While on the surface second quarter returns look benign, at 1.0% for the MSCI World and 2.5% for the S&P 500, the headline numbers mask the significant volatility following the United Kingdom’s vote on June 23 to exit the European Union. Though advance polling suggested the United Kingdom would choose to remain an EU member by a small margin, the referendum in fact showed a margin of 52% to 48% in favor of the “Brexit,” with over 71% of registered voters participating.

June 24 saw a downward gap in global equity market returns, and investors continued to digest the impact of the vote over the following week. European equity markets were affected the most as the MSCI Europe Index returned -2.7% in USD terms and the FTSE® 100 Index of UK large-cap stocks, -0.9%. Financial stocks and companies with larger revenue exposure to Britain were particularly hurt, returning -10% to -30% in the final week of June. However, the narrow universe of select hedge funds that Cambridge Associates follows closely escaped much of the upheaval. Our second quarter update examines the investment landscape before and after the Brexit vote, and the effects of particular pockets of volatility.

Fundamental Hedge Fund Strategies

Value equities continued to outperform growth stocks, sustaining the reversal we discussed in our first quarter update. For April through June, the Russell 2000® Value Index returned 4.3%, compared with 3.2% for the Russell 2000® Growth Index. As of quarter-end, these indexes’ respective year-to-date returns stood at 6.1% and -1.6%—a 7.7 percentage point spread. Similar differences exist for US large-cap growth and value, and in returns for growth and value in developed and emerging markets.

Fundamental hedge fund strategies generally posted decent returns for second quarter. On a broad index basis, the HFRI Equity Hedge (Total) and HFRI Event Driven indexes returned 1.4% and 2.8%, respectively. Of the European-based long/short equity managers we follow, most struggled in June, some returning between -5% and -10%. However, many of the US-based long/short equity managers we follow were positioned conservatively ahead of the Brexit referendum, and most had little exposure to European equities and global financials. Further, many continued to benefit from value’s outperformance of growth, as did event-driven strategies: the best-performing event-driven managers that we follow closely have posted returns in the mid–single digits year-to-date.

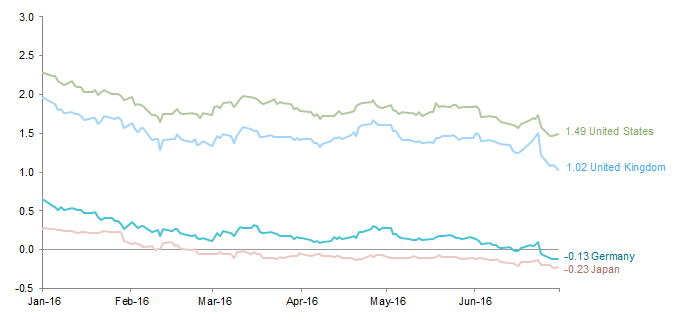

Source: Thomson Reuters Datastream.

Note: Data are daily.

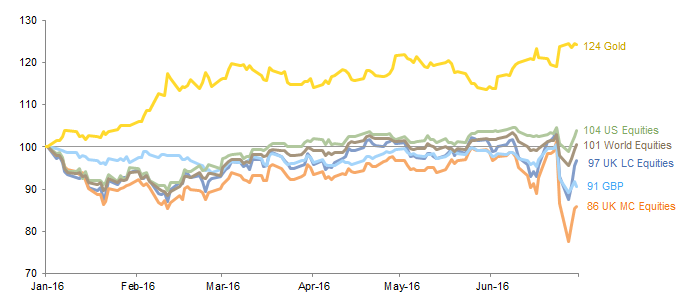

Cumulative Wealth of Select Asset Classes in 2016

January 1, 2016 – June 30, 2016 • USD Terms • January 1, 2016 = 100

Sources: FTSE International Limited, MSCI Inc., Standard and Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: Data are daily. Performance reflects total returns, except for GBP, which is the USD to GBP exchange rate, and gold, for which returns are based on changes in the spot price. UK large-cap equities are represented by the FTSE® 100 Index; UK mid-cap equities, the FTSE® 250 Index; World Equities, the MSCI World Index; US equities, the S&P 500 Index.

Macro and Uncorrelated Hedge Fund Strategies

For macro and uncorrelated strategies, the second quarter was again characterized by a fall in global yields and a flattening in yield curves. US ten-year Treasuries declined by 29 basis points (bps) to 1.49%, ten-year German bunds by 28 bps to -13 bps, and ten-year Japanese government bonds by 19 bps to -23 bps. Remarkably, almost 40% of all developed markets sovereign bonds with maturities over one year ended the quarter with negative yields. The two- to ten-year slope of the Treasury yield curve flattened by 14 bps, and the ten- to 30-year slope by 2 bps. One hedge fund manager has characterized the demand for the safety of sovereign bonds as “entering the Twilight Zone,” and a number of well-known heads of money-management firms have begun warning of frothy markets. Others are pointing to the fact that central banks are effectively out of options, as their quantitative easing initiatives run out of steam.

As noted, volatility significantly increased following the Brexit vote. The UK pound hit a 31-year low against the US dollar and continues to trade around $1.30, a value not seen since the mid-1980s. Gold gained 7.0% for the quarter after seeing an 8.8% rise in June, more than half of which occurred after the Brexit referendum. In commodities, oil rebounded by 25% over the quarter. Even normally quiescent Treasury bills have experienced swings of as much as 17 bps in a day.

All of this has led to some dramatic returns, especially for the broadly defined “systematic global macro” complex, which includes commodity-trading advisors. Managers in this group were generally long trend and/or reversals, and a number of them returned 2% to 5% just following the Brexit vote. By subcategory, the managers we follow have produced the following year-to-date average returns: quantitative futures, 2.9%; pure trend, 4.2%; trend following, 4.2%; and risk parity, 10.2%.

The prospects for volatility are quite good, given an anticipated further devaluation of the renminbi by the People’s Bank of China, as the US Federal Reserve appears on hold. A sell-off in US equities is probably required to prompt a real return of equity volatility and, perhaps, a steepening in yield curves, though such a change appears unlikely at this point. Arbitrage and discretionary global macro strategies will have to look to currencies and commodities for opportunities to produce higher returns.