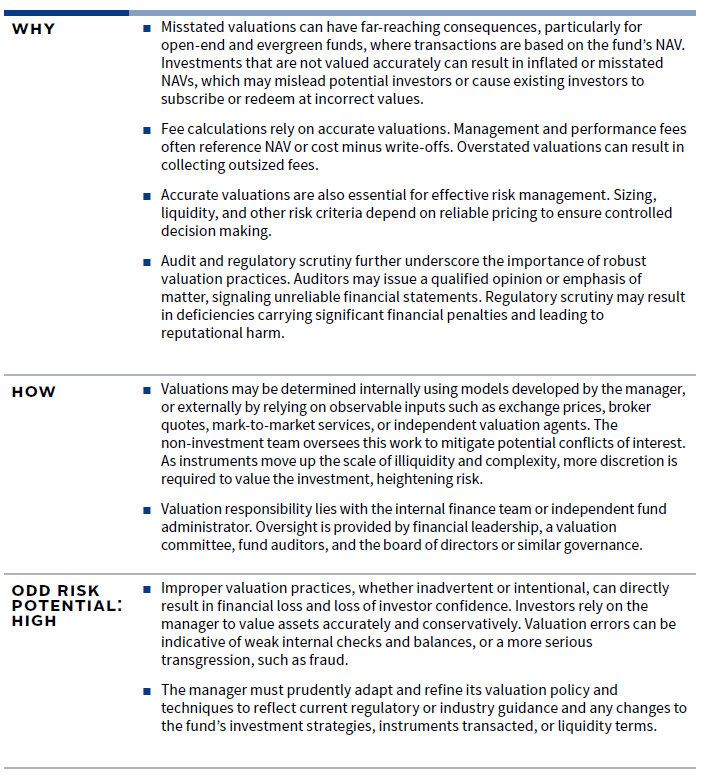

Robust valuation practices are a critical focus of operational due diligence (ODD), as they underpin accurate fund net asset values (NAV), fair fee calculations, and effective risk management. Improper or misstated valuations—whether due to weak controls or intentional fraud—can lead to significant financial losses, regulatory penalties, and reputational damage, especially in open-end, evergreen, hedge, private, and long-only funds. The ODD team assesses the strength of a manager’s valuation policies, oversight, and governance, ensuring these are tailored to the fund’s strategy and regularly updated. Key controls include clear documentation, independent oversight, and back-testing of valuation methodologies. The importance of these controls is underscored by real-world failures, such as the collapse of a fund due to fraudulent valuation practices, demonstrating the high risk and potential investor impact when proper safeguards are lacking. Investors should prioritize managers with transparent, well-governed, and independently validated valuation processes to mitigate these risks.

Role of Operational Due Diligence

A crucial component of ODD is understanding a manager’s valuation practices. The ODD team’s lens while evaluating valuation is not to audit or underwrite specific asset valuations, but rather to assess a manager’s controls, policy, oversight, and governance within the context of the strategy, fee structure, liquidity, and regulatory requirements.

Manager Relevance

Valuation practices play a critical role in ODD across all types of investment strategies underwritten by Cambridge Associates. The importance of robust processes varies by asset class, with unique considerations for hedge funds, private investments, and long-only strategies.

HEDGE FUND MANAGERS: Hedge funds often invest in complicated financial instruments that require nuanced valuation techniques. Performance fees also reference unrealized performance gains that directly ties to asset valuations. More funds now mix in private or illiquid investments, which increases valuation complexity. These investments are ideally segregated in a side pocket account to reduce the potential impact of discretionary manager valuations on investor transactions and fee calculations.

PRIVATE FUND MANAGERS: Private fund managers must value their investments often without being able to directly reference a public market price. Instead, they typically base valuations on recent funding rounds, comparisons to similar public companies, and how well the business is meeting performance goals. Investors rely on managers to recognize when an investment has entirely lost its value and to remove it from the portfolio’s cost basis. Accurate valuations are essential to investors to allow them to assess their investment’s performance and determine whether to support the manager in future fundraising efforts.

LONG-ONLY FUND MANAGERS: Long-only managers also face challenges when valuing their investments, though certain long-only fund structures—particularly undertakings for collective investment in transferable securities (UCITS) and US mutual funds—have stricter rules to mitigate potential valuation risk. Valuations become especially nuanced for strategies that invest in less frequently traded securities or in emerging markets. These situations may require extra care to ensure valuations are accurate and reliable.

Key Control Review

A thorough review of key controls is essential to ensure that valuation practices are reliable and consistent. Three main areas of focus are incorporated into reviews: clear documentation of valuation policies, strong oversight mechanisms, and regular back-testing of outcomes. By examining these controls, we can better assess whether a manager’s process meets industry standards and protects investor interests.

#1 Documentation of Policies

- The Valuation Policy and valuation language in governing legal documents should be tailored to the manager’s strategy and outline the specific pricing sources and valuation techniques applied, which personnel are tasked with each step of the process, required approval, challenge or dispute thresholds, and Valuation Committee composition.

- The policy should be reviewed and updated at least annually by the Valuation Committee, CCO, and the Board of Directors or LP Advisory Committee.

- Valuation Committee meetings and decisions should be documented in written minutes that are stored with supporting documentation, including valuation memos, models, and independent assessments.

#2 Oversight

- For publicly traded strategies, valuation responsibility primarily sits with the fund administrator, middle office, and non-investment team.

- For private investment strategies, the investment and non-investment teams typically collaborate on compiling data and constructing valuation models.

- Cambridge Associates has seen a proliferation in use of independent valuation agents that are engaged for illiquid securities to provide specific asset marks, a range of values, or positive assurance over valuation practices. This provides an independent validation of internal valuation approaches.

- The Valuation Committee plays an important oversight role and should be made up mostly of members who are not part of the investment team. This group is responsible for addressing valuation challenges, providing final approval, and overseeing any updates to the written policies.

#3 Back-Testing

- The valuation methodology and process should be back-tested by comparing investment realization values against preceding valuations, allowing the manager to better refine the process.

- As part of the annual fund audit, the auditor is responsible for reviewing valuation practices and portfolio valuations for compliance with the written policy guidelines and accounting principles. Some auditors may use a specialized valuation team to conduct this review.

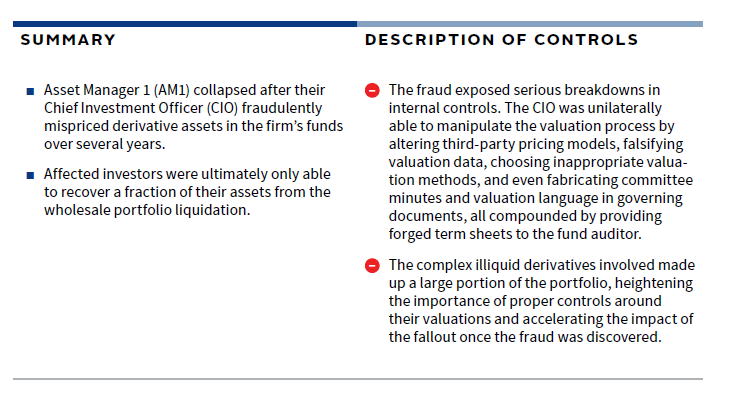

Case Study: Asset Manager 1

Case studies offer valuable lessons on the real-world impact of valuation controls. In this example, weaknesses in valuation oversight and basic controls contributed to the collapse of a fund. These insights highlight the importance of strong valuation practices in protecting both investors and fund managers.