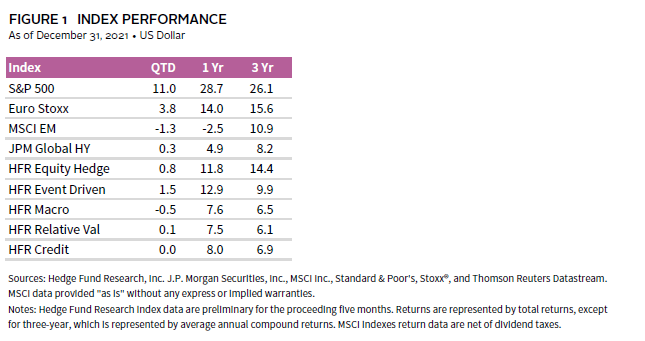

Global capital markets remained volatile during fourth quarter 2021 but ended in strong positive territory for the quarter and year. Positive equity markets index performance during the fourth quarter masked the underlying carnage that occurred in high-growth sub-sectors. These sectors continue to respond negatively to anticipated central bank tightening. Core hedge fund strategies were mostly positive during the quarter; however, hedge fund alpha generation was poor. HFRI Equity Hedge (Total) produced 0.8%, HFRI Event Driven (Total) increased 1.5%, HFRI Macro returned -0.5%, and HFRI Relative Value gained 0.1%.

While hedge funds generally produced positive absolute performance, many growth-oriented long/short equity managers experienced significant drawdowns during the quarter. High-growth, cash flow–negative companies in software and internet suffered a significant correction during the quarter. Widely held hedge fund names, such as Coupa Software, Twilio, Snowflake, Unity Software, and Roblox, corrected 15%–60% from the highs set earlier in the year. Broken growth stories like Peloton and Zillow are down 70% to 80% from their peak. The disparity of results between these equities and mega-cap technology companies, such as Microsoft and Apple, is stark. The fourth quarter and year-to-date returns of the major indexes were once again driven by a small number of large technology names (Figure 2).

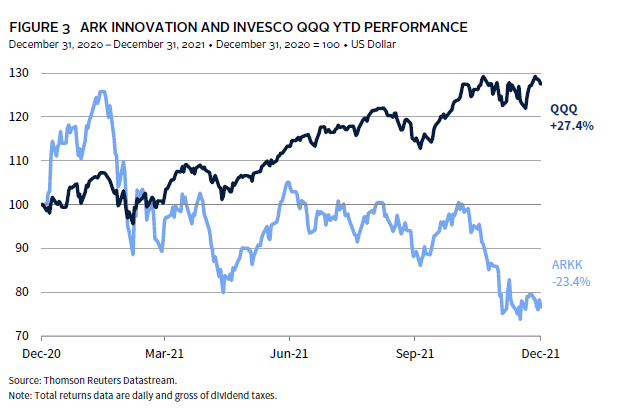

The selling of growth company equities appears to be driven by hedge funds and innovation-focused, long-only investors like Cathie Wood’s ARK Funds (Figure 3). In December, Goldman Sachs reported net hedge fund buying in “TMT,” but this was the first reported monthly inflow over the last eight months. As a result of the large sell-off, many technology-focused long/short managers experienced significant drawdowns during the quarter. We observed a wide range of outcomes for these managers ranging from -20% to 5%.

The current environment provides technology-focused long/short equity managers with an incredible opportunity to purchase compelling growth companies at a large discount to recent valuation multiples. The sector has been ripe for alpha generation for many years and should continue to because of the continued disruption created by innovation. This market appears to be giving investors an attractive entry point for those able to accept the associated volatility.

Eric Costa, Global Head of Hedge Funds

Kristin Roesch also contributed to this publication.