We expect public infrastructure equities to perform similarly to developed market equities in 2025, propelled by supportive regulations for energy transition and strong demand for power infrastructure to fuel AI. While we believe US REITs should underperform US equities, US private real estate funds raised in 2025 should generate above-average returns, benefiting from distressed deals and solid fundamentals.

Infrastructure Equities Should Perform Similar to Developed Markets Equities in 2025

Sehr Dsani, Senior Investment Director, Capital Markets Research

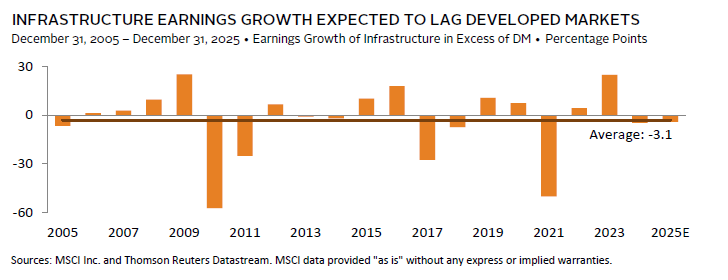

Infrastructure[1]As expressed by the MSCI World Core Infrastructure Index. earnings growth accelerated in recent years to above usual levels, partly due to the end of COVID-19 lockdowns, supportive regulation, and AI development. As a result, some sub-sectors enjoyed strong performance, but overall, returns have lagged those of DM equities since 2020. Going forward, as we balance infrastructure’s lower earnings growth relative to DM equities against its defensive attributes and reasonable valuation, we think it will likely perform in line with DM equities.

Infrastructure equities offer defensive qualities, such as steady dividends that are backstopped by stable inflation-protected income. Recently, their dividends have become more attractive as interest rates have declined—with dividend yields nearly twice those of DM equities. We think these attributes will help retain interest in the sector.

However, infrastructure earnings are expected to grow at a healthy cadence of mid-single digits in 2025 versus strong double-digit growth in 2022 and 2023. Meanwhile, valuations sit at the 66th percentile of data from the past 20 years. Conversely, DM equities are meaningfully more expensive, but growth of 7.2% is accelerating and handily outpacing that of infrastructure.

Supportive regulations for energy transition and strong demand for digital and power infrastructure to fuel AI development have propelled growth. Sub-sectors directly related to these tailwinds are overweight in infrastructure and trade at rich valuations, such as electric utilities (77th percentile). Globally, new legislations have been introduced to inject investment into infrastructure and shorten permitting timelines to incentivize new projects. Although, the recent change in US administration could result in some of these legislations being repealed. Additionally, AI data storage needs are significant and have driven power and digital infrastructure demand higher, creating growth opportunities for utility companies. While we think these tailwinds largely remain, since growth rates are forecast to normalize in 2025, expensive valuations in these key sub-sectors pose a risk to performance.

We think AI-related stocks within both infrastructure and DM equities will likely take a breather in 2025 after rallying at a torrid pace. This—alongside the dynamics of income generation, growth, and valuation levels—should result in similar performances between infrastructure and DM equities.

US REIT Performance Should Lag Broader Equity Markets in 2025

Wade O’Brien, Managing Director, Capital Markets Research

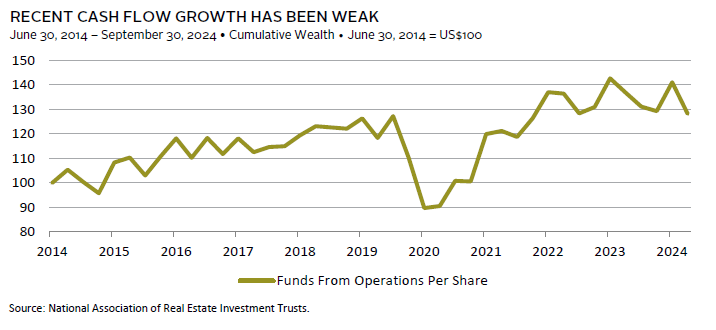

Despite a strong third quarter rebound as the long-awaited Fed easing cycle began, US equity REITs are on track to again trail broader US equity benchmarks in 2024. We expect this underperformance to continue next year. Earnings growth trails that of broader indexes, valuations are uncompelling, and the delayed impacts of the previous hiking cycle are still being felt.

Fundamentals look reasonable for US equity REITs, with average occupancy rates of around 94% across categories, slightly above long-term averages. While sectors like office continue to show elevated vacancy, demand for others like data centers and warehouses is more robust. Despite high occupancy, REIT earnings may barely rise in 2024. And even with expected improvement in 2025, the sector’s 4% earnings growth may trail earnings growth in major US equity indexes.

Valuations seem unlikely to provide a tailwind in 2025. Metrics like price to funds from operations (P/FFO) look in line with historical averages but low transaction volumes raise questions about asset values. Many investors buy REITs for their income potential, and REIT yields are well below those of credit assets like BBB-rated corporate bonds as opposed to offering their traditional premium.

REITs have historically done well during rate-cutting cycles, which both flatter their dividend yield and lower the cost of their leverage. Recent outperformance can be viewed through this lens. However, many REITs have outstanding debt that was issued at low yields well before the 2022–23 hiking cycle, which insulated earnings in recent years. Notwithstanding additional expected easing, issuers may still face higher borrowing costs to refinance this debt.

Investors looking to allocate to real estate next year may find better opportunities in private funds, which offer the opportunity to get access to operators that can add value via development and management expertise and offer tailored exposure to secular themes like digital infrastructure and the growth of senior housing. As with public markets, of course, valuations need to be taken into consideration.

US Private Real Estate Funds Raised in 2025 Should Deliver Above-Average Returns

Marc Cardillo, Head of Global Real Assets

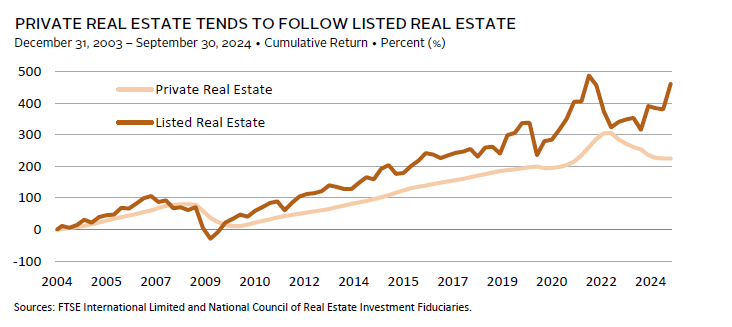

The past few years have been challenging for commercial real estate (CRE), driven by higher interest rates and a constrained lending environment. Sentiment toward CRE has been weighed down by a steady barrage of negative headlines highlighting distressed property owners. However, we believe CRE values are near a bottom and the large pool of distressed owners will create an attractive investment environment for new CRE commitments in 2025.

Distressed CRE in the United States stood at $94 billion as of the end of second quarter 2024, and is expected to continue rising, with much of that made up of properties purchased and financed when interest rates were at record lows. Despite this dynamic, CRE values appear near a bottom, having declined 19.6% since their third quarter 2022 peak. Listed real estate, which is typically a leading indicator to private CRE in both downturns and recoveries, troughed in October 2023 and is up 38.9% from that point through November 2024.

Two additional data points suggest CRE values are near a bottom. Lending markets have continued to improve throughout 2024, marked by higher advance rates and narrowing spreads. Improvement in debt markets was reflected in stable year-over year levels of transaction activity following significant declines in 2022 and 2023. Higher transaction volumes reflect buyers and sellers having a similar view of value, which is also consistent with a bottoming process. Finally, the recent cut in interest rates has further improved sentiment and the view that the market is near a bottom.

Notably, CRE fundamentals have remained largely resilient even during the period of Fed tightening, with office a notable exception. The residential, industrial, and self-storage sectors have seen significant new supply delivered in 2024. However, new constructions starts have declined meaningfully in response to higher financing costs. The retail sector has remained strong with minimal new supply added since the pandemic.

The combination of distressed deal flow, improving debt markets, and solid CRE fundamentals should create a favorable investment environment for CRE funds raised in 2025.

Figure Notes

Infrastructure Earnings Growth Expected to Lag Developed Markets

Data for 2024 reflect year-over-year growth through November 30 and 2025 estimates reflect differences in 12-month forward EPS growth forecasts.

Recent Cash Flow Growth Has Been Weak

Funds from operations per share pertain to all equity REITs. Data are quarterly.

Private Real Estate Tends to Follow Listed Real Estate

Return data are quarterly. “Private Real Estate” is represented by the NCREIF Fund Index – Open-End Diversified Core Equity (Net) and “Listed Real Estate” is represented by the FTSE® NAREIT All Equity REITs Index.

Footnotes