Global equities stumbled for the third consecutive week as geopolitical tensions drove market volatility higher. There were indications that the US Federal Reserve’s interest rate cuts will not begin as soon as previously expected, dampening investor sentiment.

- Israel launched a retaliatory attack against Iran. The aerial strike appeared to be limited in scope, but markets remained on edge. The VIX Index, which represents implied volatility, ended the week at its highest level since October 2023.

- The US economy continued to show strength. Both retail sales and industrial production readings topped expectations. These readings came after the higher-than-expected March inflation release. The US ten-year Treasury note moved 12 basis points higher to 4.62%.

- Investors expected a delayed timeline for Fed rate cuts. Fed Chair Jerome Powell noted on Tuesday that it is taking longer than expected for inflation to return to the targeted 2% level, and markets are now pricing only one rate cut in 2024.

- The European Central Bank (ECB) appeared ready to cut its policy rate in its June meeting. Inflation has continued to cool in the Eurozone, which supports potential rate cuts. However, ECB officials have noted that policy divergence between the Fed and the ECB could drive the value of the euro lower versus the US dollar.

- Growth stocks stumbled as concerns about higher-for-longer US interest rates weighed on large technology companies. The MSCI World Growth Index shed almost 5%, its worst weekly loss since September 2022.

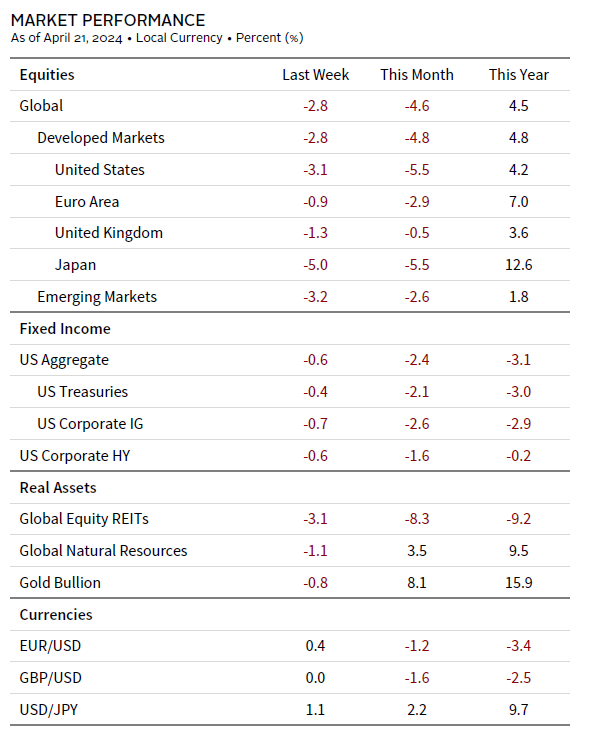

Sources: Bloomberg Index Services Limited, MSCI Inc., and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: This edition was prepared on April 21, 2024, and it reviews developments of the prior week. The equity data are total returns net of dividend taxes of MSCI indexes in local currency. Global natural resources equities are represented by the MSCI All Country World Commodity Producers Index. The fixed income data are total returns for Bloomberg indexes. Gold Bullion uses near-month gold futures contracts, as traded on the COMEX, to determine performance. Currency performance is based on Reuters data.