This new publication will discuss trends in real assets, with a primary focus on private strategies (agriculture, energy, infrastructure, metals & mining, property, and timber) using Cambridge Associates’ unique dataset. Each edition will bring you insights from the leaders of our real assets research on what they think about an aspect of this market today. This first edition shares our views on the amount of capital raised by private equity funds to take advantage of the oil market dislocation.

Energy Fund Raising

Many established and new market entrants in the private space are trying to capitalize on the effects of the plunge in oil prices on the energy industry. From their peak in June 2014, WTI crude prices fell 76% to a low of $26/barrel in mid-February, dragged down by continuing global oversupply, before recovering to near $50/barrel at the end of May. Natural gas prices similarly plunged, falling to $1.49/MMBtu by early March, their lowest levels in 17 years, as a strong El Niño contributed to one of the mildest winters on record.

The dramatic fall in oil reverberated across the commodity complex in 2015, with all energy-related strategies ending the year in the red, though private strategies were less impaired than public strategies. The Cambridge Associates private energy benchmark, which includes both private equity energy and upstream energy and royalty funds, was down 20.5% for the year, outperforming mPME returns for commodity futures (as measured by the mPME S&P GSCI™) by over 1,300 bps and mPME returns for global natural resources equities (as measured by the mPME Datastream World Oil & Gas Index) by over 60 bps.[1]Cambridge Associates’ modified public market equivalent (mPME) methodology replicates private investment performance under public market conditions and allows for an appropriate comparison of … Continue reading During this period, private managers were realistic in their markdowns, and we believe their year-end valuations generally reflect true value.

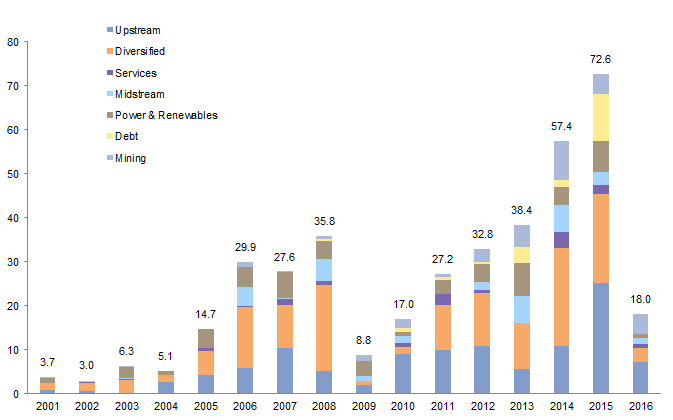

This volatility in energy prices led to robust capital raising in 2015. Private equity natural resources managers announced an unprecedented $72.6 billion in fund-raising targets, an increase of 29% over the prior 2014 fund-raising peak of $57.4 billion (Figure 1). Established and developing energy managers accounted for $51.5 billion, or 71%, of the total while new managers jumped into the fray with plans to raise $21.0 billion, or 29% of the total.[2]Data are preliminary and may revise as funds close. New managers are defined as raising their first or second fund, developing is the third or fourth fund, and established is the fifth fund and … Continue reading On top of all this, generalist private equity firms raising capital in 2015 are expected to allocate an indeterminate portion of their funds to energy deals. Anecdotally, managers intended to deploy the majority of capital raised for upstream exploration & production investments, but also to use a significant portion for investment in oilfield services companies, which they expected to experience the greatest distress on the heels of the oil price decline.

Source: Cambridge Associates LLC

Notes: Fund capitalization calculated according to vintage year inception. Data are preliminary for 2014, 2015, and 2016 and may vary as funds close. Funds launched in 2014 and 2015 may still be fund raising in 2016. 2016 represents funds currently known to be fund raising in the calendar year.

See the first quarter 2015 edition of VantagePoint, a quarterly publication from Cambridge Associates’ Chief Investment Strategist, published January 20, 2015.

In early 2015, a number of high-profile firms launched funds to invest in distressed energy credits—dedicated energy distressed strategies represented 16% of total funds raised in 2015. These funds’ strategies ranged from buying liquid corporate energy credits trading at distressed levels to providing new debt to pay down bank debt, putting the funds in position to lead a potential debt restructuring in the future. We were skeptical about running headlong into energy credit investments and in early January 2015 advised investors interested in pursuing the energy dislocation to favor more traditional private equity energy opportunities. Those funds that began investing capital in the first half of 2015 suffered mark to market losses as the “double dip” in crude prices began mid-year. Few new energy credit funds were launched in the second half of 2015. Many of the funds appear to have been disciplined in deploying capital in anticipation of better opportunities in 2016, but they will have to contend with considerable dry powder for energy investments within the universe of generalist distressed funds.

As we look at our forward calendar of private equity funds raising capital now and on the horizon, we expect new capital formation for energy will be far lower in 2016 relative to 2015, and in fact relative to the last five years. This, coupled with managers not being in a rush to invest or raise additional capital as deal flow is still materializing, has us asking, was it too much?

Was It Too Much?

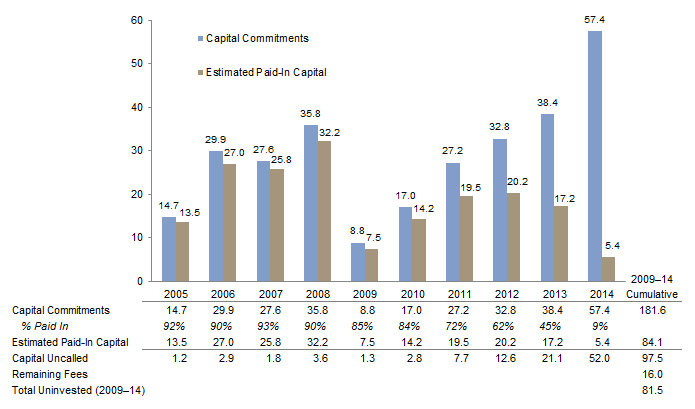

At first glance, global private equity energy managers are awash in dry powder. As seen in Figure 2, of the approximately $181.6 billion raised from 2009 to 2014, managers are still sitting on $81.5 billion, or 45% of the total. However, this figure likely overestimates total uncalled capital as private equity energy managers often stage-in equity. Based on our conversations with managers and historical investment patterns, it is reasonable to believe that most of the dry powder from vintages 2009 to 2012 is fully committed, albeit not fully invested, along with a good portion of vintage year 2013, making the amount of dry powder something less than $70 billion. US funds make up the majority of funds in the universe and therefore capital is likely earmarked for US deals—but deal flow is global. Outside of the United States, competition is limited, particularly for mid-market deals. Generalists have retrenched, and strategics are slowing their activities.

Source: Cambridge Associates LLC.

Notes: Estimated paid-in capital is based on the percentage paid in by funds tracked by Cambridge Associates LLC in each vintage year. The remaining fees are calculated assuming a ten-year life span with a 1.5% management fee decreasing linearly over the life of a fund, and no re-investment of capital.

While a lot of private equity energy capital has been raised in recent years, amounts are reasonable compared to the investment opportunity set. Capital spending by US energy companies is down but still significant, as their free cash flow and debt availability cannot meet their spending needs. For instance, 2016 capex estimates for the US upstream industry alone range from $31 billion to $88 billion. In 2015, global M&A activity in oil & gas was $380 billion, according to EY, a drop from 2014. In the upstream sector (excluding the Royal Dutch Shell-BG Group transaction) total value was $71 billion, a drop of over half from 2014. Oilfield services transaction value dropped significantly as well, while midstream stayed at a relatively high value and downstream M&A value was slightly up. Overall, deal volume in oil & gas has been trending down since 2011. If 2016 is a repeat of this weaker energy M&A environment, then private equity firms should still be able to put capital to work. Bid-ask spreads remained wide to start 2016, however, making it imperative to invest with disciplined managers with deep knowledge of the market, that are not in a rush to deploy capital, and that are not too distracted with problem companies from prior funds.

Overall, while still early days, we continue to feel positive about our early 2015 advice to focus on private equity energy investments, which outperformed in 2015 relative to public comparables, and stand to have the most flexibility to invest in distressed opportunities as the price of oil continues to be volatile.

Marc Cardillo, Managing Director

Meagan Nichols, Managing Director

Robert Lang, Managing Director

Footnotes