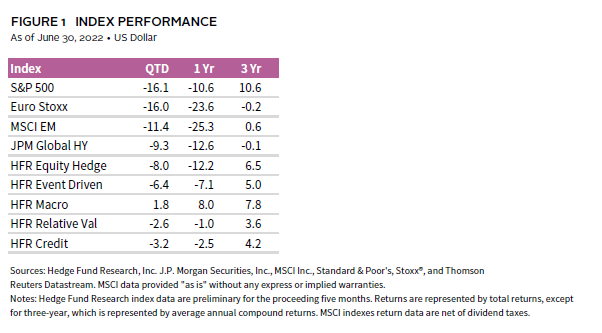

The volatility experienced in high-growth, high-valuation equities over the last few quarters spread across sectors and asset classes globally. Most broad equity market indexes hit bear market territory during second quarter 2022, making first half 2022 the worst start to a year for the S&P 500 Index since the early 1960s. Although there were brief periods of respite, the quarter could be characterized as a traditional risk-off period culminating with a large June sell-off. By the end of the quarter, value-, cyclical-, and energy-related equities also participated in the correction and high-yield credit declined as well. Volatility peaked in June as markets struggled to find equilibrium between inflationary pressures and the prospects of a recession. In summary, there was no shortage of uncertainty. Given the environment, hedge funds performed relatively well versus broad equity and credit market indexes, despite most strategies experiencing absolute losses.

Uncorrelated strategies—such as global macro, managed futures, and equity market neutral—continued to generate modest gains, while fundamental strategies declined. Equity long/short experienced losses for the second consecutive quarter. Interestingly, the declines in technology equities subsided by the end of the second quarter, while other growth-oriented equities, such as biotechnology and China equities, rallied sharply. Event-driven strategies were negatively impacted as both credit spreads and merger spreads widened significantly.

Event-driven managers invested across the capital structure in a broad spectrum of corporate events and various time horizons. Given the de-risking that occurred in capital markets, shareholder activist equity positions and softer catalyst equities with longer durations suffered most. Periods like second quarter 2022 tend to elongate the timeline of events and put activist investor value creation plans on pause. We observed event-driven managers with significant activist or directional equity exposure declining as much as 10%–15% during the quarter.

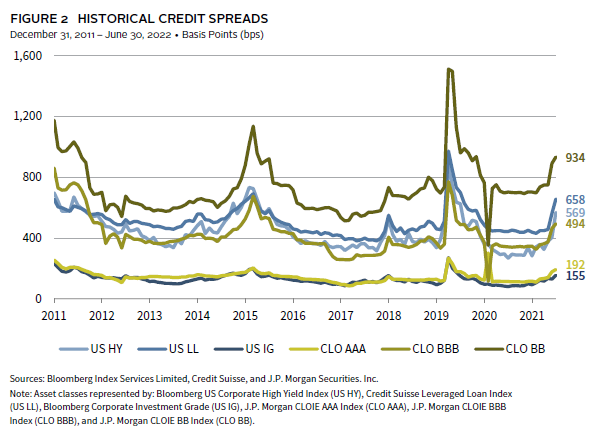

High-yield, stressed, and distressed credits also suffered during second quarter 2022. A rising-rate environment, coupled with spread widening, created a challenging environment for event-driven credit investors. Managers with significant directional exposure to stressed and distressed credit experienced losses of 5%–10% during the second quarter. In response, many event-driven managers have begun adding to credit exposure, while some are in the process of raising new capital. Credit is likely to be the source of attractive opportunities looking forward.

Merger arbitrage spreads widened significantly during the quarter. Merger activity has slowed this year relative to 2021 due to elevated economic uncertainty and deteriorating business conditions. The risk of deal breaks is also increasing. Deal value renegotiations have already begun with Thoma Bravo convincing its target (Anaplan) to reduce the agreed upon purchase price from $10.7 billion to roughly $10.4 billion to avoid litigation and a potential deal break. Elon Musk also indicated his interest in renegotiating the purchase price of Twitter prior to rescinding his offer. The Musk/Twitter deal will now head to litigation. Situations such as these are decent predictors of future deal breaks and broader spread widening. Deal breaks typically result in permanent impairment; however, general spread widening offers event-driven managers attractive entry points.

The performance drawdown in event-driven managers may continue in the short-to-intermediate term. An economic recession will exacerbate losses with additional credit spread widening and potential corporate defaults, but will ultimately lead to attractive risk/return opportunities in stressed and distressed credit and merger arbitrage. Investors in hedge funds should prepare to deploy capital to event-driven and credit managers with the ability to play offense in a challenging environment.

Eric Costa, Global Head of Hedge Funds