Once perceived as a US ally, India has recently been thrust into geopolitical crosshairs. On August 27, the United States imposed an additional 25% tariff on India in response to India’s continued purchases of Russian oil, on top of a 25% “reciprocal” tariff rate announced previously. As a result, India now faces a tariff rate of 50%, which is the highest in Asia and amongst the highest globally. The latest US tariffs create added uncertainty for India’s economy and equity market, which are already facing headwinds from slower economic growth and elevated equity valuations. Indeed, Indian equities have underperformed broader emerging markets (EM) since late 2024, and the gap in performance has widened in recent months as trade negotiations between the United States and India stalled. Despite the recent decline in Indian equities, we do not think now is an opportune time for investors to overweight the region, given increased macro uncertainty and still elevated valuations. Instead, within EM, we favor Latin American equities, where valuations remain at a deep discount both in absolute and relative terms, thus offering lower downside risks and higher upside potential.

Growth in India had Been Cooling, Even Ahead of Recent Tariffs

Indian equities have declined 13.6% since September 2024 in US dollar terms—a contrast to broader EM, which gained 9.5%. Close to half of India’s underperformance has come in the past two months as trade negotiations stalled between the United States and India. This recent equity market weakness is a sharp reversal from its prior strength between 2022 and 2024, when Indian equities beat EM peers by more than 11 percentage points (ppts) annualized,[1]Based on the trailing three-year relative performance ended September 30, 2024, in USD terms. and reflects a market that is facing cooling economic growth, even ahead of tariffs. India’s GDP growth came in at 6.5% in the fiscal year ended March 2025, down from 9.2% the prior year, as the post-COVID boost from increased government spending and private capital expenditures faded. The lagged impact of tight monetary policy has also weighed on credit growth, which continues to decelerate despite recent policy easing by the Reserve Bank of India (RBI). Consensus forecasts expect India’s growth will continue to moderate in the coming fiscal year and remain at 6.4%, although these estimates likely do not yet reflect the impact of the August 27 US tariffs, which are expected to place a further 0.5–1.0-ppt drag on India’s GDP growth.

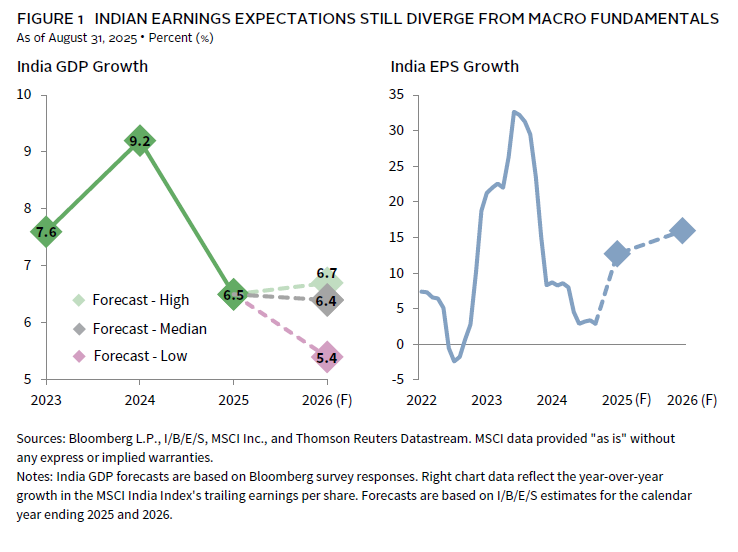

Amid cooling economic growth, Indian corporate earnings have also come under pressure (Figure 1). As of August 31, trailing 12-month earnings per share (EPS) grew by 2.9% year-over-year, a slowdown from the 8.7% growth in 2024 and below the long-term average of 10%. Yet, while forward earnings growth expectations have been revised lower, they remain optimistic, with analysts still expecting Indian EPS growth of 12.7% for 2025 and 15.9% in 2026. In our view, achieving above-trend earnings growth is unlikely considering the already weakening economic backdrop and the added impact of US tariffs. On one hand, the direct impact of tariffs on Indian corporate earnings should be modest, given less than 8% of the MSCI India Index’s total revenues are derived from the United States, and some of these revenues are either exempt from the higher levies[2]The 50% tariffs apply only to goods exports (i.e., excludes services exports), and excludes sectors that are subject to separate sectoral tariff rates such as consumer electronics and pharmaceuticals. or derived from Indian company subsidiaries based in the United States. However, the second order impact of tariffs on domestic growth and consumption do not yet seem to be reflected in the earnings outlook.

In addition, while valuations for Indian equities have declined, they remain elevated. Our preferred valuation metric for India is at the 85th percentile relative to its own history, and at the 75th percentile relative to broader EM equities. Current levels of valuations add to downside risks, particularly amid a weakening backdrop and increased macro uncertainty (Figure 2).

Tariffs Add to Near-term Macro Uncertainty, While Challenging India’s Longer-term Outlook

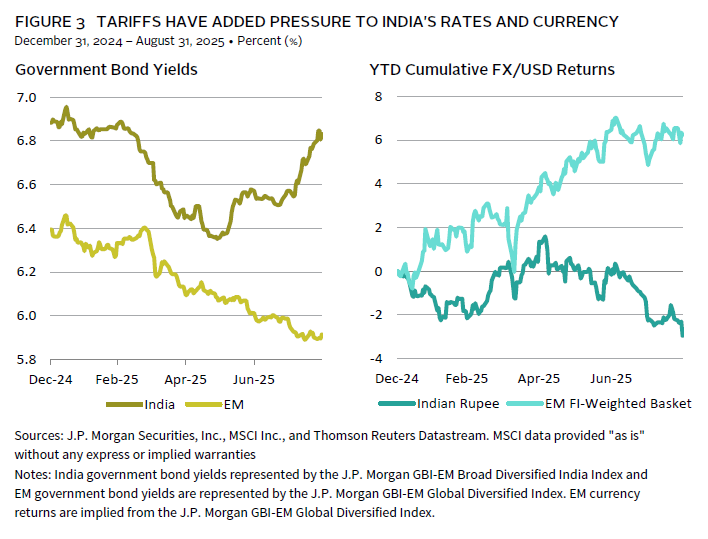

At this stage, it is premature to assume that the 50% US tariffs on India will stay in effect, as they could be a negotiation tool. In the near term, India also has some buffer, given its economy is more domestically oriented than other Asian peers. Private consumption accounted for around 60% of India’s GDP in 2024, while goods exports to the United States made up 2%. Furthermore, certain key Indian exports such as pharmaceuticals and electronics are currently subject to separate, lower sectoral tariff rates. As such, it is estimated that the restrictive 50% levy will impact around half of India’s goods exports to the United States, or 1% of India’s GDP. At this level, it may be manageable in the near term, as there is scope for the government to stimulate domestic demand to counter the drag to exports. India has already introduced modest income tax cuts this year and is moving to reform and reduce its goods and services taxes to further boost demand. The RBI has also cut rates aggressively by 100 basis points since February, bringing its policy rate to 5.5%. Nevertheless, the extent to which India further stimulates remains to be seen, given the government’s focus on fiscal consolidation. Considerations around inflation and currency stability may also constrain further RBI easing. Indeed, the Indian rupee has depreciated 3.0% year-to-date to an all-time low against the US dollar amid tariff uncertainty, a contrast to other emerging market currencies which remain up against a weaker dollar. At the same time, Indian bond yields have also moved higher, unlike other emerging market bonds which continue to rally year-to-date (Figure 3).

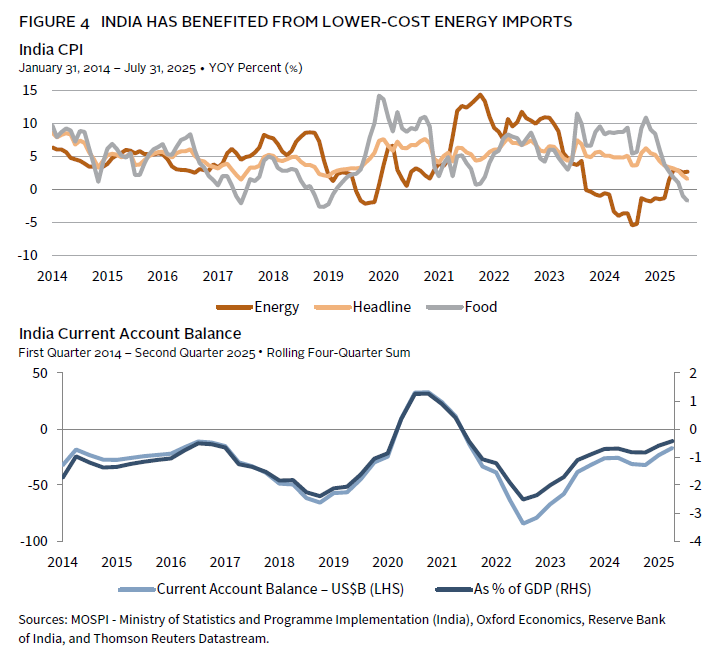

The recent moves in India’s rates and currency highlight the broader implications for India from moving away from cheaper Russian oil, which Trump has stipulated is necessary for the punitive 25% tariffs to be removed and to which India has yet to agree to. India currently imports around one-third of its oil from Russia at a discount that is reported at 5% relative to global oil prices. From a direct cost-savings perspective, India appears to have more to lose from higher tariffs compared to cutting Russian oil, given savings from the latter amounted to just 0.1% of GDP in the latest fiscal year. However, India has seen other benefits to lower-cost energy imports, including lower domestic inflation and a narrowing of its current account deficit, which in turn has supported the Indian rupee (at least, until recently). A decision to cut back from Russian oil would cause a reversal of all three outcomes. The extent of the price shock to India is also uncertain, given the move will likely drive up global oil prices, but the resultant impact will be upwards pressure on India’s inflation and rates, which add to headwinds for its economy and equity market (Figure 4).

Since the announcement of the tariffs, India has stepped up public appearances with Russia and China, indicating it is not in a rush to pivot from Russian oil and is willing to distant itself from the United States. India’s response thus far indicates it recognizes the challenges to pivoting from Russian oil, and therefore is willing to sacrifice some exports-led growth in the short term. Political motivation may be another factor, given the United States has sought for India to lower its own agricultural import barriers, a move that India has been unwilling to compromise on for political and economic reasons. As such, India appears to be caught between a rock and a hard place. In the near term, higher tariffs may be manageable considering the composition of its economy. However, should tariffs of 50% remain permanent or expand to other sectors, they will ultimately dampen India’s export competitiveness to the United States compared to other Asian peers and create a drag on India’s exports growth. Overall, the fact that India itself is now in the crosshairs of US tariffs challenges Prime Minister Narendra Modi’s manufacturing ambitions for the economy, which had been one anticipated growth engine for India’s longer-term employment and structural growth.

Conclusion

Given the increased macro uncertainty, we would not overweight India at this time, particularly as equity valuations remain elevated despite the recent underperformance. Trade policies remain in flux, and there are measures that India can take to counter the near-term impact of tariffs. However, investors should monitor negotiations around India’s Russian oil imports, as these could have wider implications for the economy and market, especially the rupee. Within EM, we continue to recommend a modest overweight to Latin American equities, which are relatively more insulated from trade shocks compared to other EM peers, and where depressed valuations can offer more attractive upside potential.

Vivian Gan, Investment Director, Capital Market Research

Graham Landrith also contributed to this publication.

Footnotes