We continue to advise an overweight to Eurozone equities versus US equivalents given attractive relative valuations, greater potential for earnings growth, and tailwinds from the improving macro environment

- Eurozone equities have performed strongly year-to-date but may have more room to run given valuations and weaker medium-term performance.

- UK equities have similar valuations but are less compelling due to headwinds like currency strength and high commodity exposure.

- European equities in general should benefit from high dividend yields and the potential for cash-rich companies to expand buybacks.

- The Eurozone macro environment is improving, helped by record-low interest rates and the cheaper euro. Wildcards include the fate of Greece, the direction of oil prices, and the pace of ongoing structural reform, which could support earnings.

- We continue to recommend non-local investors hedge their exposure to European equities given foreign currency exposure is a source of additional portfolio volatility for which there is little reward.

European equities, and particularly Eurozone equities, are off to a strong start in 2015, as the European Central Bank (ECB) has delivered on earlier promises to fight deflation, and economic data have started to inflect upward. Given attractive relative valuations and the prospects for profits to rise from current depressed levels, we have been constructive on European equities for some time, with our preference turning to Eurozone equities at the end of 2014 in light of additional tailwinds such as the cheaper euro and lower interest rates. Is the recent outperformance of Eurozone equities sustainable? Is it too late to increase exposure? While the 17% year-to-date return for Eurozone equities is likely to mean the pace of recent gains will slow, we continue to believe investors should overweight them versus US equivalents in their portfolios.

Macro Outlook More Supportive, Though Risks Remain

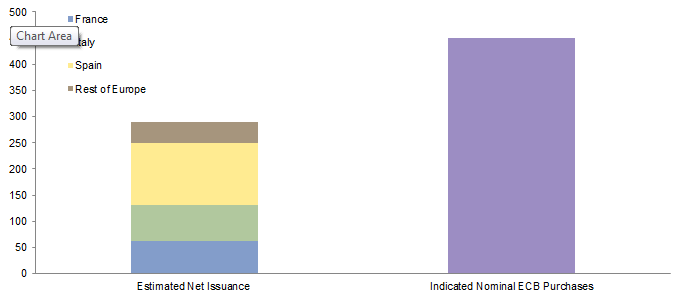

After expanding by around 0.9% in 2014, a more positive macro tone has emerged year-to-date in the Eurozone economy, and 2015 GDP growth forecasts now stand around 1.5%. Growth has been boosted by several forces, including the reduction of fiscal austerity efforts, rising confidence, and the ECB’s significant expansion of asset purchases. The size of the ECB’s anticipated €1.1 trillion of purchases relative to expected net supply of government bonds is enormous (Figure 1), causing yields to move into negative territory on many sovereign and high-quality corporate bonds. Lower interest rates are providing fiscal relief to many countries that still suffer from elevated debt burdens, allowing them to spend funds that had been earmarked for debt service on other projects. Lower rates have also weakened the euro and thus boosted the value of foreign sales for Eurozone companies, while also forcing many investors out of negative-yielding bonds and deposits and into higher-beta investments such as real estate and equities.

Figure 1. Expected Net Issuance of Sovereign Bonds vs Expected ECB Purchases

March 1, 2015 – December 31, 2016 • Euro (billions)

Sources: Barclays and Thomson Reuters Datastream.

The plunge in oil prices should serve as a tailwind for growth across Europe, where oil imports amount to around 3.5% of GDP. Brent crude has mounted a small rally in recent weeks but still remains around 45% below peaks last summer. Anecdotal evidence suggests that consumers are starting to spend this windfall, and the downward pressure on inflation is what paved the way politically for the ECB’s more aggressive policy.

The stimulative impact of currency depreciation and oil weakness are not the only tailwinds for growth—a good thing since these factors may prove ephemeral. Structural reforms also seem to be boosting Eurozone competitiveness and confidence, though the pace of these reforms is not consistent across countries. For example, Spain has eased labor laws and lowered wages and in turn created around 500,000 jobs over the past year (though unemployment remains stubbornly high). In contrast, Italy’s constant political change has stunted the extent of reforms, though recent changes to labor laws and over the banking sector have been favorably received.

See Stephen Saint-Leger et al., “The Burden of European Debt,” Cambridge Associates Research Brief, April 27, 2015.

Offsetting these positives are some longstanding headwinds: the excessive debt burdens that have been generated in recent years trying to fight the financial crisis (Figure 2) and demographics that feature aging populations. Investors also continue to be rattled by ongoing political tensions across Eurozone member states, the consequence of using a common monetary system in countries with vastly different fiscal policies, inflationary pressures, and debt burdens. Germany is currently growing faster than most of its fellow Eurozone members in part because the inexpensive euro helps its exporters, but is wary of rising price and wage inflation that may prove long lasting. Conversely, Italian growth remains anemic despite the weak euro, though servicing a debt burden that stands at around 110% of GDP is much easier given low ECB policy rates and assumed ring-fencing from Greek contagion. The recent rise in support for extreme political parties also has spooked investors, but better growth and recovering labor markets may be diminishing these parties’ appeal. Spain’s accelerating recovery (it recently boosted its GDP growth forecast for 2015 to 2.9%), for example, has seen the left-leaning Podemos party plunge in the polls.

Source: International Monetary Fund – World Economic Outlook Database.

Note: Figures for 2014 for France, Greece, Italy, Switzerland, and the United States are estimates as of April 2015.

Greece is also an important wildcard for European investors. The country re-entered headlines earlier this year for all of the wrong reasons after the left-leaning Syriza party won the largest share of the vote in the January elections. Syriza had campaigned on a platform of tearing up previous bailout agreements, believing its negotiating position was strengthened by the possibility of Greece running a primary account surplus in 2015, a political mandate from its voters, and Eurozone officials’ fear over contagion to bond markets for other peripheral countries.

Syriza has run into stiff resistance from Eurozone creditors, in part because it has overplayed its hand. Recent economic weakness means that hopes of running a primary surplus are now a distant memory, and Greece will need new funding for 2015. The Greek government’s budget is supported by transfer payments from other European Union (EU) members, and its banking system is being propped up by ever-expanding amounts of emergency lending assistance from the ECB. Removing these factors would likely trigger a run on bank deposits, though capital controls could be put into place to staunch savings from leaving the country. While Greece has suggested it could attempt to pay bills in a new currency or via IOUs, the viability of paying state workers who put Syriza into office in this fashion seems dubious given either form of payment almost assuredly would depreciate and thus weaken the party’s political support.

Given these dynamics, our base case remains that a deal will eventually be reached, which is likely to include some concessions on austerity targets and asset sales for Greece in exchange for the country committing to more structural reforms. The likelihood of attaining such a deal may have increased in recent weeks, as Greek Prime Minister Alexis Tsipras has struck a more conciliatory tone and sidelined some of his more extremist cabinet ministers. This said, the long-running negotiations have created many false dawns, and the risk of a financial accident is growing as time drags on. Even so, with most of Greek debt owned by official creditors, expanded QE in place, and Greece’s economy amounting to less than 2% of European GDP, implications for the wider markets are more limited.

Returns Have Been Robust

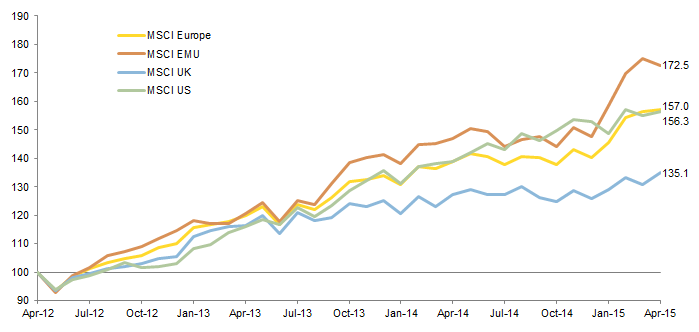

Given the economic backdrop and favorable starting valuations, Eurozone equities have generated strong recent performance, returning nearly 17% since January in local currency terms. These returns have easily surpassed those of the MSCI US Index (2.1%) and even the China-led rebound in emerging markets stocks (10.9% in local currency terms). Returns on the MSCI EMU Index now easily surpass those of the MSCI US Index over the past three years (Figure 3), though European returns overall have been dragged down by the lackluster return on UK equities.

Figure 3. Performance of European Equities vs US Equities

April 30, 2012 – April 30, 2015 • Local Currency • Rebased to 100 on April 30, 2012

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

This recent EMU outperformance may seem astounding until one considers it was about three years ago (the summer of 2012) when ECB President Mario Draghi made his now famous “do whatever it takes” comments about protecting the euro. In fact, looking beyond just the past three years, a considerable performance gap opens between the Eurozone and US equity markets. For example, over the past five years, the cumulative return on US stocks has been 90%, nearly 50% higher than the cumulative 59% return on Eurozone equities. Viewed another way, the MSCI EMU Index still stands below its July 2007 peak, while the MSCI US Index is roughly 40% higher.

In a similar vein, while the roughly 72% cumulative return of Eurozone stocks during the past three years has been more than double that of UK equivalents, looking back five years, the outperformance is a much more modest 9%. UK equities have not recently benefited from tailwinds like a cheaper currency and more aggressive central bank, but nor did they suffer in the first place from the existential crisis that seemed to pervade the Eurozone during the depths of the debt crisis.

Valuations Are Higher but Remain Reasonable

Strong recent returns have pushed Eurozone and broader European equity valuations higher, and some metrics now stand above historical averages. However, the earnings cycle and context of lackluster intermediate-term returns are important when determining their absolute attractiveness. The broad MSCI Europe Index now trades around 16 times composite normalized earnings (Figure 4), around 10% above its historical fair value level and the highest level since mid-2008. Short-term metrics look more aggressive, with the MSCI Europe Index trading at 16 times expected earnings, almost 30% above its historical average. On a relative basis the story is more encouraging. European stocks are around 30% cheaper than US equivalents using normalized multiples and around 8% cheaper on a forward basis.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: The composite normalized price-earnings (P/E) ratio is calculated by dividing the infl ation-adjusted index price by the simple average of three normalized earnings metrics: ten-year average real earnings (i.e., Shiller earnings), trend-line earnings, and return on equity–adjusted earnings. Average for forward P/Es based on data from June 2003 to present.

Despite recent gains, EMU equities (which contribute nearly 50% of European market cap) currently trade around 16 times composite normalized earnings, roughly in line with their historical fair value level. Like the broad Europe index, forward price-earnings (P/E) ratios show EMU equities farther above long-term averages. Despite slightly higher relative valuations versus US equities, Eurozone equities may have the greatest potential for subsequent returns. The consensus now expects Eurozone profits to rise 17% in 2015, in contrast with the expected 1% rise in the United States. Eurozone earnings barely grew in 2014 and hopes for an earnings per share rebound have been dashed many times in recent years, but several dynamics suggest optimism for 2015 is well founded. Near-zero nominal interest rates are serving as fiscal stimulus to many countries, allowing them to reduce spending on debt service and thus increase spending on other goods and services. A similar dynamic holds true for companies, which are refinancing existing debts and locking in lower rates. As economic growth rebounds, operating leverage is kicking in and pushing margins and thus profits higher. The weak euro should boost the value of profits earned abroad for exporters and companies with extensive international operations.

UK equities (just over 30% of European market cap) look just above historical fair value on a normalized basis but more expensive on a forward P/E basis relative to their own history. However, earnings growth has been weaker in the United Kingdom than on the Continent, and headwinds may be stronger; the consensus expects earnings to contract another 11% in 2015. The MSCI UK Index has large weights for energy (15%) and materials (8%) firms, which have suffered and may continue to suffer from lower commodity prices. It also prominently features companies that are based in or focused on emerging markets, which are suffering from a cyclical slowdown as well as in some cases the end of the commodities supercycle. Finally, UK companies may not benefit from the same FX tailwinds as Eurozone counterparts both because the pound has not sold off to the same extent as the euro but also because many companies report in US dollars and thus receive no translation benefit from overseas sales. Offsetting these headwinds is that domestic economic growth has recently been stronger in the United Kingdom than on the Continent, but this is in part because government spending (and therefore deficits) has been higher. The May election results suggest a continuation of the recent fiscal status quo, though the promised referendum on EU membership, if successful, could eventually result in disruptions to trade and potentially see companies relocate out of the United Kingdom.

The most expensive major European market is Switzerland, where the forward and composite P/Es suggest local equities are 20% to 40% overvalued. This seems to reflect investor appetite in recent years for defensive consumer staples and health care stocks as opposed to earnings growth. Index earnings have basically been flat for the past 12 months and are expected to contract in 2015. While Swiss equities are likely to display some defensive characteristics should the markets again come under pressure, the headwinds of high valuations and a resurgent Swiss franc reduce the attractiveness of the market.

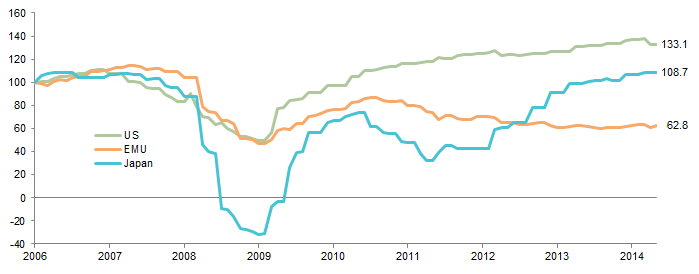

Looking ahead, European equities could outperform if the valuation discount relative to the United States continues to close, if earnings growth is superior, or if both of these dynamics play out. In light of signs that at least earnings growth in the Eurozone will prove superior, we continue to prefer this sub-exposure to that of the broader market. Aside from the currency movement and cyclical forces discussed earlier, the Eurozone earnings recovery is made more likely given a lower bar. Since the start of 2007, Eurozone index earnings are down around 37% while US earnings have risen over 30% (Figure 5), leaving margins in the latter stretched from a historical perspective.

Figure 5. Comparing EPS Growth Across Regions

December 31, 2006 – April 30, 2015 • EPS for each region rebased to 100 on December 31, 2006

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Sector Outlooks Are Mixed—Can Financial Earnings Continue to Rebound?

The potential for a Eurozone earnings rebound is broad based and not limited to one sector, though the fate of financial sector (which generates around 30% of index profits) will have an outsized impact. On an absolute basis, financial earnings are down around 40% since 2007. On a per share basis, the decline is even greater (65%)—surpassed only by the energy sector (Figure 6)—given massive share issuance by many banks to shore up capital bases. As the pace of this dilution slows and some banks put the worst of their crisis-related write-downs and legal settlements behind them, bank earnings have the potential to inflect upward. This already seems to be occurring; the sector saw a large uptick in profits in fourth quarter 2014 and is expected to see earnings rise another 44% in 2015. The nascent rebound in credit demand that is underway in the Eurozone also could be constructive for bank earnings.

Figure 6. MSCI EMU: Percentage Change in Sector EPS and Current Index Weight

December 31, 2006 – April 30, 2015

Sources: FactSet Research Systems, MSCI Inc., and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Other cyclical sectors such as energy and materials stocks have also seen large earnings declines since the crisis, and valuations relative to other sectors reflect this (Figure 7). Here the outlook is cloudier given the potential for commodity prices to remain depressed over the course of 2015, though it is worth noting that several exploration & production majors have surprised to the upside in first quarter as costs are being rationalized and refining and trading profits prove robust. Sectors such as telecoms and utilities have also seen substantial losses, and for some of these the outlook may be more constructive. For example, the telecoms sector has suffered from stiff competition pressures and excessive capital expenditure in recent years, especially in contrast to the United States, where a much smaller number of firms serves a much larger market. As write-offs for some of this wasteful spending fade and as recent and expected merger & acquisition activity thins the number of players, sector profits in Europe may improve going forward.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Return on equity is calculated by dividing the index’s price-to-book ratio by its price-earnings ratio.

Dividends and (Possibly) Buybacks May Boost Returns

US equity outperformance in recent years has been supported by significant amounts of share buybacks. Last year S&P 500 companies purchased around $565 billion of their own equity, an all-time record, and some sell-side analysts believe this level will be easily surpassed in 2015. In comparison, European firms (EMU and others) have been far more parsimonious, repurchasing just over €100 billion of stock annually in recent years. The result is that cash balances for European non-financial companies are much higher than US equivalents; European companies are sitting on cash equivalent to around 14% of market cap while US companies have just 8%.

Some investors hope that European companies will become more aggressive in returning cash to investors in 2015, boosting per share earnings and providing another tailwind. There are some signs this is occurring (Vivendi, Michelin, etc.), but whether it will substantially increase is unclear. A recent Nasdaq study suggested that European firms that increase buybacks actually underperform, though some US studies assert the opposite. The outcome may depend in part on what companies are hearing from investors. To the extent that near-zero yields on bonds are pushing investors into equities, the stability of a dividend may be preferable to the potential lumpiness of cash flows from buybacks. In any event, higher dividends are an important part of the return stream for European equity investors; the current dividend yields on the MSCI EMU (2.9%) and UK (3.8%) indexes are much higher than the 2.0% expected in the United States.

A separate topic is whether the depressed euro makes Eurozone companies more tempting as takeover candidates for companies with stronger home currencies. While this is difficult to discuss without drilling into currency, tax, and other topics such as family control, there are indeed some signs that US acquisitions of Eurozone companies are accelerating, according to JP Morgan.

Implementation: An Active or Passive Approach?

Investors seeking to increase exposure to Euro zone equities face some tricky questions when considering implementation options, such as how far along the equity market recovery is and whether the market has moved from a broad-based macro driven equity rally to more of a stock-pickers’ market. Strong recent returns suggest the beta trade may be fading for at least some assets, though index valuations remain undemanding. But if the ECB’s expansion of QE (and risk factors like Greece) indicates that markets will remain macro driven, does this mean correlations will continue to be elevated, making it more difficult for talented active managers to choose their spots?

The argument in favor of an active approach is that macro-driven flows may be indiscriminately boosting value of some less-deserving companies, creating opportunities to underweight or short certain stocks that can be harvested when conditions normalize. Using the financial sector to illustrate the point, many banks in the Eurozone have issued new shares and rebuilt balance sheets, and credit demand seems to be recovering. However, in many markets excess competition continues to depress product margins and thus profits, and banks will need to continue to delever, lowering returns (Figure 8). In a similar vein, while low interest rates serve as a huge boon to leveraged companies, by lowering discount rates they boost the value of liabilities for companies with large defined benefit pension schemes. These liabilities are enormous in some markets—according to one recent study by Mercer, the unfunded pension deficit for DAX-listed companies is over $200 billion. The benefit to companies with foreign revenues from currency depreciation is also not straightforward. Some companies may be using overly conservative exchange rate forecasts when providing guidance to sell-side firms for 2015 results, creating the potential for positive earnings surprises. On the other hand, some exporters have both foreign factories (and thus foreign costs) and large currency hedging programs in place, eliminating much of the perceived benefit, at least in the near term, from the cheaper euro.

Sources: European Central Bank, Federal Reserve, and International Monetary Fund – World Economic Outlook Database.

Complicating the picture is that correlation metrics (such as those of individual stocks with the overall index and between stocks), which can be used to gage the opportunity set for active management, are fairly volatile. For example, in recent months the average correlation between returns of individual stocks in the MSCI EMU Index and the overall index has fallen to roughly its historical average, suggesting markets were becoming more discriminating. However, for most of the previous six months, it has been above average, as investor inflows into Eurozone stocks accelerated. A continuing decline in correlations would provide fertile ground and favor an active approach. That said, investors may want to resist using too many different active managers, as the calls some get right may be offset by mistakes in other funds. To use one recent example, positions in expensive and now currency-challenged Swiss equities have weighed on several European equity managers in recent months.

A related topic is currency hedging, which we continue to recommend for non-local investors in Eurozone equities (and European equities more broadly). Our advice is not based on currency valuations, which by some metrics suggest the euro at least is undervalued, or a focus on return enhancement. Rather, it stems from historical data that suggest unhedged currency exposure is a source of additional portfolio volatility for which there is little reward. Investor inflows into Eurozone equities in recent months have been dominated by currency-hedged passive products like exchange-traded funds that remain a low-cost and thus sensible option. For investors that prefer an active approach or desire to stick with an existing stable of managers, currency overlay managers are an option as are currency-hedged vehicles from some managers.

Concluding Thoughts

It is too early to fade the rally in Eurozone equities as valuations remain more compelling than US equivalents, earnings are starting to rise from a depressed base, and the macro environment provides a stronger tailwind than in certain other markets. However, other European equity markets are less compelling for a variety of reasons that include weak earnings potential (United Kingdom) and stretched valuations (Switzerland). Given large recent gains, Eurozone returns going forward will likely be lower than they have been the past three years. Still, valuations and the longer-term underperformance of Eurozone equities suggest there may be some gas left in the tank.

We are currently biased in favor of passive approaches, which allow investors to specifically access Eurozone stocks, as opposed to active funds that focus on Europe more broadly. That said, a number of managers have generated alpha through the cycle, and conditions for all active managers would be improved by lower correlations. What seems more clear cut is the rationale for currency hedging, which should reduce portfolio volatility for non-local investors and cushion against some macro shock that could see the euro move sharply. That such an event will occur is not our base case, but as we have seen with Greece and some other situations during the past few years, many things are possible.

Wade O’Brien, Managing Director

TJ Scavone, Investment Associate