Global equity markets continued to advance in third quarter 2017. The S&P 500 Index reached new record highs and had returned 4.5% by quarter-end, bringing year-to-date returns to 14.2%. Most major US sectors, as represented by the corresponding S&P 500 indexes, appreciated in third quarter; the exception, consumer staples, returned –1.3%. Energy and information technology led other sectors, returning 6.8% and 8.6%, respectively, for third quarter. European and emerging markets equity indexes produced strong results as well, particularly in USD terms. The STOXX 600 Index returned 6.5% for third quarter and 23.2% year-to-date (in USD terms), and the MSCI Emerging Markets Index returned 7.9% for third quarter and 27.8% year-to-date. This outcome stands in stark contrast to those of recent years, when US equity markets, as represented by the S&P 500, were generally the top performer. The more recent dominance of non-US equity markets has been an inherent tailwind for active managers, given that so much global capital is invested passively in the S&P 500. This quarter, we discuss the positive effect this reversal had on fundamental strategies, and the challenges momentum-based managers confronted.

Fundamental Hedge Fund Strategies

Fundamentals-focused hedge fund managers continued to benefit from the shift toward non-US equity market leadership. The HFRI Equity Hedge Index returned 3.7% for third quarter, and the HFRI Event-Driven Index, 2.1%. In recent quarters, we have encouraged patience with fundamental hedge fund strategies such as long/short equity and event driven, bearing in mind the cyclicality of return streams. The sustained rebound in these strategies’ performance remains broadly encouraging.

Europe- and Asia-focused fundamental hedge fund managers we follow have also achieved attractive performance. Goldman Sachs recently reported that these managers’ year-to-date returns as of third quarter had exceeded those of Americas-focused strategies by 0.8% and 5.5%, respectively. Year-to-date, Morgan Stanley reports that, on average, European long/short equity managers have returned 9.4%; US long/short, 8.6%; and Asia long/short, 14.1%. Our own data show significantly better results from the non-US long/short equity managers we follow closely. Last year, performance data from both Goldman Sachs and Morgan Stanley showed that US-based hedge fund managers had significantly outperformed their European and Asian counterparts. The latter’s improved performance in 2017 has bolstered investor demand for non-US equity long/short managers. According to Morgan Stanley, hedge fund exposure to European equities has increased recently, but remains 54% below its 2007 peak.

Non-US equity markets are less crowded than US markets, so the trend toward non-US equities could persist. Although performance results and flow data are backward looking, results so far this year serve as a reminder that diversified and balanced hedge fund investing across strategies as well as geographies can enhance returns before the benefit of manager selection.

Diversifying Strategies

Third quarter extended the streak of poor performance among momentum-based hedge fund strategies that began in March 2015. Excluding equities, markets continued to exhibit mean-reverting (rather than trending) characteristics. Pure trend strategies faced the greatest hurdles, as evidenced by the Société Générale Trend Index, which returned –0.1%. The Société Générale CTA Index, which is also momentum based, returned 0.7%. Discretionary macro managers were unable to navigate the choppy markets much better, despite a heavy carried-interest component, and returned 0.39%.

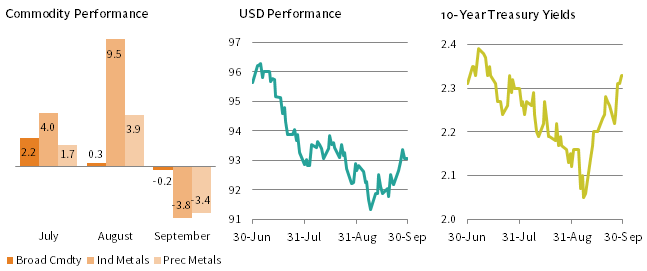

July was light on major geopolitical news, and investors concentrated on the commentary of central bankers around the globe. At the Federal Reserve, Chair Janet Yellen appeared to strike a slightly dovish tone; this, combined with the European Central Bank’s suggestion that it would begin to taper its bond-buying program, boosted the euro over the month as the dollar fell against most major pairs. Dollar weakness generally helped boost commodity prices, continuing a reversal of the downward trend that had ended in June. Most trend-based strategies were roughly flat for July, as gains in equities and foreign exchange (FX) were offset by losses in the commodity markets.

Sources: Bloomberg, L.P. and Thomson Reuters Datastream.

Notes: Commodity performance data are price returns represented by: Bloomberg Commodity Index (“Broad Cmdty”), Bloomberg Commodity Industrial Metals Index (“Ind Metals”), and Bloomberg Commodity Precious Metals Index (“Prec Metals”). US dollar performance represented by the DXY Index, a trade-weighted exchange rate.

August was a generally positive month for trend strategies despite a number of geopolitical shocks, as well as Hurricane Harvey’s devastation in the Houston area. Investors mostly seemed to shrug off tensions between US President Donald Trump and North Korean President Kim Jong-un, given that the Chicago Board Options Exchange Volatility Index (VIX) never closed higher than 16.04 for the month. The fixed income and metals markets continued to rally, driving trend performance.

September, however, saw a number of reversals from August and essentially wiped out trend strategies’ gains from the prior month. While equities were modestly positive, in keeping with their recent momentum, any impact was overwhelmed by losses in fixed income, FX, and commodities. Fixed income underwent an about-face as macroeconomic data continued to improve and central banks adjusted their guidance. The US dollar, after mixed and relatively flat performance in August, rose against several other currencies. The metals complex saw a significant reversal, with copper leading prices down.

Heading into the fourth quarter, trend managers continued to be positioned net long in equities, while also maintaining long positions commodities with the exception of agriculture, which most are net short. They also generally remain net short the US dollar, but have begun paring these positions back as the dollar has continued to rally. Fixed income positioning is mixed depending on the speed of the system and the geographic exposure. In the face of synchronized global growth and stronger macroeconomic fundamentals, discretionary global macro managers anticipate a stronger dollar, an uptick in inflation, and more hawkish central-bank policy.