Developed markets equities rose steadily in second quarter despite negative geopolitical developments and increased tensions on the trade front. Still, uncertainty regarding the ongoing escalation in tit-for-tat tariff announcements between the United States and its major trading partners weighed against otherwise broad-based economic growth and strong corporate fundamentals. Growth stocks once again outperformed their value counterparts globally as the US “FANG” and Chinese “BAT” stocks continued their impressive run-up in market value.

The S&P 500 Index returned 3.4% for second quarter, bringing its year-to-date result to 2.6%. Energy stocks enjoyed a strong rebound with the S&P 500 energy sector returning 13.5%. The other leading sectors were consumer discretionary (8.2%) and information technology (7.1%), both continuing trends observed in recent quarters. Meanwhile, industrials (-3.2%), financials (-3.2%), and consumer staples (-1.5%) lagged.

US equities continued to outperform other developed markets as in the prior quarter; the MSCI World and STOXX 600 indexes returned 1.7% and -1.3% (in USD terms), respectively. Meanwhile, emerging markets stocks weakened further following their January peak, and many finished the quarter in negative territory for the year. The MSCI Emerging Markets Index returned -8.0% (in USD terms) in second quarter, bringing its year-to-date result to -6.7%.

Against this market backdrop, hedge funds overall experienced positive results for the quarter, with the HFRI Fund Weighted Composite Index returning 0.8%; year-to-date performance also ended up 0.8% after the index was effectively flat in first quarter. In terms of second quarter performance for the main hedge fund categories, event-driven managers generated the strongest returns, with the HFRI Event-Driven (Total) Index gaining 2.2%. Equity long/short and relative value strategies also enjoyed positive performance; the HFRI Equity Hedge (Total) Index and HFRI Relative Value (Total) Index returned 0.9% and 1.1%, respectively. Global macro and equity market neutral managers generally treaded water, with their respective HFRI indexes returning -0.2% and 0.0%.

In this quarter’s update, we look at the environment and opportunity set for event-driven strategies, highlighting conditions that have fostered a constructive outlook for merger arbitrage in particular. We also explore hedge fund managers’ increasing use of activist campaigns as a tool to effect corporate change and improve shareholder returns, both in the United States and abroad.

Event-Driven Strategies

Conditions have improved for event-driven strategies, such as merger arbitrage and activism, and debt-fueled deals may be sowing the seeds for the next distressed cycle. On June 12, 2018, US District Court Judge Richard Leon allowed multinational telecommunications conglomerate AT&T to move forward with its bid to buy Time Warner “without conditions,” and rebuked the Department of Justice (DOJ) in a sharply worded opinion, advising the regulator against contesting the ruling. Many managers and market pundits had eagerly anticipated such a decision, believing it would have broad implications for a number of outstanding deals—particularly vertical mergers such as Aetna/CVS, Express Scripts/Cigna, and Fox/Disney. The spreads of several such deals tightened as a result of the ruling, and merger arbitrage trades involving these pairs or outright long positions in targets, such as Time Warner, boosted funds’ June returns.

Surprisingly, on July 12 the DOJ filed a notice of intent to appeal the AT&T ruling, although spreads in the aforementioned vertical deals did not move materially on the news, and the Federal Communications Commission moved the following week to block Sinclair’s proposed acquisition of Tribune Media. To account for heightened risks, deal spreads are likely to remain wide among certain high-profile mergers that, for instance, have received attention from the White House or have been affected by the deteriorating trade relationship between the United States and China—appropriately so, as evidenced by the recently scuttled, cross-border, technology deal NXP/Qualcomm. Additionally, uncertainty produced by the DOJ’s pending appeal could prompt some spread widening and delay the announcement of some contemplated tie-ups. But, even so, the carefully crafted AT&T ruling could further embolden companies seeking to combine, prompting a fresh wave of merger proposals—particularly in telecommunications and media, as firms are scrambling for content and bolstering their digital strategies to combat threats from Netflix and YouTube. In fact, Comcast offered to buy Fox’s entertainment assets the day after the AT&T decision, only to see Disney make a topping bid shortly thereafter. Meanwhile, British regulators have been weighing Fox’s bid for Sky PLC, and Comcast has now initiated a bidding war for that business, as well.

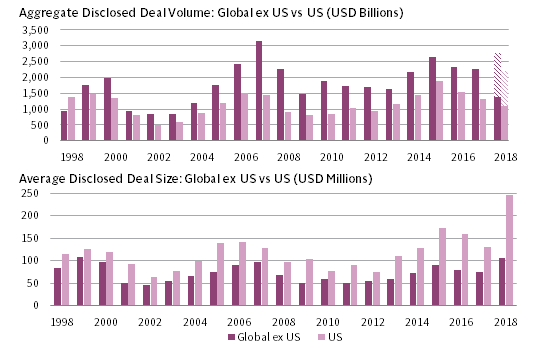

Source: Dealogic.

Notes: Announcements are based on deal acquirer nationality. Dealogic updates its database on a regular basis; therefore, historical data may change. Data for 2018 are as of June 30. Shaded bars represent annualized estimates through the end of 2018.

The clock is starting to tick loudly in other corporate board rooms, too. Numerous industries appear ripe for disruption and consolidation, judging by examples such as Amazon’s recent acquisitions of Whole Foods and PillPack, and Conagra Brands’ bid for Pinnacle Foods. Changes in the corporate tax code and a relatively benign regulatory environment offer tailwinds to deal making, and animal spirits seem high with respect to initiating transformative transactions—especially as multiple expansion may be slowing with the dwindling effects of quantitative easing (QE), and also as rising interest rates are making deal financing more expensive. Further, although company management teams have demonstrated greater deal making discipline in recent cycles, it seems inevitable that some will stretch too far, ultimately saddling companies with unsustainable debt loads that will provide happy hunting ground for event-driven and distressed debt managers in years to come.

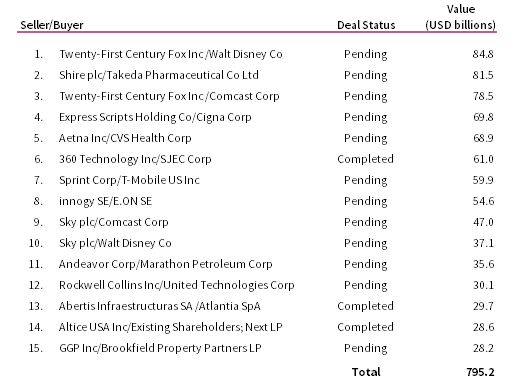

Source: Dealogic.

Notes: Acquisitions include announced deals and exclude related company transactions, as well as terminated deals. Value is based on equity price pending or at completion. Dealogic updates its database on a regular basis; therefore, historical data may change. Figures may not total due to rounding.

In the meantime, managers that are prepared to use activism continue to find opportunities to create their own events by encouraging corporate change, potentially via mergers or spin-offs. Years of QE-fueled easy money and concurrent stock price increases have allowed companies to kick the can down the road, placating investors while masking organizational problems or simply avoiding close scrutiny. The Wall Street Journal recently reported that managers are launching activist campaigns, which do not always generate positive returns for their sponsors, at a record pace; as of July, nearly 20% of all such activity for 2018 was initiated by first-time activists.[1]Cara Lombardo, “Activists Turn Up Heat in Drive for Returns,” The Wall Street Journal, July 13, 2018. Interestingly, US-based managers have taken their skills abroad; several have launched campaigns in the United Kingdom and Europe. Others have gone farther east, looking to effect change in Japan, which is littered with the carcasses of predecessors who have mostly tried and failed to penetrate the country’s notoriously closed corporate culture. Managers insist that this time is different: the Japanese government is supporting corporate governance reform and urging businesses to improve their returns on equity, engage with outside shareholders, and diversify their boards to promote growth. Ultimately, the near-term opportunity set for event-driven strategies such as merger arbitrage and activism appears reasonably favorable—a welcome development for event-driven managers feeling left behind by the momentum-driven market rally in growth-oriented assets in recent years.

Footnotes