The first quarter was characterized by heightened volatility in global equity markets, which sold off significantly in January and early February, then rallied—some even finished the quarter in positive territory. Bonds experienced a dramatic decline in yields and flattening in the “belly” of yield curves, while the value of the US dollar declined against a basket of developed market currencies.

The S&P 500 returned 1.3% in the first quarter, while the MSCI World and MSCI Emerging Markets indexes returned -0.3% and 5.8%, respectively, in USD terms. Gains in March helped US and emerging markets equities return to black, with the latter enjoying a particularly significant boost, returning 13.3% for the month in USD terms. On a broad index basis, hedge funds declined; the HFRI Fund Weighted Composite Index posted a -0.7% return for the quarter.

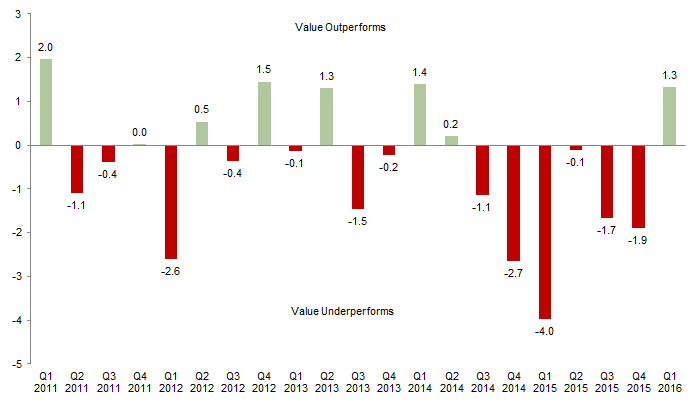

Our first quarter update examines the switch in the performance of value- and growth-oriented managers, as value equities outperformed their growth counterparts globally for the first time in seven quarters. We also comment briefly on Valeant Pharmaceuticals given the headlines it generated in the first quarter. Finally, we review the changes over the quarter that contributed to better performance from uncorrelated and systematic macro strategies.

Fundamental Hedge Fund Strategies

Long/short equity hedge funds in general suffered steeper losses than the broader hedge fund universe this quarter with a -1.7% return for the HFRI Equity Hedge (Total) Index. US equities weathered one of their worst Januarys on record (-5.0%), then dropped further in early February. At one point, the S&P 500 Index was down by more than 10% year-to-date, though it would later rally, as noted. Fears of China’s slowing economy continued to put pressure on oil prices and industrial metals at the start of the year, but both sectors rebounded significantly following China’s policy responses and the US Federal Reserve’s decision to slow future interest rate hikes. The energy and materials sectors of the S&P 500 Index returned 9.3% and 7.7%, respectively, in March.

Growth vs Value

Within long/short equity hedge funds, growth- and value-oriented managers alike were susceptible to the volatility over the quarter, posting sharp losses (-4.5% for HFRI Equity Hedge) for January. The onslaught continued through mid-February, according to available weekly and mid-month estimates. As global markets rebounded, hedge fund performance began to diverge. The prior 18 to 24 months had been defined by strategies with a growth and/or earnings momentum factor tilt strongly outperforming their value-tilted peers, the struggles of which were widely reported in the media.

However, value-oriented hedge funds appeared to recoup most of their early 2016 losses, aided by exposure to value equities in the industrial and materials sectors, which in the S&P 500 finished February up 7.6% and 4.0%, respectively, and returned over 7.0% apiece in March. Meanwhile, growth-oriented hedge fund managers struggled throughout February—the technology and health care sectors of the S&P 500, popular areas for growth, returned -1.2% and -0.5%, respectively—and failed to fully capitalize on the market rally in March. Technology shares bounced back strongly in March (9.2%), and health care posted relatively modest gains (2.8%) in comparison. The performance of small-capitalization stocks in the United States exemplified the shift in value’s favor: the Russell 2000® Value Index returned 1.7% for the first quarter, while the Russell 2000® Growth Index returned -4.7%. Further, value’s outperformance was apparent despite a poor showing from bank stocks for the quarter: the S&P 500 Bank Index declined by 12.8%.

Some market participants speculated that deleveraging or significant reductions in gross and net exposures prevented many funds from capitalizing on the market rally. This may be true from an industry-wide perspective; however, several managers we follow closely observed that deleveraging was not, in fact, widespread, though some funds did consciously reduce gross and/or net exposures amid the volatility in January and February. Aside from a handful of noteworthy stock-picking mistakes, the likely culprit behind hedge fund underperformance was factor exposures.

Please see “Will Value Stocks Continue to Outperform?,” CA Answers, April 19, 2016, and the second quarter edition of VantagePoint (a quarterly publica-tion from Cambridge Associates’ Chief Investment Strategist), published April 21, 2016.

It is too early to tell whether recent market performance indicates value investing is coming back into favor, or whether the first quarter was just another blip in a prolonged period of outperformance by growth and momentum strategies. Still, value investing is a strategy that generally works over the long term, so we encourage investors to be patient with allocations to high-quality, value-oriented hedge fund managers that have strong long-term track records and stable businesses.

Relative Performance of MSCI ACWI Value vs MSCI ACWI Growth

First Quarter 2011 – First Quarter 2016 • Total Return Differential in LC Terms (ppts)

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Data are gross of dividend taxes.

A Word on Valeant Pharmaceuticals

Valeant Pharmaceuticals International made headlines again during the first quarter. On its fourth quarter earnings call on March 15, Valeant guided 2016 earnings lower and announced that it would delay filing its 2015 financial statements. The latter development was related to the firm’s internal investigation of incorrectly recorded revenue through drug distributor Philidor Rx Services. The news left investors speculating whether Valeant was at risk of technical default in the coming months. In late March, the company announced it would begin searching for a new CEO, but that current CEO Michael Pearson would remain until a replacement was identified. Shortly thereafter, Pearson was subpoenaed to testify before a Senate committee investigating sudden price spikes in certain medications.

Valeant equity traded downward by more than 50% on March 15 and by more than 70% for the first quarter—an astonishing decline in value for a mega-cap company. Fortunately, most of the long/short equity hedge fund managers Cambridge Associates focuses on had significantly reduced or eliminated their exposure to Valeant equity prior to the March earnings call. However, two high-profile activist investors maintain large allocations to Valeant, as well as seats on its board of directors.

Valeant’s credit also traded lower after the fourth quarter earnings call. Given the complexity, the number of issues, and the different maturities in Valeant’s capital structure, many event-driven and distressed credit hedge fund managers had begun searching for opportunities to invest in Valeant credit by quarter-end.

Macro and Uncorrelated Hedge Fund Strategies

For macro and uncorrelated strategies, the first quarter was characterized by a dramatic decline in yields, flattening in the “belly” of yield curves, and a decline in the value of the US dollar. In bond yields, the most pronounced decline was in ten-year rates: US Treasury ten-year bonds and swaps dropped by 49 and 54 bps, respectively, to 1.78% and 1.64%, owing to the Fed’s shift toward a more dove-like approach to raising rates. The two- to ten-year slope of the Treasury yield curve flattened by 17 bps, whereas the ten- to 30-year slope steepened by 8 bps. The demand for the safety of ten-year sovereign bonds was even more dramatic overseas: ten- year German bunds declined by 48 bps to 16 bps, and ten-year Japanese government bonds declined by 31 bps to a remarkable -4 bps.

At this point, the Fed appears to have slowed—perhaps even stopped—interest rate tightening. For many discretionary macro managers, “reading” the Fed has been frustrating given that the US dollar has not risen, and neither have front-end rates. This has caused fears of nascent inflation, currency wars, and the concomitant rise in gold by 16% to $1,234 per ounce.

The slight rise in the energy complex over the quarter (Brent and WTI were up 6.2% and 3.5%, respectively) has taken some pressure off those companies in the oil patch whose bonds were given up for dead. The issue for some in the multi-strategy space and in high-yield bonds is whether they bought the debt of energy producers too early, as oil plummeted past $30. The temporary rebound to $39.60 (with a high of $41.79) has given some relief to that complex.

The strongly trending markets in the first quarter provided excellent conditions for uncorrelated and systematic macro strategies: the uninterrupted yield-curve flattening, strength in the euro and Japanese yen, and energy’s progression from weakness to a rebound all proved supportive. A number of systematic strategies generated high single-digit and low double-digit returns, with the average for the universe of strategies we follow closely falling between 4% and 5%.

Of note, many of the mean-reversion models used by fixed income–oriented managers—whether discretionary macro or arbitrage—are proving increasingly irrelevant. Thanks to the unprecedented liquidity provided by central banks, one-third of developed markets bonds now have negative yields. Further, the “risk-free” government rates in many developed markets are now higher than interest rate swaps. Hence, these commoditized models that stood the test of time for three decades now need to adapt to new paradigms.