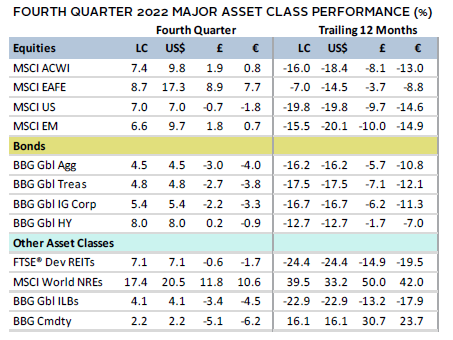

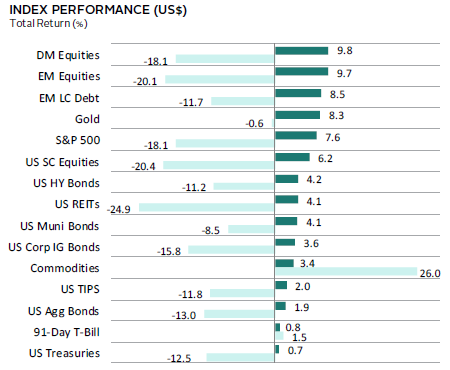

Risk assets closed a tumultuous year on a positive note in fourth quarter. Global equities notched their only quarterly gain in 2022, as developed shares topped emerging markets. Value outgained growth for a third quarter this year, bringing annual outperformance to its widest since 2000. Returns for small caps and large caps were roughly on par in fourth quarter. Bond markets rallied as inflation rates softened and central banks began dialing back their rate-hiking pace. Real asset categories broadly gained, highlighted by a rebound in industrial and precious metals prices. The US dollar weakened at the fastest clip since 2010, while the euro and UK sterling appreciated.

Sources: Bloomberg Index Services Limited, Bloomberg L.P., EPRA, FTSE International Limited, MSCI Inc., National Association of Real Estate Investment Trusts, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Local currency returns for the Bloomberg fixed income indexes, the Bloomberg Commodity Index, and the FTSE® Developed REITs are in USD terms.

The Macro Picture

Macroeconomic developments were the key drivers of risk asset performance in fourth quarter. Chief among them were signs that inflation slowed from the 40-year highs hit earlier this year. Investors anticipated a possible downshift in the pace of recent central bank tightening following the weaker-than-expected inflation prints, which helped propel markets higher. Despite the gains in fourth quarter, the overarching bearish sentiment in 2022 left investors few places to hide as global equities and bonds both declined by double digits.

Fragile investor sentiment was still evident at the end of the year. Equity performance faltered in December after central bankers challenged the notion that recent inflation data suggest a less restrictive policy stance. The Federal Reserve, Bank of England (BOE), and European Central Bank (ECB) all lifted rates by 50 basis points (bps) during the month. Although the Fed’s hike was lower than the 75 bps in the four prior meetings, they raised their terminal policy rate expectations, implying that additional rate hikes were on the horizon. The major central banks’ commitment to tighter policy comes amid a weakening economic outlook. Indeed, activity in rate-sensitive sectors, such as housing, has slowed, while purchasing manager index (PMI) data in much of the world turned contractionary.

Policy developments in China captivated markets in fourth quarter as economic data deteriorated further. In December, authorities abruptly ended the widely unpopular zero-COVID policies, leading to a severe outbreak of the virus. Markets had previously cheered any signals of a shift in the government’s zero-COVID policy stance, but the policy shift is expected to exact a heavy human and economic toll in the near term, and the longer-term pathway to economic normalcy is likely to be turbulent.

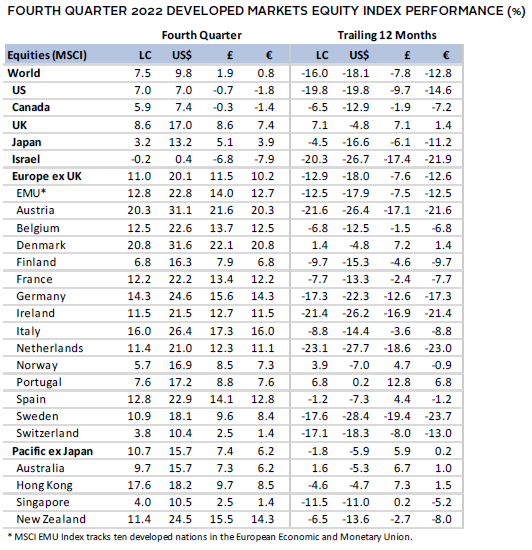

Equities

US equities advanced, delivering their only quarterly gains for all of 2022. US stocks lost nearly 20% on the year—their largest annual decline since 2008—and have lagged developed ex US peers in four straight quarters. Nine of 11 S&P 500 Index sectors advanced in fourth quarter, led by the cyclical and value-oriented energy, industrials, and materials sectors. Tech-heavy and rate-sensitive sectors—such as consumer discretionary, communication services, and real estate—lagged. These underlying sector dynamics meant that value topped growth by the widest margin in 22 years, for both the quarter and the calendar year. Large caps outgained small caps in fourth quarter, but annual performance from both segments was roughly in line with the broader market.

Inflation reports and Fed policy were the primary drivers of performance, while other economic data were mixed. US inflation slowed more than expected, reaching 7.1% year-over-year (YoY) in November, which was down from the recent high of 9.1% YoY in June. Core inflation rates posted their slowest month-on-month rise in more than a year. While investors cheered these reports and signals that the Fed would slow their rate-hiking pace, hawkish forward guidance sapped sentiment in December. The Fed now expects to lift rates to 5.1% in 2023, 50 bps higher than their September forecasts. The labor market remained resilient, adding more jobs than expected throughout the quarter, and the unemployment rate held steady at 3.7%. However, PMI data fell deeper into contractionary territory by December, suggesting that business activity fell at the fastest rate since May 2020.

European equities gained the most since second quarter 2020 and outperformed broader developed markets for a third straight quarter. Europe ex UK shares outgained UK counterparts on the quarter after underperforming for most of 2022. In fact, for the calendar year, UK stocks outperformed continental peers by the widest margin in 35 years.

Eurozone inflation softened but remained in double-digit territory at 10.1% YoY in November. The softness was driven largely by slowing energy prices, as core inflation rates held steady. The ECB lifted policy rates by a total of 125 bps during the quarter, bringing the benchmark deposit rate (2.00%) to its highest level since 2008. In addition to the rate hikes, the ECB announced plans to further reduce monetary accommodation by reducing the size of its balance sheet starting in March. PMI data suggested that private sector activity contracted for a sixth consecutive month in December.

UK markets navigated a volatile political environment, hawkish central bank, and waning economic momentum in fourth quarter. The new government reversed course from the widely unpopular spending plans of their predecessors and announced plans to enact £55 billion worth of fiscal austerity measures over the next five years. The BOE delivered their largest rate hike in more than 30 years in November, as inflation rose further into double-digit territory. Rate setters also warned of a potentially prolonged recession due to the further tightening necessary to tame inflation. Indeed, economic data remained weak, with PMI measures pointing to a contraction in activity for a fifth straight month in December.

Japanese equities gained for the first time in five quarters but lagged their broader developed peers. However, Japanese shares outperformed broad developed markets in major currency terms, as the yen strengthened against the US dollar by the most since 2008. The Bank of Japan (BOJ)—an ultra-easy monetary policy stalwart—unexpectedly adjusted policy in December, doubling its cap on ten-year government bond yields through its yield curve control measures. Although BOJ governor Haruhiko Kuroda described the move as an effort to improve market functioning, markets priced in expectations for further tightening ahead. The move also comes as Japanese core inflation reached a fresh 40-year high in November at 3.7% YoY. While service sector activity has rebounded, manufacturing remains weak as industrial production contracted for three straight months through November.

Pacific ex Japan equities advanced by double digits and topped broader developed peers. All four Pacific ex Japan countries gained, led by Hong Kong and New Zealand; Australia modestly lagged the broader region. New Zealand shares outperformed despite the Reserve Bank of New Zealand hiking its benchmark cash rate by 125 bps, a quarterly record since the rate was introduced in 1999. New Zealand’s economy expanded 2.0% quarter-over-quarter (QoQ) in third quarter—more than doubling analyst expectations—driven by construction, services, and tourism. The Reserve Bank of Australia lifted rates by a milder 75 bps during the quarter, opting for a slower approach, given the lag in monetary policy transmission to the real economy. Australian GDP growth slowed to 0.6% QoQ in third quarter. In 2022, Australian home prices fell at the fastest rate since 2008.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

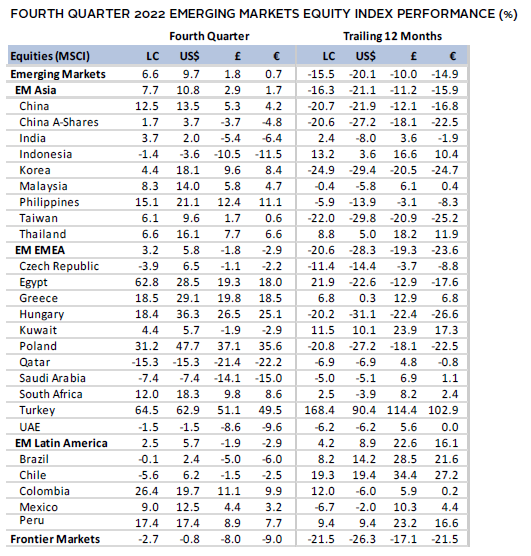

Emerging markets (EM) equities advanced but trailed their developed peers for the seventh quarter in the past two years. EM shares still managed to edge developed markets for the full year; however, they underperformed in major currency terms, given FX weakness across much of the emerging world. Among major regions, emerging Asia outperformed for the quarter, while emerging Europe, the Middle East & Africa and Latin America trailed. China gained the most among major EM countries, advancing by double digits, followed closely by South Africa. Taiwan, Korea, and India gained but trailed the broader index, while Brazil and Saudi Arabia declined. Latin American equities outperformed in 2022 and were among few major developed or emerging regions that gained for the year.

Chinese equities saw intense volatility in fourth quarter, whipsawed by COVID-19 and policy developments. Chinese stocks experienced their largest monthly losses and gains in more than a decade in October and November, respectively. The results of October’s Party Congress sapped foreign investor sentiment toward the market as Xi Jinping stacked his leadership ranks with loyalists. Shares then rebounded sharply in November on signs of a faster-than-expected unwind of the zero-COVID policy and support measures for the property sector. Economic data continued to deteriorate though. Retail sales and exports fell sharply on a YoY basis in November, industrial production growth slowed more than expected, and PMI figures remained squarely in contractionary territory. Amid this backdrop—and contrary to the global tightening bias today—the People’s Bank of China pledged to support domestic demand and push through targeted stimulus measures.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

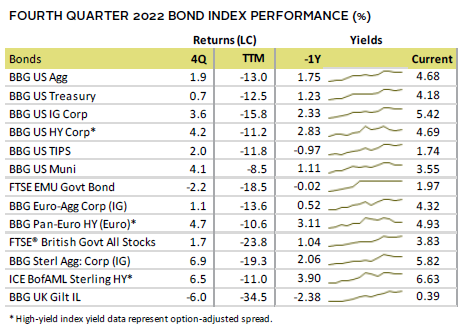

Fixed Income

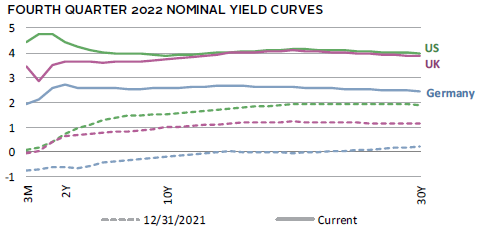

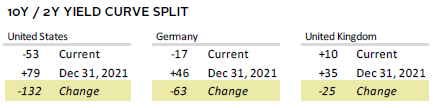

US fixed income assets gained for the first time in more than a year. In all of 2022, however, US bonds declined by double digits, with the investment-grade benchmark posting its worst year on record by a margin of 10 percentage points. Despite high volatility, intermediate-term Treasury yields were largely unchanged on the quarter. Five- and ten-year US Treasury yields ended the quarter at 3.99% and 3.88%, respectively, with both tenors finishing the quarter less than 10 bps from where they began. For the year, ten-year yields climbed 236 bps, which was their sharpest upward shift on record. Yields at the shorter end of the curve—which more closely reflect monetary policy expectations—rose sharply for both the quarter and the year, with the US yield curve reaching its most inverted state since the early 1980s.

Relative euro- and sterling-denominated bond performance largely followed their US peers in fourth quarter. UK gilts advanced, as five- and ten-year yields fell 71 bps and 37 bps to 3.61% and 3.73%, respectively. Still, UK gilts and linkers declined the most on the year, given their higher duration and sharp upward yield shifts. The UK gilt market was also temporarily thrown into crisis following the former government’s tax cut and spending plans. EMU government bonds were an outlier in fourth quarter as German ten-year bund yields rose 45 bps to 2.56% and the bund yield curve inverted.

Real Assets

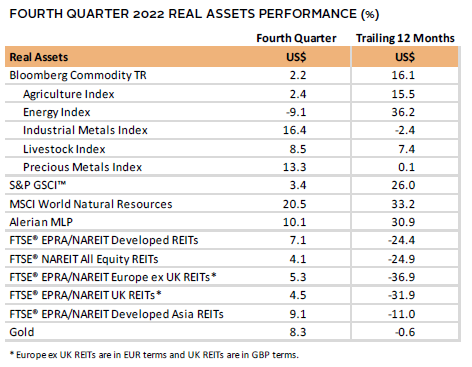

Commodity futures advanced in fourth quarter, as large gains for industrial and precious metals more than offset declining energy prices. Fourth quarter’s top performers marked a rebound from earlier in the year, as the potential for a recovery in Chinese demand and softening inflation prints boosted metals prices.

Oil prices ($85.91 for Brent and $80.26 for WTI) were relatively unchanged on the quarter but dipped to levels not seen since prior to Russia’s invasion of Ukraine. Oil markets contended with several crosscurrents during the quarter, including slowing economic growth, uncertainty regarding Chinese demand, and resilient supply of Russian oil in global markets. In addition, OPEC+ moved to cut production and an EU embargo on Russian oil went into effect in December.

Global natural resources equities and energy MLPs advanced by double digits as profits across the industry soared to record levels.

Global REITs rebounded in fourth quarter but remained deeply in the red for the year. Diminished upward momentum for bond yields and slowing inflation contributed to the rally in property securities, despite ongoing pressures from higher rates. Chinese property rallied after authorities eased financing conditions for the sector.

Gold prices rallied to $1,812.36/troy ounce, notching their first gains in three quarters. US dollar depreciation, recession fears, and stabilizing yields all boosted the yellow metal for the quarter.

Sources: Alerian, Bloomberg L.P., EPRA, FTSE International Limited, Intercontinental Exchange, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Gold performance based on spot price return.

USD-Based Investors

Risk assets rallied in fourth quarter on signs of easing inflation and slower monetary tightening. Despite the quarterly gains, most asset classes suffered heavy drawdowns in 2022. Stocks led performance in fourth quarter as broader developed markets edged emerging peers. US shares lagged, with domestic small caps gaining the least among major equity segments. US Treasuries gained the least as yields were little changed for the quarter overall, with riskier categories such as high-yield and investment-grade corporates outperforming. Gold and REITs topped commodities among real assets after underperforming for most of the year.

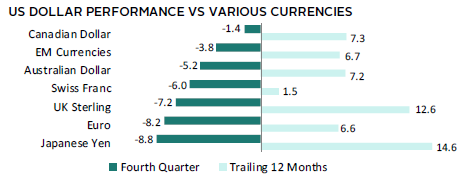

The US dollar posted its largest quarterly depreciation versus a basket of developed currencies since 2010, particularly vis-à-vis the Japanese yen, euro, and UK sterling. Despite the drawdown, the greenback strengthened broadly over the past year, appreciating the most against the Japanese yen and UK sterling.

US inflation slowed more than expected in fourth quarter, reaching 7.1% YoY in November, which was down from the recent high of 9.1% YoY in June. Core inflation rates posted their slowest month-on-month rise in more than a year. While investors cheered these reports and signals that the Fed would slow their rate-hiking pace, hawkish forward guidance sapped sentiment in December. The Fed now expects to lift rates to 5.1% in 2023, 50 bps higher than their September forecasts. The labor market remained resilient, adding more jobs than expected throughout the quarter, and the unemployment rate held steady at 3.7%. However, PMI data fell deeper into contractionary territory by December, suggesting that business activity fell at the fastest rate since May 2020.

Sources: Bloomberg Index Services Limited, FTSE International Limited, Frank Russell Company, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

EUR-Based Investors

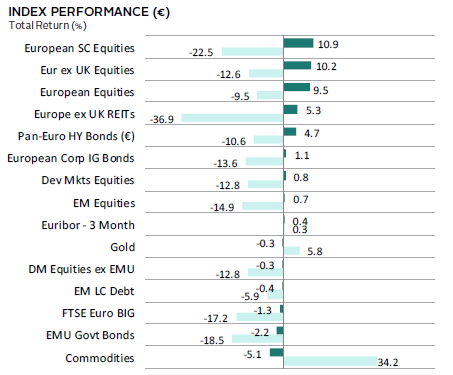

Equity markets rallied in fourth quarter on signs of easing inflation and slower monetary tightening, although other asset classes were more mixed. Most asset classes suffered heavy drawdowns in 2022. Stocks led performance in fourth quarter as European equities topped broader developed peers. Emerging markets performed roughly on par with developed shares. Euro-area government bonds declined as German bund yields continued climbing, whereas corporates advanced. Europe ex UK REITs rallied following a sharp decline during most of 2022, while gold and commodities—which are priced in US dollars—declined due to currency translation impacts from a weakening greenback.

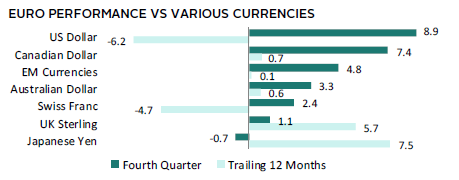

The euro mostly appreciated in fourth quarter as the ECB continued lifting policy rates. The common currency gained the most vis-à-vis the US and Canadian dollars and a basket of EM currencies but weakened versus a rebounding Japanese yen. Euro performance was more mixed over the past year.

Eurozone inflation softened but remained in double-digit territory at 10.1% YoY in November. The softness was driven largely by slowing energy prices, as core inflation rates held steady. The ECB lifted policy rates by a total of 125 bps during the quarter, bringing the benchmark deposit rate (2.00%) to its highest level since 2008. In addition to the rate hikes, the ECB announced plans to further reduce monetary accommodation by reducing the size of its balance sheet starting in March. PMI data suggested that private sector activity contracted for a sixth consecutive month in December.

Sources: Bloomberg Index Services Limited, EPRA, European Banking Federation, FTSE Fixed Income LLC, FTSE International Limited, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

GBP-Based Investors

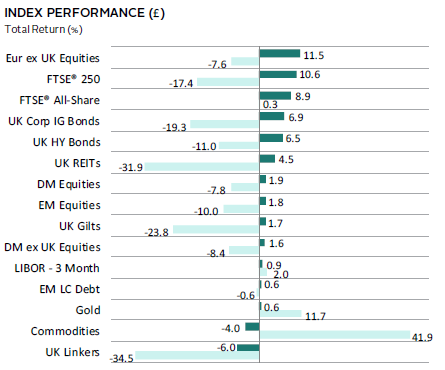

Risk assets rallied in fourth quarter. Despite the quarterly gains, most asset classes suffered heavy drawdowns in 2022. Stocks led performance in fourth quarter, with Europe ex UK and UK mid caps delivering double-digit returns. Broader UK equities topped developed markets for the quarter and were the top-performing equity market in 2022. UK investment-grade and high-yield corporates topped gilts for the quarter as yields fell. Linkers were an outlier among fixed income, falling sharply for the quarter and for the year. UK REITs rallied, whereas gold and commodities—which are priced in US dollars—lagged due to currency translation impacts from a weakening greenback.

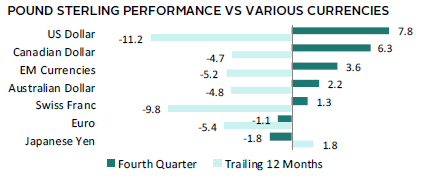

UK sterling generally strengthened in fourth quarter, gaining the most versus the US and Canadian dollars and a basket of EM currencies. The pound weakened vis-à-vis the Japanese yen and euro. Still, UK sterling depreciated markedly over the past year as political and fiscal ructions dented the currency’s value. The currency gained only against the broadly weaker Japanese yen in 2022.

UK markets navigated a volatile political environment, hawkish central bank, and waning economic momentum in fourth quarter. The new government reversed course from the widely unpopular spending plans of their predecessors and announced plans to enact £55 billion worth of fiscal austerity measures over the next five years. The BOE delivered their largest rate hike in more than 30 years in November, as inflation rose further into double-digit territory. Rate setters also warned of a potentially prolonged recession due to the further tightening necessary to tame inflation. Indeed, economic data remained weak, with PMI measures pointing to a contraction in activity for a fifth straight month in December.

Sources: Bloomberg Index Services Limited, EPRA, FTSE International Limited, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Performance Exhibits

All data are total returns unless otherwise noted. Total return data for all MSCI indexes are net of dividend taxes.

USD-Based Investors index performance chart includes performance for the Bloomberg US Aggregate Bond, Bloomberg US Corporate Investment Grade, Bloomberg US High Yield Bond, Bloomberg Municipal Bond, Bloomberg US TIPS, Bloomberg US Treasuries, ICE BofAML 91-Day Treasury Bills, FTSE® NAREIT All Equity REITs, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price, MSCI Emerging Markets, MSCI World, Russell 2000®, S&P 500, and S&P GSCI™ indexes.

EUR-Based Investors index performance chart includes performance for the Bloomberg Euro-Aggregate: Corporate, Bloomberg Pan-Euro High Yield (Euro), EURIBOR 3M, FTSE EMU Govt Bonds, FTSE Euro Broad Investment-Grade Bonds, FTSE® EPRA/NAREIT Europe ex UK RE, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price AM, MSCI Emerging Markets, MSCI Europe, MSCI Europe ex UK, MSCI Europe Small-Cap, MSCI World ex EMU, MSCI World, and S&P GSCI™ indexes.

GBP-Based Investors index performance chart includes performance for the Bloomberg Sterling Aggregate: Corporate Bond, Bloomberg Sterling Index-Linked Gilts, ICE BofAML Sterling High Yield, FTSE® 250, FTSE® All-Share, FTSE® British Government All Stocks, FTSE® EPRA/NAREIT UK RE, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price AM, LIBOR 3M GBP, MSCI Emerging Markets, MSCI Europe ex UK, MSCI World, MSCI World ex UK, and S&P GSCI™ indexes.

EM currencies is an equal-weighted basket of 20 emerging markets currencies.

Fixed Income Performance Table

Performance data for US TIPS reflect the Bloomberg US TIPS Index, with yields represented by the Bloomberg Global Inflation Linked Bond Index: US.