After several years of lackluster economic growth, more countries have moved from zero interest rate policy (ZIRP) to negative interest rate policy (NIRP) in an unprecedented attempt to ease debt affordability and/or weaken currencies, with the ultimate goal of inducing a return of growth and inflation. This transition has not gone smoothly, as the Bank of Japan’s decision in January to become the fifth central bank with negative rates hurt risk appetite and raised fears that central banks are losing their potency.

The effectiveness of negative policy rates is hotly debated. Proponents argue negative rates boost household consumption by lowering borrowing costs and making saving less attractive, improve corporate margins through lower borrowing costs, and increase exports via weaker currencies. Skeptics suggest they fuel asset bubbles, punish savers and financial intermediaries, and are unlikely to impact trade given competitive currency devaluation is a zero-sum game. Our sympathies lie mainly with the detractors. Debt levels and housing prices are rising in most countries with negative rates, overly free allocation of capital is dangerous (see: the ongoing commodity bust), and though disentangling the effects of a variety of factors is difficult, the ultimate goal of economic growth is unlikely to be achieved by NIRP.

Breaking the Zero Bound

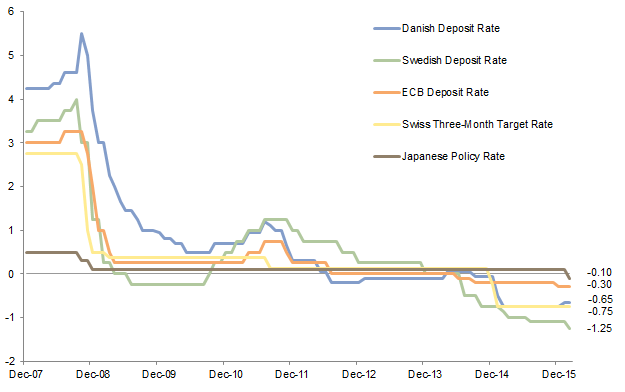

Countries have many types of interest rates, including policy rates used by central banks and market-driven rates such as interest offered on savings deposits. As growth and inflation have remained sluggish, several central banks have moved policy rates into negative territory in the hopes that market rates of interest would drop via the so-called transmission mechanism. Sweden came first in 2009, followed by Denmark in 2012, the European Central Bank (ECB) in 2014, and the Swiss National Bank in 2015. As noted, the Bank of Japan is the latest to join this club, cutting the rate of interest offered to commercial banks on balances above the regulatory minimum to -0.10% in January 2016. Countries representing around 25% of the world’s GDP now employ some type of negative policy rate, a sobering reflection of the lackluster growth rates that persist across much of the developed world.

Sources: Federal Reserve, Financial Times, and Thomson Reuters Datastream.

Note: Data are monthly.

Policymakers have various motivations for cutting policy rates, including weakening a currency (or helping to maintain a currency peg, like Denmark), lowering the cost of credit and in turn boosting demand, and improving debt affordability. Boosting inflation is often also a goal; cheaper credit and a weaker currency can help improve demand for local goods and services.

Can NIRP Boost Economic Growth?

The relatively recent nature of this phenomenon gives us no historical examples worthy of comparison, and the short track record so far is mixed.[1]Switzerland did experiment with negative interest rates on deposits by foreigners in the 1970s but this example is not especially relevant. Switzerland sharply lowered its main policy rate to -0.75% in early 2015, in part to stem the appreciation of the Swiss franc against the euro. This effort was partially successful—after an initial spike when the peg was broken, the franc steadily depreciated over the remainder of 2015. However, low rates were not enough to prevent GDP growth and credit creation from tapering off over the course of the year; both fell well below levels seen the previous year. In Sweden, which flirted with negative rates from 2009 to 2010 and moved below zero again in mid-2014, the krona has staged a mild depreciation against the euro since late 2012, and economic growth has steadily outpaced that of regional peers. Swedish GDP is expected to have expanded around 2.8% in 2015, capped by a 1.3% quarter-over-quarter expansion in the fourth quarter—roughly twice what had been expected.

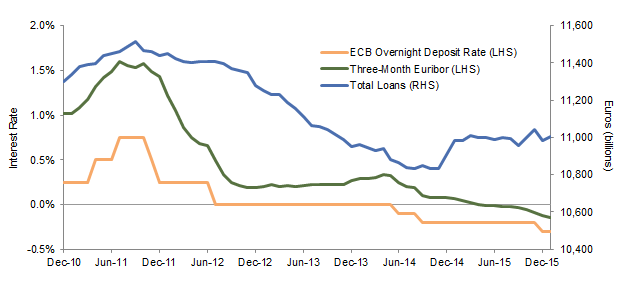

After the ECB moved to negative rates in mid-2014, lending volumes and growth started to rebound; GDP growth was 0.9% in 2014 after negative prints in both of the prior years. Lower interest rates helped ease debt burdens and provided a boost in particular to some of the heavily indebted peripheral countries. A weaker euro also helped to increase exports and corporate profits. While the initial results were deemed promising and growth continued to accelerate into 2015,[2]Eurozone GDP 2015 growth is expected to come in at 1.5%. NIRP, along with the ECB’s extensive quantitative easing, is now being greeted with more skepticism. The euro has been stable against the US dollar for the last 12 months, in part because the region runs a record trade surplus; inflationary pressures remain muted in part due to plunging commodity prices.

Sources: European Central Bank and Thomson Reuters Datastream.

Notes: Total loans represents seasonally adjusted total loan amount outstanding made by monetary financial institutions to households, nonprofit institutions serving households, nonfinancial corporations, sole proprietorships, insurance corporations, pension funds, and other financial intermediaries. Data refer to the changing composition of the Eurozone area.

These examples give a sense of how challenging it is to isolate the impact of negative rates on variables such as economic growth, inflation, and credit demand given the multitude of other forces at work. Fiscal policy, external demand, debt levels, and actions taken by offshore players such as foreign central banks can all serve to enhance (or dilute) the impact of negative rates. In theory, NIRP can impact consumer confidence and thus depress activity, but distinguishing correlation from causation is difficult and low rates clearly have not depressed activity in countries like Sweden. Longer term, NIRP, like the unconventional monetary policies that preceded it, could have the deleterious effect of distracting policymakers from pushing through necessary structural reforms such as easing labor regulations, unintentionally serving to limit growth.

The Law of Unintended Consequences

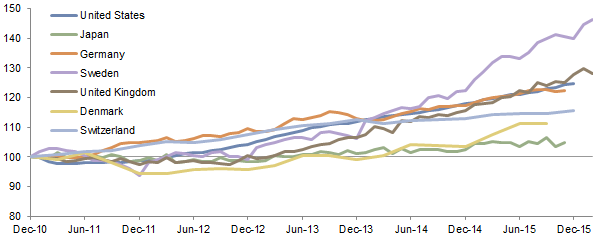

NIRP’s effectiveness is also impacted by the unintended consequences of easing debt affordability and, again, complications from other factors. Governments have benefitted from lower interest rates, but absent traditional market pressures, some have continued to accumulate what may prove to be unsustainable debt burdens. Lower borrowing costs have boosted company margins, though in some regions weak corporate confidence has led to deleveraging and in others inexpensive capital continues to encourage overinvestment. Households have generally benefitted from lower mortgage rates—short-term mortgages are available for around 2% in Germany and Sweden—but soaring property prices have offset some of the benefits. Growing levels of household indebtedness are also raising concerns over what happens to affordability when rates eventually rise and debt must be refinanced. Japan’s experience has been slightly different. Demographics and a shrinking population mean that overall housing demand is subdued; low mortgage rates have boosted house prices but newspapers often feature stories about the number of abandoned houses in cities like Tokyo.

Selected Residential House Price Indexes

December 31, 2010 – February 29, 2016 • Local Currency • Rebased to 100 at December 31, 2010

Sources: Bank of Scotland, Europace, Eurostat, Japan MLIT, NASDAQ OMX Valueguard, Swiss National Bank, Thomson Reuters Datastream, and US Federal Housing Finance Authority.

Notes: Data are monthly except for Switzerland and Denmark, which are quarterly. Data for Germany represent the Europace EPX Hedonic Composite Index. Data for Japan represent the Residential Property Index of the Japanese Ministry of Land, Infrastructure, Transportation, and Tourism and are through November 2015. Data for the United States represent the US Federal Housing Finance Authority Purchase-Only Home Price Index and are through December 2015. Data for Sweden represent the NASDAQ OMX Valueguard Sweden Composite. Data for Denmark represent the Eurostat House Price Index – Denmark and are through September 2015. Data for Switzerland represent the House Price Index for Residential Single Family Homes of the Swiss National Bank and are through December 2015. Data for the United Kingdom represent the Halifax and Bank of Scotland All Houses House Price Index. Only data for the United States and United Kingdom have been seasonally adjusted.

What low or negative rates bring to debtors they often take away from savers, and when households have more assets than liabilities the net impact can be to lower incomes and reduce consumption. Japanese households sit on around ¥900 trillion (US$8 trillion equivalent) of short-term investments like bank deposits, according to the Bank of Japan, a multiple of their liabilities, and NIRP has created significant investor angst and reduced political support for Prime Minister Shinzō Abe. Thus far, no banks in countries with NIRP offer negative rates on retail savings accounts. However, if banks were to pass on negative rates and savers responded by withdrawing money from accounts and storing it under the proverbial mattress, the ability of banks to access funds and boost credit creation could be limited. A recent survey by ING suggested around 80% of Eurozone savers were likely to change their behavior in response to negative rates, mainly by withdrawing money from savings accounts but also in some cases by saving less. The extent which savers withdraw funds and buy other assets such as stocks, bonds, and gold, could inflate these markets both domestically and offshore.

Bonds & NIRP: Not a Pretty Picture

For more about the implications of negative rates for fixed income investors, please see Stephen Saint-Leger, “What Are the Implications of Negative Interest Rates and Why Are Investors Accepting Them?,” CA Answers, March 24, 2015.

Determining how NIRP could affect asset prices is challenging as well. Bonds often appreciate in price as rate cuts cause curves to flatten and bring down longer-term rates. However, low yields on sovereign bonds can eventually discourage investor demand, especially if inflation is positive; Japan and the Eurozone have used quantitative easing to support these assets. Lower yields can also impact liquidity, as a change in yields has a greater impact on bond prices given their higher duration. The impact on credit instruments is ambiguous, putting aside the benefits from lower risk-free rates. When economic growth is slowing and corporate leverage is rising, lower rates may simply offset rising credit spreads and have limited impact on credit fundamentals. Eventually, however, credit quality may deteriorate if low yields encourage excess borrowing and/or investment by corporations. This is the situation the mining and energy sectors now face, as the desperate thirst for yield after the financial crisis (as well as unrealistic growth expectations for emerging markets) led to the excess level of investment that has now turned into write-downs and losses.

Equities & NIRP: Putting Another Floor Under Prices?

Equities could theoretically be boosted by lower discount rates and superior earnings prospects for companies with falling borrowing costs and where currency devaluations will flatter the value of offshore earnings. The relative value of stocks may also be improved by the unattractive yields on comparable assets like bonds. While this initially was the case in markets like Japan and the Eurozone, in recent months the relative performance of these markets has tapered off as concerns over economic growth have come to the forefront. Disentangling what drives equity performance in the short term is not straightforward. Japanese and Eurozone equity performance was supported in 2015 by stronger earnings growth and more attractive valuations than US equivalents; these forces have been insufficient thus far in 2016.

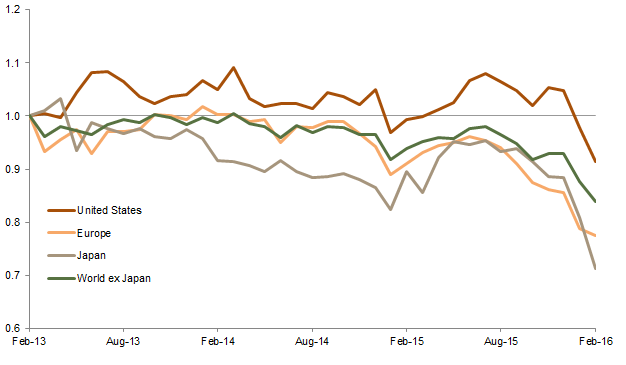

The financial sector may see more direct impacts. The implementation of NIRP in the Eurozone and Japan has weighed on financials given concerns that yields on assets such as bonds and mortgages are declining but this can’t or won’t be passed on to liabilities like deposits.[3]There are certainly other concerns, such as lingering questions about capital levels in Europe and an ongoing rethink about the exposure of certain European banks to investment banking services and … Continue reading To a certain extent the impact depends on how NIRP is implemented. Japan’s three-tier system means that the amount of Japanese bank reserves subject to negative rates amounts to just 2% of GDP. Savers could withdraw deposits and even redeem money market funds, but this begs the question of whether holding cash is worth the presumed security expenses and subsequent transaction costs (imagine paying for everything in cash). Swiss banks have maintained net interest margins by boosting fees and margins on mortgages, which effectively means NIRP has caused banks to subsidize savers at the expense of mortgage holders. Overall, the impact will vary depending on each bank’s reliance on revenue streams such as lending, asset management, and investment banking services.

Relative Performance Ratio of Selected Financial Sectors

February 28, 2013 – February 29, 2016 • Rebased to 1.0 on February 29, 2013

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: Cumulative relative performance of MSCI Banking Sector sub-index to geographic parent, calculated as a ratio of cummulative wealth from February 28, 2013. Returns are monthly in local currency.

The Bottom Line

The track record of major economies in using NIRP to boost growth has been mixed, and its ability to weaken currencies complicated by other factors; for example the yen and euro have recently risen against the dollar despite further cuts by their central banks. Negative rates can help boost debt affordability for debtors, but hurt savers, encourage additional borrowing, and help fuel asset bubbles. Home prices are inflating in many of the countries using NIRP, and the original ZIRP was one of the driving forces behind the surge in commodity-related investment that is now entering a savage default cycle. Our main concern with NIRP (and, for that matter, ZIRP) is that it distracts various stakeholders from what drives high-quality growth; namely, thoughtful investment at a company level and structural reforms at a national level. Other unintended consequences include a growing asset–liability mismatch for banks that find their customers want to borrow long (to lock in low rates), but only invest in very short-duration assets. NIRP is part of a multi-year trend of falling rates that has triggered a desperate global search for yield. Investors, like policymakers, need to carefully navigate the various potential risks and rewards of this new environment.

Wade O’Brien, Managing Director

Robert Roche, Investment Associate

Footnotes