Private equity energy fund raising is likely to hit an all-time high in 2017. In this edition of Real Asset Dynamics, we examine the trends in fund raising, commitments, and investments in energy and their implications.

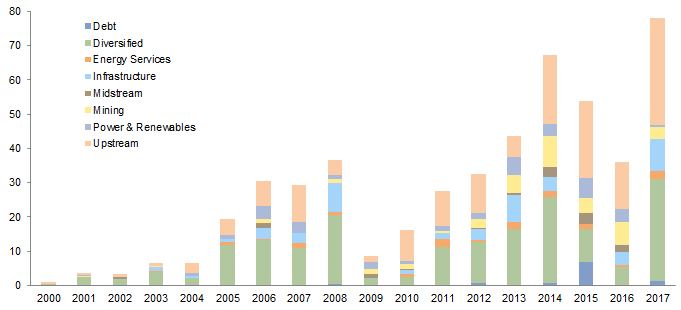

After an average year of fund raising in 2016, 2017 promises to be a banner year, with nearly $80 billion in aggregate targeted capital raises as a number of larger diversified and upstream-focused oil & gas managers return to market (Figure 1). If this materializes, 2017 could surpass 2014 as the highest-ever fund-raising year. These broad trends have been largely underpinned by meaningful increases in limited partner (LP) exposure to private oil & gas over the better part of the 2000s. Based on data from 48 college and university endowments over $1 billion that have reported their allocations annually to us for the past 15 years, the average allocation to private oil & gas went from 1.0% in 2002 to 4.7% in 2016, and the maximum allocation increased from 4.2% to 12.7%.

Source: Cambridge Associates LLC.

Notes: Data through 2016 represent sum of fund-raising targets for all funds with a given vintage year and are reported by Cambridge Associates as of March 31, 2017. Fund raising for 2017 represents a forecast for the full year based on expected or reported fund-raising targets for funds that are either open or expected to open in 2017, and is subject to change. Cambridge Associates’ data are supplemented by manager reported data and information from manager meetings as necessary.

However, despite manager optimism stemming from favorable industry trends, investors would be wise to exhibit a degree of restraint before committing to new private equity energy funds, given signs that (1) a sizable amount of unspent capital is already out there and (2) the uptake among LPs may not be as robust across the space as it has been over the past decade because of the large amount of current unfunded exposure. The implications of this dynamic are potentially significant. Investors that plow forward with new commitments in 2017 may find themselves committed to funds that end up having long fund-raising runways (and distracted managers), if demand for additional private energy exposure softens. Even if 2017’s fund-raising targets are successful, the amount of dry powder will increase substantially, which has implications for asset entry pricing, expected returns, and risk.

Reviewing the Trends

Many investment managers returning to market in 2017 have prior funds that are meaningfully less invested than they are committed. What does this mean and what’s driving this dynamic? Recall that most managers in private equity energy (particularly larger, more established ones) use an equity line of credit (ELOC) as their primary strategy. An ELOC strategy centers on managers sourcing and providing third-party management teams with a line of typically undrawn equity capital and a multi-year time horizon for the team to acquire assets and fully draw down the commitment.

When the acquisition markets are constrained and/or when there is significant competition among management teams in only a few select basins for a few select assets—as is the case today in the Permian and Delaware Basins, the SCOOP and STACK, and Eagle Ford Shale—it can be difficult for teams to actually put their committed capital to work. The result is that many teams are unable to invest their commitments in a timely manner, and the fund manager is left with a portfolio that is often much more committed than it is actually invested. Ultimately, LPs end up with higher ongoing exposure and future capital call liabilities, with less capital actually invested.

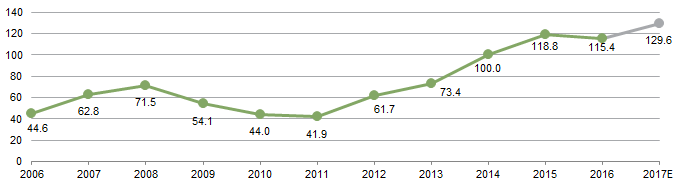

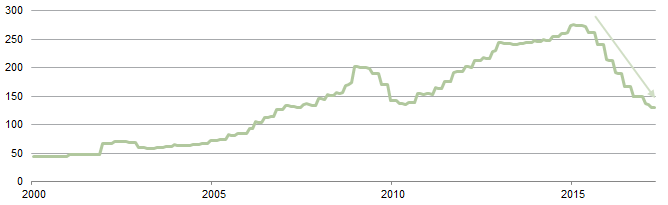

ELOC-focused funds also tend to grow in total size quickly. These managers have a faster fund-raising velocity given it is much easier and quicker to commit a fund than actually fund it, which amplifies the current dynamic. Figure 2 tracks the estimated amount of “dry powder” available in the market today, and illustrates the significant increase in dry powder into the 2014 market downturn. Fund raising and fund size growth accelerated in this period, and managers have been unable to meaningfully chip away at this capital stockpile. Contrast this with industry-wide capex, which has plunged since 2014 (Figure 3), illustrating that there simply has not been as much investment going on in the industry.

Source: Cambridge Associates LLC.

Notes: Dry powder data are cumulative for the trailing three-year period. Data for 2017 are estimated.

Figure 3. Inflation-Adjusted Capex for Global Listed Energy Companies

January 31, 2000 – April 30, 2017 • US Dollar (billions)

Source: Thomson Reuters Datastream.

Notes: Data are the aggregate amount of capital expenditures of constituents of the Datastream US Oil & Gas Index. Data are adjusted by CPI-U.

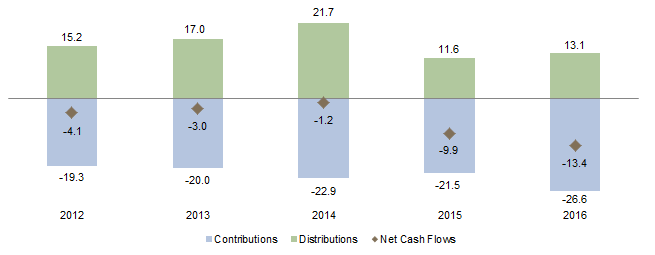

Together, these factors imply that LPs have a lot of exposure to funds they committed to several years ago, but not nearly as much actual capital invested, which likely puts meaningful distributions on these investments still another couple years away—leading to a continued likely cash outflow on commitments already in LPs’ portfolios. Net cash outflow has deepened since 2014 as capital calls were not offset by corresponding distributions (Figure 4), implying that LPs are still funding their exposure on existing positions.

Figure 4. Private Equity Aggregate Energy Cash Flows

January 1, 2012 – December 31, 2016 • US Dollar (billions)

Source: Cambridge Associates LLC.

As a result, LPs’ private equity energy portfolio exposure is likely still increasing. Several institutional LPs with which we have spoken commented that they are nearing the top end of their strategic allocation ranges for private equity energy/real assets, particularly those who aggressively committed to funds throughout the early 2010s. In addition, the trend we just discussed where managers have largely committed but not fully invested the capital from their prior funds creates challenges for investors to fully understand their true exposure. Given these trends, there may not be many real portfolio-driven catalysts to add additional exposure across a wide swath of the traditional private equity energy LP base.

Looking Ahead

The anecdotal and quantitative evidence we are seeing sets the stage for a meaningful bifurcation of outcomes with managers’ fund raises this year. Brand-name managers whose returns have consistently outperformed benchmarks will continue to hit their fund-raising targets regardless of these market dynamics. LPs are unlikely to want to give up access, viewing an ante up for the next fund as part of the price of admission no matter how much unfunded exposure they already have. However, the rest of the field—managers with modest and/or inconclusive performance on prior funds through the downturn, team turnover, succession considerations, or other manager-specific issues—could face challenges reaching some of the stated fund-raising targets. This could make prolonged fund-raising periods, certainly longer than what managers have gotten used to, more of the norm. Already, several established funds that kicked off new fund raises after 2014 have been out in the market for years in some instances without hitting their targets, and in other cases have cut target fund sizes. We would expect these types of stories to become more numerous during this cycle.

What’s the punchline from all this? While there will always be managers and fund raises, time should be on LPs’ side during this fund-raising cycle, and they should use it to their advantage to negotiate more preferential fees and terms; to manage their portfolio exposure; and to mitigate blind pool risk on new commitments.

We advise patience when making new fund commitments during this cycle, particularly to managers that manage larger, diversified funds with meaningfully unfunded legacy portfolios. When there is no access constraint, patience can mitigate one of the largest risks private equity investors face, blind pool risk, and be well worth the late-closing interest and potentially foregone first-closing fee discount.

Michael Brand, Senior Investment Director

Meagan Nichols, Managing Director