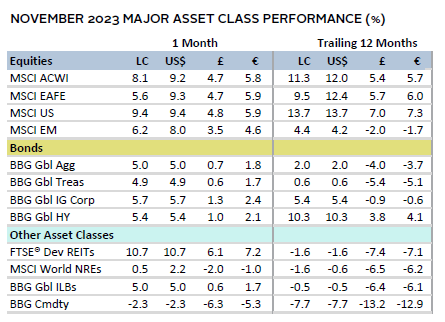

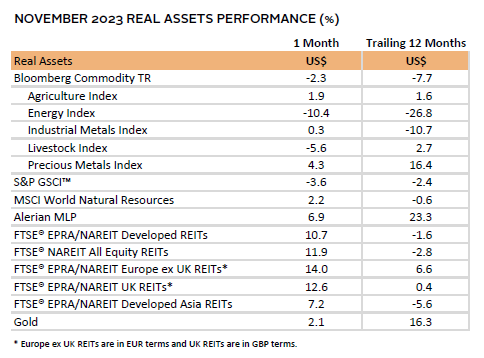

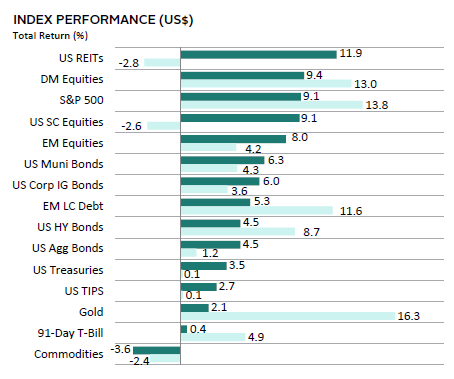

Global equities enjoyed a blockbuster month, up 8%, led by the United States. Developed markets (DM) topped emerging markets (EM), and large-cap stocks edged small caps. Growth strategies outperformed value counterparts, as the technology sector posted double-digit gains. Global fixed income assets also posted impressive mid-single-digit returns as yields declined, with the ten-year US Treasury note notably falling 51 basis points (bps). The downshift in rates also helped REITs rebound, while lower oil prices weighed on commodity futures and the energy sector. The US dollar was weaker against major currencies, while the UK sterling mostly advanced and the euro was mixed.

Sources: Bloomberg Index Services Limited, Bloomberg L.P., EPRA, FTSE International Limited, MSCI Inc., National Association of Real Estate Investment Trusts, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Local currency returns for the Bloomberg fixed income indexes, the Bloomberg Commodity Index, and the FTSE® Developed REITs are in USD terms.

The Macro Picture

Appetite for risk notably increased as inflation decelerated more than expected in the United States, Europe, and United Kingdom, prompting investors to price in rate cuts sooner than previously anticipated. Moreover, other evidence that economic growth was gradually slowing was perceived as good news for investors, as it helped entrench the case that central banks could soon pivot to more dovish monetary policy. Still, central bankers continued to emphasize caution as inflation has not yet reached target levels.

Global economic indicators showed signs of cooling, suggesting that the impact of tighter central bank policies have continued to trickle through to the real economy. In the United States, the labor market continued to loosen as the unemployment rate ticked higher. Consumption growth also slowed, as evidenced by the lower-than-expected change in the Personal Consumption Expenditures (PCE) price index. In Europe, PMI data improved slightly from last month, but still points to weak business activity and suggests that the bloc could see another quarter of negative growth. Germany, Europe’s largest economy, contracted in third quarter and is now mired in a budget crisis that could further dampen growth going forward. The UK economy showed stagnant growth in Q3 and is expected to lag other major economies in the next few years.

Altogether, the downshift in economic data has been perceived positively by investors, who see improving chances of an economic “soft landing.” Indeed, the VIX reached its lowest levels this year during November.

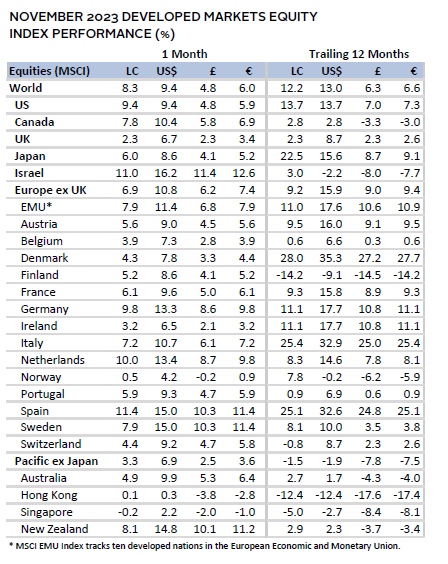

Equities

US equities surged nearly 10% in November, leading DM counterparts. Stocks gained momentum after inflation cooled more than expected to 3.2%. This sparked optimism among investors, who interpreted the inflationary reading as a signal that the Federal Reserve could cut rates earlier than previously anticipated. As such, growth and interest rate sensitive sectors, such as technology and REITs, respectively, saw strong performance. However, the energy sector significantly lagged. It was the only sector with negative returns, attributed in part to slowing demand and lower oil prices.

The Fed elected to hold the Fed funds rate steady this month as it continues to monitor the economic impact from its prior rate-hiking campaign. Fed governors continued to indicate their commitments to keep rates high until inflation sustainably reaches its 2% target. Federal Open Market Committee minutes acknowledged that members felt that risks between hiking too much and not enough were now balanced.

Q3 GDP growth was revised up from 4.9% to 5.2%, the fastest rate in nearly two years. Upward contribution came from both residential and nonresidential investments—however, consumer spending was revised down. Q4 GDP estimates are pointing to growth slowing to about half the Q3 level. This aligns with other economic data suggesting a slowdown. For instance, the November PCE price index came in slightly below expectations, posting the smallest annual gain since March 2021. Additionally, the labor market cooled, with recurring unemployment claims rising to a nearly two-year high.

European equities European equities trailed broader DM shares this month. Europe ex UK stocks outperformed UK counterparts and continue to lead year-to-date (YTD).

The latest Eurozone inflation data at 2.4% came in lower than expected and slowed versus the prior month. Although inflation is approaching the European Central Bank’s (ECB) 2% target, policymakers warned that the “last mile” of inflation will be tougher to tame. Despite this, investors are increasingly optimistic about the odds of avoiding a recession and are now pricing in a rate cut in spring 2024. Investors were encouraged by the flash manufacturing PMI recovering to a six-month high, albeit still contracting. Nevertheless, uncertainty remains as ECB President Christine Lagarde emphasized the need for clarity on fiscal plans, reacting to Germany’s budget crisis, which has led to a suspension of its net new borrowing limit and signaled more bund issuance.

Investor sentiment on the UK economy also improved as inflation beat expectations, down almost 200 bps from the prior month to 4.7%. Additionally, the Office for Budget Responsibility now estimates that UK 2023 GDP will grow by 0.6%, compared to the 0.2% decline estimated in March. Consumer confidence also improved, and the government introduced a slew of supportive measures, including a 2% cut to payroll tax and boosts to investments in manufacturing. Still the UK economy is expected to lag other major developed economies, as reflected in the relatively modest equity returns. The Bank of England (BOE) signaled that it will keep monetary policy tight until it achieves its target inflation rate of 2%. The market expects it to hold its rate at 5.25% and begin cutting in the second half of 2024.

Japanese equities lagged broader DM stocks this month but maintained their top spot among DM peers YTD. Returns in US dollars slightly increased in November as the yen appreciated after the currency reached a multi-decade low in October. However, weaker-than-expected GDP (-2.1% annualized), due to slowing consumer and business spending, appeared to limit the central bank’s desire to tighten its monetary policy. Bank of Japan officials have reiterated their commitment to striking a balance between supporting the yen and economic growth, warning against a premature shift in its ultra-loose monetary policy. Core inflation did grow by less than expected in October at 2.9% but remains well above the central bank’s 2% target. The Japanese government recently announced a new stimulus plan, including tax cuts and cash payouts, to help low-income families cope with higher inflation.

Pacific ex Japan equities lagged the broader DM index. New Zealand equities led the region, while Singapore continued to lag. As expected, the Reserve Bank of New Zealand (RBNZ) left its official cash rate at 5.5%. However, accompanying hawkish statements emphasized the possibility of future rate hikes if inflation accelerates. Separately, new Prime Minister Christopher Luxon shared that his government would change legislation for the RBNZ to focus solely on price stability, scrapping a focus on full employment. The Reserve Bank of Australia increased its benchmark cash rate by 25 bps to 4.35% in November, but is expected to pause in December, on weaker-than-expected retail sales and a faster-than-expected decline in inflation to 4.9%.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

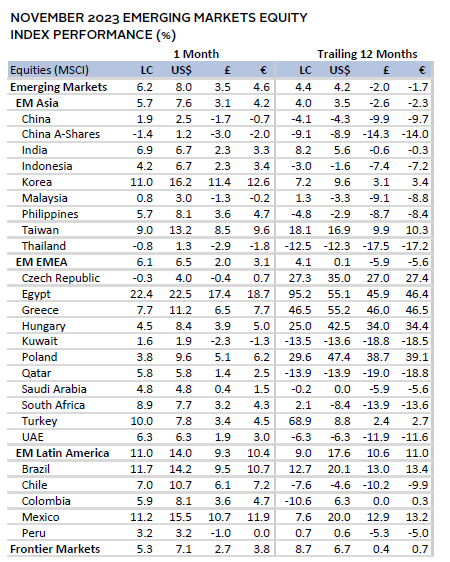

Emerging markets equities advanced in November but lagged DM peers. Latin America led among regions, with both Brazil and Mexico posting double-digit local currency returns. Asia underperformed due to underperformance in China; South Korea, Taiwan, and India posted strong returns in local currency terms.

Brazil’s central bank cut rates by 50 bps for the third time, with the central bank chief Roberto Campos Neto noting it was unlikely that further cuts will create downside risk on the exchange rate front, as interest-rate differentials remain wide versus most developed economies. In South Korea, the central bank left its repo rate unchanged as retail sales and exports for semiconductors surprised to the upside. However, factory production unexpectedly fell to the lowest level in ten months on lower chip production toward month end. In India, GDP surprised to the upside, growing by nearly 8%, supported by manufacturing and government spending. Its central bank held its interest rate steady, while CPI fell to 4.87%—well within the target range of 2% to 6%.

Chinese equities lagged EM counterparts despite efforts by the government to support its beleaguered property sector. Those efforts included providing financial aid to 50 builders, loosening down payment requirements, and encouraging banks to lend to the sector. The initial boost to stocks from this news was not sustained, as markets turned their focus to PMI data that showed contraction in both manufacturing and services, the latter of which dropped to its lowest level this year. President Joe Biden and President Xi Jinping held talks in November, pledging increased cooperation between the world’s largest economies. This offered some reprieve from the recently escalating tensions between the two countries.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

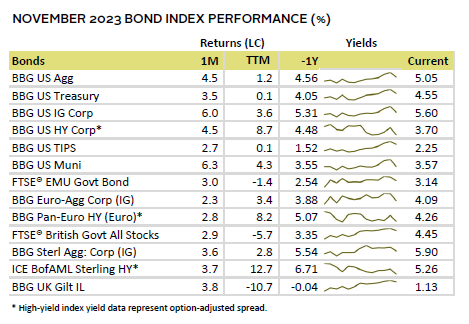

Fixed Income

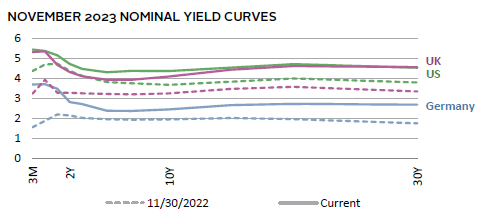

US fixed income assets rose 4.5%, a return magnitude not enjoyed by the asset class since the mid-1980s, as yields for tenures longer than five years plunged around 50 bps. November’s banner return was enough to turn YTD performance for the Bloomberg US Agg Index positive. Yields were driven down as inflation rose at a slower pace than anticipated and investors positioned for the Fed to begin cutting rates in the first half of 2024. Yield declines on shorter-dated Treasuries were relatively modest, and the ten-year/two-year spread widened by 17 bps. This further inverted the curve, as the market prices in nearly 100% odds that the Fed will not raise its benchmark policy rate at its December meeting.

UK gilts enjoyed a similar trend, with the index gaining nearly 3% in November, although the trailing 12-month returns remain negative. The ten-year nominal gilt yield fell 41 bps to 4.10%. Linkers outperformed nominal gilts amid declining real yields. After underperforming for the first ten months of 2023, UK investment-grade equivalents performance matched their high-yield counterparts in November. German yields saw less reprieve, as the threat of increased supply of bunds to fund the budget weighed on the market. Ten-year bund yields fell 36 bps to 2.45% and the yield curve became slightly more inverted. European bonds gained similar to the UK market, and high-yield bonds only modestly outpaced investment-grade equivalents. Investors became more optimistic about the economy and began pricing in rate cuts as early as spring 2024.

Sources: Bank of England, Bloomberg Index Services Limited, Federal Reserve, FTSE Fixed Income LLC, FTSE International Limited, Intercontinental Exchange, Inc., and Thomson Reuters Datastream.

Real Assets

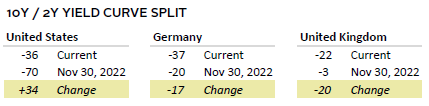

Real assets were mixed in November. While interest rate–sensitive assets benefited, slowing demand weighed on other segments. Commodity futures declined on weaker energy prices, despite a boost in copper prices likely supported by improving sentiment for China’s property sector.

Oil prices ($83 for Brent and $76 for WTI) dropped around 6%, extending quarter-to-date declines to around 15%. Slowing demand and an International Energy Agency estimate for the oil markets to flip to a surplus in the beginning of the new year weighed on sentiment. OPEC+ met late in the month, after postponing its initial meeting due to a disagreement on quota levels between Saudi Arabia and African producing nations. The consortium extended its production cuts as widely expected by the market. The group also doubled the volume cut to 2 million barrels per day, in hopes to support a floor on pricing around the $80 level. Commensurately, global natural resources equities posted only modest gains this month.

REITs reacted favorably to lower interest rates posting strong double-digit returns in most regions. However, returns remain negative YTD in the United States and most DMs. All segments of real estate advanced as investors positioned for more supportive financial conditions.

Gold prices advanced to $2,038 on a combination of lower yields, a weaker US dollar, and ongoing geopolitical concerns.

Sources: Alerian, Bloomberg L.P., EPRA, FTSE International Limited, Intercontinental Exchange, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Gold performance based on spot price return.

USD-Based Investors

All asset classes advanced in November except for commodities, which were held back on slowing demand and lower oil prices. Investors became increasingly bullish as inflation declined faster than expected and they priced in rates cuts earlier than previous estimates. As such, the interest rate–sensitive REITs sector enjoyed a robust recovery, in contrast to the poor returns they have experienced YTD on the higher rate narrative. Over the last 12 months only REITs, small caps, and commodities remain in negative territory.

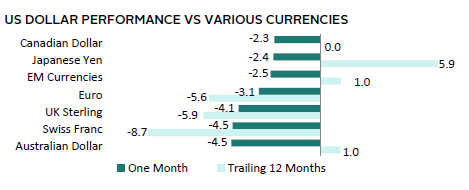

The US dollar broadly declined as yields moved down more than in other major DM markets. It weakened the most against the commodity-linked Australian dollar as well as the Swiss franc. Over the last 12 months, the US dollar is weaker versus the Swiss franc, UK sterling, and euro, but has gained the most vis-à-vis the Japanese yen.

The Fed elected to hold the Fed funds rate steady this month as it continues to monitor the unfolding economic impact from its prior rate-hiking campaign. Fed governors continued to echo prior commitments to keep rates high until inflation sustainably reaches its 2% target. Q3 GDP growth was revised up from 4.9% to 5.2%, the fastest rate in nearly two years. Upward contribution came from both residential and nonresidential investments—however, consumer spending was revised down. Q4 GDP estimates are pointing to growth slowing to about half the Q3 level. This aligns with other economic data suggesting a slowdown. For instance, the November PCE price index came in slightly below expectations, posting the smallest annual gain since March 2021. Additionally, the labor market cooled, with recurring unemployment claims rising to a nearly two-year high.

Sources: Bloomberg Index Services Limited, FTSE International Limited, Frank Russell Company, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

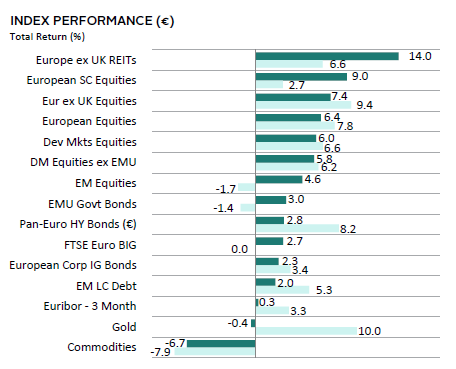

EUR-Based Investors

Most asset classes advanced in November as investors became increasingly bullish on the narrative that the global economy would likely avoid a recession. Investors priced in rates cuts earlier than previous estimates, as inflation declined at a faster-than-expected pace. Commodities and gold, however, posted negative returns. The former was held back on slowing demand and lower oil prices, while gold declined on a stronger euro. The interest rate–sensitive REITs sector enjoyed a robust recovery as yields declined. Small-cap equities also enjoyed impressive returns on an improving economic backdrop. Indeed, over the last 12 months only commodities, EM equities, and EMU sovereign bonds remain in negative territory.

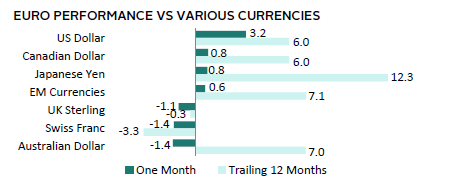

The euro’s performance was mixed and strengthened the most notably against the US dollar as interest rate differentials improved. The common currency weakened most vis-à-vis the commodity-linked Australian dollar and the Swiss franc. Over the last 12 months, the euro advanced the most against the Japanese yen and EM currencies but was weakest versus the Swiss franc.

The latest Eurozone inflation data at 2.4% came in lower than expected and slowed versus the prior month. Although inflation is approaching the ECB’s 2% target, policymakers warned that the “last mile” of inflation will be tougher to tame. Despite this, investors are increasingly optimistic about the odds of avoiding a recession and are now pricing in a rate cut in spring 2024. Investors were encouraged by the flash manufacturing PMI recovering to a six-month high, albeit still contracting. Nevertheless, uncertainty remains as ECB President Lagarde emphasized the need for clarity on fiscal plans, reacting to Germany’s budget crisis, which has led to a suspension of its net new borrowing limit and signaled more bund issuance.

Sources: Bloomberg Index Services Limited, EPRA, European Banking Federation, FTSE Fixed Income LLC, FTSE International Limited, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

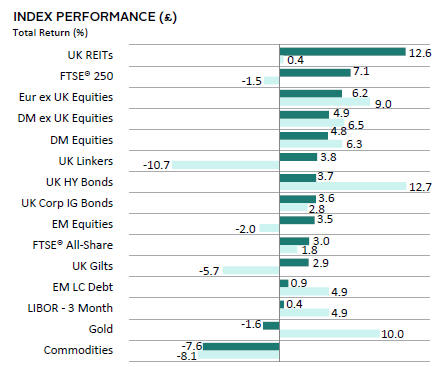

GBP-Based Investors

Asset returns were mostly positive in November; gold and commodities were the only asset classes in the red. The stronger sterling was the primary reason for gold’s negative return, while commodities stumbled amid falling oil prices and tepid demand. UK REITs saw a massive monthly gain, sparked by the significant drop in interest rates. The falling rate narrative also helped all fixed income categories realize gains during the month, while UK high-yield bonds have been the top-performing asset class in the past 12 months.

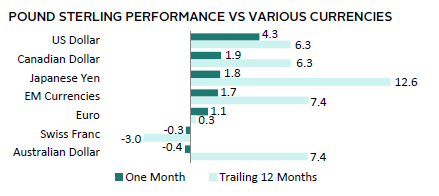

The UK sterling was mostly positive in November, gaining notably against the US dollar. Sterling weakened only modestly vis-à-vis the safe-haven Swiss franc and commodity-linked Australian dollar. Over the last 12 months, UK sterling is mostly stronger, gaining the most vis-à-vis Japanese yen and the Australian dollar, and declining only versus the Swiss franc.

Investor sentiment on the UK economy also improved as inflation beat expectations, down almost 200 bps from the prior month to 4.7%. Additionally, the Office for Budget Responsibility now estimates that UK 2023 GDP will grow by 0.6%, compared to the 0.2% decline estimated in March. Consumer confidence also improved, and the government introduced a slew of supportive measures, including a 2% cut to payroll tax and boosts to investments in manufacturing. Still the UK economy is expected to lag other major developed economies, as reflected in the relatively modest equity returns. The BOE signaled that it will keep monetary policy tight until it achieves its target inflation rate of 2%. The market expects it to hold its rate at 5.25% and begin cutting in the second half of 2024.

Sources: Bloomberg Index Services Limited, EPRA, FTSE International Limited, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Performance Exhibits

All data are total returns unless otherwise noted. Total return data for all MSCI indexes are net of dividend taxes.

USD-Based Investors index performance chart includes performance for the Bloomberg US Aggregate Bond, Bloomberg US Corporate Investment Grade, Bloomberg US High Yield Bond, Bloomberg Municipal Bond, Bloomberg US TIPS, Bloomberg US Treasuries, ICE BofAML 91-Day Treasury Bills, FTSE® NAREIT All Equity REITs, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price, MSCI Emerging Markets, MSCI World, Russell 2000®, S&P 500, and S&P GSCI™ indexes.

EUR-Based Investors index performance chart includes performance for the Bloomberg Euro-Aggregate: Corporate, Bloomberg Pan-Euro High Yield (Euro), EURIBOR 3M, FTSE EMU Govt Bonds, FTSE Euro Broad Investment-Grade Bonds, FTSE® EPRA/NAREIT Europe ex UK RE, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price AM, MSCI Emerging Markets, MSCI Europe, MSCI Europe ex UK, MSCI Europe Small-Cap, MSCI World ex EMU, MSCI World, and S&P GSCI™ indexes.

GBP-Based Investors index performance chart includes performance for the Bloomberg Sterling Aggregate: Corporate Bond, Bloomberg Sterling Index-Linked Gilts, ICE BofAML Sterling High Yield, FTSE® 250, FTSE® All-Share, FTSE® British Government All Stocks, FTSE® EPRA/NAREIT UK RE, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price AM, LIBOR 3M GBP, MSCI Emerging Markets, MSCI Europe ex UK, MSCI World, MSCI World ex UK, and S&P GSCI™ indexes.

EM currencies is an equal-weighted basket of 20 emerging markets currencies.

Fixed Income Performance Table

Performance data for US TIPS reflect the Bloomberg US TIPS Index, with yields represented by the Bloomberg Global Inflation Linked Bond Index: US.