Global markets reflected a positive risk environment in February, supported by positive economic data and ongoing sector rotations. While geopolitical tensions and sector headwinds created volatility, most major equity and fixed income markets posted gains, with strong results in certain regional equity and real asset categories.

- Economic data releases continued to bolster risk sentiment. February PMI figures for major regions, including the US, euro area, and Japan, all signaled expanding activity. Notably, euro area manufacturing PMI reached its highest level in over three years.

- Software stocks underperformed as new AI tools raised concerns about long-term revenue streams. However, aggregate analyst growth expectations for the sector, both near and long term, remained unchanged.

- The rotation in equity markets continued, with value stocks generally outperforming growth stocks and small-cap equities tending to outperform large-cap equities.

- The US and Israel conducted strikes against Iran following escalating threats related to concerns over Tehran’s nuclear ambitions. US President Trump urged the Iranian people to overthrow their government. Near-month WTI futures rose 8% during the month, reaching $67 per barrel.

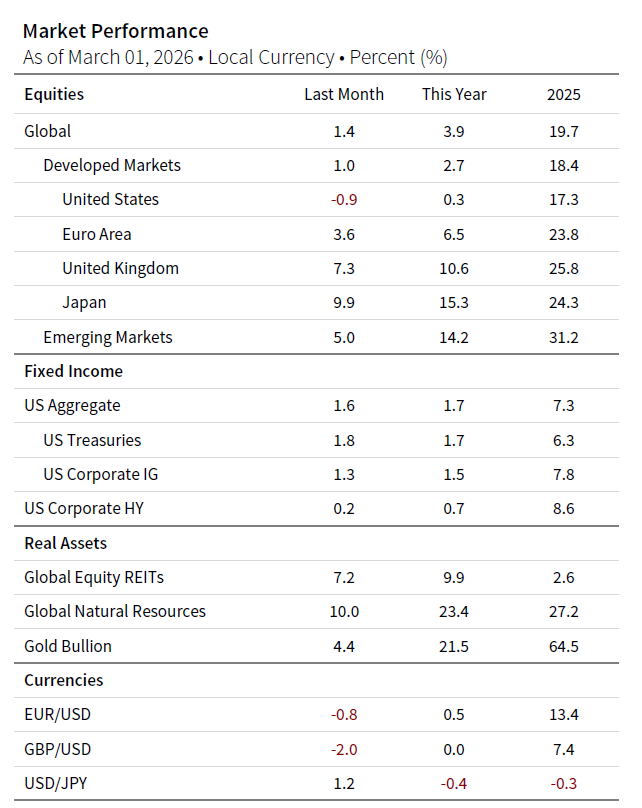

Sources: Bloomberg Index Services Limited, MSCI Inc., and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: This edition was prepared on March 1, 2026, and it reviews developments of the prior month. The equity data are total returns net of dividend taxes of MSCI indexes in local currency. Global natural resources equities are represented by the MSCI All Country World Commodity Producers Index. The fixed income data are total returns for Bloomberg indexes. Gold Bullion uses near-month gold futures contracts, as traded on the COMEX, to determine performance. Currency performance is based on Reuters data.