Global equity markets surged during second quarter, leaving many equity indexes at all-time highs. All major sectors were positive. Growth outperformed value, and developed cyclical companies edged defensive equivalents. The positive equity market performance masked underlying volatility in some corners of the market, similar to what occurred during first quarter. Once again, social media–driven stocks like GameStop and AMC Theaters surged. Also, US-listed Chinese equities experienced declines as China regulators continue to crackdown on large Chinese technology companies.

Sources: Hedge Fund Research, Inc. J.P. Morgan Securities, Inc., MSCI Inc, Standard & Poor’s, Stoxx®, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: Hedge Fund Research index data are preliminary for the proceeding five months. All returns one-year or less are total returns and greater than one-year are AACR. MSCI indexes return data are net of dividend taxes.

Core hedge fund strategies posted positive results for the quarter. Long/short equity produced positive returns as both value and growth biased managers contributed to gains. The surge in names like GameStop and AMC Theaters did not have a negative impact on returns. The great short squeeze of first quarter 2021 remained top of mind for hedge funds and, therefore, exposure to these names was limited.

Event-driven managers continued to perform well, benefiting from attractive merger arbitrage spreads, stressed credit, and opportunities in SPACs (special purpose acquisition companies). Fixed income relative value was modestly positive for second quarter, but some managers did struggle to adjust to the fall in rates. The quarter began with markets concerned about inflation and surging rates with the ten-year Treasury at 1.74%. By the end of the quarter, concerns had shifted toward deflation and rates began to decline, with the ten-year Treasury bottoming at 1.45%.

Chinese regulators continue to clamp down on large-capitalization technology companies and companies listed in New York. In this quarter’s edition, we will explore the challenges and opportunities facing investors in US-listed Chinese equity.

US-Listed Chinese Equity Challenges and Opportunities

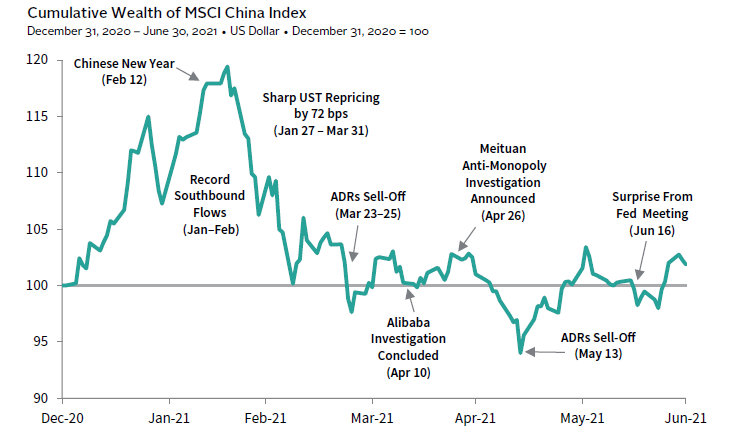

Second quarter 2021 was filled with much market action in the Chinese equity market. Anti-monopoly investigations into Alibaba and Meituan grabbed headlines in April, renewing investors’ concerns over how the Chinese government viewed the dominant internet platform businesses. The education sector was also caught in the line of fire, with President Xi Jinping lashing out at the industry’s “disorderly development” in May. Share prices of some of widely held names like TAL Education and New Oriental Education lost around 40%–50% during the quarter. The silver lining included the healthcare sector, which gained 21% in the quarter, according to MSCI (Figure 2).

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: Data are daily. Returns are total returns and are net of dividend taxes.

Performance figures provided by prime brokers suggested that all equity long/short strategies were up 3.3% on average in second quarter. Anecdotally, equity long/short managers with a skew toward China technology and education sectors underperformed peers that were running a broader Pan-Asia mandate. But China healthcare-focused funds had an extremely strong quarter, with gains in the range of mid-teens to high twenties.

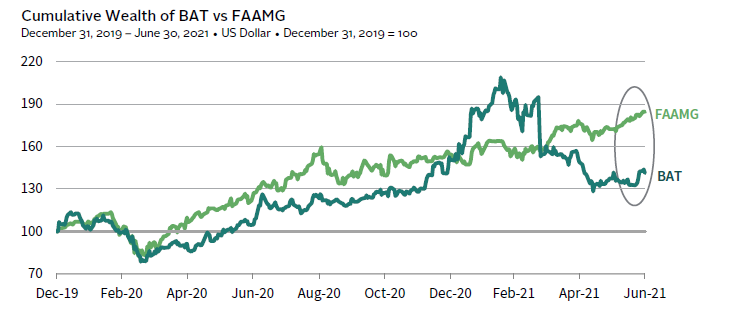

At the end of June, the Chinese authorities launched an investigation into Didi Chuxing two days after it went public, citing the need to protect national security and public interest. This has added more near-term uncertainty surrounding Chinese internet companies as the government increasingly asserts control. As a result, share prices of US-listed Chinese companies fell. There was a net selling of US American depositary receipts and H-shares, which was partially offset by net buying of A-shares. This exacerbated the dispersion of returns of US versus Chinese technologies companies, which started in late February 2021 (Figure 3). Looking ahead, the actions taken by the Chinese authorities will likely dampen investors’ growth potential of the Chinese internet platform companies.

Source: Thomson Reuters Datastream.

Notes: Data are daily. Equity baskets are equal weighted. Baidu + Alibaba + Tencent (BAT) securities represent the American Depository Receipts. FAAMG includes Facebook, Amazon, Apple, Microsoft, and Google.

Despite the regulatory overhang in China, we believe that this short-term noise does not detract from the longer-term attractiveness of the technology sector in the region. Several remaining subsectors that exhibit interesting characteristics, such as artificial intelligence and enterprise software. Alongside that, the Chinese healthcare sector is still in its nascent stage of development. There is a dearth of investment talent in the sector, creating less competition and a greater potential for alpha. As the universe of publicly investible healthcare companies expands, it builds a strong case to have dedicated China healthcare exposure. In both areas, there is a huge addressable market with many sub-sectors that are growing at a rapid pace.

Investing in Asia hedge funds goes beyond China. Another area that is less talked about is Japan-focused fundamental long/short equity managers. A majority of the Japan-focused managers tend to adopt a trading-oriented approach, with a small handful that are fundamentally driven. Foreign capital tends to favor large- and mega-cap companies. Local retail investors participate more actively in the small- and mid-cap companies. Given the lack of institutional participation, the amount of sell-side coverage of these companies has dwindled over the years; they focused resources on a limited number of large and mega caps, primarily those with trading volumes that justify the costs. The renaissance of Japan’s new generation of entrepreneurs serves as a tailwind to create value to a much-underserved society. There is a lack of capital available in Japan’s private market due to several factors, including cultural and language barriers, unfavorable tax and corporate laws, and a bank-centric financial system that favors conservative investment strategies. This allows public managers to tap on the market inefficiency, establish strong relationships with target private companies early, and be well positioned to invest in them when they become listed. Such dynamics allow for a compelling alpha opportunity that will provide investors with a differentiated returns stream.

Eric Costa, Global Head of Hedge Funds

Benjamin Low, Senior Investment Director, Hedge Funds

Kristin Roesch also contributed to this publication.