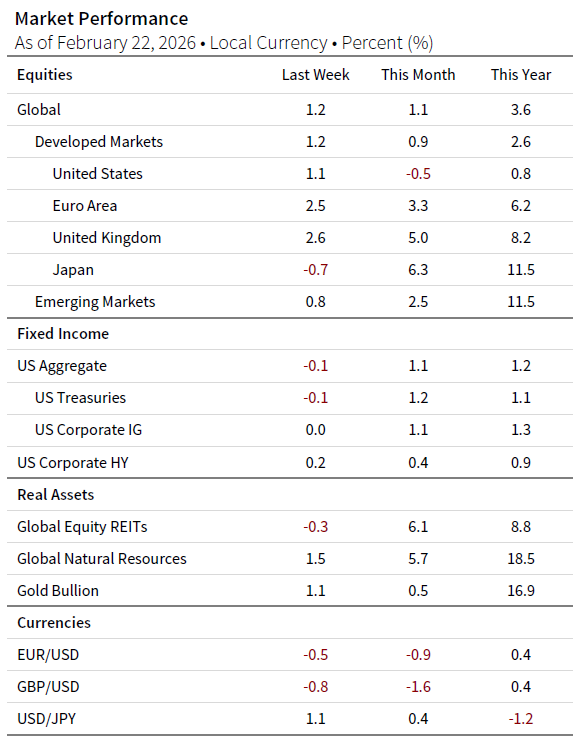

Global equities posted positive returns, boosted by a rally on Friday as the US Supreme Court struck down a significant part of the Trump administration’s tariff policy.

- Global equities jumped following the US Supreme Court ruling that the “reciprocal tariffs” issued under the International Emergency Economic Powers Act (IEEPA) were illegal. European markets outperformed last week, given the benefit of reduced tariffs, while Japan and emerging markets lagged, as Asian markets were closed before the tariff ruling was announced.

- US government bond yields rose modestly, buffeted by conflicting economic data and the tariff ruling. Q4 US GDP growth, hit by the US government shutdown during the quarter, came in much lower than expected at 1.4% quarter-over-quarter annualized, compared to 4.4% growth in Q3. For 2025 as a whole, GDP growth was 2.2%. However, core PCE prices—the Federal Reserve’s preferred inflation metric—came in higher than expected at 3.0% for 2025, which pushed back Fed rate cut expectations. The tariff ruling also pushed up bond yields, given the need to refund an estimated $160B in tariffs.

- Gold and natural resources also rallied, partly due to growing concerns about a possible military strike on Iran. REITs sold off on the back of higher interest rates, which also helped the US dollar rise.

Sources: Bloomberg Index Services Limited, MSCI Inc., and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: This edition was prepared on February 22, 2026, and it reviews developments of the prior month. The equity data are total returns net of dividend taxes of MSCI indexes in local currency. Global natural resources equities are represented by the MSCI All Country World Commodity Producers Index. The fixed income data are total returns for Bloomberg indexes. Gold Bullion uses near-month gold futures contracts, as traded on the COMEX, to determine performance. Currency performance is based on Reuters data.