We expect REIT and public infrastructure performances will improve, given undemanding valuations and our view on interest rates. We believe private infrastructure funds will perform well, and we think nuclear energy will emerge as a small but important opportunity.

US REIT Performance Should Rebound in 2024

Sehr Dsani, Investment Director, Capital Markets Research, and Marc Cardillo, Head of Global Real Assets

US REITs have performed poorly since the end of 2021, underperforming US equities by 20 ppts. Increases in bond yields were a significant headwind, diminishing the relative attractiveness of REIT dividend yields and raising concerns over the value of underlying assets. Following the weak performance, valuations have fallen to an attractive level. This reality—combined with the fact that REITs are well positioned to take advantage of acquisition opportunities from overlevered private property owners—positions the sector for a rebound in 2024.

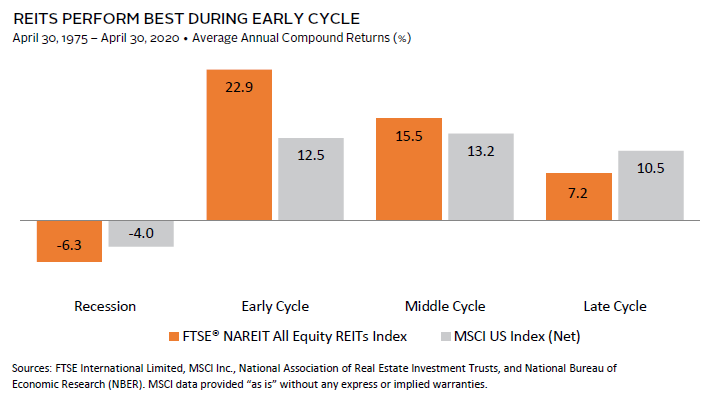

Recent poor performance has improved the attractiveness of valuation metrics. First, the sector’s price-to–funds from operations (P/FFO) multiple relative to a similar measure for the broader US market is at the 35th percentile of observations since 1990. Second, REITs are trading at a 17% discount to net asset value, which is lower than the 20-year average of a 0.9% discount. Taken together, these metrics suggest the market has already adjusted price levels to reflect difficult conditions in 2024. Historically, REITs have outperformed as a new business cycle emerges. We expect investors will increasingly get clarity on the next business cycle as 2024 evolves.

Despite concerns that the real estate sector must refinance a material volume of debt, REIT balance sheets are generally sound. This is in part because REITs delevered since the GFC. The sector’s debt/equity leverage ratio is 35% versus the sector’s 50% level during the GFC and 60%+ for many private counterparts today. Around 90% of REIT debt is fixed rate, maturities are reasonably staggered, and the low leverage rate relative to the private sector is due in part to REITs’ low office exposure (4.6%). In addition, many REITs have the advantage of being able to access the unsecured debt market. These dynamics position REITs favorably relative to their private peers and should allow them to address upcoming refinancings and have the necessary capital to make strategic acquisitions in this environment.

Infrastructure Performance Should Rebound in 2024

Wade O’Brien, Managing Director, Capital Markets Research

Public infrastructure equities underperformed broader benchmarks in 2023, weighed down by rising interest rates, policy uncertainty, and recent profit warnings in some sectors. Improved valuations, a supportive policy backdrop, and an ability to grow earnings during inflationary environments mean the sector should boost investor portfolios in 2024.

Infrastructure assets include those in areas such as transportation, communications, and power generation. An increase in benchmark bond yields, as well as profit warnings from some large renewable energy players, caused listed infrastructure assets to underperform, with US and global ex US infrastructure stocks returning -4.5% and 2.4%, respectively, year-to-date through November 30.

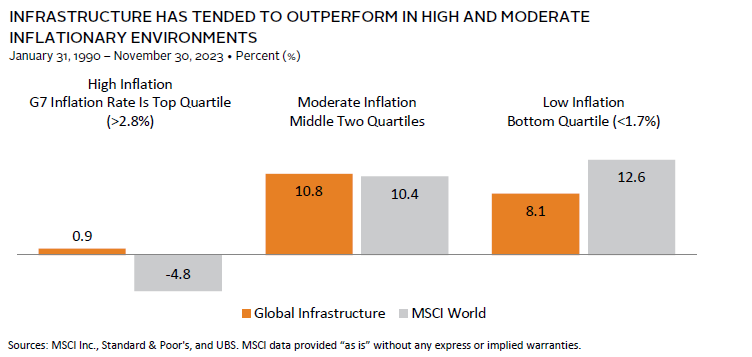

Improved valuations should mean better relative and absolute performance in 2024. P/E ratios for global ex US and US infrastructure indexes have fallen by around 40% and 25%, respectively, since their mid-2021 peaks. Despite weaker earnings guidance from some companies, profitability in both regions remains in line with long-term averages and is protected by long-term contracts that include the ability to pass on higher costs to users. These dynamics help explain why utility sector earnings forecasts have predicted higher growth than most others in 2023, as well as why listed infrastructure assets historically have outperformed during periods of elevated inflation.

Infrastructure assets also have tailwinds from recent policy developments. Legislation like the US Inflation Reduction Act and the European Commission’s REPowerEU plan will boost demand for clean energy infrastructure and underlying profit margins. Ambiguity around yet-to-be finalized language in the US legislation has been one factor recently weighing on stock performance, but this should be cleared up in the months ahead.

While public infrastructure equity performance is likely to improve in 2024, investors willing to lock up liquidity for several years may also benefit by allocating to private funds. While approaches and operational risks can vary (i.e., greenfield versus brownfield assets), the best of these funds can offer exposure to skilled operators capitalizing on secular themes such as the energy transition and burgeoning data center demand. Despite near-term economic uncertainty, these trends continue to accelerate, which we expect will generate rewards for investors.

Nuclear Should Emerge as a Budding Investment Opportunity in 2024

Michael Brand, Managing Director, Real Assets

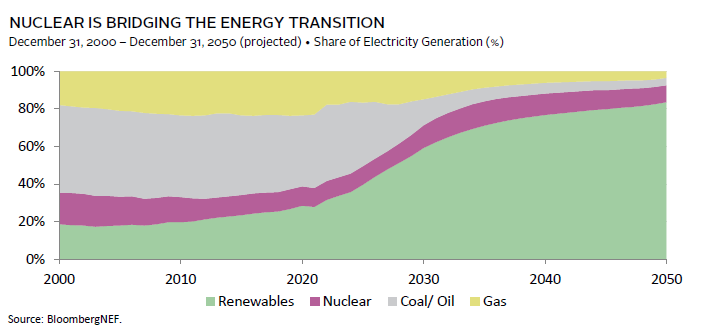

Technological advancement, moderating public perception, improved safety, and new challenges in the drive for net zero have created a foundation for nuclear energy’s next chapter. Renewable energy’s adoption as a key replacement for dirty coal and other fossil fuel–oriented power has created large challenges in maintaining reliable baseload power capacity, which underpins the keystone of energy transition—electrification. Even as the memory of past disasters lingers and the issue of waste storage endures, new technologies and the urgency to bridge the new challenge of intermittency has helped nuclear re-emerge as an option for clean, reliable, and scalable baseload electricity. Policymakers have also provided a boost, with countries such as France pledging in 2022 to further build out its nuclear fleet, and even the United States implementing substantial subsidies to keep its existing fleet operational as part of the recent Inflation Reduction Act—a sharp about-face from a policy standpoint. We believe nuclear will emerge as an energy transition investment opportunity in 2024, given the need for clean, reliable baseload electricity, recent government policy changes, and technological advancements.

The opportunity is not exclusive to just reactors, where it is unclear whether the future is modular or traditional, large-scale. Complementing the reactor fleet is a fragmented ecosystem of services and technology companies, which both construct new reactors and keep existing ones running. The landscape features an abundance of small, entrepreneur-run businesses that fly under the market radar and transact at significant discounts to the broader opportunity set. These companies seek to add value by helping businesses professionalize, consolidate, and harness new technologies. There are also opportunities associated with AI, software platforms, and plant-management technology, all of which should continue to make the sector safer and more efficient.

Hurdles certainly exist in the form of public perception, political jockeying, and even securing a steady stream of fuel, as the mining sector remains constrained. However, energy transition’s demands have created an ideal environment for the sector’s next chapter. With power-hungry 21st century initiatives, such as digitization and electrification, the sector should continue to enjoy increased investor attention as the opportunity emerges.

Figure Notes

REITs Perform Best During Early Cycle

Data are monthly. Recessions are NBER-defined US recession dates. Early, middle, and late cycles are expansion phases divided by time into three equal parts. Dates based on six full economic cycles with available data.

Infrastructure Has Tended to Outperform in High and Moderate Inflationary Environments

Data are monthly. Global Infrastructure stocks are represented by the UBS Global Infrastructure Index from January 31,1990 to November 30, 2001, and the S&P Global Infrastructure Index from December 31, 2001, to present. The data are segmented into three distinct periods of high, medium, and low inflation. The period of high inflation is defined as the period when the YOY G7 CPI is equal to or exceeds the 75th percentile of historical observations. Medium inflation refers to the period when YOY G7 CPI exceeds the 25th percentile but does not exceed the 75th percentile of all observations. Low inflation refers to the period when YOY G7 CPI is equal to or falls below the 25th percentile of all observations.

Nuclear Is Bridging the Energy Transition

Projections come from BloombergNEF’s New Energy Outlook 2022 report. Renewables sector is composed predominantly of solar and wind power, with 7% classified as “other renewables” by 2050. Analysis excludes hydrogen and “other”, which together are projected to contribute 1% of electricity generation by 2050.