Infrastructure investments have generated attractive returns in recent years and helped stabilize portfolios due to their ability to generate inflation-protected returns across various economic environments. The asset class has grown rapidly and offers investors a way to capitalize on secular themes like decarbonization and digitization. Growing demand in areas such as energy transition and telecommunications infrastructure (e.g., cell towers and data storage for artificial intelligence [AI]) create opportunity across the sector. However, the market environment today is complicated by higher interest rates, rising capex costs, and increasing supply chain bottlenecks. The investment acumen and operational skill demanded of infrastructure managers is the highest it has been since the Global Financial Crisis.

This note provides an update on the current opportunity set in infrastructure investments and highlights some of our preferred areas in the private space, including energy transition and digital infrastructure.

Growth in Infrastructure Opportunity Set Broadens Its Investor Base

Infrastructure investments are often characterized by stable and inflation-linked contractual cash flows, high barriers to entry, diversified return drivers, and the potential for attractive income. This sector traditionally featured projects with modest yet predictable earnings growth such as toll roads and bridges. While its salient characteristics still hold true, the asset class has expanded beyond project finance opportunities.

Twenty-first century infrastructure investing includes telecommunications assets such as cell towers and data storage, emerging technologies in clean energy, and “platform companies” intended to scale their operations rather than investing in single assets. This means growth opportunities are significantly more substantial today. Operational expertise is therefore more important than ever to develop assets and drive returns versus simple financial structuring.

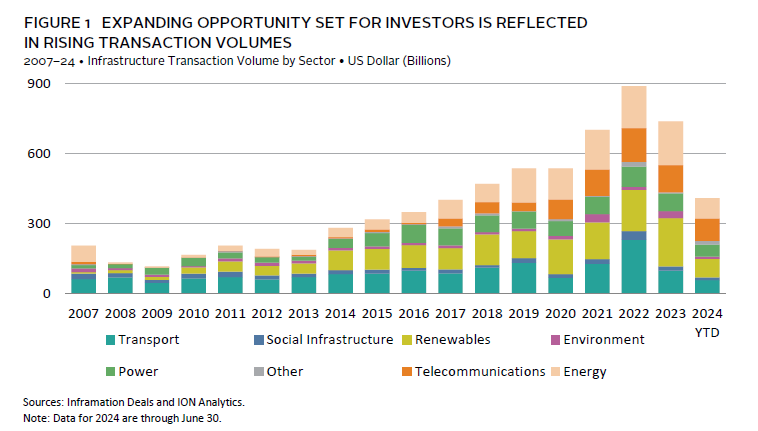

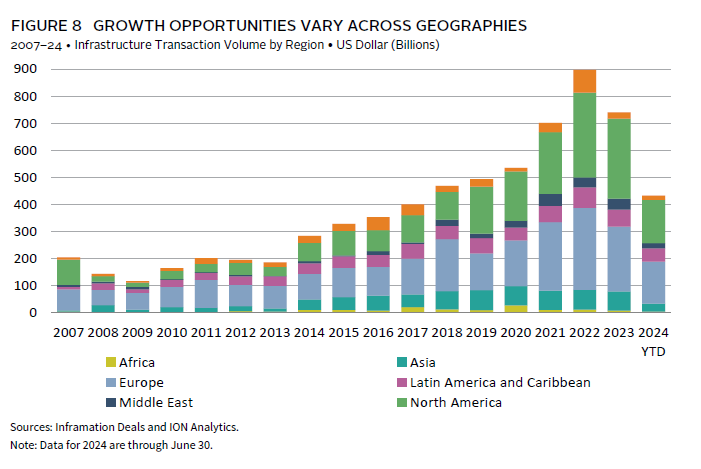

The expanding opportunity set for investors, as well as increasing liquidity of the underlying investments, is reflected in rising transaction volumes (Figure 1). In turn, the universe of potential investors has expanded beyond traditional participants, such as pension funds and insurance companies, to include sovereign wealth funds, endowments and foundations, and private individuals. These investors seek income and inflation protection as well as total returns, which compete with those of other private real assets strategies.

Comparing Public and Private Infrastructure Strategies

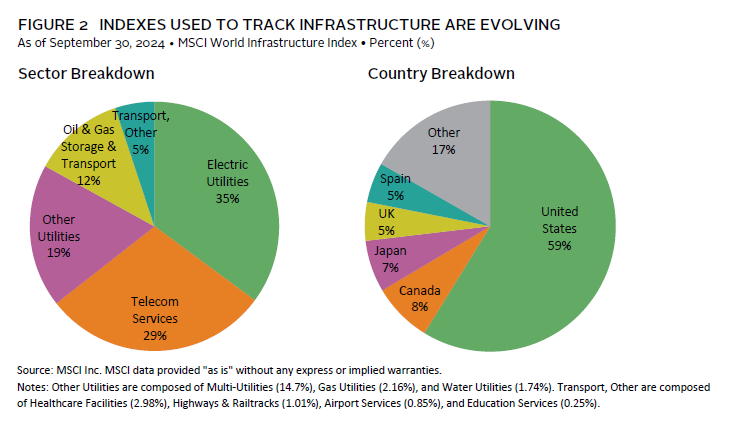

The definition of infrastructure investment is evolving as are the indexes used to track this asset class. Many infrastructure indexes are heavily weighted toward traditional sectors such as utilities, telecommunications, and transportation (Figure 2), though in other cases, “infrastructure” indexes can include constituents in tangential categories like industrial companies. In comparison, private infrastructure offers more tailored exposure and can provide risk profiles ranging from core to opportunistic investments. Risk and reward can vary significantly across strategies, which can span greenfield project development to lower-returning regulated operating assets. These differing sector and project exposures mean return drivers can be very different between public and private infrastructure indexes.

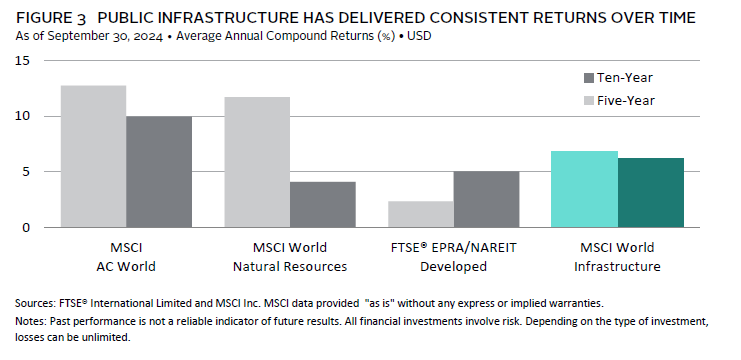

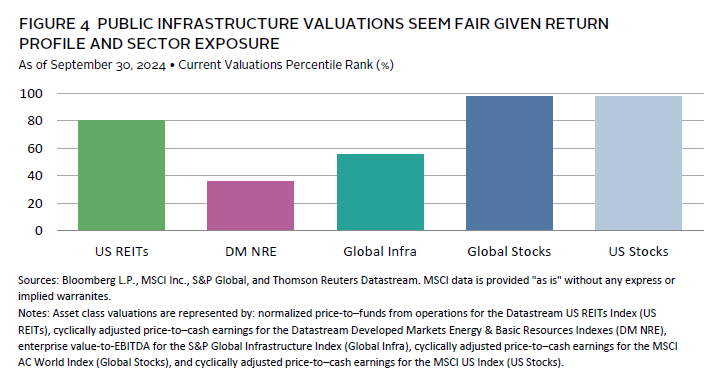

Public infrastructure equities have posted mid-single-digit annualized returns in recent years (Figure 3). The asset class has performed similar to most real assets peers but with more consistency, given the higher return contribution from dividends. Year-to-date performance has been stronger as interest rate cuts have again piqued investor interest in the sector’s steady dividend stream. Not all funds have done well. Some previous projects have suffered from higher-than-expected financing costs and some have had sector-specific issues, such as the struggles of European utilities. Public infrastructure indexes have also not enjoyed the same performance uplift as private equivalents, given their lack of exposure to recent winners like digital infrastructure. Still, despite strong recent returns, valuations look attractive relative to both other real assets categories and broad equity markets (Figure 4).

Private Infrastructure Returns Have Been Compelling

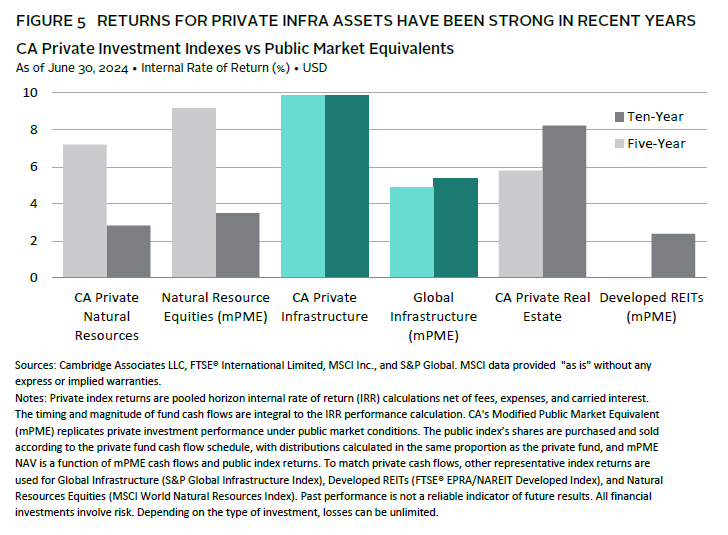

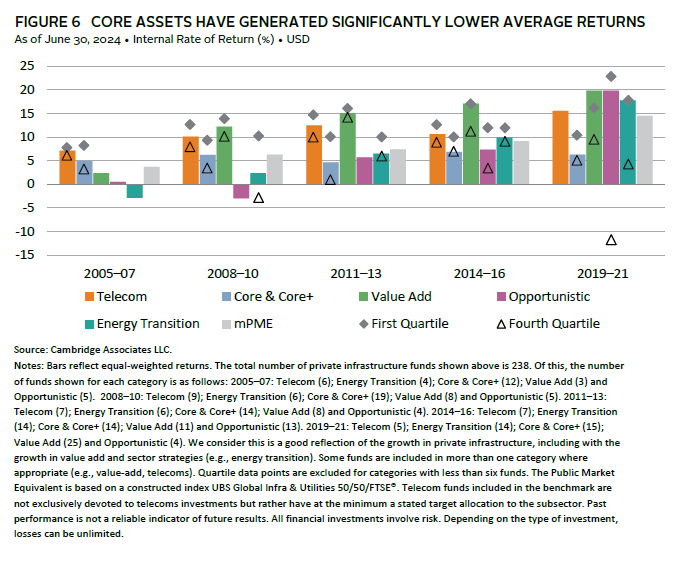

In contrast, returns for private infrastructure assets have been strong in recent years and compare favorably with those of other real assets (Figure 5). Across categories, core assets have generated significantly lower average returns (Figure 6), reflecting their lower risk profile while also increasing competition. Returns for more value-add and specialized categories have been significantly higher. This is especially true for energy transition funds in recent years, reflecting the maturation of technologies (e.g., renewables) from earlier funds that tended to underperform, as well as the green premium for such assets being offered recently. Digital-focused strategies have also significantly outperformed, benefiting from market growth.

The growing size of infrastructure funds and competition among funds (and with strategic buyers) has boosted valuations, which could create a headwind to returns, especially for existing core assets. This has also been a tailwind to some value-add investors that have benefitted by selling to core investors and providing multiple expansion opportunities. Nonetheless, the infrastructure sector may face fewer secular challenges than some of its peers. For example, private office real estate may continue to struggle with high office vacancy rates, rising insurance costs, and diminished bank appetite to lend. Similarly, private natural resources have lagged as investors shift focus to renewable energy sources, which has weighed on valuations.

Diversification Benefits

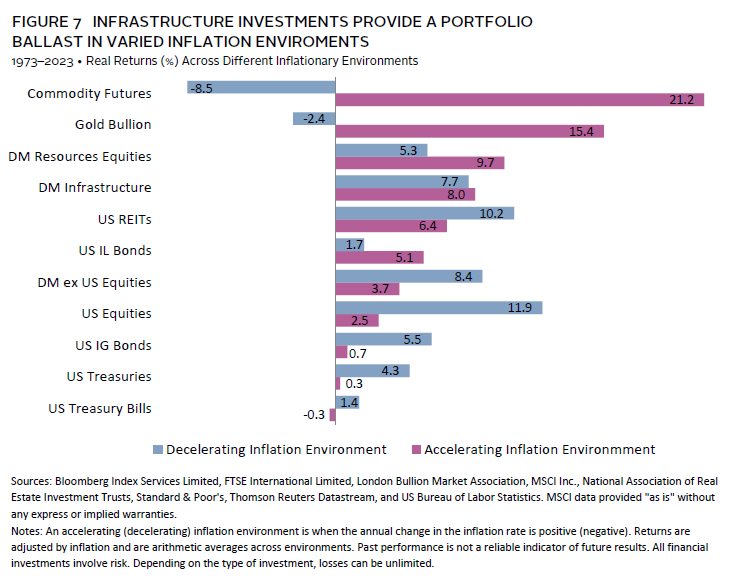

Infrastructure investments can also help reduce overall portfolio volatility. Given their ability to post steady returns across various economic environments, infrastructure assets can aid in stabilizing overall portfolio performance. Demand for services like toll roads and power tends to be recession resistant and providers (often protected by long-term contracts) can pass inflationary pressures to end-users, supporting returns on capital. Figure 7 illustrates how infrastructure investments provide a ballast to portfolios by generating attractive real returns in both rising and falling inflation environments. In fact, the consistency of their returns across these environments suggests they are better suited to cushion portfolios against both inflationary and deflationary shocks.

Where Investors Should Focus

Private investments are our preferred method of gaining exposure to infrastructure because of their ability to curate exposure to attractive sub-sectors. We like assets within infrastructure that support energy transition and digital infrastructure, which are boosted by secular tailwinds and offer especially attractive opportunities. Taking on greenfield (earlier stage development) projects is not without risk and leverage must be used prudently. However, private infrastructure funds that can successfully construct essential and scalable assets are likely to continue rewarding investors.

Energy Transition

Energy transition refers to the ongoing shift in sourcing the world’s power needs from fossil fuels to options with lower greenhouse gas emissions. Despite political crosscurrents in some regions, this transition is occurring rapidly. In 2023, capacity growth in renewables rose a staggering 50%. Significant capital flows are fueling this growth. According to Bloomberg, global energy transition investment totaled around $1.8 trillion in 2023, and 30% of private infrastructure investment focused on renewables.

Within renewables, the opportunity set is shifting, as prices for existing and contracted assets have risen. Private infrastructure funds seeking higher returns are developing assets and often start by acquiring renewable energy “platforms” (i.e., companies with in-house management teams) or through utility-scale greenfield developments. Developing assets is far less costly than acquiring assets from utilities or other players (e.g., c. $5K/megawatt [MW] for pre-permitted development solar projects versus c. $350K/MW for built projects).[1]Example of an Irish solar project seen by Cambridge Associates LLC. While many private energy transition funds from recent vintages seem on track to post high returns, others have been hit by rising costs, asset markdowns, and other challenges, such as delays to grid connections.

Opportunities vary across geographies. The United States presents significant growth opportunities for renewables development. The policy backdrop has been favorable, given the benefits from the Inflation Reduction Act. However, there is risk in this policy being unwound following the recent US presidential election. In our view, the growing demand for power in the United States, especially from data centers, continues to create a relatively attractive investment environment. The flipside is that valuations of developed projects can be elevated, while new projects may face multiyear delays to be connected to the grid. In Europe, experienced management teams are also increasingly scarce. Furthermore, the complexity of the European regulatory environment, along with challenges in grid connectivity, has impacted investment. Finally, Asia-Pacific offers significant growth opportunities and supportive regulatory regimes, though proven management teams can be harder to source. Australia, Japan, Korea, and Taiwan are examples of geographies seeing increased investment, including in solar and offshore wind projects.

Transition fuels such as natural gas are an opportunity within energy transition. Demand in Asia and Europe is rising, creating a need for new liquefied natural gas infrastructure, including storage and transportation. The Middle East and United States will play a significant role. Traditional energy producers are also likely to support the growth of blue hydrogen, which currently has greater economic viability than early-stage green hydrogen (but subsidies and technology risks remain).[2]Green hydrogen is produced from water using electrolysis powered by renewable energy, while blue hydrogen is generated from natural gas with carbon capture and storage (CCS) technology.

Electric vehicle (EV) charging is a burgeoning market that will likely continue to offer attractive opportunities in Europe. This market stands to benefit from subsidies and the potential for lower marginal costs. In contrast, the geographic size of the United States, shifting policy backdrop after the recent elections, and cultural attitudes are likely to make EV adoption slower and slow investment in underlying charging infrastructure.

Circular economy development offers another opportunity through building infrastructure for waste collection, recycling, and distribution. This has generally been successful, although areas such as energy from waste have seen challenges, including securing feedstock. Additionally, battery storage solutions continue to scale, offering complementary support to renewables in mitigating intermittency. Co-location and hybrid projects (a mix of wind, solar, and batteries) are also growing and can have contractual backing to mitigate market and technology risks.

Digital Infrastructure

The global demand for digital infrastructure assets, such as cell towers, fiber optic cables, and data centers, has surged dramatically. This heightened interest is driven by interconnected trends, including the proliferation of data-intensive devices, the expansion of the Internet of Things (IoT), and the rise in mobile content creation and streaming. Consequently, the need for enhanced global interconnectivity is escalating, with bandwidth projected to grow at a compound annual growth rate (CAGR) of over 30% from 2022 to 2026.

Data centers address the growing need for more data storage and handling, accelerated in recent years by the growth of generative AI. “Hyperscalers” like Amazon, Google, Meta, and Microsoft have growing global footprints, creating opportunities for developers and operators of these assets.

Power demand has also significantly jumped since data centers have substantial electricity needs, creating a related opportunity. According to Goldman Sachs, electricity demand in the United States had been relatively flat for years but is now expected to rise around 2.4% per annum through 2030, largely due to demand from these sites. The main customers of these facilities want them powered by low-carbon energy, creating an opportunity for new providers that make use of renewables and perhaps nuclear sources. Infrastructure funds seeking to fill this void need to navigate challenges, which can include grid capacity, intermittency issues, and local regulatory requirements.

Telecommunications-focused infrastructure funds have also generated strong overall returns in recent years and have bright prospects. Increasing cell tower capacity will mostly come from densification of existing assets, and the penetration of 5G/6G technologies is expected to have a long runway of opportunity. Permitting requirements for additional buildouts can be a challenge, as can the need for some managers to rely on large telecommunication groups to try and monetize their existing infrastructure.

Fiber optics presents another growth opportunity, but this segment can be more cyclical in nature. Some Fiber to the Home (FTTH) developments have failed, as adoption levels fell short of expectations, costs rose, and “overbuild” became a concern. It is likely this slower adoption will continue in some regions (e.g., Germany, the United Kingdom, and the United States), particularly as newer technologies (e.g., satellites) become an option for less urbanized regions.

Other Private Infrastructure Opportunities We Find Attractive

Infrastructure debt and secondaries have seen significant growth, benefiting from broader growth in global private credit and secondary markets. These strategies let investors gain exposure to the trends we prefer, while allowing them to tailor their risk profile through debt securities or by purchasing assets at a discount (relative to direct equity) via secondaries.

Infrastructure debt opportunities are attractive because they can provide stable income. They currently offer compelling spreads of 200 basis points (bps) to 300 bps over investment-grade opportunities, and an attractive return profile of 10%–15% returns for development opportunities, particularly for those focused on renewables and natural gas ecosystems.

Secondaries are increasingly attractive as the impact from the denominator effect (investors being overweight private investments and needing to sell) and pension de-risking creates attractive buying opportunities. The market has enjoyed tremendous growth, from $1 billion to $2 billion a decade ago, to transaction volumes of $15 billion in 2023.

Conclusion

We believe allocations to infrastructure will likely continue, given its diversification benefit and potential to outperform comparable public and private real assets. We prefer to lean on private strategies that offer tailored exposure to sectors boosted by supportive tailwinds such as digital infrastructure and energy transition. We believe these will continue to attract a wider cohort of investors and present an outsized opportunity for growth but require nuanced expertise for successful development and thus, value creation. As a result, we advise aligning with proven and operationally able managers that can increase the odds of successful execution, while being mindful of delivering on attractive return profiles for investors.

Wade O’Brien, Managing Director, Capital Markets Research

Minesh Mashru, Global Head of Infrastructure Investments

Sehr Dsani, Senior Investment Director, Capital Markets Research

Francesco Dell’Alba, Associate Investment Director, Real Assets

Drew Boyer, Elisa Lavric Chiazutto, and Graham Landrith also contributed to this publication.

Index Disclosures

FTSE® EPRA/Nareit Developed Index

The FTSE® EPRA Nareit Developed Index is designed to track the performance of listed real estate companies and REITs worldwide. By making the index constituents free-float adjusted, liquidity, size, and revenue screened, the series is suitable for use as the basis for investment products, such as derivatives and Exchange Traded Funds (ETFs).

MSCI All Country World Index

The MSCI ACWI captures large and mid cap representation across 23 developed markets (DM) and 24 emerging markets (EM) countries. With 2,687 constituents, the index covers approximately 85% of the global investable equity opportunity set. DM countries include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. EM countries include: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, the Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.

MSCI US Index

The MSCI US Index is designed to measure the performance of the large- and mid-cap segments of the US market. With 625 constituents, the index covers approximately 85% of the free float–adjusted market capitalization in the United States.

MSCI World Infrastructure Index

The MSCI World Infrastructure Index captures the global opportunity set of companies that are owners or operators of infrastructure assets. Constituents are selected from the equity universe of MSCI World, the parent index, which covers mid and large cap securities across the 23 developed markets countries. All index constituents are categorized in one of thirteen sub-industries according to the Global Industry Classification Standard (GICS®), which MSCI then aggregates and groups into five infrastructure sectors: telecommunications, utilities, energy, transportation, and social.

MSCI World Natural Resources Index

The MSCI World Natural Resources Index is based on its parent index, the MSCI World IMI Index which captures large-, mid- and small-cap securities across 23 developed markets countries. The index is designed to represent the performance of listed companies within the developed markets that own, process, or develop natural resources.

S&P Global Infrastructure Index

The S&P Global Infrastructure Index is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry, while maintaining liquidity and tradability. To create diversified exposure, the index includes three distinct infrastructure clusters: energy, transportation, and utilities.

Footnotes