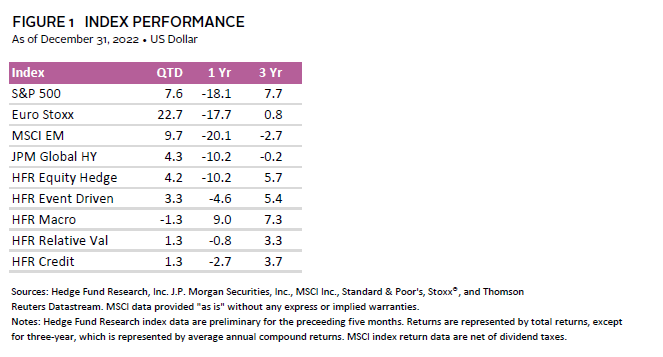

Capital markets remained volatile during fourth quarter 2022. Risk assets appreciated significantly during October and November before giving back some of the gains in December. By year end, broad equity markets and high-yield credit had steeply declined roughly 20%, while higher growth equity sectors declined even more significantly—in the 30% to 40% range.

Three consecutive quarters of positive returns and outperforming most other strategies came to an end for macro hedge funds during the fourth quarter. Macro generated negative returns, with the HFRI Macro (Total) Index declining 1.3%. Most notably, systematic macro funds—including managed futures managers—suffered particularly large losses in November due, in part, to speculations that major central banks may end interest rate hikes following a lower-than-expected inflation announcement. Lower inflation levels led to trend reversals in fixed income, currency, and commodity markets. Conversely, discretionary global macro managers were generally well-positioned for the volatility across asset classes, as reflected in their consistently positive monthly returns during the quarter.

Long/Short Equity funds staged a comeback in the fourth quarter alongside global equity markets with the HFRI Equity Hedge (Total) Index gaining 4.2%, which improved year-to-date (YTD) results to -10.2%. While managers modestly participated in the market upside in October and November, short portfolios helped protect capital in December with the index down less than 1% compared to the 5.8% decline in the S&P 500 Index and the 4.2% decline in the MSCI World Index (net). Increased dispersion appeared to help managers identify attractive long/short opportunities, leading to alpha generation on both sides of portfolios. Furthermore, those with a material tilt toward non-US equity and/or value equity outperformed their US-centric and/or growth-oriented peers. Managers remain constructive about the shorting environment thanks to the aforementioned dispersion, along with the tailwind from a positive short rebate due to increasing interest rates.

The HFRI Event-Driven (Total) Index ended the quarter up 3.3%, leaving YTD results at -4.6%. The index significantly outperformed volatile global equity and bond indexes. Performance dispersion among event-driven funds was relatively high in 2022 but generally consistent with their perceived riskiness. Catalyst-light equities were the major detractors, especially for more directional managers that profited from a growth bias over the past few years. Distressed credit opportunities remained elusive and market turbulence and regulatory policy stifled merger & acquisition deal volume. However, managers view volatility and increasing rates as precursors to a broad opportunity set across event strategies.

The years since the Global Financial Crisis were defined by zero interest rates and quantitative easing. More than a decade of “free money” led to aggressive risk taking and several market bubbles. “Buy the dip” became the preferred investment strategy for a generation of investors. Value investors approached extinction. During 2022, high-yield credit, growth equities, SPACs, cryptocurrencies, and NFT bubbles deflated to varying degrees. Today, the monetary policy and fiscal spending fueled “risk on” era appears to be over. This is a positive development for hedge fund investors akin to the post “dot-com bubble” market of the early 2000s. Any investment strategy with “hedge” in its title struggles to keep up with beta-driven upward markets; however, we currently have an investment backdrop of higher rates, competition for capital, significant short rebate, potential recession, higher volatility, and more dispersion. This change in the investment environment seems to be structural, positioning core hedge fund strategies to take advantage of unlevered alpha generating opportunities. Hedge fund investors that are underweight should consider increasing their hedge fund exposures while these market conditions remain in place.

Eric Costa, Global Head of Hedge Funds

Brendan Castleman and David Kautter also contributed to this publication.