Annual distributions from the endowment are a source of supplemental operating revenue for most endowed institutions. An institution’s endowment spending policy provides a basis for the calculation of the annual distribution, serving as a bridge that links the long-term investment portfolio (LTIP) and the enterprise. Spending policies are designed to reflect the needs of current and future generations of stakeholders, balancing the goals of providing appropriate levels of support to current operations and preserving, or even growing, endowment purchasing power.[1]Purchasing power is defined as the real market value of the endowment. An endowment that is maintaining purchasing power is keeping pace with inflation (after spending and investment returns). An … Continue reading

The data and analysis in this report cover a variety of spending topics including spending rule types, the endowment’s support of operations, and effective spending rates. This year’s report draws on a supplemental study Cambridge Associates conducted in March 2017 to dive deeper into the topics of spending policy implementation and factors that may lead to policy changes.

Participants and Spending Rule Types Defined

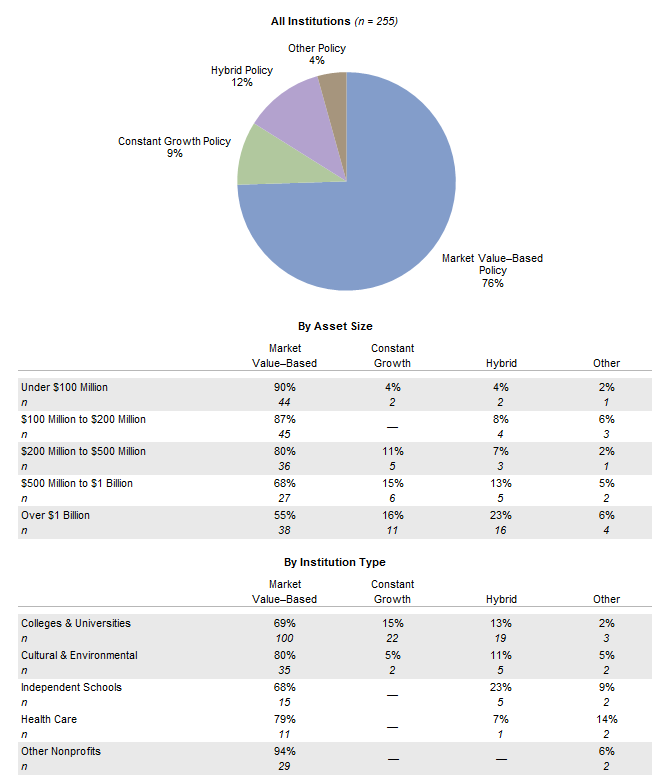

For 2016, Cambridge Associates collected spending policy data on 255 of our nonprofit clients, including 144 colleges and universities, 44 cultural and environmental institutions, 22 independent schools, 14 health care organizations, and 31 other nonprofit institutions. Foundations were excluded from the survey group as their spending is influenced by certain mandated spending requirements. A list of participants can be found at the back of this report. Figure 1 shows the distribution of these institutions across various asset size bands.

Source: Spending policy data as reported to Cambridge Associates LLC.

Institutions in this study use three primary spending rule types. Market value–based rules link the spending amount directly to the endowment’s market value. Constant growth rules increase spending each year by a defined growth factor. Hybrid policies combine the elements of both market value–based and constant growth rule types.

Figure 2 shows the prevalence of the spending rule types across participating institutions. The most frequently used rule type is a market value–based policy, cited by 76% of institutions. Market value–based rules are most common among the smallest portfolios, with nearly 90% of institutions with assets under $200 million using this rule type. In comparison, 55% of institutions with assets over $1 billion use a market value–based rule. Hybrid and constant growth rules were cited by 12% and 9% of all participants, respectively. Both rule types were more likely to be used by larger portfolios than smaller portfolios. Among the institutions with assets over $1 billion, 23% used a hybrid policy and 16% used a constant growth policy.

Source: Spending policy data as reported to Cambridge Associates LLC.

Notes: Market value–based spending policies base spending on a prespecified percentage of a moving average of market values. Constant growth policies increase prior year’s spending by a measure of inflation and/or a prespecified percentage. Hybrid policies are those that incorporate a weighted average of a constant growth rule and a percentage of market value rule. Other policies are those that cannot be classified as market value–based, constant growth, or hybrid policies.

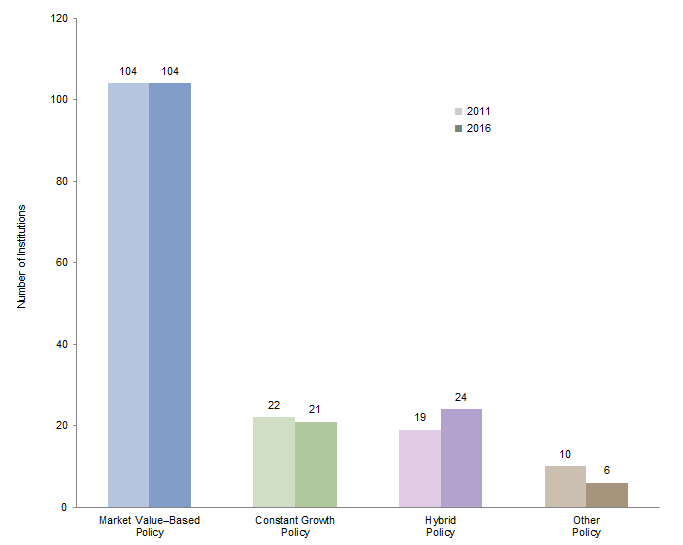

Figure 3 shows the distribution of rule types for the 155 institutions that provided spending policy data in 2011 and 2016. The market value–based rule continues to be the most common among institutions in this study, with the same number of institutions using this policy in 2016 as five years ago. Among the other rule types, five more institutions used a hybrid policy; one less institution used a constant growth policy; and four fewer institutions used some other policy.

Source: Spending policy data as reported to Cambridge Associates LLC.

Note: Bar graph represents the 155 institutions that provided a spending policy in both 2011 and 2016.

Market Value–Based Policies

A market value–based rule dictates spending a percentage of a moving average of endowment market values. By linking the spending distribution amount directly to the endowment’s market value, this rule type usually produces the most dramatic changes in spending when investment conditions shift. Therefore, purchasing power preservation is prioritized during periods when the endowment’s market value declines.

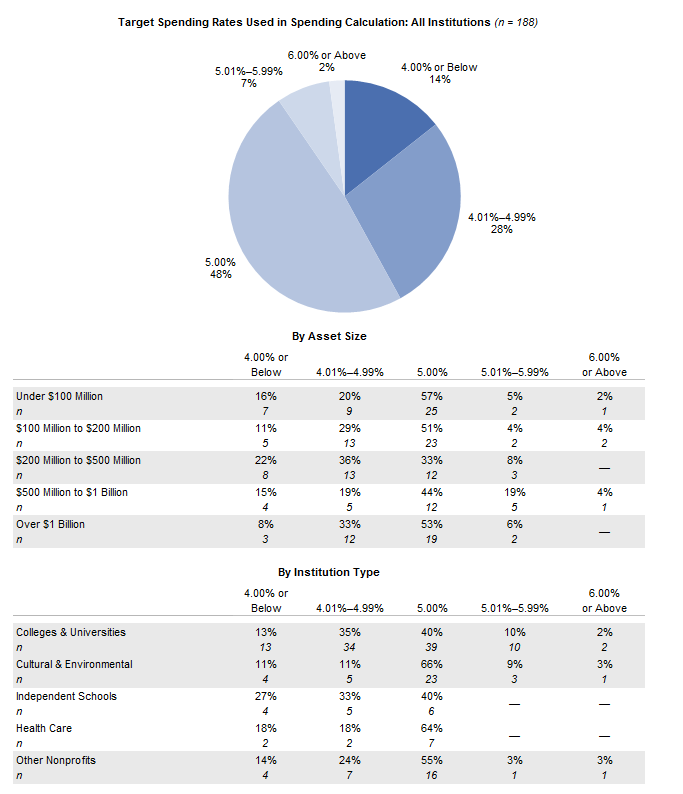

The primary levers of this rule type are the target spending rate and the date or smoothing period used to measure the market value. Some institutions also use a cap and floor to contain changes in the annual spending distribution during volatile market periods.

Target Spending Rate. The target spending rate helps determine the proportion of the endowment that is distributed on an annual basis. Institutions incorporate long-term investment return expectations and inflation into the selection of the appropriate target spending rate. To preserve the purchasing power of an endowment,[2]In this instance, we use the term “endowment” to refer to a single fund with no future inflows. An LTIP, which is a collection of multiple endowments and other long-term funds, can use inflows to … Continue reading the spending rate would align with long-term real investment return expectations. The purchasing power of an endowment will increase when the spending rate is lower than the long-term real return, and vice versa.

In 2016, the majority (88%) of participating institutions that cited a market value–based rule used a pre-specified target rate; the remaining institutions allowed some discretion by setting a pre-specified percentage range within which the target spending rate may fall. For the purposes of comparing target spending rates, we assume the midpoint for institutions that specified a discretionary range. Of institutions with a market value–based policy, 48% used a target spending rate of 5%, and 42% of respondents used a target rate below 5%. Only 10% of institutions applied a rate that exceeded 5% (Figure 4).

Source: Spending policy data as reported to Cambridge Associates LLC.

Notes: Market value–based spending policies base spending on a prespecified percentage of a moving average of market values. Graph reflects data for the 188 institutions that provided detailed data on their target spending rate. If a range was provided, the target spending rate was calculated using the midpoint of the range.

Source: Spending policy data as reported to Cambridge Associates LLC.

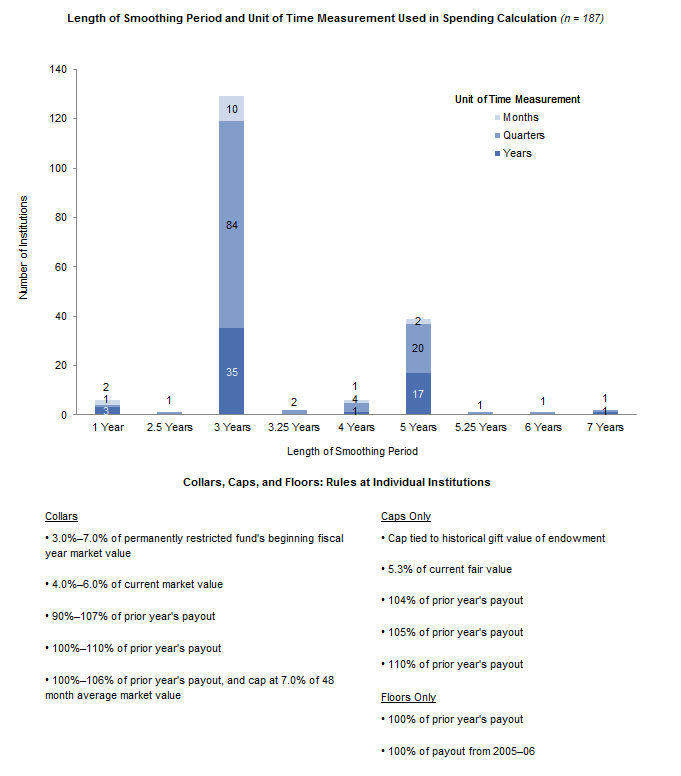

Notes: Market value–based spending policies base spending on a prespecified percentage of a moving average of market values. Unit of time measurement indicates whether spending is calculated using monthly, quarterly, or yearly market values. Graph reflects data for the 187 institutions using a market value–based spending policy that provided the unit of time measurement in their spending calculation.

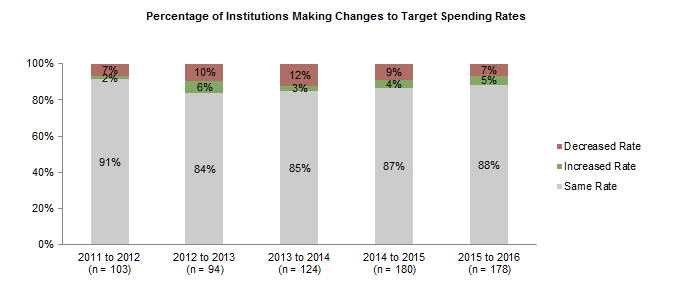

In fiscal year 2016, 88% used the same target spending rate as reported in the previous year (Figure 5). This is consistent with the trend we have observed over the last five years, where the vast majority of institutions make no change in any given year. Approximately 7% of institutions decreased their target spending rate in 2016, while another 5% increased the rate.

Figure 5. Changes in Target Spending Rates for Market Value–Based Spending Policies

Fiscal Year 2011–16

Source: Spending policy data as reported to Cambridge Associates LLC.

Notes: Market value–based spending policies base spending on a prespecified percentage of a moving average of market values. If a range was provided, the target spending rate was calculated using the midpoint of the range.

Smoothing Period. The spending distribution under a market value–based rule is determined by applying the target spending rate to the endowment’s market value. This is usually measured as an average market value over a period of time, known as a smoothing period. By capturing the endowment’s market value over several points in time, the smoothing period helps reduce year-to-year volatility in spending distributions. Smoothing periods for participants in this report range from one to seven years, and the time interval (i.e., monthly, quarterly, or annual market values) can vary (Figure 4). The most common measurement period was 12 quarters (45% of those with a market value–based policy).

Cap and Floor. The introduction of a spending floor and/or cap can also serve as a smoothing mechanism for spending dollars by limiting the change in spending during particularly volatile periods. A floor used in a market value–based rule prevents spending from falling below a certain level, usually the previous year’s spending dollar amount. While a floor can relieve budgetary pressures during market downturns for institutions with concerns about spending cuts, limiting the decline in distributions can further erode the endowment’s market value and make purchasing power preservation more challenging over the long run. A cap limits spending increases when endowment growth is particularly strong by setting a maximum annual growth rate. When paired together, a cap and floor (known as a collar) can produce smoother distributions by maintaining a level of spending during challenging economic environments and saving a greater portion of investment gains from periods with exceptional endowment growth.

In practice, only 12 institutions (6%) that use a market value–based rule employ a cap and/or floor. Eight institutions use a cap and/or floor based on a percentage of a prior year’s spending distribution while three institutions apply a cap and/or floor to the endowment’s market value on a specific date. Another institution links its cap to the historical gift value of the endowment. For the 23 institutions that outline a discretionary range for the target spending rate, the range serves as a collar in that it allows institutions to raise the rate of spending in down markets and lower the rate of spending when endowment growth rates are high.

Constant Growth Policies

A constant growth spending policy increases the prior year’s spending amount by a measure of inflation and/or a pre-specified percentage. Institutions tend to use this rule type when the endowment is a significant source of operating revenue and volatility in annual spending distributions is less tolerable. More predictable spending is derived from constant growth rules with a fixed annual increase in spending rather than those linked to inflation, which is not a constant number and not known in advance. Of the 24 institutions that use this rule type, 12 use a pre-specified percentage growth rate; 11 use an inflation-index growth rate; and one uses an inflation-index growth rate plus a pre-specified percentage (Figure 6).

Source: Spending policy data as reported to Cambridge Associates LLC.

Note: Constant growth policies increase prior year’s spending by a measure of inflation and/or a pre-specified percentage.

While the strict application of a constant growth rule produces predictable spending, this rule type has some notable shortcomings. Increasing spending during prolonged periods of low or negative investment returns quickly eats away at an already dwindling market value and may permanently impair the endowment. Conversely, in a high return environment a strict constant growth rule can be perceived as significantly under-spending.

In practice, institutions mitigate these shortcomings by imposing a spending cap and floor based on a percentage of the endowment’s market value, or a moving average of market values (Figure 6). Spending collars essentially transform the constant growth rule to a market value–based rule in times of significant endowment growth or contraction to avoid a complete disconnect between spending and the endowment market value. When the constant growth rate falls behind endowment growth by a certain amount, the floor is triggered and the spending distribution is raised to a new level determined by the floor. The cap works in the opposite manner by resetting spending to a lower level than was calculated from the growth measure. Spending caps are typically triggered during periods where the endowment’s market value has significantly declined.

Hybrid Policies

A hybrid spending policy blends the more predictable spending element of a constant growth policy with the asset preservation principle of a market value–based policy and allows an institution to set the appropriate mix that best meets its needs. The rule is expressed as a weighted average of a constant growth rule and a percentage of market value (or average market value over a period of time) rule.

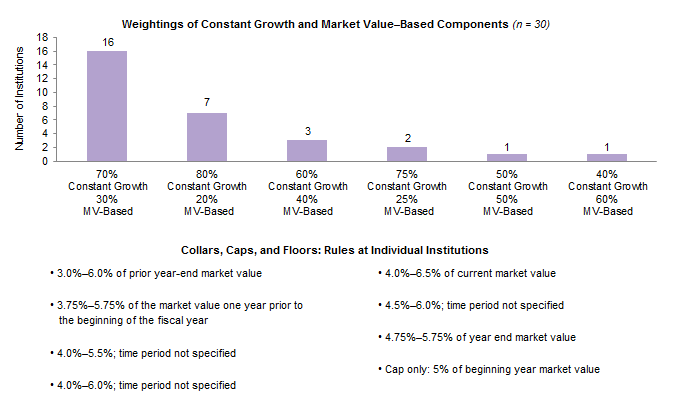

An important decision with the hybrid rule is to determine the weighting of the market value and constant growth components. The larger the weighting to the market value component, the more impact that a change in the endowment’s market value will have on the annual spending distribution. Most institutions apply the larger weighting to the constant growth component, emphasizing more predictable spending. Just over half of respondents (16 of 30) that use this rule type assign a 70% weighting to the constant growth portion and a 30% weighting to the market value–based portion (Figure 7). Among institutions in this study, the constant growth component is most frequently linked to an inflation index. For the market value component, nearly half of participants used a 5% spending rate. Inputs to the calculation of both the constant growth and market value–based components are shown in Figure 7.

Source: Spending policy data as reported to Cambridge Associates LLC.

Notes: Hybrid policies essentially have the effect of spending a prespecified percentage of an exponentially weighted average market value (MV). The rule is expressed as a weighted average of a constant growth policy and a percentage of market value policy. Of the 30 institutions that use a hybrid spending policy, 22 do not use a collar, cap, or floor to contain year-to-year spending.

Source: Spending policy data as reported to Cambridge Associates LLC.

Notes: A hybrid rule is expressed as a weighted average of a constant growth policy and a percentage of market value policy. One institution that uses a hybrid policy did not provide details for the mechanics of the market value–based component of its rule.

Support of Operations

Since few nonprofit institutions generate enough revenues from their core operations to break even on their annual operating budgets, many rely on their LTIP to provide additional financial support. The level of LTIP support varies considerably among the institutions in this study. Spending distributions supported 1% or less of the operating budget for some institutions, while for others it is the single largest source of revenue.

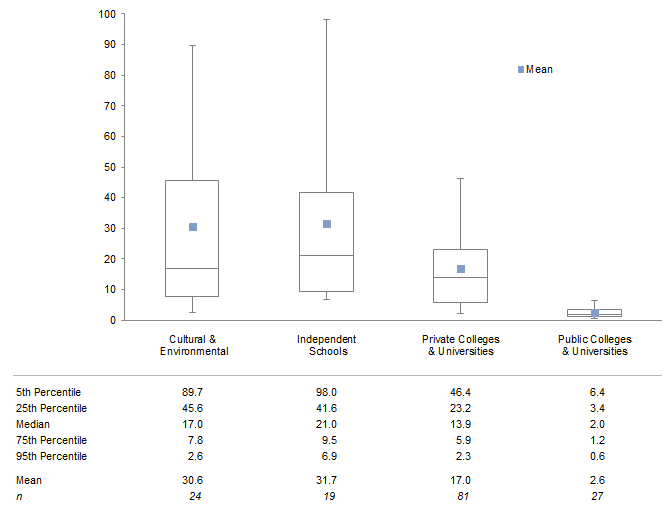

Public universities, which receive financial support from state appropriations, generally rely less on the LTIP to fund the operating budget compared to private colleges and universities and other nonprofits. For the 27 public universities that provided data, median support from the LTIP as a percentage of operating expenses was 2.0% in 2016. Median support for private colleges and universities was 13.9% (Figure 8).

Source: Spending policy data as reported to Cambridge Associates LLC.

Notes: LTIP support of operations is the proportion of the operating budget that is funded from LTIP payout. For the two health care institutions and six other nonprofits that provided data, LTIP support of operations averaged 59.3% and 41.4%, respectively.

Among independent schools and cultural and environmental institutions, reliance on the LTIP is higher, as median support of the operating budget was 21.0% and 17.0%, respectively.

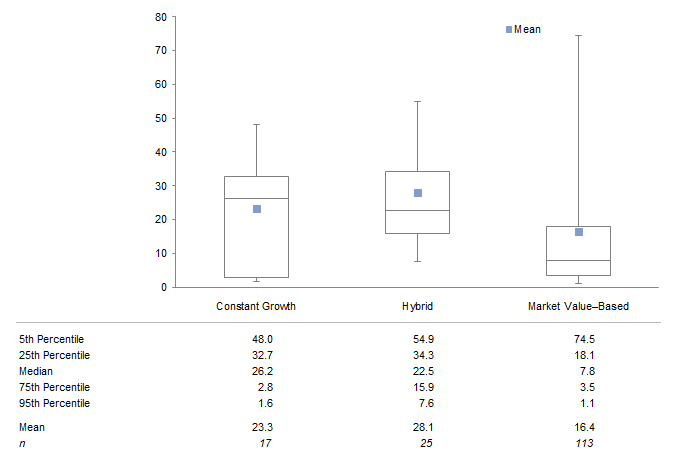

The more predictable stream of spending dollars presumably makes the constant growth and hybrid rules appealing to institutions with higher reliance on the LTIP. Median LTIP support was 26.2% for institutions using a constant growth policy, the highest among the three main rule types (Figure 9). Institutions using hybrid policies, which also contain a constant growth component, had the second highest median LTIP support (22.5%). For institutions using a market value–based policy, median LTIP support was just 7.8%.

Source: Spending policy data as reported to Cambridge Associates LLC.

Notes: LTIP support of operations is the proportion of the operating budget that is funded from LTIP payout. For the four institutions that reported “Other” spending policies, LTIP support of operations averaged 49.2%.

Effective Spending Rates

At what rate have institutions actually spent from their LTIP? The effective spending rate can help answer this question. The effective spending rate is calculated as the total annual spending distribution as a percentage of the beginning market value of the LTIP. In 2016, the average effective spending rate was 4.6% for the 114 institutions that provided data for the past ten years (Figure 10).

Source: Spending data as reported to Cambridge Associates LLC.

Note: Data represent the average of 114 institutions that provided effective spending rates for each year from 2007 to 2016.

While the effective spending rate calculation is based on the most recent year’s beginning LTIP market value, most institutions use an average market value that spans multiple years when determining the annual spending distribution. When the most recent market value is higher than the average market value from the smoothing period, the effective spending rate will be lower than the target rate in the spending policy, and vice versa. Figure 10 shows this inverse relationship between the directional trend of effective spending rates and LTIP growth rates. Effective spending rates spiked upward in 2009–10 as steep portfolio declines resulting from the global financial crisis began factoring into spending policy calculations. While average effective spending rates have declined in most years since 2010, the mean ticked up by 10 basis points in 2016.

Looking Ahead

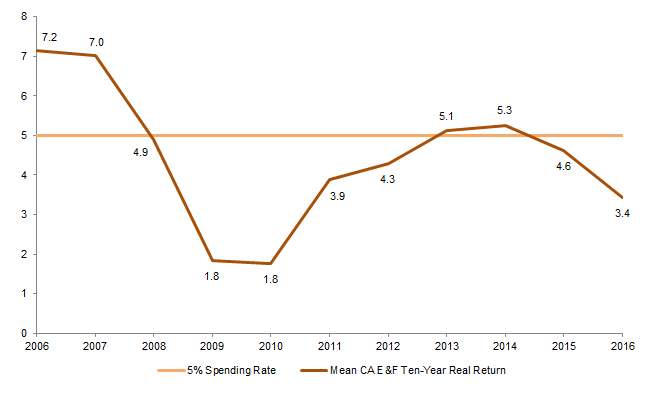

To preserve purchasing power an endowment must earn a rate of return that offsets spending and inflation over the long term. Sustaining the role of the endowment within the enterprise is a primary consideration when setting spending policy. The task of preserving purchasing power has been challenging for endowments in recent periods. Figure 11 shows the mean rolling ten-year returns adjusted for inflation for the Cambridge Associates endowment and foundation peer group. Since 2007, in only two trailing ten-year periods have average real investment returns exceeded the 5% spending rate that is most commonly targeted.

Figure 11. Rolling Ten-Year Real Mean Endowment & Foundation Returns vs 5% Spending Rate

Periods Ending June 30

Source: Return data as reported to Cambridge Associates LLC.

Note: Analysis includes 247 institutions that provided return data for fiscal years 1997 through 2016.

While 2017 may provide a reprieve to the low returning fiscal years of 2015 and 2016, that relief may be short-lived. Scenarios where market valuations and other economic fundamentals return to normal conditions point to a low return environment over the next decade. When returns fall short of spending and inflation, institutions erode the real (inflation-adjusted) value of their endowments. This is expected occasionally and can be offset by higher returning years, but a persistent low return environment could have a substantial impact on endowment values and the level of endowment support available for future stakeholders.

To understand how institutions are thinking about their spending policies in this challenging environment, Cambridge Associates conducted a brief survey in March 2017 to explore spending policy decisions more deeply. The survey collected information pertaining to who drives spending policy recommendations at institutions, which factors are evaluated when considering changes to policy, and what types of changes are being implemented or under consideration. The analysis throughout this section includes data on the 153 colleges and universities, independent schools, cultural and environmental institutions, health care institutions/hospitals, and other nonprofit organizations that responded to this survey. The vast majority (91%) of the responding institutions were included in the earlier sections of this report.

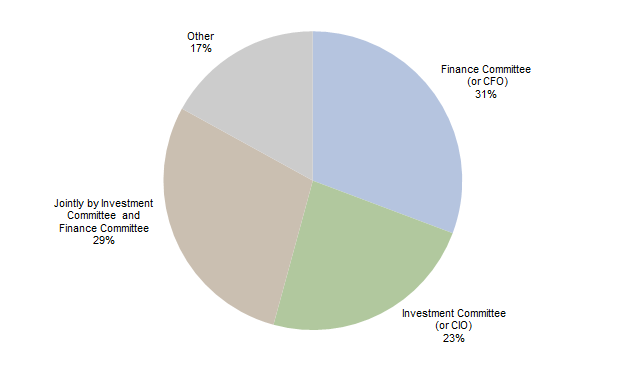

Governance. While the Board of Trustees often has ultimate authority, our mini-survey revealed that responsibility for recommending spending policy varies across institutions (Figure 12).

Source: Spending data as reported to Cambridge Associates LLC.

Note: Analysis includes 153 institutions.

Most frequently (31% of respondents) the responsibility lies with the Finance Committee or the CFO, but in nearly a quarter of the institutions the Investment Committee sets the policy. For 29% of the survey respondents, the responsibility for setting or adjusting the spending policy is shared between the Finance and Investment committees. While there is no right answer to who sets the spending policy, best practice would ensure that the decision makers have the information they need about the enterprise (finance and development) and investment portfolio to fully assess policy implications.

Spending policy, like investment policy, should reflect a long-term approach to investing and distributions. Since long-term expectations are incorporated, policies should be designed so that they do not require tweaking on an annual basis. At the same time, institutions should not be too passive in their review of the spending policy. An annual review of the policy can be a useful exercise for institutions, ensuring that the policy is still appropriate for the institution. According to our mini-survey, 56% of institutions formally review their spending policy on an annual basis.

Looking ahead over the next couple of years, a majority of respondents (63%) to our mini-survey are not implementing or considering changes to their spending policy. For those respondents that are planning to implement or are considering implementing a change to their spending policy, 8% are implementing a change in 2017, 10% are implementing a change in 2018, and 19% are considering a change in the near future but have not formally approved it (Figure 13).

Source: Spending data as reported to Cambridge Associates LLC.

Note: Analysis includes 153 institutions.

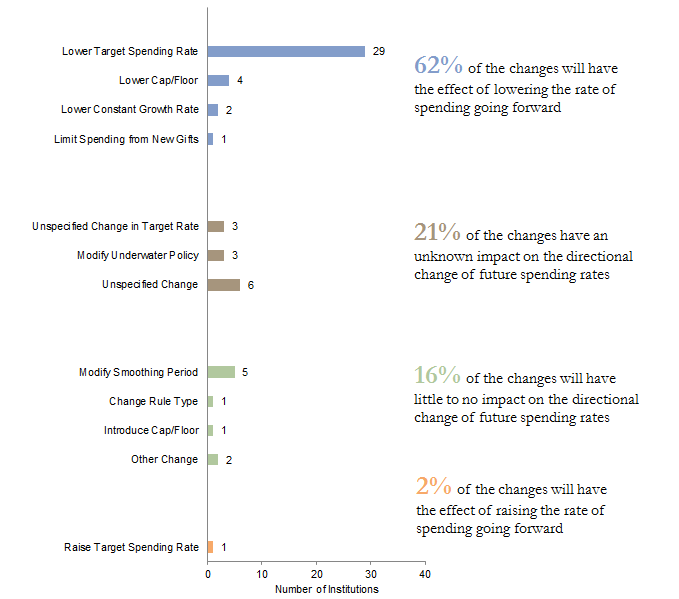

Factors that Influence Spending Policy. Given the dampened outlook for future returns, it should be no surprise that a majority of the changes awaiting implementation or under consideration are intended to lower the proportion of the portfolio that is spent in the future. As Figure 14 shows, 62% of the changes awaiting implementation or under consideration would have the effect of lowering the rate of spending going forward. This can be accomplished by lowering the target spending rate in a market value–based rule, lowering the cap and/or floor of a constant growth rule, or lowering either component in a hybrid rule. Just one institution intends to raise its spending rate in the future.

Source: Spending data as reported to Cambridge Associates LLC.

Note: There were a total of 58 changes reported across 56 institutions.

Institutions weigh a number of factors when considering changes to spending policy. As shown in Figure 15, lower return expectations are overwhelmingly the most important factor influencing future changes to spending policy; 53% of the respondents felt lower return expectations were very important and another 29% felt they were important. The expected or potential decreases to spending rates may also be explained by inflation; 52% of respondents indicated that inflation was an important factor, and 9% indicated it was a very important factor driving policy.

Source: Spending data as reported to Cambridge Associates LLC.

Inclinations to lower spending to protect endowment purchasing power may be overruled by an institution’s near-term reliance on the amount and consistency of endowment spending; 56% of respondents indicated that the need for additional support for the operating budget from the endowment is an important or very important factor in determining their spending policy, while 50% of respondents indicated that lower volatility in year-to-year distributions was an important or very important factor (Figure 15).

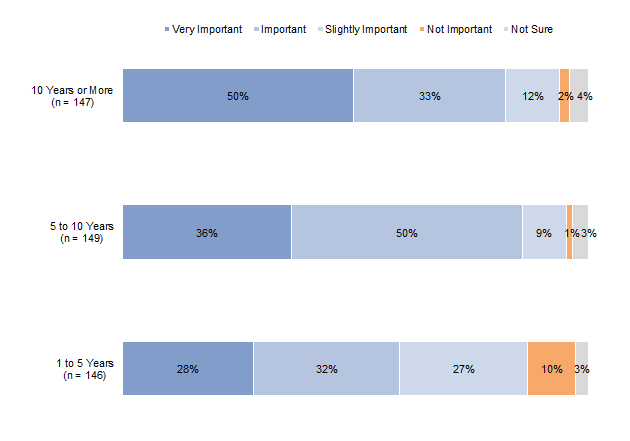

Fiduciaries have appropriately long-term perspectives when it comes to policy decisions and endowment return expectations. The vast majority of respondents reported that considering investment return expectations over long-term (ten years or more) and intermediate-term (five to ten years) time horizons were very important or important when considering spending policy changes (Figure 16). Half of the decision makers consider the long-term time horizon for return expectations as very important.

Source: Spending data as reported to Cambridge Associates LLC.

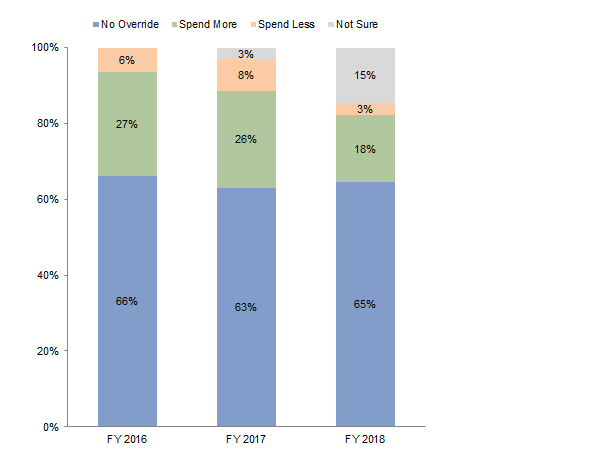

Another factor that may drive spending policy decisions is how rigidly an organization implements policy. Is an institution required to adhere to the spending distribution from its policy calculation, or do fiduciaries have the ability to override spending policy calculations to draw more or less spending from the endowment? Overrides to spending policy can provide more flexibility in the same way that a discretionary spending rate provides flexibility over a single target spending rate. Overall, 41% of respondents (62 out of 153) allow overrides to their spending policy. However, Figure 17 shows that the majority of those organizations did stick to the policy calculation in fiscal year 2016 and do not have plans to deviate from policy over the next couple of years. Of the institutions that allow overrides to their spending policy and plan to exercise that flexibility, most plan to draw additional spending to supplement their policy calculation, while only a handful plan to spend less than their policy calculation.

Source: Cambridge Associates 2017 Spending Mini-Survey.

Note: Analysis includes 62 respondents out of 153 institutions that allow overrides to their spending policy.

Since many endowments are considered permanent funds, an institution should set a spending policy for its LTIP that gives it the best chance of sustaining its role in perpetuity. As highlighted through our supplemental mini-survey results, many factors influence decision making for spending policies. Fiduciaries are challenged to implement spending policy that balances the needs of current stakeholders while preserving long-term capital for future generations. The task can best be supported by a thorough understanding of spending policy implications for the investment portfolio and the enterprise it supports.

William Prout, Investment Director

Tracy Filosa, Managing Director

Footnotes