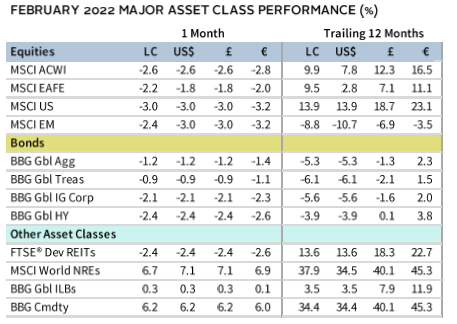

Most global assets declined again in February. Global equities fell for the fourth time in the last six months; emerging markets fared better than developed counterparts but lagged in major currency terms. Value and small caps outperformed growth and large-cap equivalents, respectively. Fixed income assets declined as nominal interest rates rose. Global government bonds held up better than corporates amid a flight to safety late in the month. Safe-haven gold also rose. Energy-related assets were again top performers as oil & gas prices surged. Among currencies, the US dollar and UK sterling declined, and the euro was mixed.

Sources: Bloomberg Index Services Limited, Bloomberg L.P., EPRA, FTSE International Limited, MSCI Inc., National Association of Real Estate Investment Trusts, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Local currency returns for the Bloomberg fixed income indexes, the Bloomberg Commodity Index, and the FTSE® Developed REITs are in USD terms.

The Macro Picture

Russia’s invasion of Ukraine sent shockwaves across the world, creating a tragic humanitarian and geopolitical crisis, and introducing new uncertainty to the global economy and financial markets. Investors braced for economic consequences as global leaders swiftly levied major sanctions against Russia. Notably, countries across the world froze Russian central bank assets and cut off several major Russian banks from the System for Worldwide Interbank Financial Telecommunications (SWIFT) payment system. The sanctions immediately began to take a toll on Russia’s economy, sending its stock market plunging and the ruble to an all-time low exchange rate versus the US dollar.

Historically, equity declines following major military-related geopolitical events have been mostly mild and short-lived, lasting a median of 17 trading days to the market bottom and recovering the amount lost in about the same amount of time. Still, the crisis in Ukraine presents a major risk to financial markets, particularly if military activity escalates and sanctions intensify further.

Investors continue to grapple with ongoing inflationary risks, central bank policy changes, and COVID-19 developments. Inflation reached multi-decade highs and central banks broadly continued their hawkish shift as imminent interest rate hikes appear to be largely unaffected by the war on Ukraine. The COVID-19 Omicron surge has largely abated but is still roaring through pockets of population centers, particularly in southeast Asia; Hong Kong, Malaysia, New Zealand, Singapore, South Korea, Thailand, and Vietnam are all currently experiencing higher caseloads than at any other point of the pandemic.

Equities

US equities fell again in February, trailing developed ex US and emerging markets peers for the second consecutive month. The S&P 500 briefly fell into correction territory before regaining some ground and ended the month 8.8% below the all-time high price it reached in early January. Ten of 11 S&P 500 Index sectors declined, led down by communication services, real estate, and information technology; industrials and healthcare fell the least, and energy advanced. Value stocks held up better than growth, as growth stocks have now declined more than 12% in 2022. Small caps advanced and bested large-cap equivalents but trailed by nearly 20 percentage points (ppts) over the last 12 months. S&P 500 earnings per share expanded 31% year-over-year in fourth quarter, based on a blend of the latest estimates and actual results from 97% of companies in the index. If this figure holds, it will mark the fourth consecutive quarter of earnings growth above 30%. However, these year-over-year growth rates benefit from base effects when compared to the depressed earnings levels due to the negative impact of COVID-19 restrictions in 2020.

The fourth quarter real GDP growth rate was revised slightly upward to 7.0% annualized according to the second preliminary estimate. Other economic data were mostly upbeat. Business activity in the services and manufacturing sectors appeared to expand at an accelerating rate in February, retail sales and industrial production rose at a faster rate than expected in January, and weekly jobless claims edged lower toward historical levels amid the tightening labor market. However, consumer confidence and sentiment declined in February, and January inflation reached its highest level in 40 years. Market participants still expect the Federal Reserve to steadily raise interest rates throughout 2022, despite ongoing concerns that the unfolding crisis in Ukraine could weigh on financial market stability and the growth outlook.

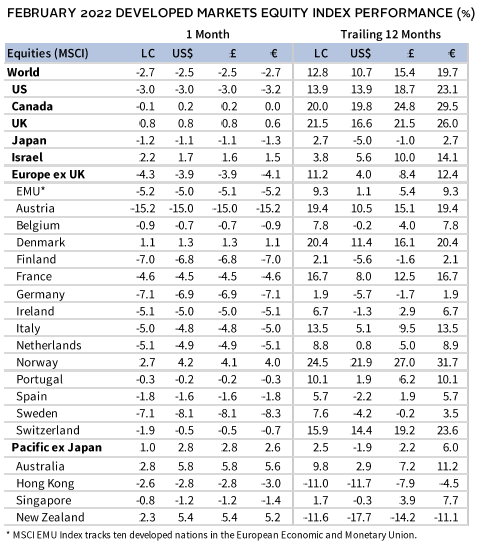

European equities declined and trailed broader developed markets. Europe ex UK stocks were the bottom performer among major developed economies, while the United Kingdom advanced. UK equities now top Europe ex UK peers on a trailing 12-month basis by more than 10 ppts, its widest lead in more than five years.

Economic data in the Eurozone were mostly positive. Services and manufacturing sectors expanded business activity in February, according to preliminary PMI reports, while industrial and services confidence indicators ticked up. However, Eurozone inflation was hotter than consensus estimates, reaching a new record. European Central Bank (ECB) President Christine Lagarde shifted to a more hawkish tone, acknowledging inflationary concerns, and is no longer explicitly ruling out the possibility of a rate hike in 2022. The European Commission announced some types of natural gas and nuclear energy would be considered green energy, prompting claims of greenwashing. Following Russia’s invasion of Ukraine, Germany halted certification of the controversial Nord Stream 2 project and policymakers discussed plans to move away more quickly from reliance on Russian gas. These plans include the development of two liquified natural gas hubs, extending subsidies for wind and solar, and potentially reopening or extending the life of existing nuclear energy facilities.

UK fourth quarter real GDP grew 1.0% quarter-on-quarter according to the first preliminary estimate, in line with expectations. Economic data were mostly positive as retail sales and industrial production topped expectations in January, and services and manufacturing activity expanded according to PMI readings. The Bank of England (BOE) increased interest rates a quarter point to 0.50% as inflation reached a 30-year high.

Japanese equities declined for the month but outperformed broader developed markets. Calendar fourth quarter real GDP grew 5.4% annualized according to first preliminary estimate, near consensus estimates, boosted by consumer spending from relaxed COVID-19 restrictions. Economic data releases were mixed as January retail sales grew faster than expected, preliminary PMI data indicated that business activity across manufacturing softened and services contracted in February, and January industrial production unexpectedly declined. Consumer price inflation grew 0.5% in January, missing expectations and remaining well below the 2.0% target set by the Bank of Japan (BOJ). The BOJ resisted a global hawkish shift, expanding its loose monetary policy by offering to buy unlimited government debt to defend its target bond yield, which had risen to its highest level since early 2016.

Pacific ex Japan equities advanced and were the top-performing major developed market in February. Australia and New Zealand rose while Hong Kong and Singapore declined. Australia led the way as retail sales, employment, and business confidence all unexpectedly rose. Shortly after the end of the month, the Reserve Bank of Australia (RBA) announced it would take a patient approach to future rate hikes. RBA Governor Philip Lowe noted that while the Australian economy continues to recover favorably, uncertainty from the war on Ukraine and associated spikes in energy prices and supply-side concerns contributed to the Board’s decision to continue supportive monetary policy. Meanwhile, the Reserve Bank of New Zealand hiked its benchmark interest rate a quarter point to 1.0% and signaled a more hawkish path forward than investors expected. Bottom performer Hong Kong was impacted by skyrocketing COVID-19 cases as the country prepared to lock down to quell the surging caseload.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

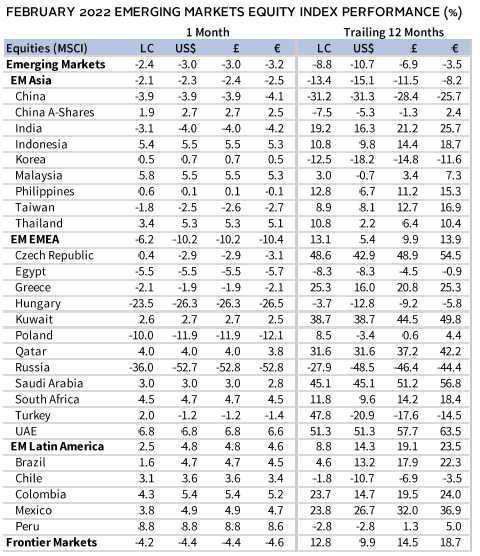

Emerging markets equities declined but topped their developed markets peers for the second consecutive month, but lagged in major currency terms. Still, emerging markets equities trailed developed markets equities by more than 20 ppts over the trailing 12-month period.

Emerging Europe, the Middle East & Africa trailed the broad index, dragged down by steep declines in Russian equities. Emerging Asia declined, but bested the broader index, and Latin America advanced. Among major emerging markets countries, China and India lagged, Taiwan topped the broader index but declined, and South Africa, Saudi Arabia, Brazil, and Korea advanced. Russian equities fell more than 50% in major currency terms in February and have lost nearly two-thirds of their value since recent highs in October. The domestic stock market was shuttered near month-end as massive sanctions coordinated across the globe effectively isolated the economy. The Central Bank of the Russian Federation, which had raised interest rates to 9.5% near the beginning of the month, raised them further to 20% in an attempt to prevent runaway inflation as the Russian ruble sank to an all-time low exchange rate versus the US dollar.

Chinese domestic A-shares advanced, as PMIs indicated the manufacturing and services sectors expanded at a faster rate in February, according to official measures. Still, just after month-end, Commerce Minister Wang Wentao warned China’s economy still faces major hurdles, including rising uncertainty over global trade and still-lackluster domestic consumption.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Fixed Income

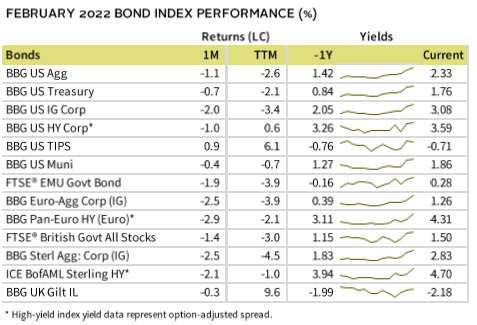

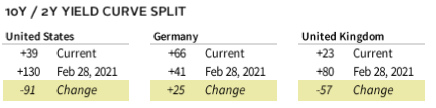

US fixed income assets mostly declined in February as interest rates rose across all maturities and the yield curve flattened. US Treasuries declined but held up better than corporate equivalents; high-yield bonds topped investment-grade corporate peers. Five- and ten-year Treasury yields rose 9 basis points (bps) and 4 bps to 1.71% and 1.83%, respectively. The ten-year yield touched above 2.00% early in the month for the first time since 2019, but fell on news of Russia’s invasion of Ukraine, prompting the highest Treasury yield volatility since March 2020. The ten-year/two-year Treasury yield spread declined another 22 bps to its lowest level—and the three-month cash rate continued to surge to its highest level—since the start of the pandemic. US TIPS were the only major bond category to advance, while tax-exempt municipal bonds declined but outperformed nominal Treasuries.

Similarly, all major European fixed income asset classes declined. Among UK categories, gilts outperformed corporates, investment-grade corporates trailed high-yield peers, and linkers outpaced nominal gilts. Five- and ten-year gilt yields rose 18 bps and 16 bps to 1.28%, and 1.48%, respectively, as rates across tenors continued to rise. Euro-denominated bond prices followed a similar pattern as EMU government bonds topped corporate equivalents, but investment-grade corporates bested Pan-euro high-yield equivalents. German ten-year bund yields rose 14 bps to 0.16%, its highest reading in three years.

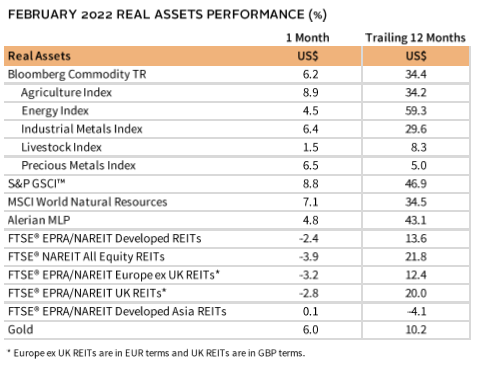

Real Assets

Commodity futures advanced and were a top performer in February, supported by rises in agriculture and precious and industrial metals subindexes. The energy subindex lagged, even as oil and European natural gas prices increased sharply. This was likely because the BCOM index measures futures contracts of US natural gas prices, which declined 9.3%, even though European natural gas prices rose 16.7%.

Oil prices ($100.99 for Brent and $95.72 for WTI) spiked to their highest levels since late 2014. Brent and WTI have advanced nearly 30% year-to-date. Supply constraint risks have significantly worsened since Russia invaded Ukraine. Although Russia continues to supply oil and natural gas to Europe, the risk remains that the Russian government could turn off the spigot to pressure the EU, which obtains 30% of its oil and 40% of its natural gas from Russia. European nations sought deals with smaller regional producers to hedge against this risk, but these could still fall short as many OPEC nations had been struggling to increase output prior to the current crisis.

Global natural resource equities and energy MLPs also delivered among the top returns of any major asset class, boosted by rising energy prices and significant earnings and revenue results.

Global developed REITs broadly declined as interest rates continued to rise and central banks continued their hawkish shift. US REITs, Europe ex UK REITs, and UK REITs declined and trailed broader index; developed Asia REITs were roughly flat.

Gold prices ($1,903.75/troy ounce) advanced and were a top gainer amid war in Europe and the associated flight to safety.

Sources: Alerian, Bloomberg L.P., EPRA, FTSE International Limited, Intercontinental Exchange, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Gold performance based on spot price return.

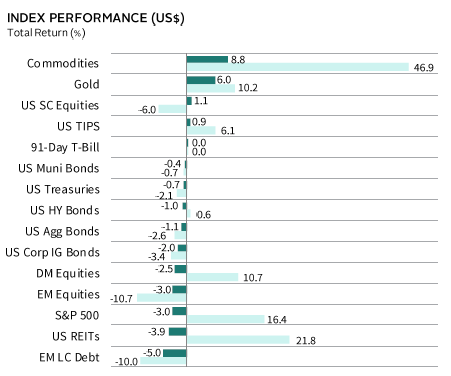

USD-Based Investors

Most asset classes declined in February as Russia’s invasion of Ukraine created a tragic humanitarian and geopolitical crisis. Domestic small-cap equities gained, besting large-cap peers, which were one of the bottom performers. Developed markets equities edged emerging markets equivalents, which were hampered by a 50%+ decline in Russia. Among domestic fixed income categories, US Treasuries held up better than corporate equivalents, high-yield bonds bested investment-grade peers, and TIPS advanced. Commodities were the top performing asset class, led higher by steep price increases impacted by the war on Ukraine. Safe-haven gold also rose and was a top gainer amid war in Europe and the associated flight to safety.

The US dollar mostly depreciated, declining the most versus the Australian dollar, Swiss franc, and Canadian dollar. The dollar was flat against Japanese yen and UK sterling, appreciating only vis-à-vis our basket of EM currencies. The greenback broadly gained over the trailing 12-month period, advancing the most against the EM currencies, Japanese yen, and the euro.

S&P 500 earnings per share expanded 31% year-over-year in fourth quarter, based on a blend of the latest estimates and actual results from 97% of companies in the index. Business activity in the services and manufacturing sectors appeared to expand at an accelerating rate in February, retail sales and industrial production rose at a faster rate than expected in January, and weekly jobless claims edged lower toward historical levels amid the tightening labor market. However, consumer confidence and sentiment declined in February and January inflation reached its highest level in 40 years. Market participants still expect the Fed to steadily raise interest rates throughout 2022.

Sources: Bloomberg Index Services Limited, FTSE International Limited, Frank Russell Company, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

EUR-Based Investors

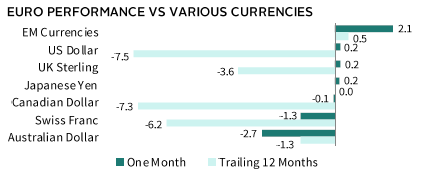

Most asset classes declined in February as Russia’s invasion of Ukraine created a tragic humanitarian and geopolitical crisis. European large-/mid-cap equities bested small-cap peers, which were one of the bottom performers. Developed markets equities edged emerging markets equivalents, which were hampered by a 50%+ decline in Russia. Among European fixed income categories, EMU government bonds held up better than corporate equivalents, and European corporate investment-grade bonds topped pan-Euro high-yield peers. Commodities were the top-performing asset class, led higher by steep price increases impacted by the war on Ukraine. Safe-haven gold also rose and was the only other major asset class to advance amid war in Europe and the associated flight to safety.

The euro was roughly flat against most currencies in February, gaining the most vis-à-vis our EM currencies basket, and declining the most against the Australian dollar and Swiss franc. The common currency mostly depreciated over the trailing 12-month period, declining the most vis-à-vis the US and Canadian dollars and the Swiss franc, while advancing only versus EM currencies.

Eurozone services and manufacturing sectors expanded business activity in February, according to preliminary PMI reports, while industrial and services confidence indicators ticked up. However, inflation was hotter than consensus estimates, reaching a new record. ECB President Christine Lagarde shifted to a more hawkish tone, acknowledging inflationary concerns, and is no longer explicitly ruling out the possibility of a rate hike in 2022.

Sources: Bloomberg Index Services Limited, EPRA, European Banking Federation, FTSE Fixed Income LLC, FTSE International Limited, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

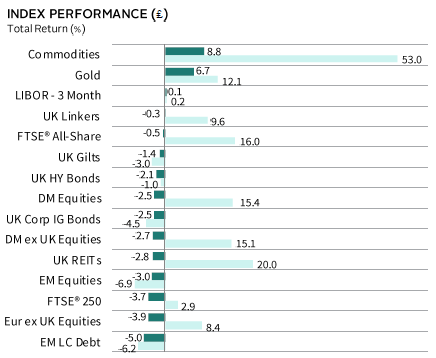

GBP-Based Investors

Most asset classes declined in February as Russia’s invasion of Ukraine created a tragic humanitarian and geopolitical crisis. UK large cap equities bested mid-cap peers, which were one of the bottom performers. Developed markets equities edged emerging markets equivalents, which were hampered by a 50%+ decline in Russia. Among UK fixed income categories, gilts topped corporate equivalents, UK high-yield bonds bested UK corporate investment-grade peers, while Linkers held up better than nominal gilts. Commodities were the top-performing asset class, led higher by steep price increases impacted by the war on Ukraine. Safe-haven gold also rose and was the only other major asset class to advance amid war in Europe and the associated flight to safety.

UK sterling mostly depreciated, declining the most versus the Australian dollar, Swiss franc, and Canadian dollar; the British pound was flat against Japanese yen and US dollar, appreciating only vis-à-vis our basket of EM currencies. UK sterling was mixed over the trailing 12-month period, advancing the most against the EM currencies, Japanese yen, and the euro, and declining the most vis-à-vis the US and Canadian dollars and the Swiss franc.

UK fourth quarter real GDP grew 1.0% quarter-on-quarter according to the first preliminary estimate, in line with expectations. Economic data were mostly positive as retail sales and industrial production topped expectations in January, and services and manufacturing activity expanded according to PMI readings. The BOE increased interest rates a quarter point to 0.50% as inflation reached a 30-year high.

Sources: Bloomberg Index Services Limited, EPRA, FTSE International Limited, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Performance Exhibits

All data are total returns unless otherwise noted. Total return data for all MSCI indexes are net of dividend taxes.

USD-Based Investors index performance chart includes performance for the Bloomberg US Aggregate Bond, Bloomberg US Corporate Investment Grade, Bloomberg US High Yield Bond, Bloomberg Municipal Bond, Bloomberg US TIPS, Bloomberg US Treasuries, ICE BofAML 91-Day Treasury Bills, FTSE® NAREIT All Equity REITs, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price, MSCI Emerging Markets, MSCI World, Russell 2000®, S&P 500, and S&P GSCI™ indexes.

EUR-Based Investors index performance chart includes performance for the Bloomberg Euro-Aggregate: Corporate, Bloomberg Pan-Euro High Yield (Euro), EURIBOR 3M, FTSE EMU Govt Bonds, FTSE Euro Broad Investment-Grade Bonds, FTSE® EPRA/NAREIT Europe ex UK RE, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price AM, MSCI Emerging Markets, MSCI Europe, MSCI Europe ex UK, MSCI Europe Small-Cap, MSCI World ex EMU, MSCI World, and S&P GSCI™ indexes.

GBP-Based Investors index performance chart includes performance for the Bloomberg Sterling Aggregate: Corporate Bond, Bloomberg Sterling Index-Linked Gilts, ICE BofAML Sterling High Yield, FTSE® 250, FTSE® All-Share, FTSE® British Government All Stocks, FTSE® EPRA/NAREIT UK RE, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price AM, LIBOR 3M GBP, MSCI Emerging Markets, MSCI Europe ex UK, MSCI World, MSCI World ex UK, and S&P GSCI™ indexes.

EM currencies is an equal-weighted basket of 20 emerging markets currencies.

Fixed Income Performance Table

Performance data for US TIPS reflect the Bloomberg US TIPS Index, with yields represented by the Bloomberg Global Inflation Linked Bond Index: US.