A number of Asian private equity real estate managers that we view favorably are likely to fundraise in the latter half of 2017 and first half of 2018. We expect that many of these managers, while performing well, will face challenges raising additional capital as limited partners question the merits of investing in Asian property. In particular, US investors perceive the market to be overheated and have concerns about foreign currency risks. In this edition of Real Asset Dynamics, we examine and analyze these concerns further.

Investors, particularly those in the United States, are generally cautious about Asian property investments today. Concerns including the region’s growth prospects, currency volatility, and poor past performance are leading investors to question the merits of such investments. Although these macro concerns are valid, they are not insurmountable, as we will discuss. Investing in Asian real estate is very much a bottom-up exercise. Select high-quality opportunistic managers have proven themselves capable of consistently generating good returns irrespective of the market cycle by taking advantage of bottom-up, idiosyncratic opportunities. Many of these managers will be returning to the market in the months ahead to raise capital. Investors may want to reconsider including Asian real estate in their portfolios with a commitment to one or more of these managers.

Growth Prospects. Despite a general slowdown in the region’s post-2008 economic growth, we believe the long-term growth trajectory in Asia remains intact. Urbanization, positive socio-demographic factors, and growing inter-Asian trade are the three key structural economic drivers underpinning Asian regional economic growth. The Asian region is expected to grow by 4.5% per year for the next decade, according to IHS Markit, significantly higher than the rate of economic growth in the European Union or the United States. The Brookings Institution predicts that by 2030, Asia will account for 65% of the world’s middle class—the current share is 46%—and 57% of global middle class consumer spending. Growth in the middle class and in consumerism should benefit commercial, residential, and logistic property assets in Asia.

Currency Volatility. Investors’ memory of significant losses in Asian real estate in 2008–09 has created a perception that currency volatility is high in Asia. However, Asian currencies have not been more volatile versus the US dollar than other currencies over the past 20 years; emerging Asian currencies in particular have been significantly less volatile than other emerging markets (Figure 1).

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: For developed markets, currency volatility is calculated as the annualized standard deviation of monthly exchange rates. For emerging markets, volatility is calculated as the annualized standard deviation of the monthly local currency return divided by the USD equity returns for MSCI emerging markets indexes.

As investor interest ramped up in the mid-2000s, some investment bank–sponsored real estate managers used financial engineering to attempt to generate outsized returns. These managers acquired real estate assets in Asia with 70%–90% leverage, often in USD-denominated offshore loans because local currency loans were so expensive that they were not accretive to returns. Meanwhile, rents were paid in local currencies that were left unhedged. This mismanagement of leverage and currency exposure was a key underlying reason for the 2008–09 losses, not currency volatility.

Investors should not ignore the foreign currency exposure from making an investment in Asian property, but they should not overemphasize it either. Asian real estate managers generally borrow at a more moderate level of 50%–65% loan to value in local currency, which acts as a natural hedge against currency movements because both rent and interest payable on these loans are in the same currency. Investors may want to deduct some amount, such as 100 to 200 basis points (bps), from any fund’s target net USD returns to account for currency volatility.

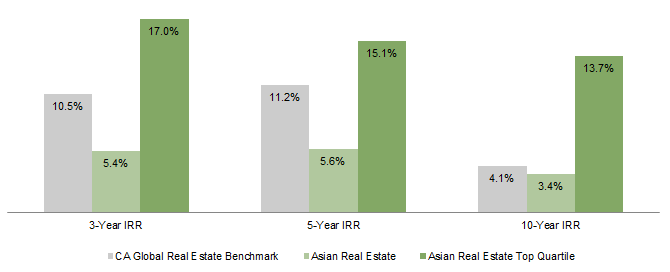

Past Performance. Due to overleverage and poor underwriting standards by large, investment bank–sponsored real estate funds in the 2000s, among other factors, the pooled performance of Asian real estate funds in the Cambridge Associates Global Real Estate Index has lagged the overall benchmark by 72 bps on a horizon net to LP internal rate of return (IRR) over the ten-year period ending March 31, 2017. Over the most recent three- and five-year periods, the pooled performance of Asian real estate funds has underperformed the overall benchmark by 507 bps and 560 bps, respectively (Figure 2).

Figure 2. Performance of Asian Real Estate vs Global Real Estate

As of March 31, 2017 • Internal Rate of Return (%)

Source: Cambridge Associates LLC.

Notes: Returns for the CA Global Real Estate Index are a horizon calculation based on data compiled from 942 real estate funds, including fully liquidated partnerships, formed between 1986 and 2016. Asian real estate returns represent 99 real estate funds focused on the Asia-Pacific region in the global benchmark. Pooled horizon returns are net of fees, expenses, and carried interest.

However, this does not mean there are no attractive investments in Asian real estate. Funds in the top performance quartile have significantly outperformed, with top quartile funds returning around 1,000 bps more than Asian real estate funds on a pooled basis over the three-, five-, and ten-year periods to March 31, 2017 (Figure 2). Top quartile Asian real estate funds have also beaten the global benchmark over all three time horizons, and by nearly 1,000 bps on a pooled basis over the ten-year period. The wide dispersion of manager quality underscores the importance of manager selection in Asia compared to other regions.

Manager Selection. We look for three key value drivers in evaluating managers in this space. First, a focus on identifying bottom-up, idiosyncratic investment opportunities, those that are less dependent on the traditional growth drivers and where entry valuations are generally more attractive. Second, discipline in capital deployment and exits. Third, judicious employment of leverage, at around 50%–65% loan to value, and the decision to borrow in local currencies to minimize losses from currency volatility.

We believe there is a good probability that select managers can repeat their past performance despite concerns that the market is overheated. Although more capital is chasing real estate investment opportunities today relative to the recent past, investors should take some comfort that Asia has received far less capital (10%) relative to its investable universe (35%) in the last five years compared to other regions (Figure 3). Attractive investment opportunities in Asia are therefore likely to be more numerous relative to other regions, which suggests real estate managers that can find attractive bottom-up investment opportunities could outperform their peers.

Figure 3. Real Estate Capital Flows by Region

As of December 31, 2016 • US Dollar (billion) • Percent (%)

Sources: JLL and LaSalle Investment Management.

Notes: Estimated investable universe is defined as the market cap of all public REITs and REOCs, private institutional real estate assets, and other institutional-grade real estate assets held by private managers or companies. Estimated investable universe data are as of September 30, 2016.

In summary, attractive investment opportunities in Asian real estate do exist today. Investors should look for Asian opportunistic real estate managers whose strategies have been proven to generate good returns irrespective of the market cycle and consider selectively committing capital to these funds.

Johnny Adji, Senior Investment Director