Calendar year 2013 was an active year for financial regulatory developments as US regulators continued to work through the rulemaking requirements imposed on them by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank). European regulators were also active, addressing many systemic issues during calendar year 2013. The year 2014 is setting up to be a transition period as the regulatory rules of the road are becoming clearer for many market participants.

There is no good news in the world of money market funds (or cash management more broadly). Yields remained low to nonexistent during the year, both US and European regulators proposed reforms that could prove to further hurt economics and flexibility. In the United States, unlimited federal insurance for bank accounts, put into place during the 2008 credit crisis, lapsed. This left investors with few rock-solid choices when they stared down the barrel of a potential US government default in the latter part of 2013. Adding to the misery for short-term asset investors was the prospect of a “financial transaction tax” in 11 European countries. As originally proposed, a minimum of a 10 bp tax would apply to each step (buy and sell) of a stock or bond transaction. For cash, repos, and securities lending, which have relatively high levels of turnover due to the short-term nature of such activities, the tax could take a significant bite out of returns.

Hedge funds continue to adapt their internal operations and compliance regimes to the evolving environment. Most hedge funds of institutional size are now registered with the SEC and have picked up substantial compliance burdens as a result. In addition, for firms that are active in the derivatives markets, 2013 was a year of transition as a significant number of changes in the OTC derivatives markets, required under Dodd-Frank, came into effect.

In the United States, most hedge funds, private equity firms, and managers of unregistered liquidity pools are now required to report portfolio level and business information to the SEC on Form PF, which is not a publicly available filing. During mid-2013, SEC staff released its first report using summary data from this private filing. While not all of the data are in a form that institutional investors are accustomed to, the report provides an interesting look at the depth and breadth of the private funds market as defined by the SEC.

After issuing hundreds of pages of text, reviewing thousands of comment letters, and with five different regulatory agencies approving the regulations simultaneously, legislators released the final regulations for the Volcker Rule in late 2013. Generally, the Volcker Rule bans certain types of proprietary trading by banks, and limits their participation in and holdings of private funds. The rules are expected to go into effect in the first half of 2014 while market participants have until mid-2015 to comply.

Financial firms continue to divest private investment assets and spin off businesses in response to pending regulatory requirements. This along with some other post-crisis divestitures has provided fodder to the well-funded private equity secondary business. The same pressures have also fueled a number of ownership transfers in asset management businesses.

Looking forward for 2014, there are a number of regulatory-based themes to keep an eye on.

- Money Market Fund Reform. Reform of money market funds continues to be a topic in the US funds industry and in Europe. Regulators in both markets have proposed different ways to address the systemic risks associated with these short-term funds. Investors should consider how the proposals could affect the liquidity and return profile of their investments.

- OTC Derivatives Regulation. OTC Derivatives regulation continues to be rolled out in the United States. To date, most of the changes have been implemented by the Commodity Futures Trading Commission (CFTC), leaving swaps in single name securities (province of the SEC) out of the mix. In late 2013, regulations establishing swap execution facilities (SEFs) were established. As we moved into 2014, regulators began to authorize trading of specific contracts on the SEFs. The first required trades are expected by first quarter 2014.

- European Regulation. As earlier mentioned, European regulators have been busy too. A raft of provisions under the European Market Infrastructure Regulations (EMIR), the EU’s answer to OTC derivatives regulation, are set to go into effect in early 2014. European Union (EU) regulators kicked off 2014 with their own version of the Volcker Rule, floating a rule prohibiting banks from proprietary trading. A money market fund reform proposal is still outstanding. And regulators are still talking about the possibility of a Tobin or financial transactions tax.

- Volcker Rule. While much of the rule appears to be finalized, market participants have not adjusted to all of the provisions. Although there will likely be other impacts over time, watch for continued asset sales by banks and further restructurings/spin-outs by private investment groups at these firms. This has also led to some interest in private equity–style asset management seeding funds, though the fund-raising environment for start-up hedge funds has been a positive one. In addition, the Volcker Rule’s prohibition of most proprietary trading seems to have contributed to a pronounced reduction in dealer inventories of credit instruments.

- Foreign Account Tax Compliance Act (FATCA). What happened to FATCA, the US tax regime aimed at capturing taxes due from US citizens on assets held in offshore accounts? It was delayed, again, until mid-2014. Industry participants warn that it really may be coming this time. With the first set of deadlines for financial institutions pending during April, investors could soon see changes in the documentary requirements for new investments.

The remainder of this quarterly update addresses these issues in more detail and also shares some of the data from the SEC’s report on Form PF.

Money Market Fund Reform

During 2013, the SEC and EU authorities both proposed changes to the way that money market funds are implemented. Confounding industry expectations, the proposals did not mirror each other.

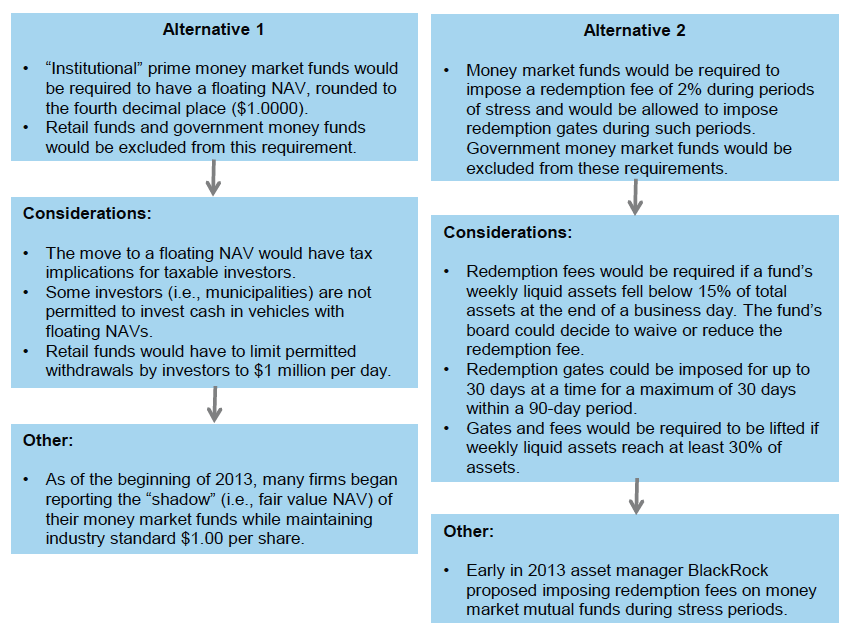

The SEC proposal includes two alternative approaches. Both approaches include elements of proposals floated by asset management industry participants. It is possible that elements of both proposals will find their way into the final regulations. The proposal also includes new diversification, stress testing, and other requirements (Figure 1).

The EU proposal, issued in the second half of 2013, addresses some portfolio-level liquidity requirements, but also requires that constant NAV money market funds establish a 3% capital buffer to act as a stabilization reserve during market stress environments. The EU proposal is expected to be an area of focus during 2014.

Continued Migration of the OTC Derivatives Market

In the United States, regulators continued to phase in reporting and trading changes to the OTC derivatives market. During the year, trade reporting requirements for financial and non-financial counterparties were phased in for credit, commodity, foreign exchange, and interest rate swaps under the watchful eye of the CFTC. The SEC has not finalized rules related to single name swaps, which are under that agency’s jurisdiction.

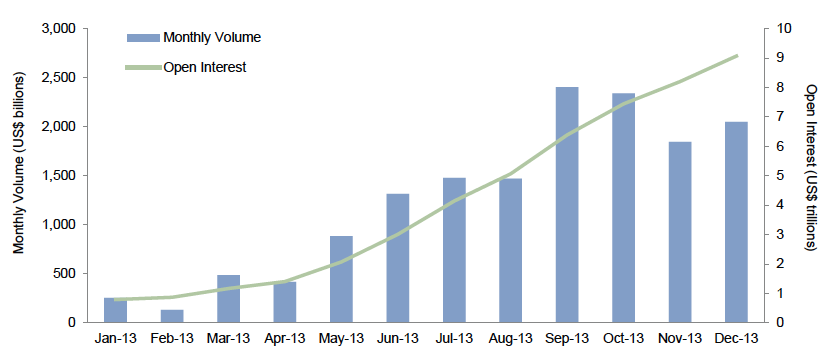

Dodd-Frank sought to create greater transparency and reduce systemic risk in the OTC derivatives market. Part of the new regulatory regime requires that designated swaps be subject to clearing by a central counterparty and 2013 was a transitional year for this requirement (Figure 2). Swaps market transactions are also required to be reported to a centralized data repository—hence the need for swaps market participants to get individual legal identifiers to aid in tracking swaps activity.

Source: CME Group.

Legislation also proposed a new class of registered entity—SEFs—that market participants will be required to use in the execution of designated swaps transactions. SEFs are in essence electronic trading platforms linking multiple buyers and sellers. Many such platforms exist but had not been subject to registration with the CFTC.

Going forward, swaps will become subject to mandatory swaps execution on SEFs under the following process: (1) the CFTC makes the swap subject to mandatory clearing; and (2) a trading platform makes the same swap available to trade. To date, the CFTC has made some interest rate swaps and index credit default swaps subject to mandatory clearing. And several classes of swaps are expected to be made available to trade on SEFs starting in early 2014. All of this has required action on the part of swaps markets participants. SEFs were required to create new “onboarding” documents and market participants will need to adjust their own operational and compliance procedures to meet the new requirements for working with these registered entities. Under the new SEF requirements, market participants that had not executed the new user agreements would not be permitted to trade on the platforms.

As these reforms continue, active participants in the swaps market may find they need to post more collateral to support trades than in the past. However, central counterparties continue to innovate, and there have already been developments in enabling market participants to “optimize” their use of margin. Another related development has been the creation of futures contracts deliverable into swaps. These products are fairly limited in scope so far but are intended, in part, to realize significant efficiencies in margin costs.

During 2014, US regulators may finalize margin requirements for off-exchange OTC trades. If they operate as expected, the rules will increase the cost of off-exchange trades relative to that of centrally cleared trades, acting as an incentive to move trades to cleared equivalents. European regulators are following a similar approach. In the EU, regulators have proposed initial margin requirements on non-centrally cleared swaps ranging from 1% (short-dated interest rate swaps) to 15% (equity-based or inflation swaps).

In Europe, European Market Infrastructure Regime (EMIR) transaction reporting requirements for derivatives are scheduled to take effect in early 2014. Other changes in the derivatives trading market, including the establishment of central clearing, are expected in the latter part of the year. Unfortunately for market participants that transact in both the United States and Europe, EMIR’s requirements are not harmonized with US standards, raising the cost and infrastructure requirements of operating in multiple markets. Further changes in derivatives market regulation, whether through EMIR or Markets in Financial Instruments Directive (MiFID II) are foreseeable in 2014.

Volcker Rule

Part of Dodd-Frank, the Volcker Rule bans certain types of proprietary trading by banks and limits banks’ investment in private funds. While US regulators issued draft regulations in late 2011 and early 2012, the multiple agencies involved in the rulemaking were slow to finalize implementing rules, not approving them until December 2013. The final regulations become effective in early 2014 and banks have until mid-2015 to come into compliance.

Several issues that were of particular concern to banks outside the United States have been clarified in the new regulations. For example, US regulators excluded UCITs from their list of private funds subject to ownership restrictions. In addition, foreign banks’ trading activities in their home country sovereign debt were excluded from the definition of proprietary trading.

Now that there is a formal implementation framework and timeline for the Volcker Rule, some market participants expect a pick-up in transactions by banks seeking to move into compliance. For example, under the Volcker Rule, financial firms will be subject to limitations on their ownership or investment in private equity funds. Though Volcker Rule implementing regulations had not yet been finalized in early 2013, industry commentators expected that sales of private equity stakes by financial institutions would pick up. By year end, financial institutions were estimated to have made up more than 25% by volume of 2013 transactions. According to Cogent Partners, transaction activity by financial institutions may pick up in 2014 now that the (Volker) rules of the road are clear. These would include sales of private equity interests in the secondary markets.

In many instances proprietary trading teams have already spun out of banks or moved to other less constrained firms. At the same time, some non-bank firms have raised private equity–style seeding funds, hoping to provide start-up capital to newly launched hedge funds and thus filling a void left by banks. Given the fairly positive environment for start-up hedge funds thus far, this may not be the robust, regulatory-driven opportunity set that one might have anticipated.

According to Bloomberg, whether in response to Volcker Rule restrictions on proprietary trading or for other reasons (e.g., bank capital requirements), anemic dealer inventories continue to be a feature of the credit markets.[1]Bloomberg, Machines Trading $400 Billion of Bonds as Humans Retreat, October 15, 2013. This has clear implications for liquidity and with many investors exposed to the still-booming credit space, this trend bears watching (Figure 3).

Figure 3. Primary Dealer Inventory and Corporate Debt Outstanding

October 31, 2004 – January 31, 2014 • US$ Billions

Sources: Federal Reserve and MarketAxess.

Note: Corporate debt outstanding data begin October 1, 2004.

During 2013, some industry commentators pointed to sagging bond inventories as a trend favoring the further development of electronic trading platforms for bonds. Given the large number of tradeable bonds and their relatively low turnover, electronic platforms for bonds have not gotten the same traction as for cash equities or futures. However, larger players in the space reported considerable growth during 2013. And some estimate that electronic trading could make up 20% to 30% of volume in corporate credit by 2015.

Regulators acted quickly to resolve community banks (CDOs) concerns about the treatment of TruPS-backed collateralized debt obligations[2]TruPS CDOs are asset-backed securities backed by Trust Preferred Securities, a hybrid debt/equity security. under the finalized Volcker Rule by grandfathering qualifying holdings. What has not been addressed is holdings of certain collateralized loan obligations (CLOs) by banks. Under the rule, banks are not permitted to hold CLOs that include both leveraged loans and debt. US bank holdings of CLOs are estimated to be $70 billion and by some estimates US and foreign banks hold close to two-thirds of all CLOs rated AAA. To date, regulators have not taken action to grandfather CLOs being held by banks, or otherwise give relief on the issue. Will this be an opportunity for less constrained investors? Not yet. Banks have a number of ways to resolve this issue, whether by encouraging CLO managers to bring holdings into compliance with the Volcker Rule or through action by regulators. To date, industry participants have not seen changes in secondary market pricing of CLOs, though new issuance is muted relative to last year’s levels.

FATCA—Coming Soon?

The Foreign Account Tax Compliance Act (FATCA) was part of legislation enacted in 2010 that is coming into effect beginning in 2014. FATCA’s objective is to significantly increase reporting of the estimated $100 billion in US taxpayer assets thought to be held in offshore accounts—the law is focused on compliance, not revenue generation.

FATCA establishes a punitive 30% withholding tax against foreign financial institutions (FFIs) that do not meet its disclosure requirements as a way to encourage increased disclosure of offshore-based US taxpayer accounts.

During 2013, the US Internal Revenue Service (IRS) announced delays in the implementation schedule for FATCA. These generally pushed back reporting obligations under FATCA by six months to mid-2014. Under the revised deadlines, FATCA withholding is scheduled to begin on July 1, 2014.

Similarly, financial institutions will have until July 1, 2014, to establish new, FATCA-compliant account opening procedures. Finally, the IRS pushed back the dates for the first account reporting required under FATCA. No reporting will be required for calendar year 2013. Instead this requirement will begin for calendar year 2014, and be due in 2015.

The United States is not seeking information about US tax-exempts’ investments in offshore funds as part of this effort. However, any entity employing a non-US investment structure could be impacted by FATCA’s withholding regime if the offshore investment is not deemed to be FATCA compliant. Since the tax is assessed at the fund level, all investors stand to be affected by it.

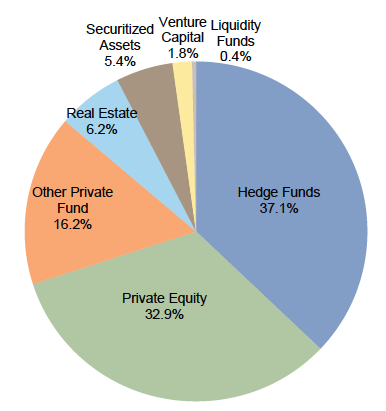

First Look at New Private Funds Industry Data via Form PF

During 2013 SEC staff provided the US Congress with its first report on the data gathered through Form PF[3]US Securities and Exchange Commission, Annual Staff Report Relating to the Use of Data Collected from Private Fund Systemic Risk Reports, July 25, 2013.—a Dodd-Frank required disclosure form for managers of hedge funds, private equity funds, and large, unregistered liquidity funds. Form PF submissions by managers are not publicly available, but this report provided an interesting, aggregated look at the private fund industry (Figure 4).

Source: US Securities and Exchange Commission.

According to the SEC staff report, advisers filing Form PF advised over 18,000 funds with an aggregate of over $7 trillion in Regulatory Assets Under Management (RAUM)[4]RAUM are the gross value of assets and, in the case of private equity funds, include unfunded commitments. and a further nearly $2 trillion in managed accounts employing parallel investment strategies.

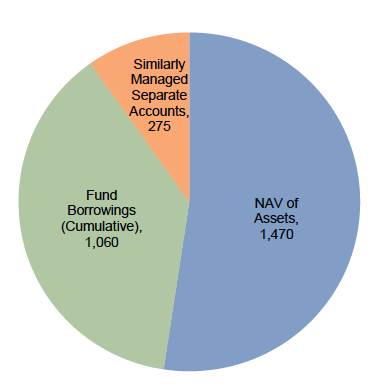

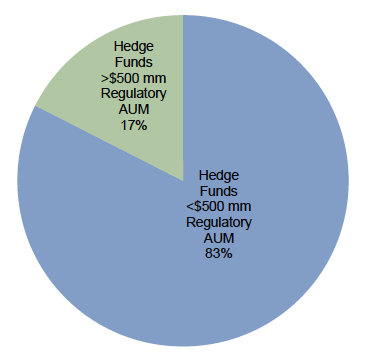

The report provided some interesting aggregated data about the private funds industry. For example, the SEC report provided detail on leverage levels and the prevalence of separately managed accounts among large hedge fund advisers (Figure 5). The report also helped provide color on concentration of assets under management within the hedge fund industry more broadly. Funds with greater than $500 million in RAUM are a relatively small portion of the industry by number (Figure 6), yet they represent the dominant share (81%) of assets in the industry (Figure 7).

Figure 5. A Closer Look at Large Hedge Fund Advisors

Data filed October 1, 2012 – December 31, 2012 • US$ Billions

Source: US Securities and Exchange Commission.

Notes: Large advisers are firms with at least $5 billion in assets under management attributable to hedge funds. This represents filings by 823 firms.

Figure 6. Number of Hedge Funds Reporting by Regulatory Assets Under Management

As of May 15, 2013 • Assets in US$

Source: US Securities and Exchange Commission.

Note: There were 5,514 hedge funds with less than $500 mm in regulatory AUM (RAUM), and 1,169 hedge funds with more than $500 mm in RAUM.

Source: US Securities and Exchange Commission.

Note: Regulatory assets under management (RAUM) are the gross value of assets in the case of private equity funds, including unfunded commitments. Hedge funds with more than $500 mm in RAUM had $3.28 trillion cumulative RAUM, and hedge funds with less than $500 mm in RAUM had $7.82 trillion cumulative RAUM.

Footnotes