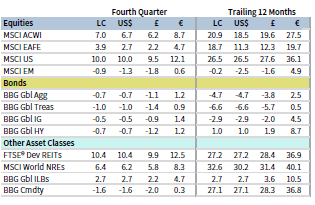

Risk assets surged in fourth quarter, capping off a year of impressive gains. Global equities advanced as US stocks topped developed ex US peers, but emerging markets shares declined again in fourth quarter. Growth bested value and large caps topped small caps, each for the third consecutive quarter. Global fixed income benchmarks generally declined as central banks turned more hawkish and inflation expectations rose. Real assets mostly advanced; energy commodities tumbled for the quarter, but still delivered top gains among major asset classes for the year. US dollar performance was mixed, the euro mostly weakened, and UK sterling generally appreciated.

Sources: Bloomberg Index Services Limited, Bloomberg L.P., EPRA, FTSE International Limited, MSCI Inc., National Association of Real Estate Investment Trusts, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Local currency returns for the Bloomberg fixed income indexes, the Bloomberg Commodity Index, and the FTSE® Developed REITs are in USD terms.

The Macro Picture

Strong economic activity and earnings helped stoke asset prices, overshadowing concerns about rampant inflation, hawkish central bank pivots, and the economic impact of the COVID-19 Omicron variant.

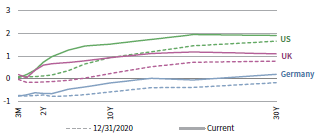

Global inflation continued accelerating and trounced expectations in fourth quarter. The US Consumer Price Index rose at the fastest year-over-year pace since 1982, and inflation across several other major economies reached multi-year highs. Central banks turned more hawkish in response: the US Federal Reserve accelerated its asset purchase tapering schedule and forecasted three rate hikes in 2022, the Bank of England (BOE) hiked rates by 15 basis points (bps) in December, and the European Central Bank (ECB) announced plans to scale down pandemic-era asset purchases in 2022. Notably, Chinese authorities moved in the opposite direction, loosening policy on both fiscal and monetary fronts.

The emergence of the Omicron variant in late November initially dampened risk sentiment, but investors turned more optimistic after early evidence suggested it is less likely than previous variants to cause severe disease. Still, markets continue to grapple with the uncertain economic impact of surging COVID-19 cases. By the end of the quarter, many countries were reporting record-breaking case counts and considering stricter containment measures. Potential limits on activity, coupled with the generally tightening policy environment, prompted analysts to moderately downgrade 2022 global economic growth forecasts.

Equities

US equities delivered double-digit gains in fourth quarter, outperforming developed ex US and emerging markets peers and notching multiple all-time highs. Following a nearly 30% gain in 2021, US stocks have effectively doubled over the trailing three-year period, delivering their strongest returns in absolute and relative terms over that horizon since the dot-com era. Recent strong performance has pushed our preferred normalized valuation metric to its third highest level on record as of quarter end. Ten of 11 S&P 500 sectors advanced for the quarter, led by real estate, information technology, and materials. Value-centric energy and financials gained the least, whereas communication services was flat. Growth and large caps topped their value and small-cap counterparts, respectively, for a third consecutive quarter.

Inflationary concerns dominated the US economic narrative in fourth quarter. Headline consumer price inflation reached 6.8% year-over-year in November and producer prices rose at a series-high 9.6%, suggesting ongoing, broad-based price pressures. The US labor market remained tight as the unemployment rate and initial unemployment claims fell and the level of job openings exceeded hires by the most on record. Consumer spending exceeded expectations as sentiment and confidence measures stabilized at the end of the quarter. Amid this economic backdrop, the Fed accelerated its policy tightening schedule, planning to commence a rate hiking cycle in 2022. US President Biden signed the $1 trillion bipartisan infrastructure bill into law; however, his broader multi-trillion dollar social spending bill stalled out in December as Democrats failed to reach an agreement on the package.

European equities advanced but lagged broader developed markets stocks due to US outperformance. Still, European shares outperformed the developed ex US index. Europe ex UK stocks bested their UK counterparts, though UK sterling strength narrowed such outperformance in major currency terms.

Service sector activity indicators weakened in Europe, largely due to surging COVID-19 cases and the reimposition of containment measures. Notably, the German services PMI dropped into contractionary territory and a ten-month low. Euro area inflation reached 4.9% year-over-year in November, the highest rate since the euro’s inception. These impacts contributed to weakening sentiment and confidence indicators, which hit multi-month lows during the quarter. Despite recent high inflation, ECB President Lagarde said rate hikes are “very unlikely” in 2022, indicating that further monetary support is required to achieve their inflation goal. Olaf Scholz was officially sworn in as German chancellor, overseeing the three-party “traffic light” coalition government, which will emphasize policy surrounding climate change among other economic reforms.

BOE policy whipsawed markets in fourth quarter. Rate setters unexpectedly held rates steady in November, opting for a patient approach upon the expiration of a pandemic furlough scheme. Markets expected a similar patient approach in December due to the emergence of the Omicron variant, but the BOE chose to lift rates. UK inflation hit 5.1% year-over-year in November, the highest rate since 2011, and labor market conditions improved, outweighing concerns over the latest COVID-19 surge. Still, service sector activity slowed in December and economic output relative to pre-pandemic levels remains the lowest among major G7 peers.

Japanese equities declined in fourth quarter, trailing all other major developed markets peers. Japanese shares lagged broader developed stocks for the full calendar year, marking their fourth straight year of underperformance. New Prime Minister Fumio Kishida announced a record stimulus package to support the ailing economic recovery, aimed at increasing real GDP by 5.6%. Kishida’s cabinet also approved a record budget during the quarter for the next fiscal year. The Japanese economy contracted by a larger-than-expected 3.6% annualized in calendar third quarter, and core consumer prices declined in October and November. Service sector activity returned to growth during the quarter, while manufacturing activity expanded despite supply constraints and rising input prices.

Pacific ex Japan equities sold off in fourth quarter and lagged the broader developed markets index. The Pacific ex Japan index gained the least among major developed markets regions for the calendar year. Australia was the lone market to post gains, whereas Singapore, Hong Kong, and New Zealand all declined. Australia’s economy appeared to have rebounded from third quarter’s milder-than-expected 1.9% quarter-over-quarter contraction. Business activity expanded for the first time in four months in October, driven by a sharp rebound in services. The labor market exceeded expectations in November, adding a record number of jobs with the unemployment rate falling to 4.6%. The Reserve Bank of New Zealand raised rates by a total of 0.50% during the quarter, bringing the policy rate to 0.75% as inflation and employment ran above target levels. New Zealand GDP fell 3.7% in third quarter, impacted by a nationwide lockdown, but the decline was far less severe than consensus estimates. Economic weakness was broad-based across most GDP components, highlighted by steep contractions in construction, manufacturing, and household consumption.

FOURTH QUARTER 2021 DEVELOPED MARKETS EQUITY INDEX PERFORMANCE (%)

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

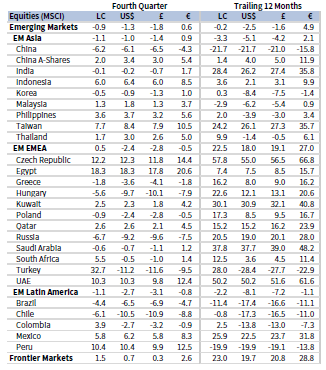

Emerging markets equities trailed their developed peers, declining for a second consecutive quarter and bringing calendar year performance into the red. Emerging shares lagged developed markets by nearly 25 percentage points (ppts) on the year, their widest underperformance margin since 2013. Investor sentiment toward emerging markets has soured; foreign investment flows to emerging markets excluding China stocks and bonds turned negative in fourth quarter for the first time since the start of the pandemic. Heavily weighted emerging Asia and Latin America trailed the broader index, whereas emerging Europe, the Middle East & Africa gained. Russia, index heavyweight China, and Brazil declined the most among major emerging countries. Saudi Arabia, Korea, and India fell but bested the broader index, while Taiwan and South Africa gained. Chinese equity losses were concentrated in offshore listings as domestically oriented A-shares advanced. Numerous emerging markets central banks, including Russia, Mexico, Colombia, Brazil, and Poland all lifted rates during the quarter to stave off mounting inflation.

China eased monetary and fiscal policies near the end of the quarter. The People’s Bank of China cut its reserve requirement ratio by 50 bps and cut the one-year loan prime rate for the first time in 20 months, while reports indicated that Chinese credit growth accelerated in November. Additionally, China’s annual Central Economic Work Conference highlighted fiscal easing measures for 2022 including new tax breaks and increased infrastructure investment. Chinese economic data were generally disappointing as retail sales decelerated, fixed asset and property investment moderated, and home prices fell for a third consecutive month in November. Property developers Evergrande and Kaisa defaulted on debt obligations after missing interest payments.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

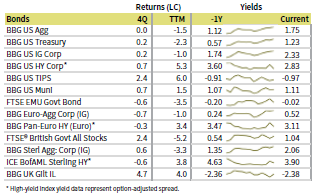

Fixed Income

The US Treasury yield curve flattened, and breakeven inflation rates climbed in fourth quarter as TIPS delivered top gains among US fixed income assets. US high-yield corporate bonds topped Treasury and investment-grade corporate peers as credit spreads ended roughly where they started. Five-year Treasury yields climbed 28 bps to 1.26%, whereas ten-year yields were unchanged at 1.52%. However, ten-year yields ranged from 1.35% to 1.68% intra-quarter. The two-year/ten-year Treasury yield spread narrowed 45 bps to 0.79 ppts, driven entirely by rising two-year yields as the Fed accelerated their monetary tightening timeline. Ten-year breakeven inflation rose 21 bps to 2.58% but had risen as high as 2.76% in November; both the ten- and five-year measures hit 20+ year highs during the quarter.

UK gilts bested investment-grade and high-yield corporates in fourth quarter, while UK linkers delivered top performance among UK fixed income categories. The UK yield curve also flattened as five-year gilt yields climbed 10 bps to 0.72%, whereas ten-year gilt yields declined 12 bps to 0.93%. Euro-denominated fixed income generally declined, but relative performance mirrored their US counterparts. Ten-year German bund yields rose 2 bps to -0.18%.

Real Assets

Commodity futures were relatively muted in fourth quarter as declines in the energy subindex offset gains among other major commodity categories. Industrial metals gained the most, driven by various metals hitting recent highs, including copper, zinc, and aluminum.

Oil prices ($77.78 for Brent and $75.21 for WTI) were relatively unchanged but rose to around $85/barrel in October before posting double-digit percentage declines in November. Various supply/demand dynamics impacted prices, including the global energy crunch early in the quarter, new international travel restrictions from the Omicron variant’s emergence, and the US-led coordinated release of strategic oil reserves among several large non-OPEC+ countries. In December, the International Energy Agency noted the oil market had returned to surplus conditions, while OPEC+ decided to stick with planned production increases.

Global natural resources equities advanced, whereas energy MLPs were more in-line with underlying commodity prices. Still, the latter delivered among the strongest real asset returns for the calendar year.

Developed REITs posted double-digit gains in fourth quarter, led by US REITs and UK REITs. Europe ex UK REITs advanced but underperformed, while developed Asia REITs declined.

Gold prices climbed to $1,822.39/troy ounce as inflation expectations climbed and real yields fell. The yellow metal rallied despite the hawkish pivot from major central banks. Gold prices declined for the calendar year, however, losing the most since 2015.

Sources: Alerian, Bloomberg L.P., EPRA, FTSE International Limited, Intercontinental Exchange, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Gold performance based on spot price return.

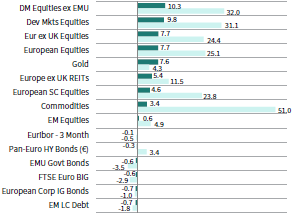

USD-Based Investors

Developed equities and inflation-sensitive assets gained the most in fourth quarter as inflation surged to multi-year highs. US stocks topped broader developed counterparts, while domestic large caps bested small caps. Emerging markets equities and local currency debt were the only major equity asset classes to decline as investor sentiment toward emerging markets has soured. US REITs outperformed all other asset classes for the quarter and full year, with commodities a close second in calendar 2021. Gold prices rallied but remained in the red on the year. TIPS led quarterly performance among domestic fixed income assets, whereas other investment-grade bonds were muted, declining for the full year.

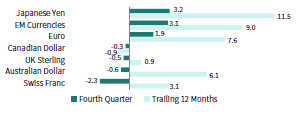

US dollar performance was mixed, advancing relative to the Japanese yen, EM currencies, and the euro, but declining the most vis-à-vis the Swiss franc. The greenback broadly appreciated over the past year, declining in value only relative to the Canadian dollar.

Headline consumer price inflation reached 6.8% year-over-year in November and producer prices rose at a series-high 9.6%, suggesting ongoing, broad-based inflationary pressures. The US labor market remained tight as the unemployment rate and initial unemployment claims fell and the level of job openings exceeded hires by the most on record. Consumer spending exceeded expectations as sentiment and confidence measures stabilized at the end of the quarter. Amid this economic backdrop, the Fed accelerated its policy tightening schedule, planning to commence a rate hiking cycle in 2022. US President Biden signed the $1 trillion bipartisan infrastructure bill into law; however, his broader multi-trillion dollar social spending bill stalled out in December as Democrats failed to reach an agreement on the package.

Sources: Bloomberg Index Services Limited, Frank Russell Company, FTSE International Limited, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

EUR-Based Investors

Developed equities and inflation-sensitive assets gained the most in fourth quarter as inflation surged to multi-year highs. European shares lagged their developed counterparts largely due to US equity outperformance. European small caps lagged their mid- and large-cap equivalents. Emerging markets stocks gained the least among major equity categories and trailed for the full year. Gold prices and commodity futures advanced, with the latter posting top gains for the year. European fixed income declined across the board for the quarter and calendar year, save for pan-euro high-yield bonds, which delivered the only gain in 2021.

The euro mostly weakened in fourth quarter, depreciating the most against the Swiss franc, Australian dollar, and UK sterling, but gaining vis-à-vis the Japanese yen and EM currencies. Relative performance trends were largely similar over the past year.

Service sector activity indicators weakened in Europe, largely due to surging COVID-19 cases and the reimposition of containment measures. Notably, the German services PMI dropped into contractionary territory and a ten-month low. Euro area inflation reached 4.9% year-over-year in November, the highest rate since the euro’s inception. These impacts contributed to weakening sentiment and confidence indicators, which hit multi-month lows during the quarter. Despite recent high inflation, ECB President Lagarde said rate hikes are “very unlikely” in 2022, indicating that further monetary support is required to achieve their inflation goal. Olaf Scholz was officially sworn in as German chancellor, overseeing the three-party “traffic light” coalition government, which will emphasize policy surrounding climate change among other economic reforms.

EURO PERFORMANCE VS VARIOUS CURRENCIES

Sources: Bloomberg Index Services Limited, EPRA, European Banking Federation, FTSE Fixed Income LLC, FTSE International Limited, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

GBP-Based Investors

Developed equities and inflation-sensitive assets gained the most in fourth quarter as inflation surged to multi-year highs. UK equities lagged their developed peers, while domestic UK mid-caps trailed the broader UK index. However, UK REITs topped all other assets in fourth quarter and bested all major equity asset classes for the full year. Emerging markets shares declined, as investor sentiment toward emerging markets stocks and bonds has soured this year. UK linkers and other real assets gained for the quarter, as commodities posted the strongest returns for the year. UK gilts and investment-grade corporates bested high-yield counterparts.

UK sterling generally appreciated in fourth quarter, advancing the most versus the Japanese yen, EM currencies, and the euro, while declining relative to the Swiss franc and Australian dollar. The pound mostly gained over the past year, rising the most relative to the Japanese yen and EM currencies, but declining relative to the US and Canadian dollars.

BOE policy whipsawed markets in fourth quarter. Rate setters unexpectedly held rates steady in November, opting for a patient approach upon the expiration of a pandemic furlough scheme. Markets expected a similar patient approach in December due to the emergence of the Omicron variant, but the BOE chose to lift rates. UK inflation hit 5.1% year-over-year in November, the highest rate since 2011, and labor market conditions improved, outweighing concerns over the latest COVID-19 surge. Still, service sector activity slowed in December and economic output relative to pre-pandemic levels remains the lowest among major G7 peers.

Sources: Bloomberg Index Services Limited, EPRA, FTSE International Limited, Intercontinental Exchange, Inc., ICE Benchmark Administration Ltd., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Performance Exhibits

All data are total returns unless otherwise noted. Total return data for all MSCI indexes are net of dividend taxes.

USD-Based Investors index performance chart includes performance for the Bloomberg US Aggregate Bond, Bloomberg US Corporate Investment Grade, Bloomberg US High Yield Bond, Bloomberg Municipal Bond, Bloomberg US TIPS, Bloomberg US Treasuries, ICE BofAML 91-Day Treasury Bills, FTSE® NAREIT All Equity REITs, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price, MSCI Emerging Markets, MSCI World, Russell 2000®, S&P 500, and S&P GSCI™ indexes.

EUR-Based Investors index performance chart includes performance for the Bloomberg Euro-Aggregate: Corporate, Bloomberg Pan-Euro High Yield (Euro), EURIBOR 3M, FTSE EMU Govt Bonds, FTSE Euro Broad Investment-Grade Bonds, FTSE® EPRA/NAREIT Europe ex UK RE, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price AM, MSCI Emerging Markets, MSCI Europe, MSCI Europe ex UK, MSCI Europe Small-Cap, MSCI World ex EMU, MSCI World, and S&P GSCI™ indexes.

GBP-Based Investors index performance chart includes performance for the Bloomberg Sterling Aggregate: Corporate Bond, Bloomberg Sterling Index-Linked Gilts, ICE BofAML Sterling High Yield, FTSE® 250, FTSE® All-Share, FTSE® British Government All Stocks, FTSE® EPRA/NAREIT UK RE, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price AM, LIBOR 3M GBP, MSCI Emerging Markets, MSCI Europe ex UK, MSCI World, MSCI World ex UK, and S&P GSCI™ indexes.

EM currencies is an equal-weighted basket of 20 emerging markets currencies.

Fixed Income Performance Table

Performance data for US TIPS reflect the Bloomberg US TIPS Index, with yields represented by the Bloomberg Global Inflation Linked Bond Index: US.