In this Edition

- New rules could benefit asset-backed securities investments

- “Brexit” has potential to create additional oversight challenges and requirements

- Burgeoning financial technology industry creates opportunity, need for oversight

- Don’t forget! Money market reform is drawing near

Asset-Backed Securities

Know When to Hold Them?

Please see Myles Gilbert, “How Is the Structured Credit Market Changing?,” CA Answers, July 12, 2016.

Though the regulatory landscape for structured credit has changed materially over the past eight years, many initiatives have yet to come into effect and regulators globally are still tinkering with their approach to these assets. These developments will continue to have an impact on pricing and return prospects for structured credit. Structured credit investments include collateralized loan obligations (CLOs), residential mortgage–backed securities (RMBS), commercial mortgage–backed securities (CMBS), and asset-backed securities (ABS). While grounded in different types of credit, all of these investments pool individual debts into a series of instruments with differing cash flow (and risk) characteristics. These more complex securities were at the epicenter of the global financial crisis and have been under regulators’ microscopes since.

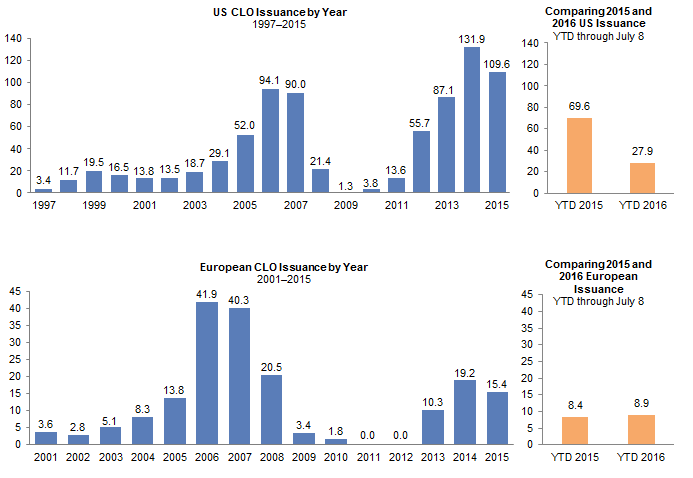

As part of the Dodd-Frank Act, banks and other structured-product managers are required to have “skin in the game” after creating a securitized structure. Dodd-Frank’s risk retention rules require that firms hold 5% of the equity tranche, or 5% of each layer of a securitization’s capital structure. The risk retention rules, which become effective at the end of 2016, pose a significant hurdle for many managers in that they will now need to source capital to support risk retention rule–driven holdings. US CLO issuance has slowed dramatically this year, as the market prepares for risk retention rules to come into effect (Figure 1). This slowdown reflects the complexity of developing a solution for capital-constrained managers. To date, manager solutions to risk retention requirements have focused on establishing majority-owned affiliates that both comply with the rules and provide a means to access needed outside capital. However, managers can choose from several structural options for garnering outside capital and each involves organizational costs, an increased degree of complexity, and regulatory approvals. Meanwhile, the European Parliament is revisiting its risk retention rules, which included what many hope is an outlier proposal that would increase the level of retention to up to 20% of a capital structure, in seeming contravention to the EU’s continued insistence that it is interested in promoting securitizations.

Sources: J.P. Morgan Securities, Inc. and Standard & Poor’s LCD.

Note: European CLO issuance for YTD 2015 and 2016 converted from values of €7.56 billion and €8.08 billion, respectively. Euros are converted using July 8 exchange rates from 2015 and 2016, respectively.

While risk retention rules will apply to new structures, banks also face US regulatory requirements to divest pre-existing holdings of “non-compliant”[1]“Non-compliant” CLOs are structures that include bonds in addition to loans in their underlying portfolios. CLOs, now by July 2017. The US Federal Reserve only recently announced a one-year extension of its previous July 21, 2016, compliance deadline for banks with non-compliant holdings. Though new CLOs issued since the 2014 finalization of Volcker Rule regulations have largely been “Volcker compliant,” there have been many questions about when (or whether) regulatory-driven divestitures would have an impact on the market. According to the Loan Syndications and Trading Association, banks held $100 billion in CLOs pre–Volcker Rule, and federal regulators estimated the banks could lose more than $3 billion on forced sales of the assets. The Fed’s extension may allow banks to largely avoid forced sales of CLOs from their portfolios as many older, non-compliant CLOs are expected to have run off by 2017. And in other instances, large banks have successfully encouraged CLO managers to restructure existing portfolios to become Volcker compliant. This has reduced the possibility of regulatory fire sales that might have created opportunities for less constrained investors.

Some other positive news for securitized assets is a recent relaxation of Basel III capital requirements. The Basel Committee on Banking Supervision, a group of global banking standards regulators, recently announced a change in the proposed capital treatment of some securitizations. Making distinctions between higher-quality and lower-quality underlying assets and between senior and junior tranches, the Committee proposed reducing the minimum level of required capital for higher-quality senior tranche securitizations meeting the regulator’s “simple, transparent, and comparable” standards to 10% from 15%. While the Committee characterized this shift as “modest,” it is not insignificant and some commentators have noted that this reflects regulators’ continued desire to encourage lending.

Taken together, many regulatory trends stand to have an impact on securitized assets and managers. In some instances, deadline extensions and regulatory refinements should improve market dynamics. Other ongoing initiatives could reduce competition in the market and increase costs. These dynamics should benefit experienced and well-resourced managers.

Brexit + Asset Management

Prepare for More Paperwork!

Britain’s vote to leave the European Union in June set the stage for numerous regulatory changes. Clearly, the asset management industry, which is already highly regulated, will be impacted by Britain’s exit from the union. Today there are more questions than answers to issues affecting asset managers given “Brexit.” However, investors should expect that in anticipation of Brexit, managers may need to make structural changes either within their organization or with respect to the funds they offer. At a minimum, these changes will likely require additional operational or legal due diligence and documentation for investors.

Today asset managers use passporting, an approach designed to allow investment managers to provide services across the EU—if a manager is regulated in its EU home country, it can offer services in other parts of the EU without the need for individual country registration. Unless the United Kingdom and EU reach an agreement to extend this arrangement after separation, UK managers will have to look to new approaches. One workaround might be to establish an EU affiliate, regulated under local law, to provide services to EU-based clients and funds. In the same vein, rest-of-world managers that established UK subsidiaries to gain passport access across the EU may be facing the cost and complexity of establishing a second EU-based affiliate. UK-based funds face similar challenges, as they would no longer get equivalent treatment in the remaining EU countries. As a result, some commentators expect that established EU fund centers Dublin, Luxembourg, and Malta will benefit as UK funds are re-domiciled or cloned to maintain EU access.

In some instances, EU law provides more flexibility to asset managers from outside the EU that are authorized by home states with “equivalent” regulatory regimes. It is at least possible that UK managers would be able to take advantage of this structure post-Brexit. In the near term, EU Directives are law in the United Kingdom and, barring action taken by the UK government, they will remain so. As the United Kingdom moves further toward the official EU exit, regulatory structures could diverge. Some jurisdictions have chosen to develop a two-track system for most asset managers: one that would meet stricter EU equivalence standards and a “lighter” structure for managers focused on domestic or non-EU markets.

Regardless of the path the United Kingdom and EU take toward separation, it seems likely that management firms will need to engage in some form of restructuring and possibly revise current documentation to reflect new and pending regulatory realities. These will eventually have a trickle-down effect, likely requiring additional due diligence and documentation requirements for investors.

Fintech: Darling or Demon?

Who says that regulation stifles innovation? One bright spot in the never-ending march of financial regulation is that it has seemingly spurred a wave of investment in technology-driven solutions. From electronic trading platforms to non-bank peer-to-peer lenders, to the growing buzz around the possibilities posed by blockchain, so-called fintech has seen a lot of investment in recent years. In fact, venture capital investment in business/financial services has more than doubled over the last two calendar years and by some estimates, more than $1 billion will be invested in blockchain this year.

See our November 2015 Quarterly Regulatory Update for more on this topic.

Regulatory hurdles and additional capital costs associated with bank-affiliated dealers holding bond inventories have had a well-documented impact on market liquidity. In response, a number of firms have established electronic trading platforms for bonds, hoping to take market share from these traditional players. This trend has seemingly accelerated over the last several years. According to Jonathan S. Sokobin, FINRA’s chief economist and senior vice president, seven of the 19 active electronic bond trading platforms entered the market in the last two years, with another four platforms in the wings. At the same time, electronic equity platforms continue to evolve, with recent entrants including asset owners developing new platforms intended to exclude high frequency traders, especially given multiple legal settlements between regulators and operators of so-called dark pools (off-exchange trading platforms).

For more on this topic, please see our May 2015 Quarterly Regulatory Update.

Regulators have also been focused on expanding the availability of credit in lending markets. European authorities in particular have been promoting alternative fund structures to encourage increased lending to corporates by non-banks. Within the United States, peer-to-peer lending platforms have grown significantly[2]According to a report on marketplace lending by the California Department of Business Oversight, the dollar value of industry transactions grew by nearly 700% between 2010 and 2014. and have begun to attract regulators’ scrutiny. Some regulators have focused on lender relationships with customers, fair lending practices, and applicability of state licensing and usury laws. Others, including the US Treasury, Office of the Comptroller of the Currency, and Financial Stability Oversight Council appear to be focused on potential systemic risks posed by the growing marketplace lending business and are also trying to determine a way to develop standards for new technologies. Ultimately, commentators expect that regulators will exercise more oversight of this corner of the lending market, and the open question is how much this will affect the business model long term.

Blockchain: No Longer Just for Bitcoin

Fintech aficionados appear to have high hopes for the future of blockchain technology. Blockchain is a system intended to offer an immutable record of transactions through a decentralized, distributed ledger. It is the focus of many initiatives that could represent a sea change for market participants by, among other things, reducing clearing times and driving down transaction and compliance costs. Enthusiasts point out that this technology could allow for self-executing “smart contracts” between parties. For example, once certain contractual conditions are met, a party might automatically receive a transfer of margin. This could eliminate the need for third-party intermediary and operational functions like post-trade reconciliation. Banks have already begun to test the technology and establish alliances with other banks and tech firms to develop the technology. By some estimates, blockchain technology could provide up to $20 billion in annual savings from efficiencies related to trade reconciliation alone. With all the enthusiasm, regulators have this on their radar screen as well since this approach could reduce systemic risks through less reliance on a single market participant and improve transaction security.

Money Market Fund Reform

There’s Still Time to Choose, But Not Much

See our August 2015 Quarterly Regulatory Update for more detailed information about these and other money fund changes.

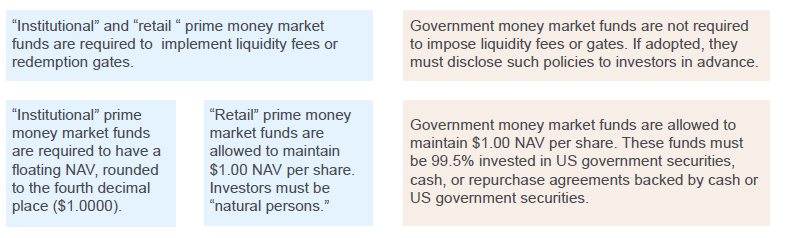

Money market funds will need to comply with new SEC rules as of October 14, 2016. For retail investors, money funds will continue to maintain a $1.00 net asset value (NAV). Institutional investors face a split: prime funds will move to floating NAV while government funds will maintain $1.00 NAV (Figure 2). Despite more than a year’s advance notice on this, managers have yet to see investors making wholesale changes in the money market fund marketplace.

Sources: T. Rowe Price and United States Securites and Exchange Commission.

Some managers have begun to offer very short duration floating NAV products as a complement to government-only institutional money market funds. But to date, they have not seen much investor interest in those funds. And that lack of interest seems to have extended to choosing a new $1.00 NAV fund. Investors may find themselves without many options if they wait until the last minute to make a change. In the past, fund complexes have closed money market funds to investors, leading to a scramble. We recommend that investors review their allocations and options sooner rather than later. Now, where’s that summer intern?

Footnotes