) assets have a greater role to play in the overall financial picture. Thus, establishing periodic reporting to the investment function about resources outside of the LTIP and any changes in business or financial structure that might affect optimal risk profile for all financial assets is an effective approach. To improve returns on all financial assets, an institution may decide to recycle excess liquidity into a long-term pool. Communication with the chief investment officer or investment committee should help inform decision makers of the trade-offs between different approaches to managing liquidity in the current environment. Some institutions may find it helpful to use a planning tool to better understand the enterprise’s sensitivity to changes in key variables including endowment values.

For more information see: “Investing Across the Institution: Managing Financial Resources Through an Internal Bank,” Cambridge Associates Research Report, 2011.

Some institutions have a more complex, decentralized organizational structure, with multiple decision makers responsible for determining the appropriate level of liquidity for their particular function, while responsibility for investments may be aggregated up to a single group to achieve economies of scale. In these circumstances, the aggregated liquidity needs of each “business unit” may in fact be excessive when viewed from the top. Institutions facing this situation may need to evaluate enterprise-wide liquidity needs and develop policies to handle the potential conflict.[4]One option might be to create an institution-wide liquidity “backstop” for participants in the liquidity pools. Some more complex organizations have employed an “internal bank” structure to … Continue reading

Liquidity Measurement

The approach for determining the size and type of pool(s) for liquidity investment depends on the complexity of the organization. At root, this is an exercise in looking at sources and uses of liquidity and articulating a comfortable target pool size to meet those needs.

What are the intended uses?

Liquidity Measurement Considerations

- Review historical cash needs versus available cash balances

- Review intermediate-term needs against financial resources

- Stress test and consider whether capital structure or other demands require an increase in cash pool or intermediate-term pool size

- Assess whether any residual balances have a sufficiently long time horizon to justify investing in LTIP

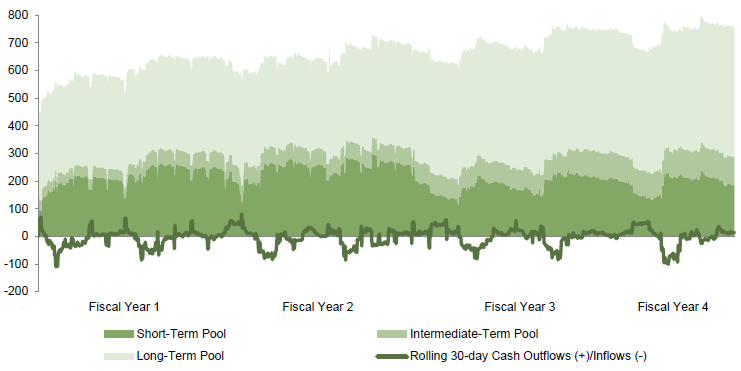

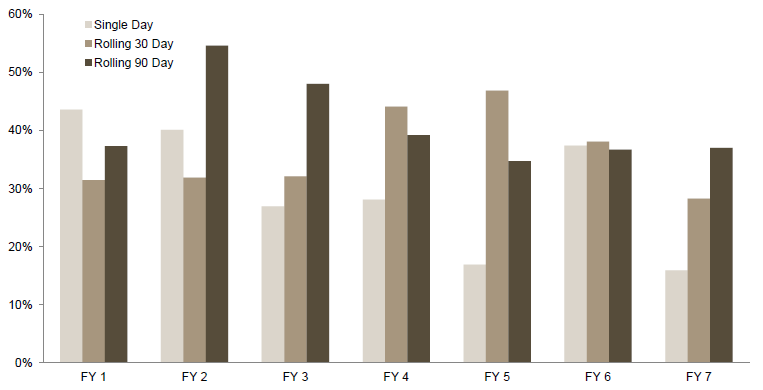

Institutions can start by reviewing historical cash needs and considering how much in very short-term assets is needed to comfortably meet near-term obligations. For an institution with a multi-pool structure, we examined rolling 30-day cash flows compared to the size of the short-term pool, shown in Figure 4. Other potential liquidity requirements (for example, liquidity needed to meet commercial paper maturities in the event of market stress) are also important to consider. Assessing maximum outflows as a percentage of the short-term pools starting value helps evaluate how frequently a target-size cash pool will meet all cash needs. For this institution, we focused on evaluating 90-day cash flows, which in one year used up as much as 55% of the short-term pool (Figure 5). Conducting analysis like that shown in these two figures will help institutions evaluate the potential size of their cash pool.

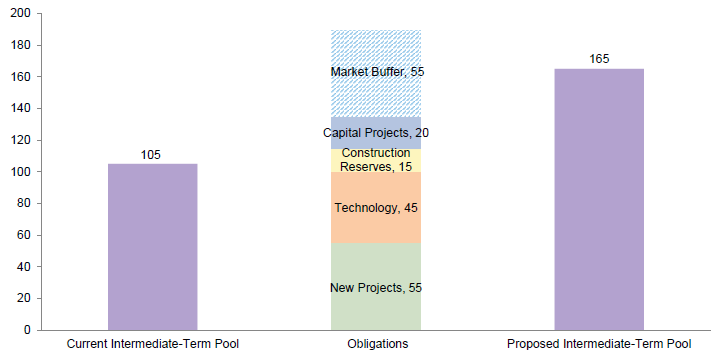

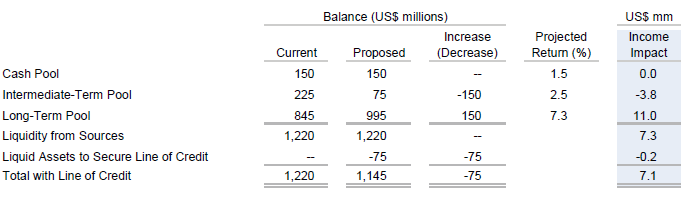

While forecasting short-term cash needs is helpful, institutions should also take into account other obligations over the intermediate term that require cash. Examples include multi-year strategic initiatives, capital expenditures, and campaign-funded buildings where the timing of gift receipts might not match a construction schedule. In conducting such a comparison for one institution, an analysis of obligations showed that the current intermediate-term pool was likely too small (Figure 6). The proposed pool size was up-sized relative to estimates of intermediate-term liquidity obligations to provide more cushion against short-term cash needs and partially buffer potential market moves.

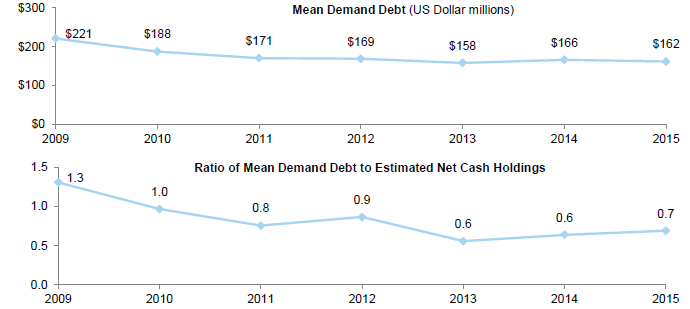

As part of a liquidity review, institutions may wish to consider whether any of these sources or uses of liquidity is likely to shift dramatically in a stressed environment. For example, some institutions with interest rate swap exposure may want to adjust expected collateral needs based on an extreme shift in rates to determine a maximum exposure level. It appears institutions have already taken action to reduce their exposure to these issues in a stressed environment. The exposure of institutions to demand debt, which might require having to come up with cash unexpectedly to meet an obligation, has decreased significantly since 2009, when Moody’s started to report this information (Figure 7).

Sources: Cambridge Associates Investment Pool Returns database and Moody’s MFRA database.

Notes: Exhibit includes 45 private colleges and universities that reported data for each year. Demand debt as defined by Moody’s includes variable rate demand obligations, commercial paper, long mode put bonds, amounts outstanding under bank operating lines of credit, bank bonds, and bank qualified loans with a demand feature.

An assessment of risks linked to time horizon is an important component of a liquidity review. Does the institution believe it has the resources to weather a longer-term market disruption? Is its risk mostly in meeting near-term liquidity needs in the event that the market seizes up? An institution may be confident in its ability to access capital markets or less liquid financial assets to get through a longer stretch of poor market performance, but concerned about keeping the bills paid and projects moving forward until longer-term assets are available. Another institution might be worried that over a longer time horizon, an extreme market shock would decrease annual giving, thereby creating a hole in the budget that will need to be filled by operating reserves and ultimately LTIP assets. Institutions should consider whether they would call on the LTIP for extraordinary withdrawals. If so, is there a sufficient level of accessible assets from both a legal[5]While we often do not distinguish among the categories of assets held in a long-term pool, this is an important consideration in liquidity planning. Some assets are “permanently restricted” at … Continue reading and investment standpoint? For some institutions, this distinction between restricted and unrestricted assets remains critical.

Structuring Liquidity

We often see institutions that address liquidity holistically using a three-pool structure for investing their liquid assets: a money market/cash pool, an intermediate-term pool, and an LTIP. For very short-term needs, there is typically a money-market type of pool. The next tier is frequently structured as an intermediate-term pool. Once short- and intermediate-term needs have been provisioned for, the open question is how to invest remaining amounts of available institutional assets. Institutions that take a multi-pool approach may look to the LTIP as an investment vehicle for these assets. However, taking this approach structurally changes the liquidity profile of LTIP-invested assets given the prevalence of illiquid and semi-liquid investments in LTIPs.

How is liquidity managed?

Liquidity Structure Considerations

- Consider a multi-pool structure (e.g., short, intermediate, and LTIP)

- Size appropriately, avoid taking risk in the “safe” pools, concentrate risk in LTIP

- Address concerns about accessing institutional assets invested in LTIP

Institutions can approach sizing each pool within a structure in a number of ways. The starting point should be the liquidity-measurement criteria just discussed. The investment structure of each of the pools should also be considered. Institutions tend to optimize the risk/return profile of the investments within any asset pool on a stand-alone basis. We find it is often preferable to have smaller, but appropriately sized (short- and intermediate-term) “liquidity pools” taking very little investment risk paired with a higher-return LTIP for remaining assets. In the aggregate, this approach should yield an attractive risk/return profile over time, while maintaining the integrity of the liquidity pools.

An oversized short- to intermediate-term pool can create a temptation to improve the return profile by taking on credit risk, duration risk, or other structural risks that could impinge on the pool’s ability to provide liquidity under all market conditions. Evaluating pool structure and size in a holistic way recognizes that investment risk and excess returns on financial assets will be concentrated in the LTIP and that the best way to optimize returns is to size the liquidity pools properly and move longer-term assets into the higher-return pool. To ensure that there are sufficient liquidity backstops, some institutions have established lines of credit, which, depending on funding costs, can be an efficient source of liquidity. Some may find that the expected return on the investment of longer-term financial assets in the LTIP should more than make up for the costs associated with maintaining a line of credit.

For example, an institution is considering opening a line of credit to make up for a reduction in liquidity if it moves some assets from its intermediate-term pool to the long-term pool. Figure 8 shows the cost/benefit analysis. The expected gain from moving $150 million from the intermediate-term pool to the long-term pool is $7.3 million based on the projected returns of each pool. This gain more than offsets the implied (20 bps) cost of maintaining the line, leaving the institution with a projected $7.1 million in investment earnings from revising the size of its pools.

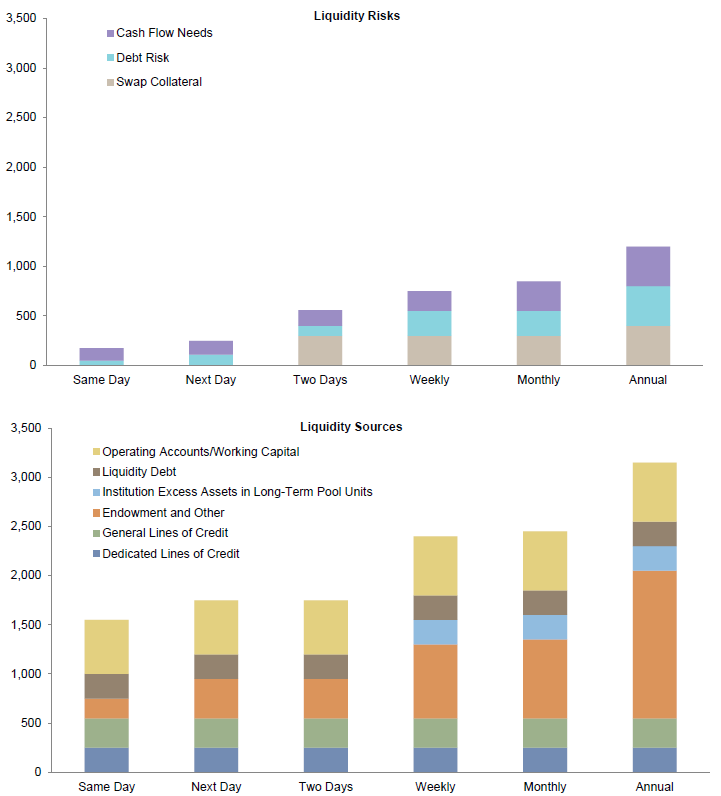

While we have mostly discussed determining the amounts needed for liquidity and an approach involving dedicated liquidity pools, there are other options. We have also worked with institutions that granularly review potential sources of cash needs—ongoing operating expenses, expenses related to financing arrangements, and extraordinary expenses—and have then mapped those cash needs to a particular timeframe. Available assets to meet the needs are determined and mapped by liquidity. These liquidity sources could include working capital, operating reserves, any available investments in a long-term pool, and external financing such as a line of credit. Both sources and uses of cash are assessed over a variety of time horizons to ensure that the institution does not have an asset/liability mismatch. An example of such a map is shown in Figure 9. This approach can be especially helpful when a portion of assets outside of the LTIP are invested in less liquid funds.

Some institutions have reported that access and liquidity concerns prevent staff from committing assets to LTIPs, perhaps due to a perception that once assets from operations have been added to a long-term pool, decapitalization policies may prevent the funds’ withdrawal. Investment policies and guidelines may require contributions to long-term pools to be invested for a set number of years, and finance staff might understandably be reluctant to make that kind of commitment or to come back for assets ahead of schedule. Even without an explicit request for a multi-year commitment of investments to a long-term pool, the staff’s awareness of the less liquid profile of the pools and of how these can become much less liquid in a stressed environment can influence decision-making. These concerns will have to be addressed before use of an LTIP for longer-term assets is a welcome alternative.

Institutions with liquidity (including lines of credit) that exceeds short- and intermediate-term requirements should define the circumstances for accessing these assets. Are such assets available only for operating needs at the discretion of the chief financial officer? Must the investment function sign off on extraordinary withdrawals from the LTIP? Could the investment team call on assets in shorter-term investment pools as a temporary source of “dry powder?” Institutions may need to address these issues as they structure liquidity pools.

Investing the Cash

With the short end of the yield curve still anchored close to zero, few attractive investment options for cash exist today. Institutions should, however, take several considerations into account to ensure that liquidity pool assets are available when needed, and can also look into options for investing oversized liquidity pools with the expectation of decreasing cash drag.

Where should assets be invested?

Cash Investment Considerations

- Yields are still extremely low across all low-risk forms of cash

- Pending money market reforms will have an impact of on institutional cash offerings and opportunity set

- Institutions with oversized liquidity pools for structural reasons might consider taking on credit, duration, or liquidity risk (e.g., through investments in low-volatility hedge funds) to offset cash drag associated with these super-sized pools

See the November 2014 edition of Cambridge Associates’ “Quarterly Regulatory Update” for more information on US money market mutual fund reforms.

Following 2008, many investors focused on maintaining some of their liquidity in registered, daily liquidity government securities money market mutual funds. Yields remain quite low and regulatory pressures may be a drag on future returns. In the United States, while final regulations have not yet been implemented, most of the pending money fund reform initiatives could have the effect of reducing returns for institutional money market mutual fund investors looking for $1.00 NAV funds. Undoubtedly, opportunities will arise to take advantage of shifts in the regulatory environment to earn modestly higher returns in less constrained pools. Those with the scale to invest on a customized basis will need to evaluate whether these opportunities represent compensated risk and fit within the objectives of the overarching liquidity plan.

Post-crisis, many institutions looked to bank deposits as a way to diversify cash holdings. Until the end of 2012, US bank deposits were covered by unlimited FDIC insurance, a big benefit for risk-averse investors. However, federal insurance has now reverted to a $250,000 maximum. With that change, investors must decide whether to hold uninsured deposits or move to a more complex, multi-bank program such as CDARS.[6]“CDARS,” the Certificate of Deposit Account Registry Service, allows large deposits to be broken into smaller FDIC insurance–eligible deposits at multiple banks.

While we favor an approach to liquidity management that emphasizes high-quality, highly liquid assets in dedicated pools coupled with leveraging the LTIP for the investment of long-term capital, there are thoughtful institutions that include less liquid or riskier assets in short- or intermediate-term pools. In some cases, the institution may find that it holds more than required in short and/or intermediate pools as a result of a governance or organizational structure issue. Including riskier assets in the short- and intermediate-term pools, such as credit products or lower-volatility hedge funds, may help offset the cash drag associated with oversized pools. Institutions employing this approach should give careful consideration to communicating the risks being taken to participants in the pools.

In the current environment, characterized by liquidity concerns in fixed income markets, institutions may also want to consider the investment structure through which they implement short- and intermediate- term pool investments. For investors with scale, separate accounts have always offered more control over specific holdings and portfolio characteristics. In contrast, mutual funds or other commingled vehicles offer a less-tailored approach and can be forced to sell holdings at inopportune times to facilitate redemptions. Given the considerations, maintaining a separate account may be an especially attractive option for those institutions that choose to stretch beyond the most liquid fixed income securities.

Conclusion

Without frequent communication and a full understanding of the institution’s liquidity needs under a variety of scenarios, institutions may find themselves, in effect, double-reserving for liquidity. This could be because an investment committee is holding additional cash as a buffer against perceived operating needs or risks at the same time that the finance staff has built up significant liquid assets outside of LTIP. Similarly, institutions may have improved their liquidity position through capital-structure improvements or by adding a line of credit. All of these shifts could have an impact on the appropriate level of liquidity within the organization, but might not be shared with an investment committee or other constituents to help inform decisions about the optimal use of all institutional financial assets.

With valuations shifting in many asset classes, now is a good time to revisit liquidity positioning throughout an enterprise. In some cases, institutions may find that they need to rethink their policies to ensure that liquidity is managed appropriately. This includes looking at who is responsible for determining the appropriate level of institutional liquidity, what the intended uses of liquidity are, how liquidity is managed, and where the assets should be invested. The answers to these questions should inform the risk posture of institutions’ LTIPs or may encourage consideration of external sources of liquidity (e.g., lines of credit) to supplement existing resources. Finding the right balance will require the engagement of finance and investment functions, and should help institutions improve the use of their assets while enhancing financial flexibility.

Mary Cove, Managing Director

Geoffrey Bollier, Investment Analyst

Emily Ginsberg, Senior Investment Associate

Footnotes