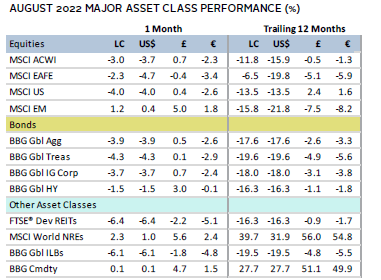

Risk assets broadly retreated in August, reversing course mid-month on the growing realization that elevated interest rates may be around longer than expected. Global equities declined for the sixth time year-to-date; emerging markets advanced, topping developed markets equities—which declined—by the widest margin in two years. Value and small caps outperformed their growth and large-cap equivalents, although all four benchmarks declined. Global bonds experienced their third steepest monthly decline in history. Treasuries declined the most, while high yields bested investment-grade peers. Real assets mostly declined, as REITs were hit particularly hard amid rising interest rates. Among major currencies, the US dollar strengthened, the euro mostly appreciated, and UK sterling broadly weakened.

Sources: Bloomberg Index Services Limited, Bloomberg L.P., EPRA, FTSE International Limited, MSCI Inc., National Association of Real Estate Investment Trusts, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Local currency returns for the Bloomberg fixed income indexes, the Bloomberg Commodity Index, and the FTSE® Developed REITs are in USD terms.

The Macro Picture

Markets remained fixated on inflation and the monetary policy outlook in August. Officials from major central banks convened at the annual Jackson Hole Economic Symposium and delivered a sobering, unified message: they will commit to forceful policy action until inflation meaningfully slows, despite likely adverse effects on economic growth.

Federal Reserve Chairman Jerome Powell delivered an unambiguously hawkish message that the Fed will maintain a restrictive policy stance until inflation returns to its 2% target, pushing back against market expectations for lower rates next year. He said the recent cooling of inflation is a welcome development but made it clear that one month of improvement falls far short of what is needed to declare the Fed’s mission accomplished. Powell acknowledged that using policy measures to reduce inflation would come with costs, likely leading to a softening of labor market conditions and economic pain for US households and businesses. Several European Central Bank (ECB) Governing Council members struck a similar tone, indicating that the ECB could turn more aggressive in its policy response as it aims to tame record inflation. The Bank of England (BOE) raised its benchmark target rate 50 basis points (bps) earlier in August and painted a bleak outlook for the rest of 2022 and 2023. Notable exceptions include Japan and China, which are both experiencing lower inflation than most of the rest of the world and focusing on more accommodative policy to reverse faltering growth.

Still, the broad messaging is clear: despite signs that price pressures may be easing in some regions, central banks are laser-focused on returning inflation to target levels—even if it means economic pain—and the reaction from markets indicates growing belief that central banks are unwavering in this commitment.

Equities

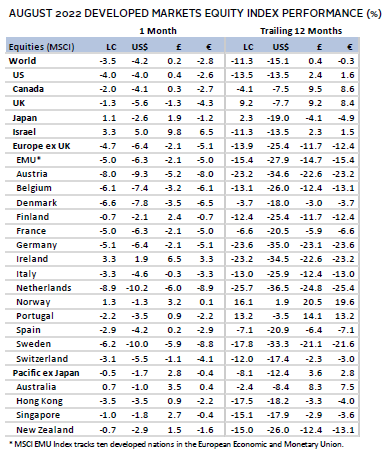

US equities declined in August, underperforming developed ex US counterparts. Small caps and value stocks held up better than large-cap and growth peers. Nine of 11 S&P 500 sectors declined. Information technology and real estate were among the worst performers, pressured by rising interest rates; healthcare was also a bottom performer. Energy and utilities were the only two sectors that increased, benefitting from ongoing—albeit mildly abating—energy price pressures. S&P 500 earnings grew 6% year-over-year in second quarter, led by energy, which saw profits increase nearly 300%. Excluding the energy sector, earnings per share declined.

The updated official GDP estimate for second quarter showed the US economy did not contract as much as initially indicated. Although the United States experienced two consecutive quarters of negative growth, meeting the definition of a “technical” recession, economic data was still generally positive. The US labor market was surprisingly strong as unemployment claims declined in August, job openings increased, and unemployment unexpectedly ticked down in July. Moreover, retail sales—excluding motor vehicles, parts, and gas—rose 0.7% in July, and measures of consumer confidence and sentiment sharply rose. However, other data made risks to US economic health apparent. Manufacturing PMI data fell toward contraction territory faster than anticipated, services PMIs unexpectedly fell deeper into contraction, and a multitude of real estate data continued to disappoint. Further, equity markets sold off sharply into month-end on the Fed’s forceful message to expect interest rates to be higher for longer, noting that despite a recent softening of inflation, it is still too early to “declare victory.”

European equities declined in August, lagging broad developed ex US shares. UK equities declined but topped the broader developed ex US index, while Europe ex UK lagged all other major developed markets and is the bottom performer over the last year.

Eurozone second quarter GDP was revised down slightly but remained positive. Headline and core inflation both increased more than expected, putting pressure on the ECB, which has lagged other global central banks at raising benchmark interest rates in the fight against rampant inflation. Measures of business activity ticked down but remain near levels that indicate neither expansion nor contraction. Business and consumer confidence measures moved up slightly but remain deeply negative, and the monetary union waded through an intensifying energy crisis. Data from economic research group ZEW showed that confidence in Germany—the Eurozone’s largest economy—continued to deteriorate in August. The country was particularly hard hit by the energy crisis and also dealt with critically low water levels on the Rhine River, affecting transit for domestic industry and exports. Adding to the gloomy outlook, Russia took the Nord Stream 1 pipeline offline at the end of the month for what it said would be three days for maintenance, a move analysts believe to be retaliation for the EU’s most recent sanctions.

The BOE raised its benchmark interest rate 50 bps in its largest hike since 1995. It now expects inflation—which surpassed expectations at 10.1% in July—to reach over 13% by the end of 2022; several major banks project UK inflation will top out even higher. Preliminary estimates showed second quarter UK GDP shrank slightly, supporting consensus outlook that the country will fall into recession this year.

Japanese equities were the only major developed market to gain in August, supported by the Bank of Japan’s (BOJ) ongoing accommodative policy; Japan remains the only major developed central bank that isn’t focused on staving off runaway inflation. Notably, the BOJ increased its ownership of local exchange-traded funds to 63% as part of its quantitative easing program. Headline inflation ticked up to 2.6% year-over-year—among its highest levels in decades, driven mostly by higher commodities prices—but remains near the BOJ’s 2% target. Second calendar-quarter GDP grew 2.2% annualized according to its first estimate, supported by solid private consumption, an indication the country may finally be rebounding from domestic COVID-19 lockdowns. Further supporting this, retail sales—one of the major drivers of the domestic economy—grew faster than expected in July. Still, BOJ Governor Haruhiko Kuroda noted the central bank has “no choice other than continued monetary easing until wages and prices rise in a stable and sustainable manner.”

Pacific ex Japan equities declined in August, as Hong Kong, Singapore, and New Zealand trailed the broader index. Australia advanced as a slew of July data supported its ongoing recovery: business confidence rebounded quicker than expected, unemployment ticked down, and retail sales expanded more than forecast. The Reserve Bank of Australia increased its benchmark cash rate 50 bps to 1.85% at its August meeting, and affirmed the central bank is committed to further tightening but noting the path of increases will be data dependent. Similarly, the Reserve Bank of New Zealand (RBNZ) increased their official cash rate by 50 bps to 3.0%. According to its most recent meeting notes, the RBNZ expects its benchmark interest rate to top out at 4.1% in early 2023 and inflation will not return to target levels until mid-2024.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

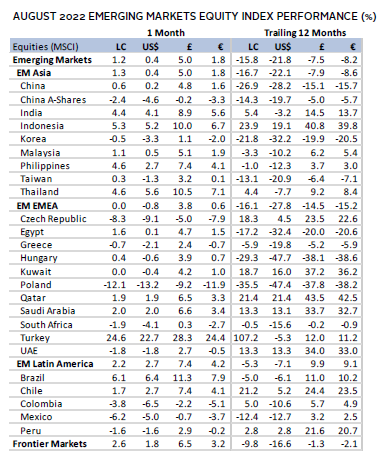

Emerging markets equities topped developed markets counterparts, advancing for just the second time this year. Performance was driven by gains in Latin America and emerging Asia, which both topped the broader index, while emerging Europe, the Middle East & Africa was flat. Among countries, Brazil, India, and Saud Arabia outgained the broad index, China and Taiwan trailed but advanced, and Korea and South Africa declined. Brazil equities’ outperformance was supported by its moderating inflation. The 10.1% year-over-year increase in July was the lowest since December, while month-on-month price levels fell 0.7%—the steepest single-month decline since records began in 1980.

Chinese equities were boosted by a landmark deal allowing US regulators access to audits of Chinese firms listed in the United States, potentially saving about 200 Chinese companies from having to delist from US stock exchanges. However, investors remained cautious as details of the deal were limited. Most other news out of the world’s second largest economy painted a bleaker picture. July economic data disappointed as retail sales growth and industrial production missed expectations, and youth unemployment reached its highest level on record at nearly 20%. The People’s Bank of China cut three key lending rates in August, impacting households, businesses, and new home buyers as the country struggles with the effects of its zero-COVID strategy, slowing global growth, and its worsening property crisis. Official and independent preliminary manufacturing PMIs indicated China’s manufacturing sector contracted in August, affected by power cuts and temporary factory closures due to COVID-19 lockdowns and a substantial drought.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

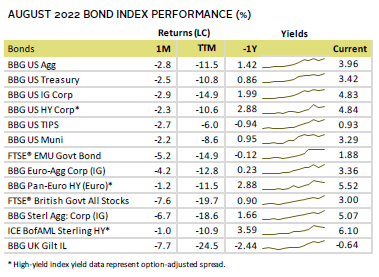

Fixed Income

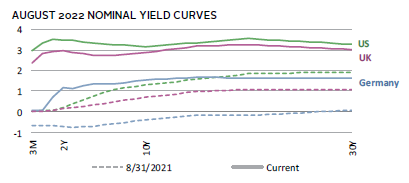

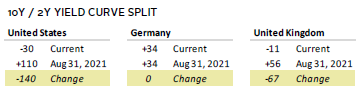

US fixed income securities broadly declined in August as interest rates rose across maturities and the Fed sent a forceful message to expect higher rates for longer. Investment-grade corporate bonds declined the most, falling more than Treasuries and high-yield corporate peers. Five- and ten-year Treasury yields rose 60 bps and 48 bps to 3.30% and 3.15%, respectively. The ten-year/two-year yield curve retreated 8 bps to -30 bps and has now been inverted for 41 consecutive business days; since data became available in the mid-1970s, every time the ten-year/two-year yield curve has inverted for at least 20 consecutive business days, there has been an official recession within the following two years. TIPS trailed nominal Treasuries as real ten-year interest rates rose 53 bps to 0.67%, and tax-exempt municipal bonds declined the least.

UK and eurozone bonds performed similarly—high-yield corporates declined moderately, investment-grade declined steeply, and government bonds declined the most. UK gilts were particularly hard hit as five- and ten-year yields rose 112 bps and 93 bps to 2.73% and 2.86%, respectively, both reaching their highest levels in about a decade. UK linkers were the bottom-performing major fixed income asset class. German ten-year bund yields rose 71 bps to 1.54%. German and Italian ten-year bond yield spreads were relatively unchanged, held in check by the ECB’s new policy tool to minimize spreads between member-countries’ borrowing costs.

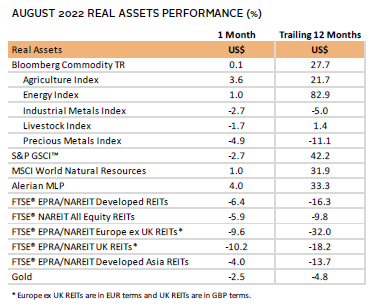

Real Assets

Energy commodities were again mixed in August as differences in composition led to divergent performance among the major commodity futures benchmarks. According to the Bloomberg Commodity Index, energy was one of two sectors to advance, while in the energy-heavy S&P GSCI, energy declined and was the bottom-performing subsector. Regardless, the broad stories in commodities were rising natural gas prices as Europe moves away from reliance on Russian gas, increasing agriculture prices impacted by Russia’s invasion of Ukraine, and declining oil prices on slowing global growth outlook.

Oil prices ($96.49 for Brent and $89.55 for WTI) steeply declined for a third consecutive month as slowing demand from China and a stronger dollar outweighed a potential OPEC+ supply cut and simmering conflict in Libya.

Global natural resources equities and energy MLPs gained and were among top-performing major asset classes.

Global REITs posted heavy declines as government bond yields rose and central bankers meeting at the Jackson Hole Economic Symposium uniformly indicated higher rates are here for the foreseeable future. UK REITs and Europe ex UK REITs fell the most, while US REITs and developed Asia REITs outperformed but also declined.

Gold prices continued their downward trend, ending the month at $1,719.56/troy ounce—the lowest month-end level in 17 months—and extending its trailing 12-month decline as the dollar strengthened.

Sources: Alerian, Bloomberg L.P., EPRA, FTSE International Limited, Intercontinental Exchange, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Gold performance based on spot price return.

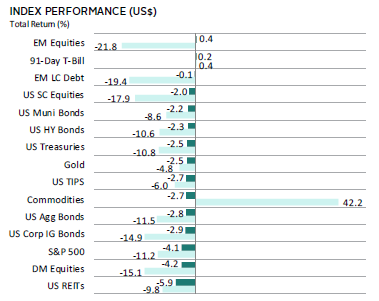

USD-Based Investors

Risk assets broadly retreated in August, reversing course mid-month on growing realization that elevated interest rates may be around longer than expected. Emerging markets equities were the only risk asset to advance, topping developed markets peers by about 460 bps. US equities edged broader developed markets, while domestic small caps held up better than large-cap peers. Among domestic bond indexes, high-yield corporates outperformed investment-grade corporates, and nominal Treasuries topped TIPS; tax-exempt municipal bonds were top performers. Notably REITs declined the most as government bond yields rose sharply.

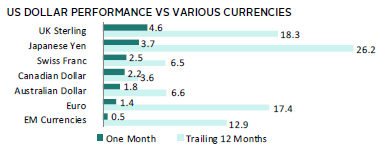

The US dollar reached a 20-year high on hawkish comments from Fed Chair Powell, advancing against all other major currencies. The greenback advanced the most vis-à-vis UK sterling and safe-havens Japanese yen and Swiss franc. The US dollar is up versus all major currencies over the last 12 months as well, advancing the most against the Japanese yen, UK sterling, and the euro.

The US labor market was surprisingly strong as unemployment claims declined in August, job openings increased, and unemployment unexpectedly ticked down in July. Moreover, retail sales—excluding motor vehicles, parts, and gas—rose 0.7% in July and measures of consumer confidence and sentiment sharply rose. However, other data made risks to US economic health apparent. Manufacturing PMI data fell toward contraction territory faster than anticipated, services PMIs unexpectedly fell deeper into contraction, and a multitude of real estate data continued to disappoint. Further, markets appeared spooked by the Fed’s forceful message to expect interest rates to be higher for longer, noting that despite a recent softening of inflation, it is still too early to “declare victory.”

Sources: Bloomberg Index Services Limited, FTSE International Limited, Frank Russell Company, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

EUR-Based Investors

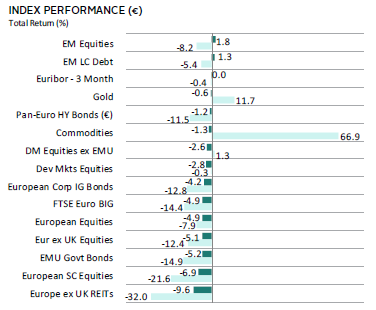

Risk assets broadly retreated in August, reversing course mid-month on growing realization that elevated interest rates may be around longer than expected. Emerging markets equities led the very few risk assets to advance, topping developed markets peers by about 460 bps. Europe ex UK equities lagged broader developed markets, while European small caps were one of the worst performers, trailing large-cap peers. Among European bond indexes, high-yield corporates outperformed investment-grade corporates, and EMU government bonds lagged all other major fixed income categories. Notably, REITs declined the most as government bond yields rose sharply.

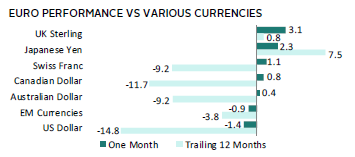

The euro mostly advanced in August, appreciating the most versus UK sterling, Japanese yen, and Swiss franc, and only declining vis-à-vis the US dollar and our basket of emerging markets currencies. The reverse is true over the trailing 12-month period, where the common currency showed marked weakness, declining by double digits vis-à-vis the US and Canadian dollars, and nearly 10% against the Australian dollar and Swiss franc.

Headline and core inflation both increased more than expected, putting pressure on the ECB, which has lagged other global central banks at raising benchmark interest rates in the fight against rampant inflation. Measures of business activity ticked down but remain near levels that indicate neither expansion nor contraction. Business and consumer confidence measures moved up slightly but remain deeply negative and the monetary union waded through an intensifying energy crisis. Adding to the gloomy outlook, Russia took the Nord Stream 1 pipeline offline at the end of the month for what it said would be three days for maintenance, a move analysts believe to be retaliation for the European Union’s most recent sanctions.

Bloomberg Index Services Limited, EPRA, European Banking Federation, FTSE Fixed Income LLC, FTSE International Limited, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

GBP-Based Investors

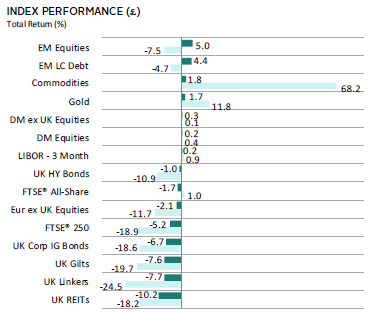

Risk assets broadly retreated in August, reversing course mid-month on growing realization that elevated interest rates may be around longer than expected. Emerging markets equities led the few risk assets to meaningfully advance, topping developed markets peers by about 480 bps. UK equities lagged broader developed markets, while UK mid caps trailed domestic large caps. Among UK bond indexes, high-yield corporates outperformed investment-grade corporates, and nominal UK gilts edged linkers. Commodities and gold also advanced, but this was due to sterling’s sharp decline against the US dollar. Notably, REITs declined the most as government bond yields rose sharply.

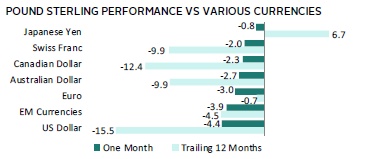

UK sterling broadly weakened in August as inflation hit new highs this cycle and the BOE painted a bleak outlook for the rest of 2022 and 2023. UK sterling declined the most versus the US dollar, our basket of emerging markets currencies, and the euro. Sterling is similarly weak over the past 12 months, falling by double digits vis-à-vis the US and Canadian dollars, and declining nearly 10% against the Australian dollar and Swiss franc.

The BOE raised its benchmark interest rate 50 bps in its largest hike since 1995. It now expects inflation—which surpassed expectations at 10.1% in July—to reach over 13% by the end of 2022; several major banks project UK inflation will top out even higher. Preliminary estimate showed second quarter UK GDP shrank slightly, supporting consensus outlook that the country will fall into recession this year.

Sources: Bloomberg Index Services Limited, EPRA, FTSE International Limited, Intercontinental Exchange, Inc., J.P. Morgan Securities, Inc., MSCI Inc., National Association of Real Estate Investment Trusts, Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Performance Exhibits

All data are total returns unless otherwise noted. Total return data for all MSCI indexes are net of dividend taxes.

USD-Based Investors index performance chart includes performance for the Bloomberg US Aggregate Bond, Bloomberg US Corporate Investment Grade, Bloomberg US High Yield Bond, Bloomberg Municipal Bond, Bloomberg US TIPS, Bloomberg US Treasuries, ICE BofAML 91-Day Treasury Bills, FTSE® NAREIT All Equity REITs, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price, MSCI Emerging Markets, MSCI World, Russell 2000®, S&P 500, and S&P GSCI™ indexes.

EUR-Based Investors index performance chart includes performance for the Bloomberg Euro-Aggregate: Corporate, Bloomberg Pan-Euro High Yield (Euro), EURIBOR 3M, FTSE EMU Govt Bonds, FTSE Euro Broad Investment-Grade Bonds, FTSE® EPRA/NAREIT Europe ex UK RE, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price AM, MSCI Emerging Markets, MSCI Europe, MSCI Europe ex UK, MSCI Europe Small-Cap, MSCI World ex EMU, MSCI World, and S&P GSCI™ indexes.

GBP-Based Investors index performance chart includes performance for the Bloomberg Sterling Aggregate: Corporate Bond, Bloomberg Sterling Index-Linked Gilts, ICE BofAML Sterling High Yield, FTSE® 250, FTSE® All-Share, FTSE® British Government All Stocks, FTSE® EPRA/NAREIT UK RE, J.P. Morgan GBI-EM Global Diversified, LBMA Gold Price AM, LIBOR 3M GBP, MSCI Emerging Markets, MSCI Europe ex UK, MSCI World, MSCI World ex UK, and S&P GSCI™ indexes.

EM currencies is an equal-weighted basket of 20 emerging markets currencies.

Fixed Income Performance Table

Performance data for US TIPS reflect the Bloomberg US TIPS Index, with yields represented by the Bloomberg Global Inflation Linked Bond Index: US.