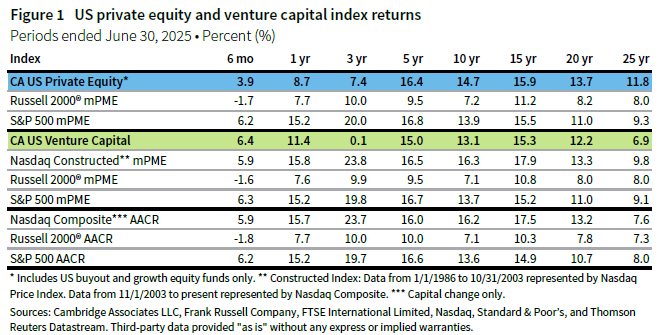

In the first half of 2025, US private equity (PE) continued its run of low single-digit quarterly returns, while US venture capital (VC) extended its recovery from a tough stretch of flat performance—the Cambridge Associates LLC US Private Equity Index® earned 3.9% and the Cambridge Associates LLC US Venture Capital Index® earned 6.4%. Within PE, growth equity outperformed buyouts (4.9% and 3.6%, respectively). Figure 1 depicts short- and long-term performance for the private asset classes compared to the public markets.

First half 2025 highlights

- The US PE index has had mixed results against public markets over the last five years, generally outperforming small-cap and equaling or underperforming large-cap indexes. In periods ten years and longer, PE’s outperformance is more consistent. Amid a historically strong market for large, public tech companies, the US VC benchmark has only consistently outperformed small-cap stocks, while struggling to keep up with the large-cap S&P 500® and tech-heavy Nasdaq indexes.

- By market value, public companies accounted for a larger percentage of the VC index (about 7%) than the PE index (about 4%), as of June 30, 2025. Non-US companies represented almost a quarter of PE and a little less than 15% of VC.

US private equity performance insights

Vintage years

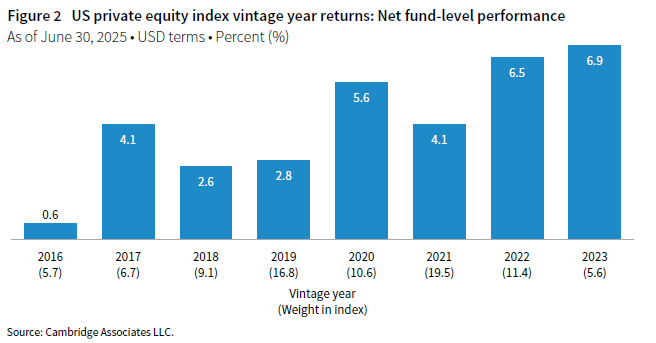

As of June 2025, eight vintage years (2016–23) were meaningfully sized—representing at least 5% of the benchmark’s net asset value—and, combined, accounted for 85% of the index. Six-month returns among the key vintages ranged from 0.6% for vintage year 2016 to 6.9% for vintage year 2023 (Figure 2).

Double-digit returns from communication services investments and mid-single-digit returns from healthcare, industrials, and IT were the biggest return drivers of for the 2023 vintage, while slightly negative returns in its two largest sectors, industrials and IT, dampened performance for the 2016 funds. The fund’s age or vintage year is one consideration when comparing returns across vintages as time is a component of the internal rate of return (IRR) calculation used for PE investments. In the current environment, hold periods have been extended, which will impact IRRs but not necessarily other return metrics, such as multiples of invested capital.

During the first two quarters of 2025, fund managers distributed more capital than they called—$78.9 billion and $67.6 billion, respectively. If this pace holds for the remainder of the year, 2025 will be a slower year than 2024 for both calls and distributions.

Five vintages (2021–25) accounted for almost all the capital called during the first six months. Two of those vintages, 2022 and 2023, were responsible for more than half the calls ($37 billion), which reflects both where they are in their investment periods and the size of those vintages in relation to the 2024 and 2025 cohorts. As is often the case, distributions were much less concentrated than contributions, and in this period, every vintage from 2012 to 2021 accounted for at least 5% of the distributions. The five most active vintages on the distribution front were 2016, and 2018–21, a potentially hopeful sign for limited partners (LPs) feeling a liquidity crunch.

Sectors

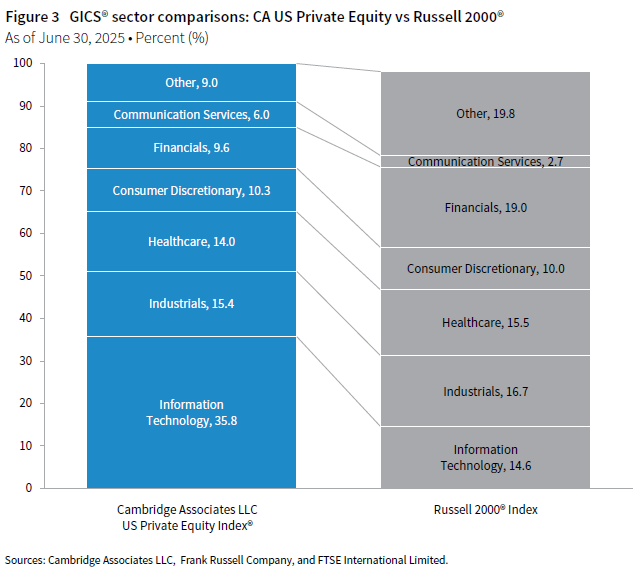

Figure 3 shows the Global Industry Classification Standard (GICS®) sector comparison by market value of the PE index and a public market counterpart, the Russell 2000® Index. The breakdown provides context when comparing the performance of the two indexes. The PE index has a significant overweight to IT and communication services as well as a meaningful underweight in “real assets,” including energy, real estate, and utilities (reflected in the “Other” category), while the public market has consistently been overweight to financials.

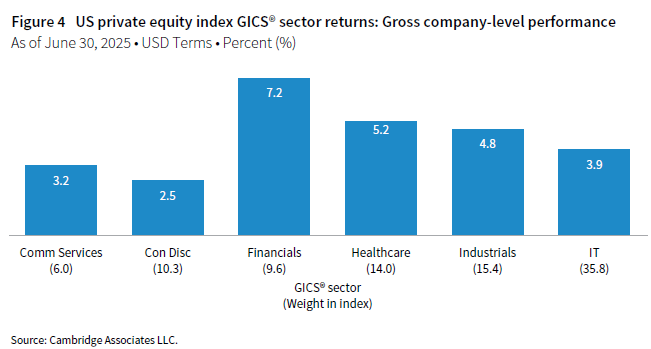

As of June 2025, at about 36% of the index’s market value, IT continued to be the largest among the six meaningfully sized sectors. Combined, the next four sectors by size—industrials, healthcare, consumer discretionary, and financials—accounted for almost 50% of the index’s value. Among the key sectors, first half returns ranged from 2.5% for consumer discretionary to 7.2% for financials. Healthcare and industrials both returned about 5% (Figure 4). Consumer discretionary investments produced mixed results among the vintages with the largest exposures, led on the upside by the 2020 cohort and on the downside by 2018 funds. Financials earned mid-single-digit to double-digit returns across the vintages with the most exposure, 2017–19.

Three sectors garnered 70% of the capital invested by US PE managers in the first half of 2025: IT (36%), healthcare (18%) and industrials (16%). Over the long term, managers have allocated 53% of their capital to those three sectors. The biggest driver of the difference was the percentage of capital allocated to IT (historically 24%). In 2025, communication services and financials companies attracted more investment than consumer discretionary businesses, in contrast with the long-term trend.

US venture capital performance insights

Vintage years

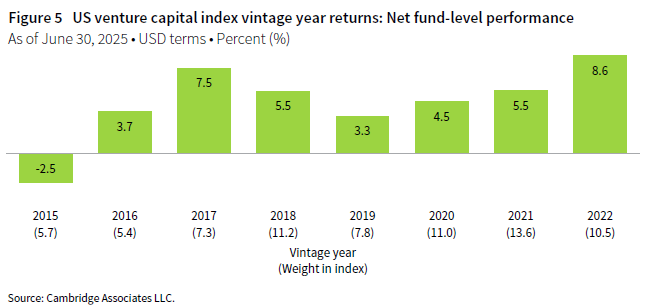

As of June 2025, eight vintage years (2015–22) were meaningfully sized and, combined, accounted for 72% of the index’s net asset value. Performance for the key vintages during the first half of the year was mixed, ranging from -2.5% (2015) to 8.6% (2022) (Figure 5). Since its stretch of seven consecutive down quarters from January 2022 to September 2023, the VC index has now posted positive returns in all but one quarter.

The best-performing and least mature key vintage (2022) benefited from gains across sectors, with its largest exposures (IT and healthcare), posting double-digit gains. Results for the worst-performing and oldest key vintage (2015) were the opposite, with negative returns for the same two largest sector exposures, IT and healthcare.

In first half 2025, VC managers called more capital than they distributed ($26.9 billion and $16.1 billion, respectively), and if the pace were to hold for the remainder of the year, 2025 will be a more active year than 2024. Since the beginning of 2022, US VC managers have called 1.6x more capital than they have distributed. In the ten years prior (2012–21), the relationship was flipped, and they distributed 1.3x what they called.

Five vintages (2021–25) accounted for nearly all the capital called during the first six months. Three of those vintages (2022–24) were responsible for almost 70% of the calls ($18 billion). Like PE, distributions were much less concentrated than contributions, and in this period, all vintages from 2012 to 2020 accounted for at least 5% of the distributions. While the 2014 funds distributed the most ($2.7 billion), there were six others that returned more than $1.3 billion to LPs.

Sectors

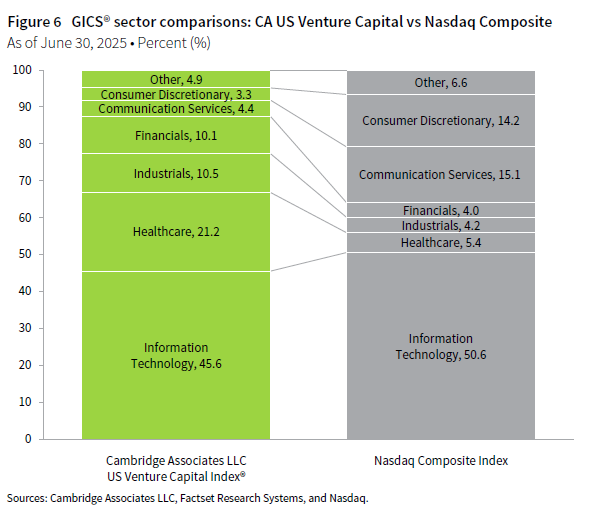

Figure 6 shows the GICS® sector breakdown of the VC index by market value and a public market counterpart, the Nasdaq Composite Index. The breakdown provides context when comparing the performance of the two indexes. The chart highlights the VC index’s substantially higher exposures to healthcare, industrials, and financials and its lower weightings in communication services and consumer discretionary. The Nasdaq index currently has a higher tilt in IT, largely a product of an extended bull run in public tech companies.

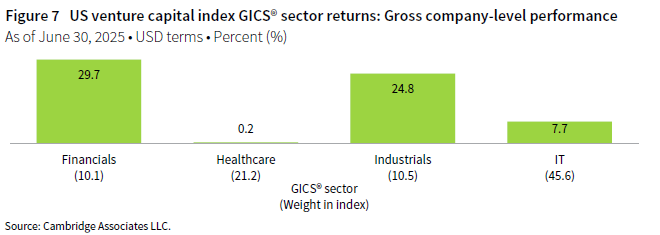

As a group, the four meaningfully sized sectors made up 87% of the VC index (Figure 7), and returns ranged from 0.2% for healthcare to 29.7% for financials. The IT sector’s return was “middle of the pack,” while results for industrials were strong. Flat-to-negative returns for healthcare in vintages 2014–20 were partially offset by positive results for the more recent vintages, whereas financials were up in all but one vintage going all the way back to 2007.

During the first six months, VC managers in the index allocated 85% of their invested capital to IT (48%), healthcare (26%), and industrials (11%). Over the long term, those sectors have garnered less than 80% of the capital, with the difference driven by the larger-than-normal allocations to IT and industrials, and lower-than-normal investment in healthcare in 2025.

Caryn Slotsky, Managing Director, PI Strategy Research

Drew Carneal, Associate Director, PI Strategy Research

Wyatt Yasinski, Associate Director, PI Strategy Research

Figure notes

US private equity and venture capital index returns

Private indexes are pooled horizon internal rates of return, net of fees, expenses, and carried interest. Returns are annualized, with the exception of returns less than one year, which are cumulative. Because the US private equity and venture capital indexes are capitalization weighted, the largest vintage years mainly drive the indexes’ performance.

Public index returns are shown as both time-weighted returns (average annual compound returns) and dollar-weighted returns (mPME). The CA Modified Public Market Equivalent replicates private investment performance under public market conditions. The public index’s shares are purchased and sold according to the private fund cash flow schedule, with distributions calculated in the same proportion as the private fund, and mPME net asset value is a function of mPME cash flows and public index returns.

Vintage year returns

Vintage year fund-level returns are net of fees, expenses, and carried interest.

Sector returns

Industry-specific gross company-level returns are before fees, expenses, and carried interest.

GICS® sector comparisons

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property and a service mark of MSCI Inc. and S&P Global Market Intelligence LLC and is licensed for use by Cambridge Associates LLC.

About the Cambridge Associates LLC indexes

Cambridge Associates derives its US private equity benchmark from the financial information contained in its proprietary database of private equity funds. As of June 30, 2025, the database included 1,700 US buyout and growth equity funds formed from 1983 to 2025, with a value of $1.6 trillion. Ten years ago, as of June 30, 2015, the index included 990 funds whose value was $523 billion.

Cambridge Associates derives its US venture capital benchmark from the financial information contained in its proprietary database of venture capital funds. As of June 30, 2025, the database included 2,699 US venture capital funds formed from 1981 to 2025, with a value of $591 billion. Ten years ago, as of June 30, 2015, the index included 1,593 funds whose value was $188 billion.

The pooled returns represent the net end-to-end rates of return calculated on the aggregate of all cash flows and market values as reported to Cambridge Associates by the funds’ general partners in their quarterly and annual audited financial reports. These returns are net of management fees, expenses, and performance fees that take the form of a carried interest.

About the public indexes

The Nasdaq Composite Index is a broad-based index that measures all securities (more than 3,000) listed on the Nasdaq Stock Market. The Nasdaq Composite is calculated under a market capitalization–weighted methodology. The Russell 2000® Index includes the smallest 2,000 companies of the Russell 3000® Index (which is composed of the largest 3,000 companies by market capitalization). The Standard & Poor’s 500 Composite Stock Price Index is a capitalization-weighted index of 500 stocks intended to be a representative sample of leading companies in leading industries within the US economy. Stocks in the index are chosen for market size, liquidity, and industry group representation.