Over the past four decades, institutional investors have implemented newer and more dynamic strategies in their portfolios in an effort to boost investment returns. During the same period, many investors reduced allocations to fixed income while increasing allocations to equities and alternative investments, including private investments (PI), hedge funds, and commodities. Private equity (PE) investments across buyout, growth, and venture strategies can provide portfolios with exposure to high-quality assets and deliver positive outcomes. However, private markets often present a timing conundrum for investors—PE exposures can take many years to develop, and their investment decisions are judged on much shorter time frames than those experienced in private markets.

This paper examines how exposure to secondary private market investments has the potential to deliver the benefits of PE within a more efficient timeframe. It reviews the potential advantages of secondaries and presents case studies that show how they can be broadly used as an effective portfolio management tool for investors of all types and sizes.

Alternative Opportunities

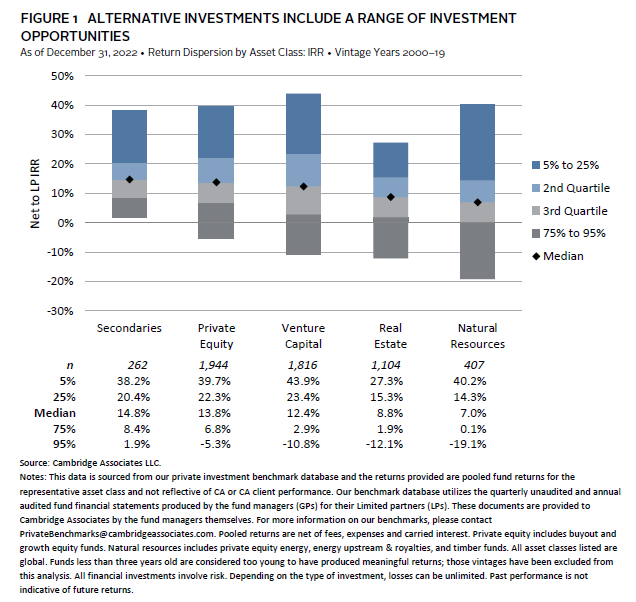

The term “alternative investments” refers to non-traditional asset classes, such as PI, hedge funds, and commodities (Figure 1). PI strategies include the following sub-asset classes:

- Private equity—buyouts, growth equity, venture capital (VC);

- Real assets—real estate, private energy, natural resources, and infrastructure;

- Private credit—direct lending strategies, opportunistic credit, and structured finance; and

- Secondaries & co-investments—transactions across all these sub-asset classes.

Accessing PE Opportunities Through Secondaries

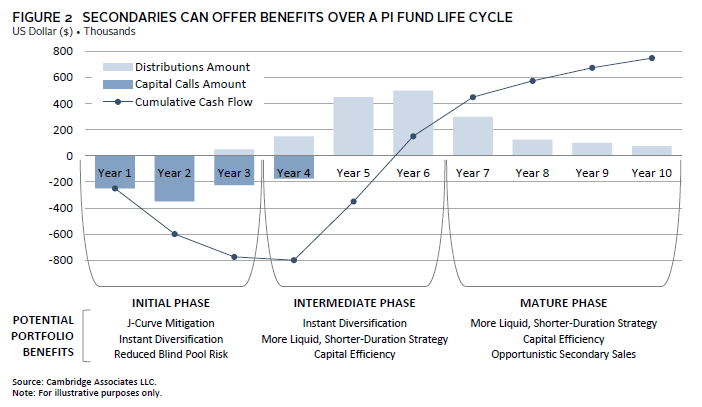

For investors looking to take advantage of the potential benefits of PE investments while mitigating some of the implementation challenges, secondaries can provide an effective, efficient solution. Secondaries can help mitigate the J-curve[1]A J-curve is an early period characterized by negative returns and cash flows, as investments are initially made and develop over time before they are in a position to be sold. impact of PE investments on portfolios and deliver all the benefits of the asset class within an accelerated timeframe. They also offer a number of attractive attributes both early on and throughout the life of a PI program.

Investing in Secondaries

PE secondaries are transactions in which an investor acquires an existing interest or asset from PE fund investors, or limited partners (LPs). Secondaries have become a growing and evolving segment of the PE landscape, as they allow flexibility for LPs who may want to liquidate or rebalance a portfolio. We believe buyers of secondaries—and, therefore, investors allocating to secondary funds—are well positioned to benefit from potentially discounted access to PE, shorter-duration investments and quicker return of capital, and enhanced visibility into the underlying portfolio or assets.

Features and Benefits of Secondaries: Beyond the Discount

More Liquidity, Shorter Duration

An allocation to secondaries offers investors potential access to more liquid investments in a traditionally illiquid asset class. Secondary funds typically purchase “slightly used” LP interests—usually between 50% and 80% funded—with a sizable upfront cost, but often at a discount to the fund’s stated net asset value (NAV). Some capital calls may still occur for follow-on investments later in a secondary fund’s life, but these capital requirements are often offset by other portfolio distributions. Importantly, because a secondary fund’s underlying investments are already seasoned, a secondary transaction can begin generating distributions as early as day one of the investment, accelerating the return of capital within a PI program.

Secondary funds typically take less time than other PE strategies to reach a distributed to paid-in capital (DPI) multiple of 1.0x, often with a 40% DPI multiple in the first five years alone, which is unusual for other PE tactics that tend to take longer to distribute capital back to their LPs. An allocation to secondary strategies can provide more liquid, shorter-duration return opportunities that simultaneously enhance overall portfolio diversification.

Reduced Blind Pool Risk

Consistent with primary PE funds (buyout, growth, VC), secondary funds start off as blind pools of capital—meaning that general partners (GPs) raise capital from LPs without immediate visibility into the underlying assets. However, at the transactional level, the makeup of an underlying portfolio is known to secondary buyers at the time of their investment. In other words, from the perspective of secondaries investors, the wait to “access” underlying NAV can be significantly decreased and often acquired at an attractive discount to the stated NAV or perceived intrinsic value.

“Instant” Diversification

Secondary funds build portfolios by purchasing existing positions in single funds or groups of funds from LPs seeking early liquidity from these positions, often at a discount to NAV. The result is a fund composed of a diversified portfolio of seasoned PI positions, often represented by hundreds of underlying assets across sectors, stages, geographies, and vintage years.

For example, say an institutional investor has gone without an allocation to PE for the past four years. A CIO seeking exposure to high-quality GPs from that period has an opportunity to obtain vintage year exposure through an allocation to secondaries. By providing investors with access to earlier vintage years they may have missed, secondaries provide a rare opportunity for allocators to help meet their investment goals.

Capital Efficiency

In addition to discounted access to PE, secondaries also offer investors a highly capital-efficient investment. At any given point within a secondary fund’s life, the percentage of capital called by the secondary manager (or “out of pocket exposure”) represents roughly 50% to 75% of investor’s capital commitment. Secondary funds often require less investor capital to be “put to work” than other PE strategies. Contributing factors to this profile for secondary funds include distributions offsetting contributions early in a fund’s life and the usage of structures including deferred payments and leverage. Secondary funds may not actually call or invest 100% of commitments, and investors should consider this in their planning as they seek to deploy a target amount of capital into the strategy.

Consistent Performance Potential

As the secondaries market evolves to include multiple sub-asset classes, deal types, and geographies, the asset class can also offer a range of interesting growth and diversification opportunities for motivated investors that are interested in PE allocations. Compared to primary funds, many secondary fund profiles tend to have a higher initial internal rate of return (IRR), and we believe secondaries have proven to be one of the most consistently strong-performing PI asset classes across varying macroeconomic environments.

Practical Application of Secondaries

The following three case studies highlight how an allocation to secondaries can accomplish distinct investment goals across the various phases of a PI program (as illustrated in Figure 2). These case studies are hypothetical examples based on the real-world experience of Cambridge Associates clients that have used PI programs to help meet a range of plan objectives over time.

Case Study 1: Initial Phase of Portfolio Development

A newly formed family office with no PI allocations.

Challenge: Timeline required to develop a mature PI portfolio.

Goals:

- “Jump-start” the PI portfolio from scratch.

- Obtain diversification across PI strategies and vintage years.

Implementation: As family offices new to PI contemplate their investment goals and portfolio lifecycle, it is important to keep in mind that early portfolios usually have J-curves. Mathematically, the IRR calculation (the “depth” of the J-curve) is heavily influenced by early cash flows. New private investment portfolios are often in an overall J-curve, meaning the portfolio is not self-funding, which requires other sources of capital and can strain an investor at inopportune times. This makes commitment planning and pacing a vital part of the overall portfolio construction discussion. The return profile of secondaries can help attenuate the J-curve effect in a nascent portfolio, truncating the time horizon of other PI strategies and facilitating a faster return of capital.

Case Study 2: Intermediate Phase of Portfolio Development

A recently frozen corporate defined benefits plan with existing PI allocations that is approximately 80% funded.

Challenge: Need for additional contribution amid increasing expenses.

Goals:

- Improve funded status.

- Refit existing PI allocation to meet the plan’s current needs.

Implementation: For some defined benefit plans that are seeking to improve their funded status and refit their existing PI allocation to meet their plan’s current needs, PI should remain a part of the portfolio. However, new commitments should be tailored toward a more mature liability stream. Rather than commit to many new managers and diversify exposures across strategies, consolidating the manager line-up—especially in growth-oriented areas such as buyouts and growth equity—is more appropriate. Furthermore, PI strategies with longer investment horizons and a more diversified manager approach (e.g., early-stage VC) may need to be cut back. The excess commitment budget from a more consolidated PE allocation should instead be tilted toward the addition of income-oriented strategies to improve the portfolio’s cash flow profile and meet more near-term liabilities. These scenarios warrant serious consideration of an allocation to secondaries, which can address many of these challenges at this intermediate phase of an investment program’s life.

Case Study 3: Mature Phase of Portfolio Development

A university endowment is overallocated to PI due to strong performance from the underlying portfolio.

Challenge: Overallocation to PI requires rebalancing in the portfolio.

Goals:

- Reduce allocation to PI.

- Redeploy capital to new manager relationships.

Implementation: At the mature phase of a PI program (Figure 2), the endowment may want to consider using the secondaries market to generate liquidity via secondary sales out of its own portfolio. There are many motivations for secondary sales—including the need for liquidity, reduced GP relationships, and reduced administrative burden of a growing portfolio of individual line items. Secondary sales often trade at a discount to NAV; however, in exchange for a discounted purchase price, a seller can re-invest sale proceeds as they see fit or address the plan’s liquidity needs.

Achieving Efficiency in PE for Investors

As investors continue to expand their investment portfolios beyond traditional equities and fixed income, secondary funds can offer a more refined, efficient approach to accessing the PI universe—one that may be better suited to their operational time frames, while still offering the benefits of investing in the asset class. We believe PE secondaries should be strongly considered by investors seeking to grow their PI program and consistently implemented in existing PI portfolios to reach performance goals and investment objectives.

Kenly Drake, Managing Director, Secondaries

Rohan Dutt, Senior Investment Director, Secondaries

Footnotes