Advice in Brief

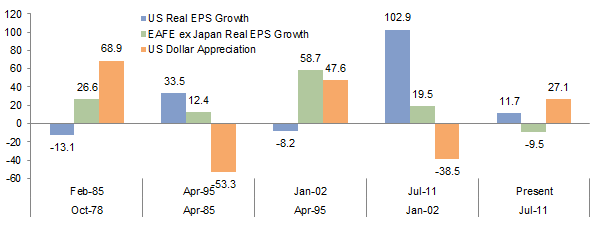

- The situations in China, Greece, and Puerto Rico serve as a reminder not to be complacent. While policymakers appear to have plenty of firepower to manage the challenges they face, downside risk remains. Investors should maintain well-constructed, diversified portfolios that are consistent with their ability to absorb downside risks while meeting long-term return objectives. We remain neutral on risky assets in general, but have become more cautious and selective.

- Very few assets are cheap today. This keeps us focused on relative value where the investment outlook offers appeal. In particular, we recommend overweighting Japanese and Eurozone equities (both currency hedged) and Asia ex Japan/Asian emerging markets relative to US equities.

- We have been wary of chasing the A-share rally, given high valuations and a ramp-up in margin lending, and believe Hong Kong–listed Chinese equities offer more reasonable value.

- We would rebalance emerging markets equity positions, maintaining modest overweights to Asia ex Japan/emerging Asian relative to US equities. The sharp declines from late-April highs through early July have moved such equities to undervalued territory and the negative momentum appears to have subsided. We continue to watch closely for signs of further softness in earnings as relative earnings strength is likely to remain key for a resumption of outperformance, particularly given potential for currency weakness relative to a strong US dollar.

Investors’ faith in central banks and policymakers is being tested. Markets have obediently appreciated when monetary policy is loosened and punished when it is tightened, at least in relative terms. Markets have accepted that Beijing has an arsenal of resources to manage a rebalancing of its economy and to handle any repercussions from China’s rapid escalation in debt as a share of GDP. This is why it comes as such a surprise to investors that the People’s Bank of China (PBOC) can apply easing measures, combined more recently with aggressive policies to encourage equity purchases, and fail to achieve an immediate response from Chinese equities. The laws of gravity have not been repealed. At the same time, the world may get to see whether the European Central Bank (ECB) does have “whatever it takes” to contain the risks associated with a Greek default and possible (though unlikely) exit from the Eurozone, although at this writing a bailout agreement appears to be within reach.

While the protracted Greek drama and the rollercoaster ride for Chinese A-share investors are today’s front-page news, a few weeks ago investors seemed focused on the reversals experienced in the major trends that have underpinned market activity since the middle of last year as bond yields rose, the US dollar weakened, oil prices rebounded, and US equities edged ahead of non-US equities.

This edition of VantagePoint reviews the potential for contagion from Greece, concluding that the ECB appears to have adequate ammunition to manage through current conditions, but longer-term political risks remain. We consider recent activity in Chinese equity markets and conclude that offshore Chinese H-shares offer more appeal than onshore A-shares, where upside potential is limited as highly leveraged investors seek to reduce exposure by selling into rallies. We examine the prospects for a sustained reversal of major trends that have persisted since last year, concluding that reversals appear unlikely for now.

The situations in China and Greece, not to mention Puerto Rico’s debt woes, serve as a poignant reminder that investors should not be complacent. While policymakers appear to have plenty of firepower to manage the challenges they face, we expect continued volatility at the very least, including more downside as markets seek to sort through the implications of the latest negotiations with Greece and a manipulated onshore Chinese equity market. Investors should maintain well-constructed, diversified portfolios that are consistent with their ability to absorb downside risks as well as meet long-term return objectives. We remain neutral on risky assets in general, but as the market cycle advances and asset classes become more stretched, we have become more cautious and selective.

Greece and the Future of the Eurozone

The consensus is that the ECB has the ability to contain any near-term risks associated with a Greek debt default and potential exit from the Eurozone. The ECB certainly has more tools at its disposal today than it did in 2012, when Europe last confronted the prospect of a Greek default and exit. The more important question today is: if Greece exits the Eurozone, can officials convince investors that membership in the currency union is irrevocable?

After another in a long chain of last chances, Greece was given 72 hours to pass reform laws through its parliament that are more austere than those rejected by popular vote just one week ago. A series of milestones have been set that, if met, will release €86 billion in bailout loans to Greece. It now appears unlikely that Greece will default on July 20, when a €3.5 billion bond redemption is due to the ECB, although implementation risks remain.

Even if Greece remains in the Eurozone, the mere suggestion that a country could be temporarily pushed out of the euro—raised in the negotiations this weekend—could mean markets start to price in a risk premium in peripheral sovereign debt, increasing the cost of capital for peripheral European and corporate borrowers, slowing economic activity, and increasing debt burdens. While the ECB has the ability to push rates down, it would be important to convince the markets that Greece is a special case and that exit from the euro is not possible for other countries.

The hard line that creditors set in negotiations with Greece reduces the risk of a rise in power of extremist political parties in the Eurozone. Prospects of capital controls, bank failure, and economic devastation will not inspire other countries to follow suit.

The “Greek drama” should serve as a reminder to investors of the importance of a well-diversified portfolio in allowing asset owners to withstand the volatility associated with such events and to take advantage of opportunities that would arise, such as in this case the ability to add to Eurozone equity positions at more favorable valuations should progress toward a bailout agreement falter.

China

China remains a double-edged sword for investors. Monetary easing in China has both helped reduce the risk of a near-term hard landing and ignited a massive rally in the onshore A-share market. The sharp rally, fueled by a quadrupling in margin lending in the past year, predictably turned into a serious rout in June. With the Shanghai Composite down roughly one-third peak-to-trough as of early July, Chinese authorities announced a slew of measures to support the market, including a halt to IPOs and a broker-backed market stabilization fund that will receive additional firepower from a capital injection by the PBOC to the China Securities Finance Corporation (the official intermediary for margin lending to brokers). It took a six-month ban on selling by shareholders with ownership shares exceeding 5% for the market plunge to subside, at least for now.

The decline has been severe enough that many are evaluating the degree to which there may be economic contagion. Historically, China’s economy and A-share market have had little relationship. Only 36% of the market freely floats; the remainder is owned by the government and business owners. Retail investors dominate trading activity, accounting for more than 80%. As such, the market is driven by liquidity far more than fundamentals. However, given the sharp rise of the market, high margin lending, and use of shares as loan collateral, it is worth considering that a severe market decline may have a feedback effect on the economy. The wealth effect should still be limited since households have less than 15% of their wealth in equities, while less than 10% of households own any stocks. The financial industry accounts for less than 10% of GDP and equities’ role in financing businesses is even more limited. Assessments of risks to banks are mixed, as the degree to which shares have been pledged as collateral against bank loans is unknown, as is the amount of “grey-market” margin lending that would add on to the official margin lending that accounts for 9% of the market capitalization of the on-shore market.

Should investors view the market sell-off as an opportunity to buy Chinese equities? We have been wary of chasing the A-share rally, given high valuations and a ramp-up in margin lending, and believe Hong Kong–listed Chinese equities offer more reasonable value. The A-share market will likely remain under pressure and range bound as retail investors reduce their margin exposure by selling into rallies, thus capping market upside. Hong Kong–listed shares trade at a 20% discount to historical averages based on our normalized price-earnings metric, while onshore markets are roughly at their historical average. Further, the discount for H-shares relative to A-share issues for the same companies is wide, at roughly 30%. The ultimate question for Chinese equities (both onshore and offshore) is the degree to which earnings growth is improving, and the evidence for this is mixed. We prefer to have exposure via Hong Kong–listed equities given less downside and lack of leveraged investors. Investors that have taken our advice and implemented an overweight to Asia ex Japan or emerging Asia relative to US equities already have an overweight in Chinese H-shares.[1]As of June 30, 2015, Chinese H-shares represented 30% of the MSCI All Country Asia ex Japan Index and 36% of the MSCI Emerging Markets Asia Index.

Stretched Technicals

The second quarter saw bond yields rise, the US dollar weaken, oil prices rebound, and US equities outperform non-US equities (in local currency)—a reversal of the strong trends that prevailed throughout much of late last year and the first quarter of this year. Some fundamental reasons for these reversals can be found (e.g., mixed economic data in the United States, uncertainty over the timing of tightening by the Federal Reserve, and the fate of Greece), but the most obvious reason appears to be a technical unwind. These markets simply went too far too fast and a reversal was overdue. Sometimes the simplest explanation is the right one. In fact, bond yields have largely leveled off, the US dollar has come back from recent lows, and oil price gains have reversed. The exception so far has been US equity leadership, which has been benefitting relative to other major markets from the risk-off environment. Below, we review the prospects for a continuation of these longer-term trends, with particular focus on the potential for US equities to underperform other markets.

Bond Yield Bounce

In mid-April, developed markets sovereign bonds began a phase of volatility that has seen prices fall and yields rise. The cause and implied signaling of the moves experienced in bond markets have been a source of active debate. Although the recent yield increases have been large, particularly in the context of ultra-low yields, yields remain quite low from a historical perspective. We maintain our view that higher-quality sovereign bonds are overvalued, as bond yields remain below fair value even after recent increases in US and German bund yields.

The increase in yields has been concentrated in German bonds. In mid-April, German bund yields, which had been falling for months, made a steep reversal that continued into June and have remained relatively level into July. The German yield curve had compressed to the point where the yield on the ten-year was below the two-year, an inversion of the yield curve that placed holding cash on essentially equal footing with holding ten-year sovereign debt. At the same time, Eurozone economic and sentiment data were showing improvement. Given the dichotomy between improving growth and extreme yield compression in the bond market, investors unsurprisingly sold (and shorted) long-duration bond positions, sharply driving up yields at the long-end of the German yield curve. Real yields increased, but to a lesser degree, increasing break-even inflation rates, while the yield curve steepened.

Notably, the sell-off was concentrated in the longer end of the yield curve; the short end has remained relatively unscathed since April. The lack of movement in the short end of the curve could indicate that near-term credit risk remains unchanged, and that little expectation exists for central banks outside the United States to begin increasing rates in the near term. An increase in long-term rates relative to short-term rates is generally a pro-cyclical phenomenon that implies higher future expected growth and inflation and can be a motivation for bank credit formation. A steeper yield curve can also spur greater demand for credit as potential borrowers see that the cost of capital may increase in the future and so decide to lock in today’s cheaper rates. This process can create a virtuous cycle that can last until interest rates begin to eclipse growth rates.

However, as we go to press, a Greek sovereign debt default, failure of its banks, and even abandonment of the euro remain possibilities if the Greek parliament does not pass required reforms. The initial German bund and US Treasury market reaction has been muted as the market has priced in expectations that contagion risk is limited. We have continued to advocate holding some portion of portfolios in high-quality sovereign bonds, even at low yields, as a sensible component of portfolio diversification. Nevertheless, given low yields and thus low expected returns and limited appreciation capacity in the event of a risk-off environment, we have advocated that investors—other than those seeking to defease liabilities (e.g., pensions)—hold a portion of sovereign bond portfolios in cash. We expect bond volatility to persist as markets evaluate future growth prospects for the Eurozone, potential for the United States to raise the Fed Funds rate, and risks associated with slowing Chinese economic growth. While in the near term we expect yields to be stable or fall amid risk-off conditions, if a relief rally ultimately transpires that pushes sovereign bond yields toward fair value levels (e.g., presently 2.6% for ten-year US Treasuries), we would deploy such cash into bonds.

The US Dollar Takes a Pause

Please see Aaron Costello and Jason Widjaja, “What’s Next for the US Dollar?,” Cambridge Associates Chart Book, March 2015, for more discussion on US$ dynamics in a historical context.

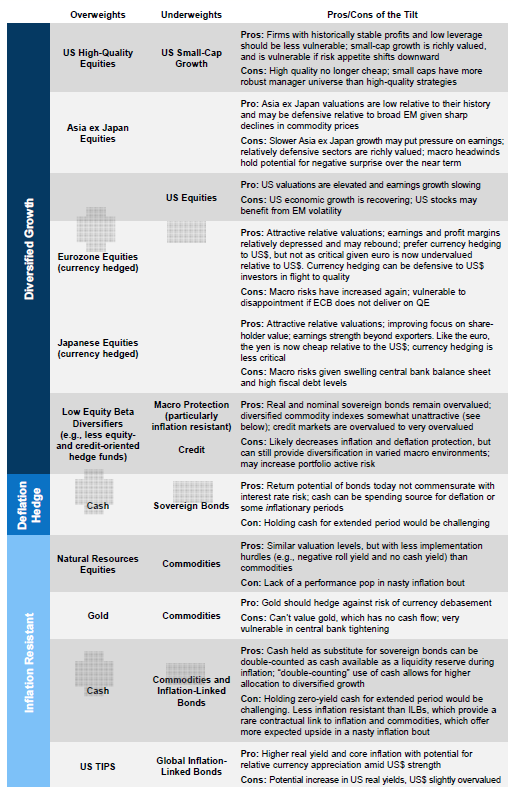

We observed last quarter that the US dollar was overbought and seemed due for a period of consolidation. Net long non-commercial positioning was at levels last seen in the late 1990s US$ bull market cycle, and both 12-month and 6-month appreciation was at stretched levels that historically saw reversals. In just over eight months from July 2014 through mid-March of this year, the US dollar appreciated 23% in trade-weighted terms. The pace of appreciation was the fastest since the Federal Reserve Major Currencies Index was incepted in the early 1970s, but comparable to the upturn in the early 1980s dollar rise that ended in the Plaza Accords and the brief but sharp run-up during the global financial crisis. The US dollar fell about 6% from mid-March through its low in mid-May and has been moving sideways since. Such pull-backs are typical during up legs of US$ cycles (Figure 1).

Figure 1. US Dollar Bull Markets

As of May 31, 2015 • Rebased to 100 at the start of each bull cycle

Sources: Credit Suisse and Thomson Reuters Datastream.

We continue to recommend US$-based investors hedge some non-US$ exposure; at a minimum, developed markets currency exposure associated with tactical positions. By hedging such exposures, investors can maintain neutral US$ positioning at the total portfolio level while overweighting more attractive non-US$ denominated assets.[2]We expect the US dollar to continue to appreciate against some emerging markets currencies as well. However, the cost of hedging emerging markets currencies and the negative interest rate carry make … Continue reading Similarly, non-US$ investors should seek to maintain neutral US$ positioning even if underweight expensive US equities. Strategic hedging to mitigate currency volatility may also be appropriate for investors with large allocations (e.g., 20%–25% or higher) to foreign currencies.[3]Typically, investors with such programs hedge roughly 50% of foreign currency exposure. Given that currency moves can be significant, maintaining such a program requires use of currency hedged … Continue reading

Refining Oil Expectations

The price of oil bounced back in second quarter from lows reached in January, retracing about 30% of its 60% decline through its January low. Having fallen to roughly $45 a barrel, oil prices, like the US dollar and bond yields, had extrapolated a trend, moving too far too fast. As traders unwound positions and short covering transpired, markets moved rapidly in reversal. These trends are not unrelated, as the US dollar and oil price tend to move in opposite directions.

In late June through early July, oil prices began falling again, reflecting continued uncertainty around the future supply/demand balance. The improvement in oil prices has been supported by fundamentals, but the outlook continues to shift. As oil prices fell, demand increased, with growth in oil consumption predicted to be roughly double that expected at the start of the year. At the same time, lower prices have spurred producers to slash planned capital expenditures by as much as 20% globally and 40% in North America and to cut back on drilling, with US rig counts now down 60% from October 2014 peak levels. The consensus has been expecting oil supply from US shale to begin to adjust this year. These factors have been supportive to oil prices. However, in recent days, as oil prices appeared to be stabilizing at a higher level, more producers expressed intentions to increase production, and rig counts increased slightly for the first time this year. Expectations for increased production from Iran have also accelerated, which, paired with concerns of lower demand growth from China, have increased market expectations for a continued supply glut. The market remains focused on the potential for positive supply shocks outside the United States, but the potential for negative supply shocks related to ISIS activity and war in Yemen should not be ignored. We expect this volatility to continue as the market searches for equilibrium.

Energy company fundamentals remain weak. For the most efficient, lowest cost producers, the ability to increase profit margins even at reduced oil prices exists, as efficiency gains in shale production have brought marginal costs down. Service cost concessions, estimated to be as much as 20%–40%, have brought some additional, if not cyclical, relief. However, the overall picture remains challenging. Energy companies’ revenues have been falling for a few years and are projected to end this year about 65% below 2011 levels, while earnings could trough more than 35% below 2011 levels based on current expectations. According to data from E&Y, write-offs for impairments by the 50 largest public oil & gas companies in the United States nearly tripled between 2013 and 2014, and many expect such write-offs to increase as lower oil prices start to have an impact. If oil prices remain depressed for an extended period, distressed opportunities will emerge. According to Goldman Sachs estimates, the breakeven cost for US shale has fallen from $80 to $60 for WTI and could even reach $50 by 2020. Much of the roughly $1 trillion in debt-financed investment since 2003 underwritten at much higher oil prices is likely to be uneconomic. For now, distress has been delayed by accommodative capital markets, although activity has died down, with E&P companies issuing $3.7 billion new equity in the second quarter, only 35% of the equity raised in the first quarter of this year. Many in the industry believe that bank reserve base redeterminations this fall will be a catalyst for increased transaction activity. We will find out soon.

For further discussion on the outlook for publicly traded natural resources equities and energy-related MLPs, please see Sean McLaughlin et al., “Feeling Energetic About Natural Resource Shares Amid an Oil Rout,” Cambridge Associates Research Note, January 2015.

Given the uncertainty regarding when and at what price the oil market will settle, we continue to urge patience in opportunistic investments, and believe that committing capital to private equity energy managers with the ability and skill to acquire upstream assets from distressed owners and distressed oilfield services businesses from unnatural owners offers the best approach to energy today. For investors with liquid inflation-sensitive or hard asset mandates, we continue to recommend underweighting the area, substituting a portion of plain vanilla commodity future allocations with natural resources equities and more diversifying hedge funds outside of the real assets space with less equity and credit exposure. While fundamentals for natural resources equities are challenging, and further earnings write-downs are likely in the offing, natural resources equities are undervalued and should provide reasonable long-term returns. Commodity futures strategies, in contrast, may now offer reasonably valued spot prices, but continue to suffer from the drag of contango and virtually no return on collateral. Master limited partnerships (MLPs) are fairly valued and offer a distribution yield of 6.3% (based on the Alerian MLP Index). As supply and demand remain out of balance, volatility may continue to increase in this market. However, 6% yields plus a more moderate annual yield growth of 3% to 5% annually appear plausible, as regulated pipeline tariffs grow 2.65% per year plus the producer price index.

The End of US Equity Outperformance?

Last quarter we reviewed our recommendation to maintain neutral weights to equities as a whole and within equities maintain a modest underweight to US equities and overweights to Eurozone and Japanese equities (currency hedged) and emerging Asia or Asia ex Japan equities. We also cautioned that given such a strong outperformance in the first quarter, particularly in the Eurozone and Japan, we would not be surprised to see some near-term consolidation and thus recommended trimming positions that have grown, while remaining overweight these markets. Indeed, Eurozone equities in particular have lost some steam over the last few months, but remain 13.9 percentage points ahead of US equities in local currency terms through July 10. In US$ terms they are 5.0 percentage points ahead, highlighting the importance of hedging.

Will global ex US equities continue their outperformance, or was this a false start that will bend to a resumption of US equity dominance? A review of historical cycles gives us more comfort that a period of global ex US outperformance is on the horizon. However, such periods historically have been accompanied by an upturn in relative earnings levels and return on equity (ROE), a condition that has not yet transpired but appears to be emerging, particularly as US earnings come under pressure. This analysis is focused on developed markets. We discuss emerging markets in a separate section.

Figure 2 shows the ratio of the cumulative wealth of $100 invested at year-end 1969 in developed equity markets outside the United States relative to the same investment in US equities in US$ terms. Over the full period (1969 to present), US and global ex US equities[4]We use MSCI EAFE ex Japan rather than MSCI EAFE to reflect global ex US equities to adjust for the significant index construction biases inclusion of Japan poses. Japan’s equity bubble and lack of … Continue reading have generated nearly identical returns (cumulative wealth ratio of 1.0), but there are distinct cycles. The grey shaded areas reflect the five periods of outperformance relative to the United States. The turning points of cycles show some similarities in the relative wealth, with global ex US equities rotating into leadership over US equities when their cumulative wealth hit 80% to 90% that of US equities (i.e., a wealth ratio of 0.8 to 0.9). Similarly, global ex US equities have topped out, transitioning leadership back to US equities, when their cumulative wealth exceeded that of US equities by 40% to 60% (a wealth ratio of 1.4 to 1.6). The recent low was 100%, or parity—close to a reversal point if you consider the trend has been for higher lows and higher highs over the three major cycles.

Figure 2. Total Return Cumulative Wealth: MSCI EAFE ex Japan Relative to MSCI US

December 31, 1969 – June 30, 2015 • December 31, 1969 = 100

Source: MSCI Inc. MSCI data provided “as is” without any express or implied warranties.

Note: Shaded areas denote MSCI EAFE ex Japan outperformance relative to MSCI US in US$ terms.

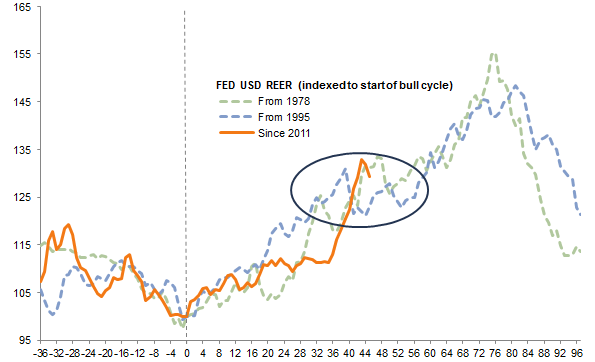

Looking at the cycles in local currency terms allows for evaluation of trends in valuations and fundamentals over the course of relative performance cycles separately from the currency effects; based on the local currency index series, there are only three cycles instead of five (Figure 3). The main difference is that in local currency terms, global ex US equities outperformed US equities steadily from November 1976 through January 1986, roughly 5.5 years longer than their lead in US$ terms. The US dollar appreciated 62% on a trade-weighted basis from late 1978 through early 1985, swamping local currency performance available to unhedged US$ investors.

Figure 3. Total Return Cumulative Wealth: MSCI EAFE ex Japan Relative to MSCI US

December 31, 1969 – June 30, 2015 • Local Currency • December 31, 1969 = 100

Source: MSCI Inc. MSCI data provided “as is” without any express or implied warranties.

Note: Shaded areas denote MSCI EAFE ex Japan outperformance relative to MSCI US in local currency terms.

Relative valuations today are cheaper than they were at the start of all three cycles of global ex US equity outperformance in local currency terms (Figure 4). However, earnings growth and ROE for global ex US markets have yet to show the relative strength they did at the start of previous cycles (Figure 4). Cumulative real earnings levels for global ex US equities outstripped that of US equities (with some business cycle–driven interim declines), as earnings grew at a faster clip over the two extended periods of outperformance. ROE for global ex US equities also showed increasing relative strength.

Source: MSCI Inc. MSCI data provided “as is” without any express or implied warranties.

Notes: Shaded areas denote MSCI EAFE ex Japan outperformance relative to MSCI US in local currency terms. Real EPS are rebased to 100 units on January 1, 1972. ROE data begin January 31, 1975.

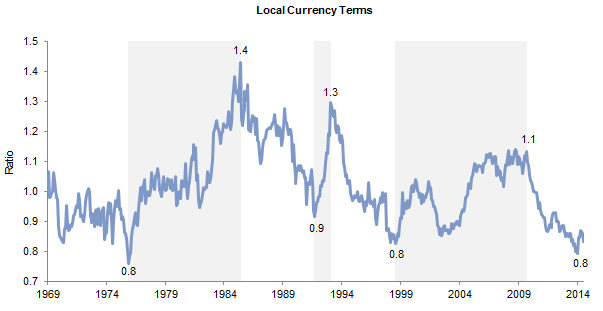

Some nascent signs suggest that stronger earnings growth outside the United States may be coming, as US earnings have come under pressure from weak energy prices and a stronger US dollar at the same time as Japanese earnings have been growing at a rapid clip and European earnings are showing some resurgence. Historically, periods of US$ appreciation have overlapped with relative earnings weakness for US equities (Figure 5). A similar dynamic may be underway today. Earnings momentum has turned up for global ex US equities and turned down for US equities.

Figure 5. Real EPS Growth During Periods of US Dollar Appreciation and Depreciation

October 31, 1978 – June 30, 2015 • Local Currency • Change (%)

Source: MSCI Inc. MSCI data provided “as is” without any express or implied warranties.

Note: US dollar appreciation assumes currency weights based on EAFE allocations.

We favor Eurozone and Japanese equities among developed markets and continue to recommend a modest overweight on a currency hedged basis relative to US equities. The justification for our recommended positioning remains intact; valuations and fundamentals are relatively attractive compared to US equities (Figures 6 and 7).

Figure 6. Normalized P/E Ratios as a Percentage of Fair Value

June 30, 2011 – June, 30 2015 • Local Currency

Source: MSCI Inc. MSCI data provided “as is” without any express or implied warranties.

Note: US, EMU, and EM fair value is measured relative to composite normalized P/E, EM Asia and Asia ex Japan relative to ROE-adjusted P/E, and Japan relative to P/B.

Sources: J.P. Morgan Securities, Inc.

Notes: Japan EPS growth/estimates are for its fiscal years ending March 31. For example, the 2015 estimate is for the period April 1, 2015, to March 31, 2016.

Eurozone: Strengthening Fundamentals With a Side of Political Risk. We remain constructive on Eurozone equities. Our view is supported by three main factors: improving economic growth after four years of depression, signs of improving earnings, and the potential for increased dividends and buybacks. The biggest risks to the Eurozone at present are political, as discussed earlier.

A weak euro, negative yields, and lower oil prices have provided support to the Eurozone economy. While it is hard to get excited about 0.4% GDP growth in the first quarter of this year, the trajectory is in the right direction and compares favorably to US economic growth over the same time horizon. Even as yields have backed up from their extraordinary, and technically overdone, lows in mid-April, they remain low, supportive of growth, and consistent with what we have seen in other examples of QE in which yields rose slightly amid expectations for improved growth and slightly higher inflation.

Credit conditions are beginning to improve from very depressed levels. An ECB survey of 140 Eurozone banks indicates that banks are easing credit standards and demand for loans is increasing. At the same time, the boost to real incomes provided by lower oil prices has led to a year-over-year increase in real consumer spending of 2%—the fastest growth since the global financial crisis. We continue to watch to see if the temporary boost to the economy from euro and oil weakness will transform into a broader, more durable virtuous cycle in which corporations increase capital expenditures, production, and hiring. Signs of hope include rising wages in Germany, where the labor market is relatively tight. Should consumer spending be sustained, it could boost capital expenditures, which have been depressed since 2009.

For more discussion on European earnings prospects, and the case for overweighting Eurozone equities relative to US equities more generally, please see Wade O’Brien et al., “European Equities: Too Early to Take Profits,” Cambridge Associates Research Note, May 2015.

Improving economic growth and a weak euro have provided support for Eurozone earnings, which increased a paltry 3% last year, but are expected to grow nearly 30% over the next two years, comparing favorably against expectations for the United States. In contrast to US earnings, which are 18% above their prior cycle peaks, Eurozone earnings are only 73% of prior high-water marks, with plenty of room to grow. Financials are the largest component of earnings, accounting for 30% of the Eurozone’s profits at present. Financials have benefited in recent quarters from the slowing pace of dilution and crisis-related write-downs and legal settlements and would stand to benefit further should credit demand continue to expand. However, improvements to profits are not without risks, as credit expansion may not come entirely from banks as alternative lending sources continue to expand, and banks have reported margin pressures on loans.

Increased dividends and/or buybacks are another potential source of higher returns. Just as the earnings recovery cycle in Europe has lagged that of the United States, so has the cycle in buybacks. Buybacks (as a share of market cap) were comparable in the United States and Europe prior to the global financial crisis; since then, US buybacks have regained considerable ground, while European buybacks have barely edged higher. The potential for increases is there—European non-financial companies (EMU and others) have cash equivalent to roughly 14% of market cap, compared to just 8% for US companies.

Japanese Equities—Strong Earnings and Hope at a Reasonable Price. While we wouldn’t read too much into Japan’s stellar first quarter GDP growth of 3.9% annualized (particularly given over half this growth was due to an increase in inventories that cannot be a sustained), many factors inspire confidence in Japanese equities today. Earnings growth has been strong, capital flows have been supportive, corporate governance appears to be ever so slowly improving, and equity valuations remain reasonable.

In 2014, earnings grew at 11%, in stark contrast to struggling 2014 economic growth, marking the highest earnings growth among major equity market regions. Expectations for forward earnings growth over the next two years are similar to that for the Eurozone—just shy of 30%—but with higher growth expected in 2015 than in 2016. Strong earnings growth has kept valuations reasonable, as price growth has lagged that of the market. Since its May 2012 trough, the MSCI Japan price index has increased 133%, falling short of the 174% increase in earnings. Over the same period, the market’s ROE has doubled to 8.1% from very depressed levels.

Capital flows also continue to support Japanese equities as foreign investors seek to reduce structural underweights that have been the norm for most of Japan’s lost decades. At the same time, Japan’s largest government pension fund, GPIF, has been shifting its asset allocation away from bonds to increase both domestic and international equities, putting an estimated ¥130 trillion ($85 billion) into Japanese equities starting in April. As expected, other Japanese institutions have followed, including Japan Post Insurance, Japan Post Bank, and other smaller pensions.

Hopes for improvement in corporate governance received more support in June as the new Corporate Governance Code went into effect. This adds to last year’s “Stewardship Code,” designed to promote dialogue between corporate leaders and institutional investors, and the January 2014 launch of the JPX Nikkei 400 stock index, eligibility for which is determined by previous profit levels, historical ROE, and corporate governance. Structural changes take time to work, but the focus on governance appears to be beginning to have some effect. According to data from proxy voting advisor Institutional Shareholder Services Inc., almost 95% of the 2500 companies it covers have at least one outside director, up from 72% in December. A growing number of corporations have set ROE targets as institutional investors, including the GPIF, increasingly have been using ROE as an investment criterion. Firms are also increasing buybacks and dividend payments as pressure on corporations mounts to put sizeable cash stocks to productive use or return money to shareholders. Dividends and buybacks totaled ¥12.8 trillion in the 12 months ended March 2015, with plenty more room for growth as the ¥231 trillion cash on corporate balance sheets equates to about 50% of GDP.

Our near-term enthusiasm for Japanese equities remains checked by the considerable macroeconomic risks facing the economy given shrinking demographics and a large debt burden relative to GDP. As such, we have recommended that investors hold only small overweights and hedge currency exposure.

For more in-depth discussion, please see Sean McLaughlin et al., “The Investment Compass Points Due East: Asia’s Appeal to Emerging Markets Equity Investors,” Cambridge Associates Research Note, June 2015, as well as the Q1 2015 and Q2 2015 editions of VantagePoint.

Emerging Markets: Lean East. In recent years we have been advocating a more nuanced approach to investing in emerging markets. While the coordinated emerging markets boom in the 2000s was driven by the integration of China into the global economy and the resultant commodity boom, the current cycle is more multifaceted and requires a more targeted investment approach. At the start of the year, we shifted our recommendation from overweighting emerging markets relative to US equities to focus on overweighting Asian emerging markets or Asia ex Japan. This view is based on the divergent conditions in emerging markets, particularly as continued commodity weakness, US$ strength, and prospects for additional monetary easing favor Asian emerging markets relative to other regions. We continue to hold this view even as commodity prices have increased, US$ strength has moderated, and Chinese growth has softened.

As both global and Asian emerging markets equities have fallen over 10% from late April highs through early July, we would rebalance global emerging markets allocations back to targets and Asian-biased allocations to modest overweight positions now that the negative momentum has subsided and valuations have moved into undervalued territory. Emerging Asian markets saw outflows amid concerns about global growth, particularly in China, and related concerns about commodity weakness. While earnings growth has slowed and expectations have softened, emerging Asian earnings remain positive and higher than expectations for US equities. We continue to watch closely for signs of further softness in earnings as relative earnings strength is likely to remain key for a resumption of outperformance.

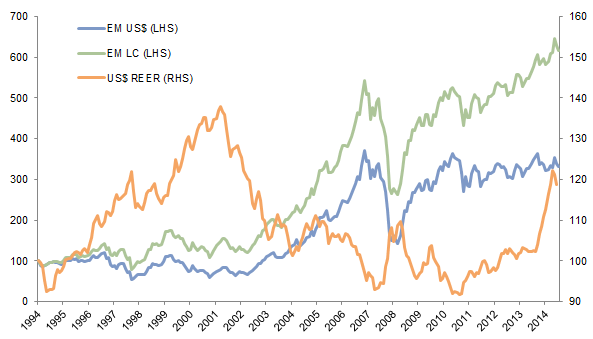

Should US$ strength continue, emerging markets equity returns may continue to be lower for unhedged US$ investors. Local currency returns have actually been quite respectable in recent years: since July 2011, emerging markets equities have appreciated a cumulative 25% in local currency terms, but have declined 2.1% in US$ terms (Figure 8).[5]Hedging emerging markets currencies can be quite an expensive endeavor, particularly as the weakest sovereigns have the highest interest rates and therefore, the highest carry cost of hedging. This is due in part to earnings trends, as earnings in emerging markets have been essentially flat since mid-2011. The stability of aggregate earnings masks the significant divergence across emerging markets, with Asia seeing earnings growth of nearly 15% compared to earnings contraction of 41.5% in commodity-reliant Latin America.

Figure 8. Emerging Markets Equities in US$ Terms Struggle in US$ Strength

January 1, 1995 – June 30, 2015 • December 31, 1994 = 100

Source: MSCI Inc. MSCI data provided “as is” without any express or implied warranties.

Emerging Asia’s relatively stable earnings and currency mix[6]The stability of Asian currencies is largely influenced by the high allocation to China, reflecting Hong Kong–listed shares priced in Hong Kong dollars, which are pegged to the US dollar. have enabled the region to outperform emerging markets as a whole. However, with many Asian central banks in easing mode, we continue to watch exchange rates carefully given their implications for both local economic growth and equity markets. While the US Federal Reserve could begin raising interest rates as soon as this September, Asian central banks, such as China and India, have cut rates several times this year. This may boost local economic growth by lowering debt service burdens and stimulating credit demand, but the corresponding pressure on currencies may limit returns for offshore investors. Meanwhile, inflationary pressures have been eased by lower oil prices, yet remain a threat in many countries and may circumscribe central bank policy. Should Asian currencies prove resilient, Asian companies could be hurt in markets where they compete with Japanese and Eurozone exporters that are benefitting from cheaper currencies. On the flipside, strong currencies will serve to reduce concerns where local companies have accumulated sizeable US$ debt burdens, though this risk was already somewhat mitigated in emerging Asia as high foreign exchange reserves and limited external funding needs compare favorably to other emerging market regions as a whole.

In sum, Asian emerging markets and Asia ex Japan offer attractive value relative to US equities. Their valuations are comparable to that of broad emerging markets equities and all three indexes trade at a 12% to 15% discount to fair value, putting them at the high end of our undervalued range. Tilting emerging markets portfolios toward potentially more defensive Asian markets is possible without paying a premium today. The ability of Asian markets to maintain earnings strength, particularly relative to US equities, is the key to their outperformance over the intermediate term. Near term, market sentiment and capital flows may have an outsized impact. In recent weeks, amid concerns about the possibility of the Fed raising rates, a worsening economic slowdown in China, and volatile Greek bailout negotiations, net capital inflows into emerging markets have been decreasing. Should risk aversion spike, we would expect reduced inflows to shift to net outflows. When the dust settles, however, we expect Asian fundamentals and reasonable valuations will prove defensive relative to broad emerging markets. Any such weakness would provide an opportunity to increase exposures. While there are many implementation options, investors may simply add some Asia ex Japan exposure in place of global emerging markets (GEM) equities or use a GEM manager biased toward Asia.

Neutral on Risk, with Defensive Diversification

Investors continue to face an environment where very little is cheap, the most attractively valued areas are cyclical assets related to commodities and emerging markets, and an increasing number of investments are becoming more expensive. For now, few assets fall into the extremes of very overvalued or very undervalued, where the relationship between valuations and subsequent returns tends to be strongest. This keeps us neutral on risk assets on the whole and looking for relative value opportunities where the investment outlook, especially corporate earnings fundamentals, offers appeal (e.g., Japan, Eurozone, Asia ex Japan/Asian emerging markets).

At the same time, we see risks increasing in some areas. Events in China, Greece, and Puerto Rico should serve as a reminder to investors of the importance of a well-diversified portfolio that includes diversifying hedge funds with less equity and credit exposure, as well as some high-quality sovereign bonds. Making sure that portfolios are aligned with risk tolerance and return objectives is critical in allowing asset owners to withstand volatility and to take advantage of opportunities that may arise.

Footnotes