Whether investors are ready to admit it or not, sponsor-to-sponsor transactions—in which one private equity sponsor sells its stake in a company to another private equity sponsor—are here to stay, particularly as private equity markets continue to mature. Private equity is in its fourth decade as an institutional investment strategy, and the amount of capital raised and deployed over that time period has grown steadily. Decades of fund formation, companies being acquired, and then—due to the prevailing private equity fund structure—being sold as funds approach maturity can only increase the number of “previously owned” companies in circulation. Cambridge Associates estimates the number of unrealized global private equity investments to be nearly 4,000, with more than 11,000 realizations since 1986.

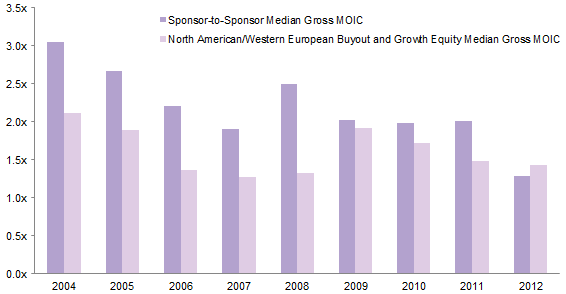

While this dynamic seems inevitable, should investors be concerned? In the past, we expect most limited partners (LPs) would have said yes. However, in our view, the bad reputation of these transactions may be unwarranted. When executed under the right circumstances, one sponsor acquiring another sponsor’s portfolio company can simply be business as usual. And in our analysis, these transactions have actually outperformed: from 2004 through 2012, on a gross multiple on invested capital (MOIC) basis, sponsor-to-sponsor transactions delivered comparable, and in some cases, better returns. In fact, the median fully realized sponsor-to-sponsor transaction during this timeframe reported a gross MOIC of 2.6 times, nearly a full turn greater than the median realized value for the private equity industry of 1.7 times. And over this nine-year period, the median sponsor-to-sponsor transaction outperformed the median global buyout and growth equity investment on a gross MOIC basis in eight out of nine years. The mean fully realized sponsor-to-sponsor transactions for this period was also 2.6 times, again comparing favorably to the mean for the private equity industry of 2.3 times.

Dataset and Methods

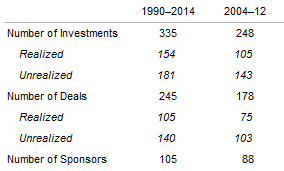

For purposes of this analysis, we cross-referenced sponsor-to-sponsor transactions reported by Dealogic with companies tracked in the Cambridge Associates performance database and verified each transaction represented a sale from one private equity sponsor to another. This process resulted in a dataset of 335 realized and unrealized investments made by 105 different sponsors from 1990 through 2014, weighted heavily toward North American sponsors. In some cases, multiple GPs invested into the same company simultaneously. To avoid double counting performance, these investments are grouped together as deals, of which there were 245 over the 25-year period. The charts and analysis presented in this paper focus on the period 2004 to 2012, a subset of the data comprising 248 realized and unrealized investments across 178 deals made by 88 sponsors. In the early years of our data set, very few sponsor-to-sponsor transactions occurred; we chose a start date of 2004 to reflect recent results with sufficient yearly sample sizes and an end date of 2012 to capture full activity in the dataset with a focus mostly on mature or realized investments.

We compared these sponsor-to-sponsor transactions with those in our broader North American and European buyout and growth equity universe. The benchmark universe comprises approximately 7,200 realized and unrealized growth equity and buyout investments in North American– and European-domiciled companies made between 2004 and 2012. These investments were made by nearly 375 unique sponsors from more than 775 unique funds. Similar to the process above, we then consolidated the universe into roughly 6,000 realized and unrealized deals to avoid double counting. Of this sample, approximately 2,700 deals were fully realized and the remaining 3,300 were not.

Private Equity Firms Are Motivated Buyers . . .

The institutionalization of private investment strategies has resulted in a structurally mandated cadence of fund investment and divestment. In the current convention, funds typically invest within a five-year period and then have an additional five years to monetize those investments and return capital to limited partners, plus extensions. Thus once a fund is active, it must find companies in which to invest within this time constraint. And in terms of capital looking for a home, the private equity industry has been on an upswing in terms of fund raising, posting year-over-year increases for three of the last four years.

Sources: Dow Jones Private Equity Analyst and EVCA.

Note: Fund-raising data are as of December 31, 2014.

Finding investments means finding willing sellers. Potential sellers include families, corporations, publicly traded companies, other non-investment entities, and other financial owners of assets. The vast majority of sellers does not operate within a private equity fund structure and therefore has no structural imperative to transact. Further, the question of where and how to invest the proceeds from a sale can cause hesitation for many constituencies. To find a motivated seller, one obvious place to look is at private equity funds, and there are thousands of them.

. . . and Motivated Sellers

Private equity funds must eventually sell what they own, no exceptions. As noted, private equity funds are structured to typically come to an end within ten years (although often extended for several years beyond that). The timing of when funds pursue exits of investments can be driven by any of the following factors:

- Unprompted inbound interest for a portfolio holding,

- Completion of value-add initiatives,

- Lack of capital to support continued value-add initiatives,

- Favorable market pricing environment prompting decision to pursue sale,

- Track record management to aid future fund raising, or

- Fund approaching end of legal life.

At the moment, the nearly 4,000 unrealized private equity investments tracked by Cambridge Associates average more than three years in age, thus within a typical timeframe to consider an exit.

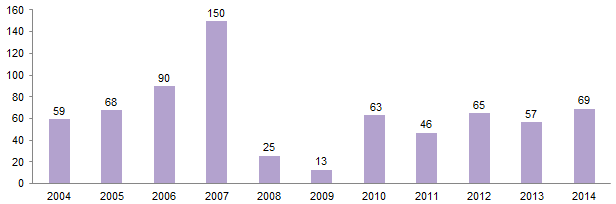

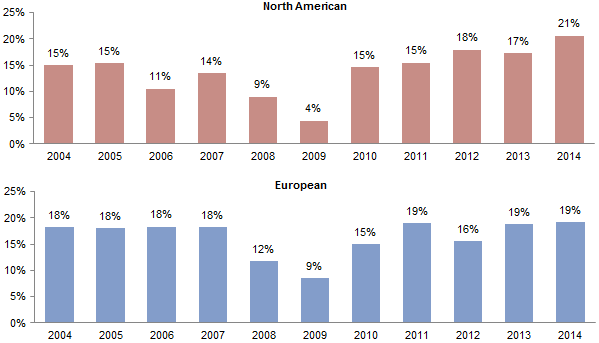

20% of Transactions Today Are Sponsor-to-Sponsor

As sponsors on both sides of the table have a structural imperative to transact, and at over 30 years on there are quite a few companies previously owned by private equity firms to acquire, it should come as no surprise that sponsor-to-sponsor activity is a constant, typically composing between 15% and 20% of transaction types by number at any given point in time. Sponsor-to-sponsor activity has been a fairly frequent and consistent source of transaction volume in North America and Western Europe. While these transactions historically occurred less frequently in North America, that trend is changing and is on an upward trajectory.

Sources: Cambridge Associates LLC and Dealogic.

Note: Dealogic updates its databases on a regular basis; therefore, historical data may change.

Sponsor-to-Sponsor Transactions as a Percentage of Total Buyout Transactions

2004–14 • Percentage of Deals (by count)

Sources: Cambridge Associates LLC and Dealogic.

Note: Dealogic updates its databases on a regular basis; therefore, historical data may change.

Goliaths Are Buying From Davids

Judging from the difference in average price paid for a private equity–backed company versus the overall average price paid, most sponsor-to-sponsor transactions involve a smaller fund selling to a larger fund. Over the last five years, the average North American sponsor-to-sponsor transaction value of $1.1 billion was over 2.5 times the average transaction value of $393 million. For the same period in Europe, the average sponsor-to-sponsor transaction value of $567 million is also over 2.5 times the average transaction value of $221 million. Sponsor-to-sponsor transactions typically being bigger is intuitive; these investments involve companies that have already received private equity capital and have presumably increased in valuation under sponsor ownership. In addition, sponsors have experience maximizing value at exit.

Sources: Cambridge Associates LLC and Dealogic.

Note: Dealogic updates its databases on a regular basis; therefore, historical data may change.

Please see Andrea Auerbach, Caryn Slotsky, et al., “The Global Overhang (According to Goldilocks): Too Much, Too Little, or Just Right?” Cambridge Associates Research Note, May 2014.

Larger sponsors have the most capital to deploy and also the greatest amount of “dry powder”; the capital overhang for funds of $5 billion or more is approaching $200 billion, just surpassing the previous peak for this size category, which occurred in 2008. Many large funds were raised in the previous era incorporating the assumption that public-to-private transactions would continue to be viable at the same volume, which has not proven to be the case. Large funds raised in the current era remain under the same time constraints but without the public-to-private option being as universally viable as before, at least for the time being.

There is nothing inherently wrong with one sponsor acquiring another sponsor’s portfolio company. Smaller sponsors may be particularly adept at working with smaller companies and growing them until they have earned their return and/or run out of time or capital to support the go-forward business plan, and so seek to sell; larger sponsors may well be the best next owner of that business. Peer-to-peer sponsor-to-sponsor transactions—where one similarly sized and situated firm sells to another, with no discernible differentiation in size, strategy, or approach—also occur. Investors with exposure to both the buying and selling private equity firm essentially continue to own the same asset, only at a higher entry valuation, with transaction costs paid to intermediaries on both sides of the transaction. When peer-to-peer sponsor-to-sponsor transactions do occur, the buying sponsor should be prepared to outline the rationale for the transaction and post-investment value-add strategy for the company to limited partners.

Sponsor-to-Sponsor Transactions . . . Outperform?

Though sponsor-to-sponsor transactions typically do not sit well with fund investors for the reasons discussed, the performance of these investments suggests that their notoriety may well be unfounded. According to Cambridge Associates data, the mean and median fully realized sponsor-to-sponsor transaction generated a gross MOIC of 2.6, comparing favorably to the realized private equity industry mean of 2.3 and median of 1.7. Furthermore, from 2004 to 2012, the median sponsor-to-sponsor transaction outperformed the median global buyout and growth equity transaction on a gross MOIC basis in all but one year, 2012.

Source: Cambridge Associates LLC.

Notes: Content is as of December 31, 2014, and gross of fees and expenses. Sponsor-to-sponsor sample comprises 178 realized and unrealized sponsor-to-sponsor transactions between 2004 to 2012. North American/Western European buyout and growth equity data from Cambridge Associates private equity benchmark universe and comprise roughly 6,000 realized and unrealized deals.

The majority of sponsor-to-sponsor activity is attributable to larger fund managers; of the 248 realized and unrealized sponsor-to-sponsor investments made between 2004 and 2012, more than 70% were made by private equity funds at least $1 billion in size. As one might expect, the median slightly declines as the fund size increases, with the lone exception being investments made by middle- and upper-middle-market private equity funds, the median of which had generated better than a 2.8 gross MOIC. However, for all categories, the majority of realized sponsor-to-sponsor transactions have delivered better than 2.0 times invested capital.

Source: Cambridge Associates LLC.

Notes: Content is as of December 31, 2014, and is gross of fees and expenses. Sample comprises 105 fully realized sponsor-to-sponsor investments made from 2004 to 2012. North American/Western European buyout and growth equity data comprises more than 3,200 fully realized North American and European private equity investments made from 2004 to 2012. First and fourth quartiles exclude the top and bottom 10% of investments as outliers.

But Watch Out for the “Heavy User.” Some sponsors pursue these transactions more than others: between 2004 and 2012, 24 firms that each completed at least four investments represented more than 55% of the nearly 250 that occurred. The performance of sponsor-to-sponsor investments completed by these “repeat offenders” slightly lagged the rest of the sponsor-to-sponsor data set, generating a mean gross MOIC of 2.6 times on realized deals versus 3.0 times for groups that had completed three or fewer. However, these “repeat offenders” still slightly bested the overall industry mean of 2.3 times.

How Could This Happen?

Any party willing to pay the highest price will prevail in an auction. Sponsors are structurally motivated to transact and often have the most experience of any buyer in transacting and also managing what they acquire. Management teams can also influence outcomes, and those that want to maintain control of their company and not become a cog in the wheel of a larger corporation may also influence the sale process toward a sponsor.

Companies can and do flourish under private equity management, pursuing business strategies best executed privately and on their own cadence, outside the public domain. And perhaps the work one private equity sponsor does implementing institutional controls and governance makes for a smoother and easier ownership transition for the next private equity sponsor, allowing the second owner and management team to focus time more effectively, with additional value created for investors.

While any number of factors could be driving these surprising performance outcomes, the fact is the sponsors that have demonstrated success with these transactions have also likely demonstrated success with investments sourced and executed through other channels. As such, the outcome here is likely a result of specific manager execution rather than anything inherently true in the sponsor-to-sponsor transaction itself.

The Bottom Line

With the continued maturation of the private equity industry, sponsor-to-sponsor transactions should be expected to continue and possibly increase in share for larger fund platforms. Whether or not the performance advantage of these transactions holds is a manager-specific question. The industry is only becoming more competitive, not less, and the ability to add value in any situation, let alone in a company previously owned by another private equity firm, will require increased manager skill, eventually backed by evidence in performance.

Andrea Auerbach, Managing Director

Chris Bull, Associate Investment Director