Overview

US private equity and venture capital funds produced healthy results during second quarter 2015, outpacing the S&P 500, the Russell 2000® small-cap, and the Nasdaq Composite indexes, as indicated by the Cambridge Associates LLC benchmark indexes of the two alternative asset classes. Over the first six months of the year, venture capital outperformed private equity, and in the public markets the small-cap and technology-heavy indexes bested large cap. Over the past 15 years, private equity and venture capital indexes have had mixed results against the public markets, but over longer time periods have handily beaten the public markets.

Second quarter’s 3.8% return for the Cambridge Associates LLC US Private Equity Index® marked the benchmark’s 12th straight positive quarter, while the 6.7% return for the Cambridge Associates LLC US Venture Capital Index® represented that benchmark’s 15th consecutive positive quarter. Though enjoying similar runs of positive performance, public market returns have been more anemic in 2015.

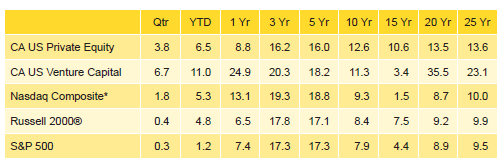

The Cambridge Associates indexes are derived from performance data compiled for funds that represent the majority of the institutional capital raised by private equity and venture capital partnerships. The Cambridge Associates LLC US Private Equity Index® includes funds raised between 1986 and 2015 and the Cambridge Associates LLC US Venture Capital Index® represents funds raised between 1981 and 2015. Table 1 shows private equity and venture capital returns based on the performance data collected versus indexes tracking large- and small-capitalization public equities—the Nasdaq Composite, the Russell 2000®, and the S&P 500.

Table 1. US Private Equity and Venture Capital Index Returns

Periods Ended June 30, 2015 • US$ Terms • Percent (%)

Sources: Cambridge Associates LLC, Frank Russell Company, Standard & Poor’s, and Thomson Reuters Datastream.

Note: Because the US Private Equity and Venture Capital indexes are capital weighted, the largest vintage years mainly drive the indexes’ performance.

* Capital change only.

Second Quarter 2015 Highlights

- As of June 30, 2015, the private equity benchmark outperformed the Russell 2000® and the S&P 500, indexes tracking small and large public companies, in seven of the nine time horizons listed in Table 1. The index underperformed both small and large public companies in the three- and five-year periods. The venture index’s success against the Russell 2000® and the S&P 500 has been similar to the private equity index in that it outperformed both small and large public companies in all but one of the time periods listed in the table. The glaring exception was the 15-year period, which encompasses both the technology crash in 2000 and the global financial crisis later in the decade. The venture index’s performance against the tech-heavy Nasdaq has been strong, outperforming it in all but one period.

- Public companies accounted for about 16% of both the private equity and venture capital indexes. Non-US companies represented about 17% and 11% of the private equity and venture indexes, respectively.

Private Equity Performance Insights

- Returns for all but four vintage years from 2000 through 2015 (which represented 99% of the index’s value) were positive for the quarter. The vintages that were down in the quarter all fell less than -1.3%.

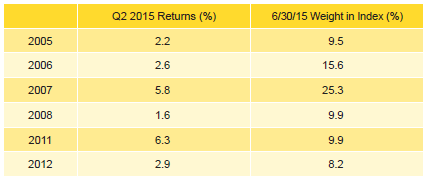

- Among the six vintage years that were meaningfully sized (representing at least 5% of the index), returns ranged from 1.6% to 6.3%; 2011 was the best-performing vintage year, while funds formed in 2008 earned the lowest return of the group (Table 2). Led by 2007, the top six vintage years by size together represented 78% of the index’s value. The 2009 vintage was the only other vintage year that was close to qualifying as a key performance driver, representing 4.6% of the benchmark’s value.

Note: Vintage year fund-level returns are net of fees, expenses, and carried interest.

- Vintage year 2011 had write-ups in all but one sector, and the largest dollar increases were in consumer, health care, IT, and energy; only the mining sector had write-downs, which were minimal. For the 2008 vintage, write-downs in energy companies were the primary driver of performance. The largest vintage year in the benchmark, 2007, represented more than a quarter of the index’s value. Its 5.8% return for the quarter was the second best of the large vintages and was driven by write-ups in health care, construction, consumer, IT, and software.

- During the second quarter, fund managers called $18.3 billion, a 20.2% increase from the previous quarter. Limited partner distributions equaled $39.1 billion, a 39.3% jump quarter-over-quarter. The second quarter marked the 14th consecutive (and 17th out of the last 19) quarter when distributions surpassed contributions. Contributions and distributions in the first six months of 2015 trailed the same period of 2014, but contributions fell more steeply. The year-over-year drop in contributions was 25% and the fall in distributions was 12%.

- Funds raised in 2007 and 2010–14 each called more than $1.2 billion; the six vintages combined to call $16.4 billion, or 89% of total capital called. Vintages 2011 and 2012 drew down $9.1 billion, or half of what all managers called in the quarter. Vintage years 2004 through 2009 each distributed more than $2.1 billion during the quarter. Combined, they distributed $34.3 billion, or 88% of the total. The two largest vintages, 2006 and 2007, together distributed $19.5 billion during the quarter.

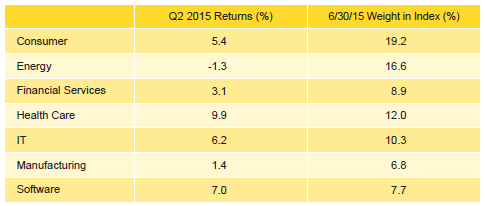

- All but one of the seven sectors representing at least 5% of the private equity index earned positive returns during the quarter; energy’s return of -1.3% was the exception (Table 3). Health care earned the highest return at 9.9%. Energy company valuation declines were dominated by the 2008 vintage year; smaller write-downs occurred in five other vintages. The biggest write-ups for energy were in the 2011, 2007, and 2012 vintages (in rank order). Write-ups in the 2006 and 2007 vintage years were by far the largest contributors to the health care sector’s performance. Of note, the hardware and electronics sectors were the only others in the benchmark with negative returns but both are de minimis in size.

Note: Industry-specific gross company-level returns are before fees, expenses, and carried interest.

- Energy businesses attracted the most capital during the quarter, 20% of the total, followed by consumer (17%) and health care companies (15%).

Venture Capital Performance Insights

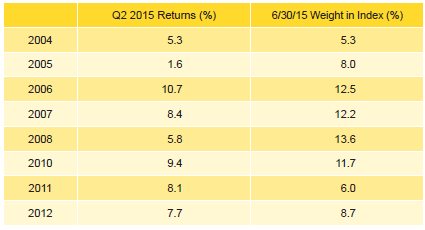

- Quarterly returns varied fairly widely across the top-sized vintages in the venture capital index (Table 4). The best return of the group (vintage year 2006) was 10.7%, while the worst (vintage year 2005) was 1.6%. With the exception of 2015, all vintages from 2000 on earned positive returns over the quarter.

Note: Vintage year fund-level returns are net of fees, expenses, and carried interest.

- For the best-performing vintage, 2006, health care and software sector write-ups were the primary drivers of performance, and for the lowest performer, 2005, gains in health care and software were partially offset by write-downs in IT.

Notably, vintage year 2000, the largest year ever for fund raising, has fallen just below the 5% threshold to 4.9%. The vintage distributed about 10% of its prior quarter’s value and its return for the quarter was 1.4%, which was driven by write-ups in health care and only modest movements in all other sectors. - Performance was strong among the four largest vintage years, 2006–08 and 2010, ranging from 5.8% to 10.7%. Health care and software were the primary contributors to the 2006 and 2008 vintage year funds’ returns. Electronics, IT, and health care were the three largest positive contributors to the 2007 vintage’s return, while a small number of sectors produced slightly negative returns. The 2010 funds’ write-ups were dominated by health care and IT.

- Venture capital fund managers called $3.8 billion from investors during the second quarter, a 3.4% increase from the previous quarter. Distributions from venture funds were $8.7 billion, a 31.0% jump from the first quarter and the highest quarterly output in almost 15 years (since third quarter 2000). Distributions outpaced contributions for the 14th quarter in a row.

- Funds formed in 2008 and 2011–15 were responsible for 87% of the total capital called during the quarter; each of these six vintages called more than $194 million with an average of $557 million. Distributions from vintage years 2000, 2005–08, and 2010 totaled $6.4 billion, representing 74% of the total from the quarter. Each of these six vintages distributed more than $500 million in the quarter, led by vintage years 2006–08, which all distributed more than $1.2 billion.

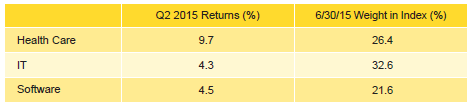

- All three sectors that represented at least 5% of the value of the index had positive returns in the second quarter (Table 5). The best return was earned by the health care sector. For the third quarter in a row, the lowest return was posted by IT companies. Write-ups for health care companies were mainly driven by the 2010 vintage year funds, which had more than $1 billion of valuation increases in the sector. IT valuation increases were widespread, with the exception of vintage year 2005, which experienced write-downs in the sector. The electronics sector, which was 4.2% of the index’s weight, returned 31.2% for the quarter, helping to boost the index’s overall performance.

Note: Industry-specific gross company-level returns are before fees, expenses, and carried interest.

- In keeping with historical norms, IT, health care, and software companies attracted the lion’s share of the dollars invested by venture capital managers in the index. At 82% of capital invested, the amount is almost 4% higher than the long-term trend for the three sectors combined.

About the Indexes

Cambridge Associates derives its US private equity benchmark from the financial information contained in its proprietary database of private equity funds. As of June 30, 2015, the database comprised 1,220 US buyouts, private equity energy, growth equity, and mezzanine funds formed from 1986 to 2015, with a value of $627 billion. Ten years ago, as of June 30, 2005, the index included 611 funds whose value was $179 billion.

Cambridge Associates derives its US venture capital benchmark from the financial information contained in its proprietary database of venture capital funds. As of June 30, 2015, the database comprised 1,589 US venture capital funds formed from 1981 to 2015, with a value of roughly $194 billion. Ten years ago, as of June 30, 2005, the index included 1,071 funds whose value was about $56 billion.

The pooled returns represent the net end-to-end rates of return calculated on the aggregate of all cash flows and market values as reported to Cambridge Associates by the funds’ general partners in their quarterly and annual audited financial reports. These returns are net of management fees, expenses, and performance fees that take the form of a carried interest.

Both the Cambridge Associates LLC US Venture Capital Index® and the Cambridge Associates LLC US Private Equity Index® are reported each week in Barron’s Market Laboratory section. In addition, complete historical data can be found on Standard & Poor’s Micropal products and on our website, www.cambridgeassociates.com.