Volatility further increased in the third quarter, with a number of notable “events.” First, the People’s Bank of China devalued the Chinese yuan (RMB, CNY) by almost 2% in early August. Ostensibly one step on the path to a designation of special drawing rights by the International Monetary Fund, it was, in fact, a response to a slowing economy and plummeting stock market. While a 2% devaluation would not be significant in most environments (the RMB was devalued by over 40% in 1994), volatility spiked because of the overheated Chinese stock market (as of September 30, the Shenzen Composite is down 45% from its peak on June 12) and a perception that China’s slowing demand would severely impact trading partners, particularly those in the Association of Southeast Asian Nations. The second “event” was the US Federal Reserve’s decision not to raise interest rates, as had been broadly anticipated, in September. While subsequent minutes show the Fed being concerned about the knock-on effects of China, the immediate market reaction was that the Fed was either privy to domestic data that would indicate a much slower US economy, or that it was out of touch with market expectations given robust growth and employment numbers.

As one would expect, the VIX more than doubled, from 16 to a high of 41 on August 24 (intraday over 50) before closing the third quarter at 25. In equities, the S&P 500 returned -6.4% (-5.3% year-to-date) in the third quarter and at one point was down over 11.2% in August alone, while broader global indexes such as the MSCI World and the MSCI Emerging Markets returned -8.4% (-6.0% year-to-date) and -17.8% (-15.2% year-to-date, respectively.

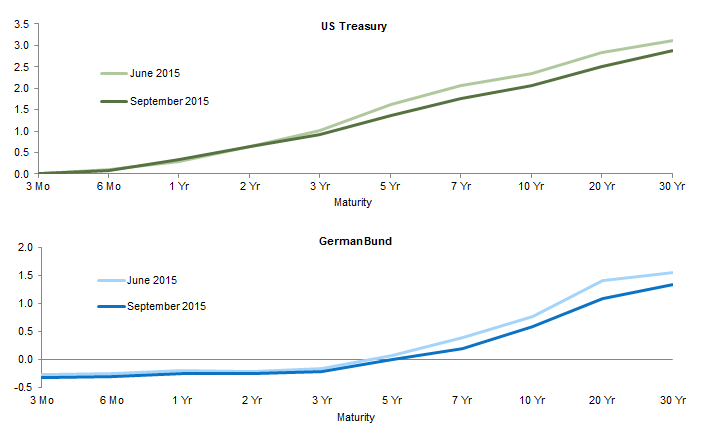

Yields in all major markets fell over the quarter due to any combination of (1) a flight to quality into sovereign bonds, (2) the Fed electing not to raise rates, (3) general market turbulence in equities and currencies, and (4) central banks cutting interest rates. In US Treasuries, the ten year dropped by almost 30 bps over the quarter, leading to a yield curve flattening of 29 bps between two-year and ten-year bonds. Ten-year German bunds and Japanese government bonds rallied by 11 bps and 18 bps, respectively. The (lack of) Fed move prompted forward rates to plummet—the one-year forward one-year dropped 23 bps.

This quarter’s update discusses performance in long/short and more diversifying hedge fund strategies and assesses the outlook for each.

Sources: Thomson Reuters Datastream and US Treasury.

Long/Short Hedge Fund Strategies

Long/short hedge funds as a group experienced losses but held up well on a relative basis, further extending their year-to-date outperformance. This serves as a reminder to investors why hedge funds are an important part of a diversified portfolio: to provide downside protection in volatile down markets and to generate attractive risk-adjusted returns across multiple market cycles. Compared to the major equity indexes, the Credit Suisse Hedge Fund Index fell by a relatively modest 2.5%, bringing year-to-date performance to -0.6%, and the HFRI Fund-Weighted Composite Index declined by 3.9% and is now down 1.5% on the year.

One area that has led to divergent returns among long/short strategies has been the performance spread between growth and value in US equities. Since the beginning of the global financial crisis, value stocks have underperformed their growth counterparts. In recent quarters, the underperformance has accelerated—year-to-date through July, the Russell 2000® Growth Index had outperformed the Russell 2000® Value Index by over 1,100 bps. This is highlighted by the struggles of several high-profile traditional value hedge funds whose disappointing recent performance has been well documented in the press. However, August and September saw a reversal of the growth/value trend, as value stocks, while negative for the period, closed the gap by over 600 bps. It remains to be seen if this reversal is an early sign of value coming back into favor or a just another short-term blip in a continuing long-term trend of growth outperformance. Still, value-oriented managers with strong long-term track records, stable businesses, and managers that have the courage and conviction to add to positions on weakness, are well positioned to capitalize when the fundamental value of these companies are appreciated by broader market participants.

The US health care sector, a source of outperformance for many long/short funds in recent years, came under pressure in the third quarter, beginning in August and accelerating during the last two weeks of September. The S&P 500 Healthcare Index declined by 13.1% in August and September alone, while the Nasdaq Biotechnology Index declined by 20.8% during the same period. Drug price increases came to the forefront of the public’s attention following news of a newly formed pharmaceutical company acquiring the rights to a legacy drug and raising list prices by 5,000% overnight. The public backlash that followed led one US presidential candidate to vow to correct drug pricing practices if elected. This, along with other mounting political pressures, prompted a swift and widespread sell-off in pharmaceutical and biotechnology stocks during the last eight trading days of the quarter. While managers we have spoken with expect multiples to remain compressed given the political overhang, many used the opportunity to add to high-quality health care names where the growth story is less dependent on price increases. Furthermore, although political rhetoric has gained steam as of late, managers believe that the government tends to move slowly and that, ultimately, price controls are unlikely or at least years down the road.

Managers in the event-driven space have generally struggled over the past 12–18 months, but many were able to provide downside protection relative to equity markets during the third quarter. Those with lower net exposure felt the benefits of their single-name shorts or portfolio hedges, while those that held more exposure to value-as-a-catalyst positions rather than hard, near-term events, tended to perform worse. Within distressed credit, managers that held exposure to energy or mining-related names suffered, as many of these credits experienced sharp sell-offs in July and August. Results across activist managers, which tend to operate concentrated, long-biased portfolios, varied widely.

Looking ahead, although global corporate activity remains elevated, or at peak levels in some cases, the environment for event-driven investing continues to be challenging. Within event equities, although deal flow has been robust, many of these deals have not generated the attractive returns investors had hoped for; spreads generally remain in the upper single digits—save for the most volatile days in the markets—and spreads that are higher come with significantly more risk. Opportunities in traditional corporate distressed remain generally muted. Large sovereign-related trades tend to be crowded, and the commodity-related positions have proven costly. Some positive signs do exist, however. The first few days of the fourth quarter saw a handful of mega-deals, which have the potential to provide large, liquid opportunities for managers to exploit. Meanwhile, managers believe that opportunities may be beginning to emerge within the commodity complex, primarily around oil & gas, as the effects of lower crude oil prices become more pronounced. Many believe that, barring any major rebound in the price, that this has potential to create opportunities for the coming years.

Diversifying Hedge Fund Strategies

The “gappy” volatility was generally welcome for most diversifying strategies, albeit a challenge for portfolio construction and volatility models. Effective risk management is much more challenging with the more “gappy” volatility that is being experienced (for example, in 2008 it took the VIX three weeks to climb over 50 post-Lehman; in August this year it took one day). In addition, liquidity is challenging in the post Dodd-Frank/Volcker Rule world where banks’ shrunken balance sheets are no longer the main liquidity buffer. Hence, when some “liquid alternatives” (exchange-traded funds) are forced sellers, there can be much more volatility.

A number of high-profile hedge funds announced closures in the third quarter: Everest, Renaissance’s Futures Fund, and, just following the close of the quarter, Bain Arc and Fortress Macro. The pure systematic and systematic global macro and trend-following strategies we follow closely declined, on average, about 4% in August, but many bounced back in September. Discretionary global macro and fixed income relative value strategies have been a bright spot; the funds we track are enjoying positive yearly returns.

At this juncture, the primary event on the horizon is the Fed’s expected rate rise, the first in nine years. Markets are looking for a rise in December, though some commentators are starting to discount the possibility of any rate rise in 2015. Oddly, a Fed rate rise may lead to less volatility, as the markets expect a slow and gradual rise (à la 2004–06), stopping below a 2% Fed Funds rate. What is certain is that the volatility regime (or lack of it) is now a thing of the past; most VaR (value-at-risk) models need to be thrown out, and markets look to be returning to a more fecund macro environment such as what was experienced from the 1999s up to the global financial crisis.