Energy Equities at Benchmark Weights Will Benefit Investors in 2023

Wade O’Brien, Managing Director, Capital Markets Research

Energy equities have massively outperformed in 2022, with the MSCI World Energy Index beating the broader MSCI World Index by around 70 percentage points through the end of November. Energy sector profits have rebounded as underlying commodity prices were boosted by the tragic events in Ukraine and related supply disruptions. Given this strong performance, investors may be tempted to underweight the sector, assuming weak growth or the long-term decarbonization and net-zero efforts of the global economy will trigger underperformance. But, in the short-term, we recommend benchmark weights, as energy equities remain inexpensively priced and could again surprise in 2023 under several scenarios.

Depressed valuations suggest energy equities are almost universally unloved, despite rebounding profits and strengthening balance sheets. Forward earnings multiples for European and US energy stocks of 5.5x and 9.8x, respectively, are both in the bottom decile of historical observations. Volatile earnings are a consideration and sector earnings are expected to decline 11% next year (versus a 4% increase for the broad index). Risks are likely skewed to the downside if a recession occurs.

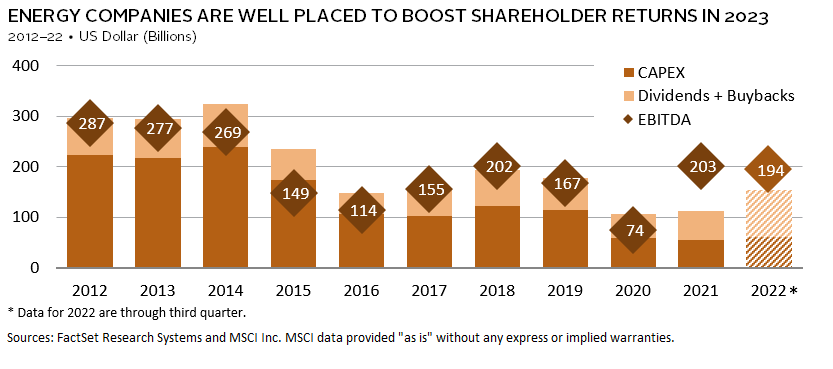

Still, there is a more constructive case for energy equities. The sector has been disciplined with capex in recent years and instead paid down debt, reducing the likelihood of a supply gut if global growth continues to slow. Energy companies also should continue to generate robust, if slightly reduced, free cash flow, offering ample cushion for dividends and buybacks. Even with reduced earnings in 2023, large US energy companies will generate enough cash flow to cover their expected dividend more than three times. Finally, there is a sad possibility that the war in Ukraine will escalate, likely putting a floor under commodity prices even amid a global slowdown.

Many questions hang over energy equities heading into 2023. The slowly unfolding energy transition presents both a long-term threat and competing opportunity set, which investors should also be pursuing. However, with valuations depressed and cash flow generation high, investors should maintain neutral positions to public energy companies in the near term. Those doing so should consider active managers that are engaged with corporate management teams and working to accelerate the transition to a low carbon economy.

The Office Sector Will Finally Present Attractive Investment Opportunities in 2023

Marc Cardillo, Global Head of Real Assets

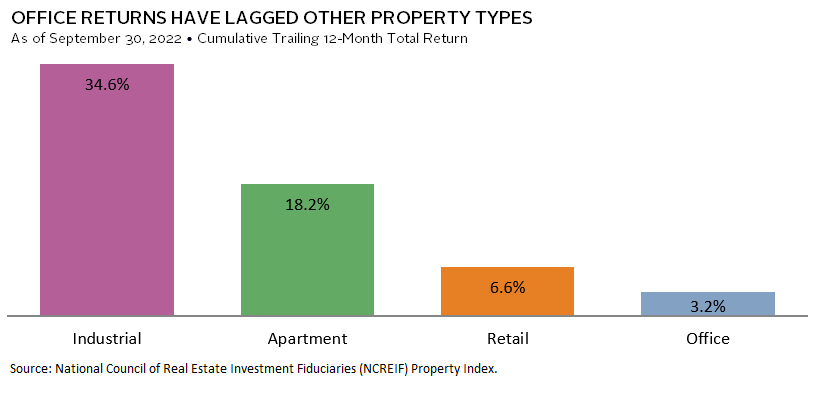

Although it has been nearly three years since the pandemic began, considerable uncertainty remains regarding the future of the office sector. Performance has severely lagged other property types. MetLife estimates that remote work has contributed 400 basis points to the current elevated 16.8% US vacancy rate, although the impact on office cash flows has been limited, given the sector’s long-term lease structures. However, this dynamic has begun to evolve as leases executed prior to COVID-19 begin to expire. Many office owners with looming debt maturities will be faced with the challenge of trying to refinance properties with declining cash flows in a higher interest rate and more restrictive lending environment. These pressures should lead to rising loan defaults and create opportunities for discerning investors to acquire high-quality office properties at attractive valuations.

However, investors will need to be highly selective, as value traps abound. The quality of physical space and a property’s amenities have grown in importance as tenants have more choices available to them and companies need to give their employees a compelling reason to come to the office. The building attributes with the greatest demand include flexible open space, shared meeting areas, sustainable building features, onsite food options, outdoor amenities, and even concierge services. Many of these requirements are best met by modern office properties. As a result, the office sector has become increasingly bifurcated into a world of “haves” and “have nots,” with the newest, best amenitized properties garnering the lion’s share of leasing activity relative to older, class B products. JLL estimates that over the past two years, the office sector has experienced over 153 million square feet of negative net absorption. However, properties built after 2014 experienced positive net absorption of over 61 million square feet.

The growing emphasis on sustainability will only accelerate the bifurcation in office markets. Opportunities will emerge to renovate and transform certain office buildings to meet the various green certification standards that tenants increasingly seek, particularly in several European cities, which have more aggressive carbon reduction goals.