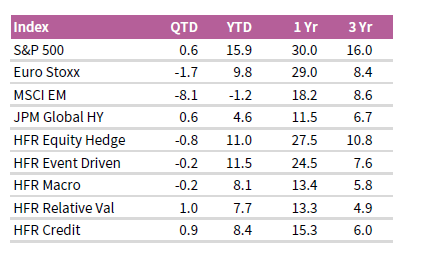

Global capital markets were volatile during third quarter 2021. In September, equity markets gave back most of the gains made earlier in the quarter. Markets are reacting to concerning economic and inflation data, geopolitical risks, and potential central bank tightening. Core hedge fund strategies were mixed but relatively flat during the third quarter. HFRI Equity Hedge (Total) produced -0.8%, HFRI Event Driven (Total) declined 0.2%, HFRI Macro returned -0.2%, and HFRI Relative Value gained 1.0%.

Sources: Hedge Fund Research, Inc. J.P. Morgan Securities, Inc., MSCI Inc., Standard & Poor’s, Stoxx®, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: Hedge Fund Research index data are preliminary for the proceeding five months. Returns are represented by total returns, except for three-year, which is represented by average annual compound returns. MSCI indexes return data are net of dividend taxes.

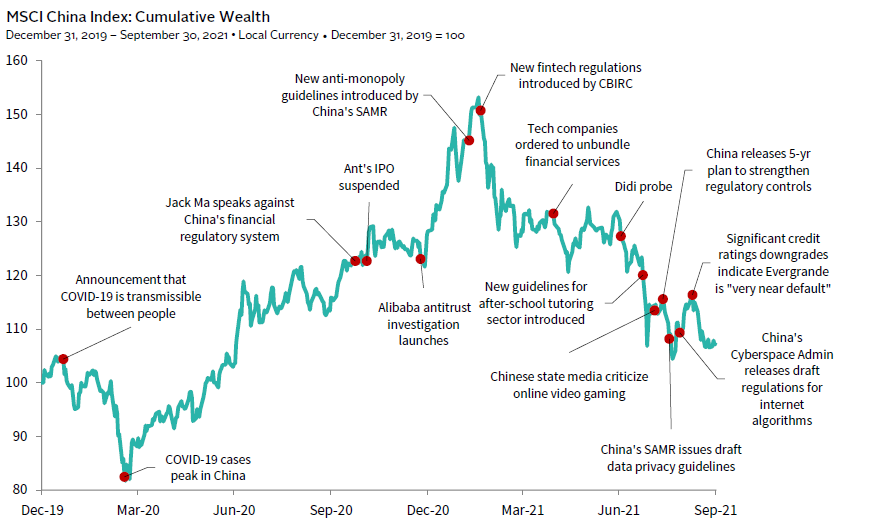

Chinese markets declined precipitously during third quarter 2021. Evergrande, one of the largest property developers in China, missed multiple debt payments, causing a sell-off in the Chinese bond market. Chinese equites (MSCI China, -18.2%) contributed to declines on continued government scrutiny and regulation on certain sectors, fears of potential contagion related to Evergrande, and rising tensions with the United States. Widely held Chinese technology names, such as Alibaba and Tencent, declined 20%–30% during the third quarter. Many Chinese equities are down more than 50% year-to-date.

As a result of increased regulatory uncertainty from the Chinese government beginning late 2020, US- and European-based long/short equity managers began reducing China long exposure and adding to shorts; therefore, losses during the third quarter related to China were negligible. Goldman Sachs reports hedge fund selling of Asian equities continued during the quarter, led by Chinese equities. In August, EM Asia also experienced its largest net selling in more than five years. Hedge fund selling in EM Asia continued into September, but there was modest net buying in Chinese equities, according to Goldman Sachs.

Asia long/short equity experienced losses, with some China managers drawing down 10%–20% during the quarter. High growth sectors, such as healthcare and technology, declined most. Gross and net exposure levels have reached the lowest levels in over a year.

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

The magnitude of the moves in Chinese markets is consistent with historical drawdowns in EM Asia. The uncertainty around future government regulation and geopolitical risk is weighing on many sectors. However, over the last several years, Chinese and Asian markets more broadly have been very attractive for alpha production due to the region’s economic size, diversity, and market inefficiencies. According to Goldman Sachs, Asia long/short equity has appreciated 1.5% and Chinese long/short equity is down 2.7% year-to-date versus MSCI China’s decline of nearly -20%. This illustrates that even in an extremely challenging market environment, alpha remains strong. Adding to long/short equity exposure in the region represents a compelling counter-cyclical opportunity.

Eric Costa, Global Head of Hedge Funds

Kristin Roesch also contributed to this publication.