Please see Jeff Blazek, Tracy Filosa, and Hamilton Lee, “Mission Critical: Maximizing the Impact of Healthcare System Investments,” Cambridge Associates LLC, 2019.

Healthcare systems can benefit greatly by maximizing equity orientation and illiquidity while prudently managing risk. But a typical healthcare system may have investment assets in multiple accounts, due to mergers & acquisitions (M&A), capital projects, and fundraising, as well as operational and pension benefit growth. Investments can be curated—identified, categorized, and clustered—for optimal efficiency and cost savings. Similarly, defined benefit pension plans can be restructured to better manage pension risk and administration. This paper discusses strategies to simplify and streamline investment structures to make complexity more manageable for investment and financial executives.

CURATING THE INVESTMENTS

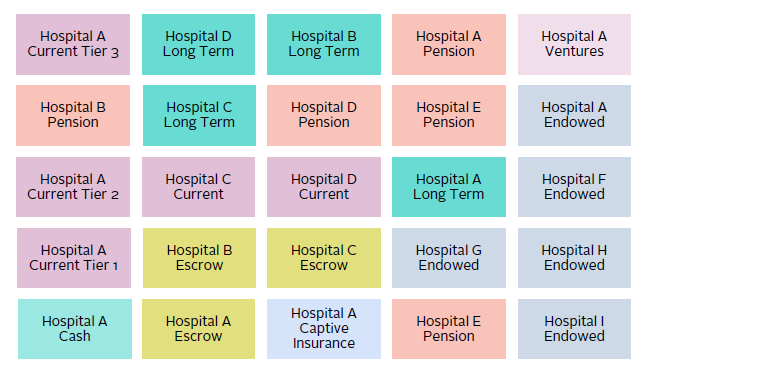

Over the past few decades, healthcare systems have become more operationally complex in order to deliver better care to the communities they serve. But with their growing scale, many healthcare systems have intricate investment structures, which often must be tracked at numerous individual account levels for specific operational and regulatory reasons. Healthcare affiliations and/or outright mergers add even further layers of complexity as legacy investments are integrated. It can be challenging to both manage parameters of each individual account and monitor investment risks of all accounts to the enterprise collectively. Figure 1 illustrates an example of a large, consolidated (but less integrated) healthcare system with numerous accounts that must be tracked separately, strewn across a number of custodians, accounts, vehicles, and investment managers.

Source: Cambridge Associates LLC.

Note: For illustrative purposes only.

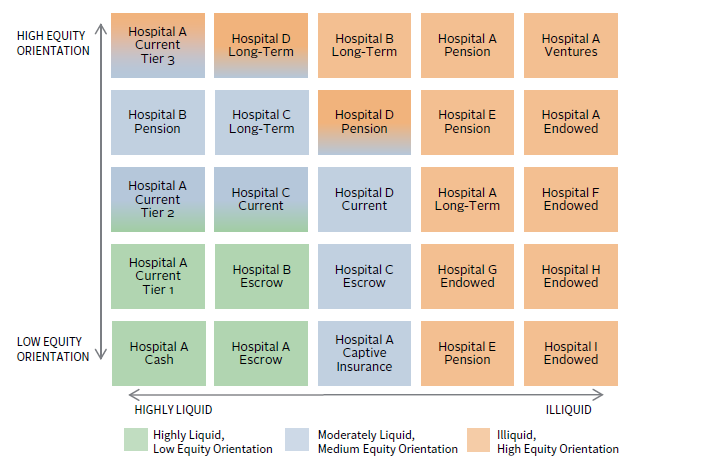

The proliferation of accounts can be better managed by delineating the role, risk tolerance, and liquidity profile of each account. Accounts can then be clustered into similar profiles, or “risk buckets.” This can help establish the baseline for a more centralized investment management structure that still enables discrete account units for their specific purposes (Figure 2). Curation can also help align policy setting, permissible investments, asset allocation targets and ranges, and other best practices for those accounts that are similar in their ultimate investment goals. Often, many long-term accounts can be collectively categorized as a long-term investment pool (LTIP), which becomes a focus for the healthcare system’s staff and governance, even if the LTIP technically contains many smaller accounts.

Source: Cambridge Associates LLC.

Note: For illustrative purposes only.

The efficiencies of curation can be amplified by developing a unitized account structure with the healthcare system’s custodian. For those systems that have less developed investment programs, we recommend using an institutional quality custodian to independently hold all investments and provide independent, accurate reporting. Most custodians offer the ability to create unitized account structures that can commingle investments from many sub-accounts and then track units of ownership in the shared structure.[1]Unitization can achieve substantial savings and synergies but requires a thorough process in partnership with a healthcare system’s custodian. Unitization can either be applied at the whole-pool … Continue reading If all the accounts share the same tax ID, this unitization can be straightforward. If multiple non-profit tax IDs are involved (such as for an affiliated foundation), structures, such as a limited liability company, can be created to achieve unitization. A similar unitization and aggregation exercise can also be achieved with Employee Retirement Income Security Act of 1974 (ERISA) assets. Ultimately, unitization is a powerful tool to extract both operational efficiencies and cost savings while managing many discrete accounts.

OPTIMIZING PENSION STRUCTURES

Healthcare systems frequently offer multiple defined benefit pension plans to their employees. These distinct plans accumulate from systems mergers, negotiations with subsets of the system’s employee base, and other factors. While the level of cross-plan uniformity that can be achieved varies from system to system, merging plans’ assets and liabilities into a single plan or combining plan assets via a master trust structure can significantly reduce the complexity of overseeing multiple pensions. Merging multiple plans generally results in a more efficient structure by significantly reducing ongoing plan administration costs, including investment manager fees, actuarial and record keeper fees, and internal management costs. The structure also helps investors to more clearly evaluate and customize the pension investment strategy within the context of both the plan and the entire healthcare system.

The Master Trust Structure

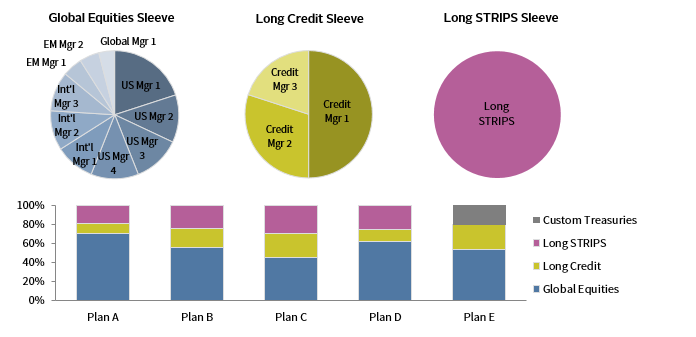

A typical master trust structure has asset class sleeves consisting of multiple managers, such as global equities, private equity, hedge funds, long credit, and STRIPS. Each plan owns a number of shares of the sleeves in proportions based on its asset allocation, and reflective of its funded status and risk profile. For well-funded plans, a plan-specific custom Treasury portfolio may also be a part of the structure.

The master trust thus streamlines management of multiple plans, with focus on overseeing managers in the master trust, and each plan’s weights to the asset sleeves of the master trust, rather than the individual managers in each asset class for each plan.

However, a merger of plans is not always possible, due to M&A agreements, geographical concerns, or employee group considerations. If merging plans is not feasible, a master trust structure can still significantly centralize investment management, reduce aggregate manager fees, and allow smaller plans to access higher value-add strategies that may not be available to them on a stand-alone basis.

CUSTOMIZING THE INVESTMENT STRATEGY: BALANCING RETURN AND LIABILITY MANAGEMENT NEEDS

Pension liabilities are highly sensitive to interest rate changes. This embedded risk may be meaningful relative to a healthcare system’s overall balance sheet and credit rating. While rate risk can be hedged, such hedges must be evaluated against the need to generate returns, whether to close the asset-liability deficit, fund future accruals, or offset ongoing administrative expenses. Healthcare plan sponsors seek to balance the conflicting objectives of returns and risk control relative to specific plan dynamics (e.g., benefit formulas, lump sums, and plan maturity), ultimate plan goals (such as termination or hibernation), business projections, the size of their LTIP relative to the pension, and general risk tolerance.

Healthcare plan sponsors may elect to maintain a heavier bias to growth assets if they are meaningfully underfunded and/or open, or if the LTIP is large and can support pension contributions in times of market stress. For most plan sponsors, even those taking an LTIP-like, total return approach, a liability-driven or at least liability-aware approach to fixed income makes sense. This is due to onerous variable-rate Pension Benefit Guaranty Corporation (PBGC) premiums and balance sheet considerations, as both are driven by changes in interest rates.[2]Even for church plans, which are not subject to PBGC premiums, balance sheet risk considerations are often sufficient to hedge at least some interest rate risk. In addition, the duration profile of fixed income investments depends on the nature of the benefit provided. For plans with traditional final or career-average pay formulas or fixed-rate cash balance formulas, long-duration bonds will most effectively hedge the long-duration nature of these liabilities. For plans with variable-rate cash balance benefits and, therefore, lower liability interest rate risk, core bonds are more appropriate.

Healthcare institutions should identify, curate, and cluster their pension plans by level of growth allocation, liability hedge allocation, and the composition/duration profile of the liability hedge to best achieve a more manageable structure, while still customizing investment strategy appropriately for the underlying plans. The sample structure highlighted in Figure 3 shows how each asset class “pie” can be diversified across a number of managers—global equities, long credit, and long STRIPS—while each discrete plan can have as much or as little of each “pie” as it wants in its own custom-weighted asset allocation.

Source: Cambridge Associates LLC.

Note: Simplified example for illustrative purposes only.

PLAN MANAGEMENT DECISIONS

Unlike their corporate counterparts, many healthcare plan sponsors may be better served by maintaining their well-funded, hard-frozen plan in hibernation rather than terminating the plan and paying the premium and administrative cost associated with transferring the liabilities to an insurance company. A well-developed investment strategy focused on liability hedging and alpha generation, if executed with the necessary investment acumen and resources, can minimize funded status volatility, while generating sufficient excess return to offset ongoing administrative expenses. In some instances (e.g., in the case of cash balance plans, plans paying large lumps, or plans with complex early retirement factors), pension risk transfer may be either extremely costly or simply not available, making hibernation the only viable solution. Moreover, in some situations, maintaining a plan in hibernation may be advantageous from an employee relations perspective as well.

CONTRIBUTION POLICY CONSIDERATIONS

An important aspect of the contribution policy for all plan sponsors is the expected return in the LTIP versus the expected return in the pension, with many plan sponsors opting to fund the pension to a lesser degree given the higher expected LTIP returns. However, for plan sponsors subject to ERISA, this approach needs to be adjusted by (1) considering the required funding to avoid a PBGC 4010 filing, an onerous and potentially sensitive filing required for deeply underfunded plans; and (2) evaluating the expected return in the LTIP versus the expected return in the pension plus potential savings on variable-rate PBGC premiums. Currently, underfunded ERISA plans are subject to a variable-rate PBGC premium of 4.5% of the asset-liability deficit (subject to a cap based on the number of participants). Thus, each dollar contributed from the LTIP to the pension generates a guaranteed return of 4.5% every year (at least until the variable-rate PBGC premium structure changes), plus the expected return in the pension. Combined, this “post-PBGC” expected return often exceeds the expected return in the LTIP, making additional contributions an attractive option.

CONCLUSION

Healthcare providers have extremely dynamic balance sheets, impacted not only by cash inflows and outflows, but also by complex investment account structures. The art and science of managing these investments involves crafting an optimized investment strategy and structure, respectively. Healthcare systems with well curated investment structures can maximize investment returns while keeping a finger on the pulse of the investment risk being assumed by the enterprise as a whole.

Jeff Blazek, CFA, Head of Cambridge Associates’ Healthcare Practice

Alex Pekker, PhD, CFA, ASA, Managing Director

Footnotes