Fourth quarter 2020 brought an end to one of the most tumultuous years in recent history. A global health crisis led to economic paralysis and one of the most severe capital markets corrections ever. There was social unrest and political chaos in the United States and US-China relations appeared to reach a new low. It’s hard to recall, but 2020 began with equity markets at all-time highs after the longest bull market in history. However, first quarter 2020 ended as the worst quarter for the Dow Jones Industrial Average dating back to 1987! Astonishingly, 2020 ended where it began with equity markets at all-time highs. This recovery in global equity markets appear inconceivable as economies still grapple with lockdown measures and COVID-19 vaccine distribution.

Capital markets performed well during fourth quarter 2020. The S&P 500 Index appreciated 12.1%, the STOXX 600 Index gained 10.8%, and JPMorgan Global High Yield Bond Index returned 6.6%. Hedge funds generated strong returns during the fourth quarter and year-to-date. HFRI Equity Hedge Index gained 14.4%, HFRI Event Driven Index appreciated 11.3%, and HFRI Global Macro Index returned 4.8% during the fourth quarter. Year-to-date HFRI Equity Hedge Index gained 17.4%, HFRI Event Driven Index appreciated 8.8%, and HFRI Global Macro Index returned 5.3%.

Equity market appreciation was broad with both growth and value participation but with value and cyclical equities outperforming in the United States and globally during fourth quarter. The Pfizer and Moderna COVID-19 vaccine approvals gave investors hope that industries hardest hit by lockdowns (e.g., airlines, gaming, and leisure) would recover in the foreseeable future. Energy, financials, industrials, and materials were the best-performing sectors. All major sectors were positive during the fourth quarter, but S&P 500 Energy Index gained more than 27% and S&P 500 Financials (Sector) Index increased 23%, while the worst-performing sectors consumer staples, utilities, and real estate appreciated between 4% and 7%. Technology and healthcare ended up between 8% and 12%.

Please see Eric Costa and Tom Gormley, “Outlook 2021 – A Year of Healing: Emphasize Hedge Funds Focused on Technological Disruption,” Cambridge Associates LLC, 2020.

Long/short equity produced exceptional absolute and relative returns for the fourth quarter and full-year 2020—its best year since 2009. Most of the alpha was created on the long side for the year. During the fourth quarter, vaccine approvals caused risk assets to rally. Value and cyclical equities outperformed growth in anticipation of a return to pre-COVID economic normalcy. The rise of the US retail investor through new trading platforms, such as Robinhood, also appeared to drive markets higher. Certain subsectors within software and the electric vehicle industrial complex are trading at historically lofty valuations. The disconnect between valuation and economic reality should result in volatility and attractive long/short investments. We continue to believe technology- and healthcare-focused sector long/short funds should provide compelling alpha opportunities in the United States and Asia.

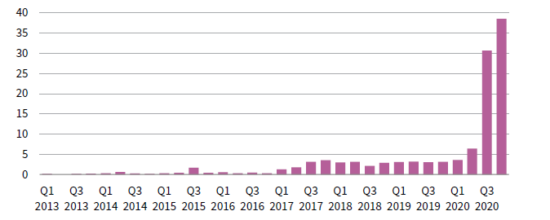

Event-driven strategies also performed well during the quarter. Large distressed credit opportunities remain scarce and merger spreads compressed. As a result, many event-driven managers found opportunities in the growing special purpose acquisition company (SPAC) market. Smaller, more nimble event-driven managers were able to take advantage of the opportunity set in a more significant way. SPAC-led IPOs have become a popular alternative to the traditional IPO process and more event-driven capital has been attracted to the space. New SPACs are being raised at a record pace and many are trading at premiums to cash today. All the classic signs of excess seem to apply with regards to SPAC activity, suggesting attractive long/short opportunities will exist as a result. However, since the opportunity set for traditional event-driven investments like distressed corporate credit and merger arbitrage should remain muted, the SPAC opportunity will continue to attract investors.

Source: Pitchbook.

Note: Data are annual.

Hedge funds should thrive in periods of volatility and 2020 provided that volatility. COVID-19 was the catalyst for unprecedented government intervention in economic activity. If government responses globally remain uncoordinated and include lockdown measures designed to shut down entire economies or large sectors within an economy, then volatility should be present. Winners and losers in the short term will be determined by the government response to COVID-19. Fundamental strategies appear to be best positioned to manage through this environment, while purely quantitative strategies may struggle to model such draconian measures.

Eric Costa, Global Head of Hedge Funds