In this Edition:

- Market illiquidity concerns prompt additional regulations, investor solutions

- New liquidity regulations designed to reduce risk and create global alignment also raise questions of applicability

- Collateralized loan obligation changes create interesting potential risk/reward opportunity

- IRS pushes back key FATCA deadlines again

Market Illiquidity Continues to Raise Concerns

Spurs New Trading Platform Developments

We have highlighted this issue in a number of past publications including: Eric Winig, “Should Investors Be Worried About Corporate Debt Liquidity?,” CA Answers, May 2015, and Eric Winig et al., “Corporate Bonds: The Next Liquidity Crisis?,” Cambridge Associates Research Brief, September 2014.

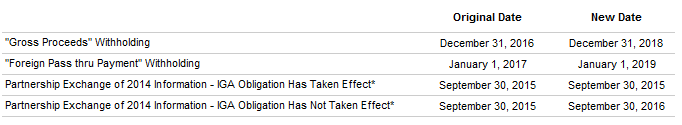

Though Federal Reserve Governor William Dudley recently downplayed concerns that bond market liquidity has diminished significantly, we keep hearing otherwise. Within weeks of Governor Dudley’s comments, the International Monetary Fund put a finer point on the liquidity debate, noting that liquidity in fixed income markets has become more fragile. Whether due to bank capital requirements, Volcker rule restrictions on proprietary trading, the prevalence of mutual funds and exchange-traded funds (ETFs) in the corporate debt and high-yield markets, or everyone’s favorite bogeyman, high frequency traders, dealer inventories remain low (see exhibit), and most managers will point to bond market liquidity as a major concern. In a recent Fed survey,[1]Board of Governors of the Federal Reserve System, “Senior Credit Officer Opinion Survey on Dealer Financing Terms,” October 1, 2015. nearly one-third of surveyed senior credit officers at major dealers indicated liquidity and functioning of a broad spectrum of credit assets had deteriorated. This follows a June survey where more than 80% of surveyed credit officers said the functioning of the secondary market for nominal Treasuries had significantly deteriorated over the last five years.

Corporate Bond Dealer Inventory and Outstanding Debt

July 31, 2001 – June 30, 2015 • US Dollar (billions)

Sources: Federal Reserve, SIFMA, and Thomson Reuters Datastream.

Note: Corporate debt outstanding data are annual except for 2015, which is as of June 30.

For more on dark pools, see the August 2014 edition of Quarterly Regulatory Update.

While equity market liquidity has not been the subject of such a persistent focus, it too has been under increased scrutiny. Starting with the “flash crash” in 2010 and reflected in the precipitous intraday moves in August of this year, equity market participants may rightly wonder about the resiliency and liquidity of equity markets. While “dark pools” (off-exchange trading systems) were thought to offer benefits to institutional investors, ongoing regulatory investigations and fines of dark pool operators have hurt confidence in what has largely been a bank-run system.

Could some developments improve liquidity on the margin? Regulators globally appear to be moving toward an approach of reducing systemic risks in financial markets (including those posed by illiquidity) by regulating activities rather than asset managers. A recent example: the US Securities and Exchange Commission’s (SEC’s) proposal to require liquidity risk management policies for mutual funds and ETFs (for more, see the next article). In the meantime, market participants are rolling out trading “solutions” at a remarkable pace. In the equity space, the buy-side has developed multiple trading venues, with two-year-old trading platform Investors Exchange now seeking approval to become a stock exchange, and asset manager–owned newcomer Luminex vowing to exclude high frequency traders and broker dealers from its platform.

While electronic trading in bonds is much less developed, liquidity worries seem to be spurring new entrants. At least three new electronic platforms for trading fixed income have launched this year. Most recently, Liquidnet (an established player in the institutional equity space) launched a fixed income platform with more than 120 asset managers signed-on at launch. While none of these developments on their own will improve the “fragility” of liquidity in trading markets, they do seem to represent a step forward in increasing available trading venues and decreasing reliance on broker-dealer driven systems at a time when dealers seem to be in retreat.

Increased Liquidity Regulations

New SEC Proposal Targets ETFs and Mutual Funds

In late September, the SEC released proposed regulations focused on reducing liquidity risks in mutual funds and ETFs. These appear to be directed at ongoing regulatory concerns with reducing systemic risks emanating from the asset management industry. Under the proposed rules, funds would be required to establish new liquidity-related policies and also maintain liquidity levels tailored to the individual fund.

Along with new rules adopted in 2014 governing money market mutual funds, these proposed rules reflect ongoing attempts to reduce risks in the financial system. One major focus of global regulators has been managing and monitoring systemic risk. To that end, the Dodd-Frank Wall Street Reform and Consumer Protection Act established a new super regulator, the Financial Stability Oversight Council (FSOC), with a mandate to identify and mitigate risks to financial stability. The FSOC has designated a number of large banks and insurance companies as systemically important, subjecting them to enhanced regulatory standards. However, after several false starts systemic regulators have, so far, failed to develop an approach to managing systemic risks in the asset management industry, including the $17 trillion investment company industry.

The new SEC-proposed liquidity risk management rules expand on a theme central to the 2014 money market fund reforms: reducing fire-sale risks. They also recognize that the market for fund investments has arguably experienced a lot of growth in less liquid strategies. In particular, the growth of corporate debt holdings by mutual funds (estimated to have tripled over the last ten years) and the rapid expansion of so-called alternative mutual funds raise concerns about funds’ ability to meet near-term liquidity demands in a stressed market.

Interestingly, the proposed rules do not require funds to maintain a specific percentage level of near-term liquidity. Instead, funds will be required to maintain sufficient liquidity to meet immediate liquidity needs based on factors including the fund’s own historical needs, cash flow projections, ownership concentration, redemption policies, and certainty around cash flow projections. The overarching objective is to ensure that funds hold sufficient cash (and assets that can be converted to cash within three days) to meet projected redemptions in a stressed market. Funds would also be required to classify the liquidity of all portfolio holdings, dividing them into pre-established groupings from one-day liquidity out to more than 30 days.

The SEC’s liquidity risk management proposal requires funds and ETF managers to carefully assess the linkages among fund size, asset holdings, and investor base. While some commentators have already raised questions about whether the proposed rules will have a disproportionate impact on large AUM funds or indexed ETFs, it is too soon to tell. The proposal allows managers latitude in breaking out single positions into more and less liquid categories based on trading history, for example. This may enable large AUM funds with large numbers of holdings to break out positions granularly, thus improving their liquidity profile.

The liquidity proposal also allows funds (other than money market funds and ETFs) to adopt so-called swing pricing. This is akin to an anti-dilution levy, familiar to many institutional commingled fund investors, and allows funds (under some circumstances) to pass through to purchasing or redeeming shareholders the expected cost of a transaction in shares. Implementation of this approach should protect ongoing shareholders from the impact of significant cash flows within a fund. This part of the SEC proposal also aligns US funds with standards in European markets.

The proposed liquidity risk management rules reflect regulators’ continuing focus on addressing systemic risks associated with the asset management industry. While these proposed regulations attempt to flexibly address liquidity concerns in the fund marketplace, they are not necessarily addressing underlying causes of market illiquidity. Further, a manager’s liquidity policy will undoubtedly rely to some extent on expectations drawn from historical norms for market liquidity, trading impact, and investor behavior. Alternative mutual funds and corporate credit funds, which may be of the most concern, have a short and mostly positive growth history, which may not prove to be a good guide. Industry reaction to the proposal will be telling, and may shed further light on how asset managers believe they should approach liquidity risks in the current environment.

Collateralized Loan Obligations

A Market Adapting to Regulatory Changes

The Volcker Rule limits banks’ abilities to invest in private funds. See the May 2014 edition of Quarterly Regulatory Update for more on this topic.

With record levels of issuance in 2014 and strong issuance in the first part of 2015, the collateralized loan obligation (CLO) market seems vibrant,[2]Collateralized loan obligations are investment structures that pool corporate loans (and a limited amount of other investments) and offer investors the ability to participate in the performance of … Continue reading but CLO managers and buyers have yet to address significant regulatory changes that will impact market structure in the years ahead. US CLO managers stand to be impacted by “risk retention” rules that require them to hold at least 5% of the capitalization of each CLO they manage. Banks, which are large holders of CLOs, have run into issues with some CLO structures conflicting with prohibitions in the Volcker Rule. This has given rise to concerns that banks could become forced sellers of portions of their CLO portfolios. To date, neither issue has resulted in an attractive opportunity for less constrained investors, but this remains an area where risk and reward may change and create opportunities.

In late 2014, US regulators finalized “risk retention” rules for CLOs and other securitized investments. Under the rules, CLO managers must retain 5% of the CLO’s capitalization either: (a) through the equity of the CLO (a “horizontal slice”), or (b) through investments of 5% in each tranche of the CLO’s capital structure (a “vertical slice”). Market participants and regulators have raised concerns that CLO managers may be hard pressed to come up with sufficient capital to meet risk retention requirements. In fact, according to one study, only 10 of the 30 largest CLO managers could meet the new requirements.[3]Haunss, Kristen, “Regulators May Allow CLO Refinancing Without Risk Retention Penalty,” Thomson Reuters, June 16, 2015. This has left some commentators predicting that the implementation of these rules will lead to a wave of manager consolidation.

Thus far, CLO managers do not appear to have settled on an approach for sourcing capital. In our discussions with managers and market participants, solutions appear to have focused on transactions where a manager retains a vertical slice of the CLO and seeks financing for the retained investment.[4]Since equity is a relatively small portion of a CLO’s capital structure, a manager that retains 5% of the value of the whole structure in the form of equity would own a substantial portion of the … Continue reading However, CLO managers and would-be financers have not yet developed a model that provides a compelling risk-reward proposition to investors, with managers proving reluctant to issue fee concessions sought by capital providers. Given that markets are well into the credit cycle, investors should have a higher return bar for stepping into these financing trades than appears to be on offer.

While CLO managers seek a new financing model, a significant slice of the CLO buyer market may instead need to sell. Banks are significant holders of CLOs, with US firms estimated to hold $70 billion in AAA and AA rated investments, according to Bloomberg. However, regulatory changes driven by the Volcker Rule now limit the types of CLOs that banks may hold. For example, for definitional reasons, CLOs that hold some bonds in addition to loans or that may invest in other CLOs may be off limits to banks. CLOs with documents permitting investors to remove/replace their investment managers may also be prohibited investments. While newly issued CLOs have taken these structural requirements into account, the terms of non-compliant issuances must either be modified or be sold out of bank portfolios. Some holders may have already taken action—market commentators noted that prices widened somewhat this summer as the Volcker Rule went into effect. Banks still have some time to work through these issues, as regulators gave banks until mid-2017 to get into compliance. However, this is an area that could see some pricing dislocations as banks work through their portfolios.

IRS Delays FATCA Penalties

Again. Really.

See the May 2014 edition of Quarterly Regulatory Update for more on FATCA.

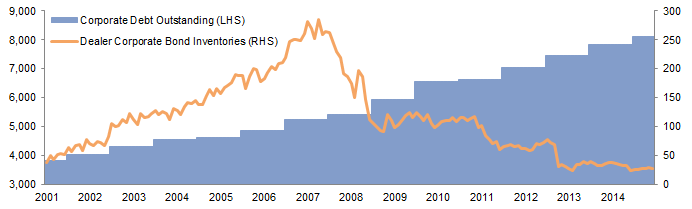

The Foreign Account Tax and Compliance Act (FATCA) has been moving slowly into effectiveness, having been enacted into law in 2010. The purpose of FATCA is to reduce tax evasion by identifying and gathering information on US taxpayers that hold non-US accounts (i.e., that make investments through non-US entities). FATCA attempts to achieve disclosure and compliance by imposing a 30% withholding tax on any US-source payments (including gross proceeds, not just net gain) to a non-US entity that does not agree to comply with FATCA’s account identification, reporting, and withholding rules. While US officials have made progress in implementing the complex withholding tax, with the first elements rolled out in mid-2014, they’ve now pushed back deadlines to begin actually withholding tax to allow more time for foreign financial institutions and other withholding agents to adapt their systems.

Sources: Internal Revenue Service and Sullivan & Cromwell LLP.

* Calendar years 2014 and 2015 treated as a transition period, with the requirement simply to show a good faith effort to comply.

Footnotes