New Zealand’s COVID-19 containment strategy served the economy well during the early days of the pandemic. However, 2021 proved to be a different story, as growth slowed to a halt late in the year due to lockdown measures while inflation moved higher given labour market constraints, leading the Reserve Bank of New Zealand (RBNZ) to tighten policy ahead of other central banks. As a result, New Zealand equities and bonds suffered in 2021. Heading into 2022, New Zealand authorities have pivoted the strategy from zero–COVID-19 to minimisation and protection, while still embarking on a monetary policy tightening cycle. Balancing both strategies will be key to supporting New Zealand’s economic growth in 2022, and any policy surprises could further upset the country’s equity and bond markets, which are already facing headwinds this year.

Macro

Following a strong rebound from the COVID-19 pandemic in 2020, New Zealand’s economic recovery extended well into the first half of 2021. Growth had been boosted by the authorities’ early containment of the coronavirus, which allowed for a swift reopening of most sectors and lent support to consumer demand and business investment. Extensive fiscal and monetary stimulus have also played a role. New Zealand’s COVID-19 Response and Recovery Fund, which provided relief to households and affected businesses and sectors, amounted to NZ$74 billion, or more than 20% of the country’s 2020 GDP, while accommodative monetary policy saw New Zealand interest rates fall to record low levels in 2020.

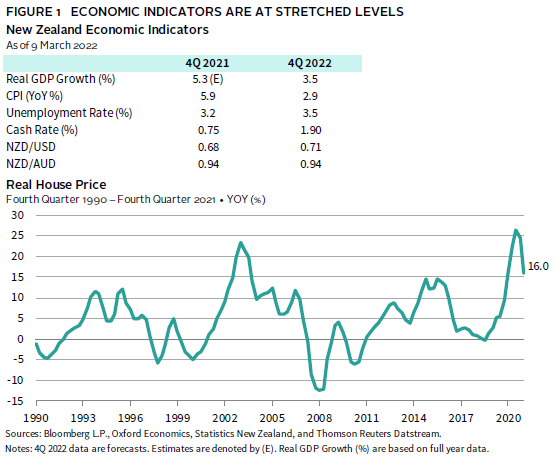

However, with New Zealand’s early success, the economy is now showing signs of overheating as key economic indicators surged to stretched levels. Headline inflation rose to 5.9% year-over-year in fourth quarter, well above the RBNZ’s target band of 1%–3%, driven by a housing market boom and a rise in housing rental prices (Figure 1). The unemployment rate has also fallen to a record low of 3.2%, as border closures and a labour shortage led to a tightening of capacity constraints in the economy. Against this backdrop, the RBNZ has started tightening monetary policy ahead of most other major central banks, implementing three 25 basis point (bp) rate hikes to its official cash rate (OCR) since October 2021, bringing it to 1.00% in February 2022. Consensus forecasts now project the RBNZ to increase the OCR to 1.90% by the end of 2022, compared to 1.50% in the United States and 0.50% in Australia.

Yet, while New Zealand’s inflation is rising in response to a tightening economy, its growth stalled in third quarter 2021 due to the country’s COVID-19 containment strategy because authorities reinstated strict lockdown measures in Auckland and neighbouring regions in response to the Delta variant. As the rest of the world continues to ease restrictions, New Zealand has pivoted from a zero–COVID-19 strategy to minimisation and protection to balance economic growth with population protection. Economic activity is expected to rebound in fourth quarter 2021, bringing the full year’s real GDP growth forecast to 5.3%. The country has also announced a phased border reopening process that will eventually allow both vaccinated skilled foreign workers and international travellers into the country. This should provide some relief to both the labour market and the hard-hit tourism and related services sectors.

Overall, the combination of monetary policy tightening and the easing of COVID-19 restrictions should help to reduce both demand- and supply-side inflationary pressures and support a more sustainable growth going forward. Consensus forecasts now expect New Zealand’s real GDP to expand by 3.5% in 2022, versus 3.6% in the United States and 4.3% in Australia. However, key risks to this outlook are if domestic labour market imbalances take longer than expected to normalize and if the ongoing war in Ukraine leads to a choke in global energy markets. These could result in inflationary pressures peaking later than the RBNZ’s expectations of early 2022 and push the central bank to take on more aggressive policy tightening. At the same time, New Zealand authorities also face the challenge of maintaining COVID-19 relaxation rules with the more transmissible Omicron variant, which has already caused a surge in daily new cases in early 2022. Thus, any surprises or imbalances in the policy pivots could dampen consumer and business confidence in 2022 and place New Zealand’s growth outlook under pressure.

New Zealand Markets: 2021 in Review

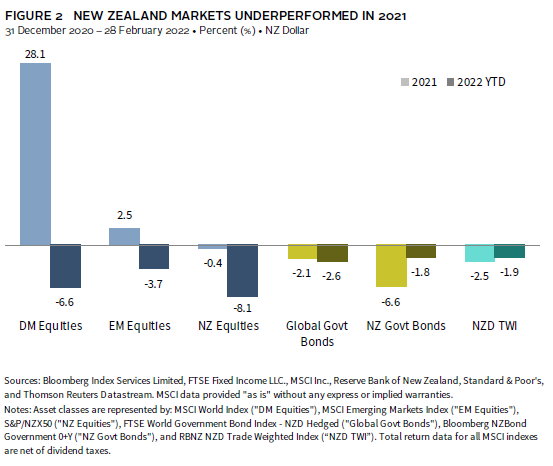

2021 was a difficult year for New Zealand assets, with both its equity and bond markets underperforming their global counterparts and the New Zealand dollar depreciating against the US dollar and its trade-weighted basket (Figure 2).

The S&P/NZX 50 Index returned -0.4% in 2021, underperforming most equity markets in local currency and New Zealand dollar terms. Part of this underperformance could be explained by valuation mean reversion; after several consecutive years of strong returns, New Zealand equity valuations were at extremely elevated levels heading into 2021. However, the market’s sector composition also plays a large role in explaining the discrepancy. New Zealand’s equities, which have significant exposures to high-yielding sectors, were under pressure as domestic and global interest rates rose. At the same time, the market also has little exposure to the sectors that did well during the global economic recovery period and rising rate environment. Energy and financials, which were among the top-performing sectors globally, accounted for less than 4.0% of the S&P/NZX 50 Index as of February 2022. The tightening of COVID-19 restrictions in New Zealand as other market moved towards easing also impacted the relative outlook for corporate earnings growth.

New Zealand government bonds underperformed their global counterparts as well in 2021, returning -6.6% compared to -2.1% for the FTSE World Government Bond Index (WGBI) in New Zealand dollar hedged terms. The start of the RBNZ tightening cycle in October 2021 was a meaningful driver of this underperformance as investors began to price in higher interest rates for New Zealand ahead of other economies.

Although the RBNZ’s rate hikes have led to a widening of interest rate differentials between New Zealand and the United States, the New Zealand dollar fell by 5.5% against the US dollar in 2021 and was down 2.5% in trade-weighted terms. The weakening of the New Zealand dollar occurred amid a broad-based rally of the US dollar as the global growth outlook cooled in 2H 2021 and the US Federal Reserve pivoted to a more hawkish stance. However, the New Zealand dollar was up 0.4% versus the Australian dollar over 2021, as the Reserve Bank of Australia has continued to signal that it is in no hurry to raise interest rates.

New Zealand Markets: 2022 Outlook

Equities. For 2022, the outlook for New Zealand equities remains muted. Corporate earnings have been slower to recover in New Zealand compared to markets such as the United States and Australia, with both the trailing 12-month and forward 12-month earnings per share remaining below pre-pandemic levels. At the same time, the market’s sector composition leaves it vulnerable to further rises in global bond yields. So far this year, the main themes of higher inflation and central bank tightening have led to New Zealand equities retreating further, although global markets were also down in part due to the ongoing war in Ukraine. As of February 2022, the S&P/NZX 50 Index returned -8.1%, with a total peak-to-trough (8 January 2021 – 24 February 2022) decline of 13.5%.

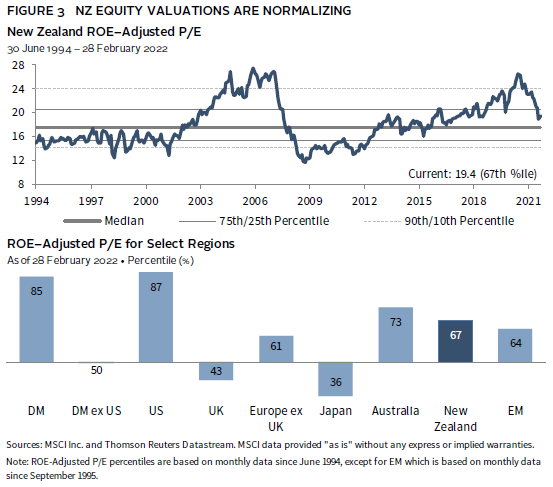

Given the market’s recent weakness, New Zealand equity valuations have fallen considerably from previously sky-high levels. The return on equity–adjusted price-earnings ratio is now at 19.4 times, which is the 67th percentile of historical observations (Figure 3). Based on this metric, New Zealand equity valuations are now lower than the United States and Australia, but they do not look too cheap yet relative to other markets.

Please see our Tactical CA House Views for our latest portfolio advice.

Overall, amid a continued global economic recovery and rising rate environment, we view that cyclical and value stocks should have more room to outperform. The war in Ukraine has added to market volatility in recent weeks, although we see that the impact of western sanctions should remain largely contained within Russian assets and is less likely to cause contagion in global equity markets. Thus, given the macro environment and current valuations, we continue to recommend tilting portfolios towards developed ex US equities, value, and small-cap equities. We also recommend an overweight to Chinese equities, for which valuations have fallen following last year’s regulatory crackdown and have more scope to rise amid China’s policy-easing cycle.

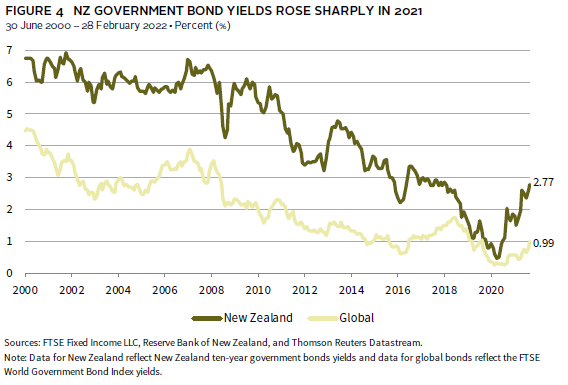

Fixed Income. After rising sharply in 2021/early 2022, yields for ten-year New Zealand government bonds are now at 2.77%—the highest month-end level since mid-2018 (Figure 4). Spreads for New Zealand government bond yields relative to global government bond yields have also widened meaningfully as a result, ending February at 178 bps.

While markets may have already priced in the bulk of the rise in New Zealand government bond yields, the risk remains that these may move higher in 2022 if the RBNZ tightens more aggressively than expected. However, global bond yields are also at risk of policy tightening, and we believe that there is room for these to rise further in 2022 given that yields in most developed markets are still trading near the lower bound of our growth-implied fair value range. Thus, given the current yield spreads and the higher duration of global bonds, we favour New Zealand government bonds vis-à-vis global government bonds. We also highlight that the New Zealand government bond market may benefit from potential index inclusion changes; pending a final review in March 2022, New Zealand government bonds may be added to the FTSE WGBI starting this year. While the size of the exposure to New Zealand in the index remains undisclosed, this addition could provide a meaningful boost to the country’s government bond market in terms of passive inflows.

Currency. The outlook for the New Zealand dollar remains mixed. With bond yields remaining higher than in the United States and Australia, these rate differentials suggest that the New Zealand dollar should remain supported in the near term, a view also embedded in the FX consensus forecasts. However, a key risk to this outlook is if the Fed turns out to be more hawkish than expected by markets, leaving the New Zealand dollar susceptible to further declines against the US dollar.

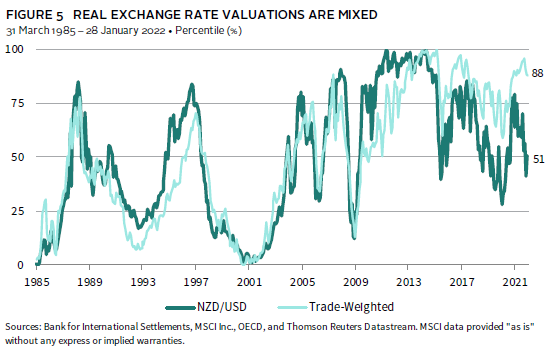

In addition, while real exchange rate valuations for the New Zealand dollar have fallen, these remain mixed and do not suggest that the currency is at oversold levels. The New Zealand dollar still trades at the 88th percentile of historical observations in trade-weighted terms, while valuations versus the US dollar are now at historical median (Figure 5). The currency also remains positively correlated with global equities, allowing for an unhedged exposure to lower equity return volatility. Thus, we still see that NZD-based investors could benefit from being partially unhedged.

Conclusion

Following a strong economic rebound from the COVID-19 pandemic, New Zealand’s economy is now showing signs of overheating. Accommodative monetary and fiscal policy, alongside global supply chain constraints and a tightening of the country’s labour market, has led to inflation levels surging well past the RBNZ’s target band. For 2022, a key risk to New Zealand’s growth is whether surging new COVID-19 cases force authorities to reinstate stringent lockdowns within the current policy tightening environment, which could dampen domestic demand and investments and add pressure to New Zealand’s equity market.

For New Zealand equities, we continue to see near-term headwinds in light of the direction of global monetary policy. As such, we recommend tilting towards developed ex US, value, small-cap, and Chinese equities, given favourable valuations and sector compositions. However, we favour New Zealand government bonds versus global government bonds in the current environment, given the former’s lower duration and higher starting yields. We also recommend that NZD-based investors remain partially unhedged to protect against any downside on the New Zealand dollar and to benefit from reduced volatility on global equity allocations.

Despite these views, the ongoing war in Ukraine remains a large source of market uncertainty. Key risks include a prolonged military conflict that disrupts the global energy/commodities market and western sanctions on Russia that trigger unanticipated liquidity shocks in the global financial system. These events could lead to a renewed wave of risk-off sentiments that result in New Zealand equities’ defensive and high-yielding characteristics coming back into favour. Global bond markets may also rally as investors seek safe-haven assets and as major central banks pull back on their hawkish rhetoric. New Zealand bonds could still outperform, given their higher starting yields, but the NZD may come under further pressure if the RBNZ halts it tightening cycle. However, aside from the short-term volatility, we believe that higher inflation and policy tightening will remain the key drivers for markets in 2022, and that New Zealand investors should diversify their exposure accordingly given New Zealand equities may remain out of favour.

Aaron Costello, Managing Director, Capital Markets Research

Vivian Gan, Senior Investment Associate, Capital Markets Research

Index Disclosures

Bloomberg NZBond Government 0+Y Index

The Bloomberg NZBond Government 0+ Yr Index is engineered to measure the market of securities issued by the New Zealand government. This is a legacy UBS index. It is a rules-based, market value weighted index which includes bonds maturing in 0+ years.

FTSE World Government Bond Index

The FTSE World Government Bond Index measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. The index is a widely used benchmark that currently includes sovereign debt from more than 20 countries, denominated in a variety of currencies, and has more than 30 years of history available. The index provides a broad benchmark for the global sovereign fixed income market. Sub-indexes are available in any combination of currency, maturity, or rating.

MSCI Emerging Markets Index

The MSCI Emerging Markets Index represents a free float–adjusted market capitalization index that is designed to measure equity market performance of emerging markets. Emerging markets countries include: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, the Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.

MSCI World Index

The MSCI World Index represents a free float–adjusted, market capitalization–weighted index that is designed to measure the equity market performance of developed markets. As of December 2017, it includes 23 developed markets country indexes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

RBNZ NZD Trade Weighted Index

The RBNZ NZD Trade Weighted Index (TWI) measures the value of the New Zealand dollar (NZD) against New Zealand’s major trading partners. It is the Reserve Bank’s preferred summary measure for capturing the medium-term effect of exchange rate changes on the New Zealand economy and inflation. Data for the nominal TWI (17) is available from 1984.

S&P/NZX 50 Index

The S&P/NZX 50 Index is designed to measure the performance of the 50 largest eligible stocks listed on the New Zealand Stock Market by free float–adjusted market capitalization. It covers approximately 90% of New Zealand equity market capitalization.