Markets witnessed a dramatic increase in volatility in fourth quarter 2016, owing primarily to the results of the US presidential election and the Federal Reserve’s December rate increase. Following the pattern of the June “Brexit” vote, pre-election polling led many to be surprised by Donald Trump’s November 8 win, and non-US equity markets and S&P futures traded downward sharply overnight. US equity market futures had reversed by the market open on November 9, beginning a rally that carried through to year-end. Whereas the ten-year US Treasury yield rose “only” 81 basis points (bps) from the beginning of November to the high touched following the Federal Open Market Committee meeting in December, this constituted a whopping 45% increase in the overall yield over just three months.

Once again, benchmark equity market performance for the quarter (the S&P 500 Index returned 3.8%; the Russell 2000® Index, 8.8%; and the MSCI World Index, 1.9%) masked the sharp reversals that occurred within the period. The energy and financial sectors were strong performers across developed markets. In US equities, significant boosts in the S&P 500 financial, energy, and industrial sectors—which returned 21.1%, 7.3%, and 7.2%, respectively—contrasted with poor to negative returns in information technology (1.2%), consumer staples (-2.0%), health care (-4.0%), and real estate (-4.4%). The rotation from growth toward value that began earlier this year continued and was particularly pronounced for small caps, where value trounced growth by more than 1,000 bps for the quarter.

US equity market performance was strong overall in 2016: the S&P 500 and Russell 2000® indexes returned 12.0% and 21.3%, respectively. Non-US developed markets equities didn’t fare as well, and returns were further reduced by the strong dollar—the MSCI EAFE Index returned just 1.0% for the year in USD terms. In contrast, the MSCI Emerging Markets Index returned 11.6% in USD terms, its first year of outperformance versus developed markets equities since 2012.

In this quarter’s update, we take a closer look at the ripples caused by the US election, and we review hedge fund performance for the calendar year, which saw a notable positive shift in event-driven strategies.

Fundamental Hedge Fund Strategies

On the whole, fundamental hedge fund strategies produced positive results in 2016. Event-driven performance led that of all other major hedge fund strategies, while long/short equity managers’ results varied. On a preliminary basis, the HFRI Equity Hedge (Total) Index returned 1.3% for the fourth quarter and 5.5% for the year, compared with 3.5% and 10.5%, respectively, for the HFRI Event-Driven Index.

Event Driven. After a poor 2015, event-driven strategies were standout performers in 2016. Although we are still gathering data, many funds in the space generated net returns well in excess of benchmarks.

As we noted in the fourth quarter 2015 edition of Hedge Fund Update and further discussed in our February 2016 Research Brief, “Tough Sailing for Event-Driven Strategies,” an expanding opportunity set in event equities—primarily merger arbitrage—and the brief yet sharp sell-off in credit markets from late 2015 into early 2016 created significant opportunities for event-driven managers. One of the strongest contributors to fourth quarter 2016 performance was the rally in Fannie Mae’s and Freddie Mac’s common and preferred shares. Once widely held, these securities had traded downward around 50% following an adverse ruling in September 2014, causing large losses for hedge fund investors. However, patient managers were generously rewarded at year-end 2016: these positions rose 100% to 200% in a matter of weeks following the election, on the hope that the new administration would successfully resolve the concerns created by the 2014 ruling. Also enhancing performance: many of 2015’s mega-mergers closed successfully, and managers were able to purchase credit positions opportunistically and inexpensively in late January and early February. Lastly, stressed and distressed credit–focused managers achieved outstanding returns due to the massive rally in high-yield credit.

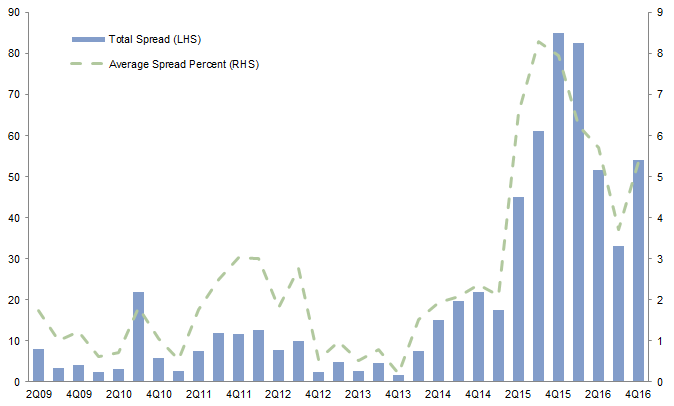

Turning to 2017, current merger & acquisition spreads are attractive relative to those of the past seven-plus years, though less compelling than those of one year ago. Still, the opportunity set for event-driven equity investing remains generally attractive in the near term. President Trump has expressed interest in overturning some of the regulations enacted by the Obama administration, as well as reducing the US corporate tax rate. Lightening these burdens could boost corporate transactions, further expanding the event-driven opportunity set. A fresh policy could reduce one of the biggest pain points in M&A investing in recent years: regulatory scrutiny and intervention, which have caused several announced mergers to break. However, many uncertainties accompany the incoming administration. Most notably, geopolitical tensions may prompt closer scrutiny of cross-border transactions.

Historical Merger Arbitrage Spreads

Second Quarter 2009 – Fourth Quarter 2016 • US Dollars (billions)

Sources: Bloomberg L.P. and Jefferies LLC.

Notes: Chart shows spreads for global merger & acquisition deals above $1 billion.

The specter of continued increases in interest rates is another factor that could benefit the merger landscape. If the Fed continues on this path, corporate management teams may be motivated to pursue debt-driven acquisitions while rates are still relatively low.

Long/Short Equity. The dispersion of returns across hedge fund strategies and managers was high in 2016. Many managers had trouble navigating the extreme rotations among sectors, market capitalizations, and some of the factors outlined above. A Goldman Sachs analysis in mid-December found the spread between the 75th percentile manager and 25th percentile manager to be more than 13 percentage points, the widest of the year. Long/short equity managers stood at the epicenter of 2016 factor rotations, which seemed not to be driven by fundamentals. These rotations shaped individual managers’ performance for the year and generally resulted in underwhelming returns for the strategy as a whole in the fourth quarter and for the year.

Of course, we cannot predict exactly when long/short equity strategies will outperform equity markets or even generate attractive absolute returns. However, the snapback in event-driven strategies in 2016 is a reminder that hedge fund strategies’ performance is cyclical. Long/short equity still faces undeniable challenges, such as investor redemptions, the continued rise of passive investing, bouts of deleveraging, violent sector and factor rotations, capital concentration among similar styles and positions, and still historically low interest rates despite the modest increases. Some of these headwinds may exhaust themselves in 2017, buoying the strategy’s overall performance. Patience and a sustained focus on manager selection are the key; managers with demonstrated skill in fundamental security analysis have outperformed most benchmarks over longer periods.

Macro and Uncorrelated Hedge Fund Strategies

Although the new highs reached in US equity markets grabbed most headlines, the relative rise in Treasury rates and the steepening of yield curves in fourth quarter were key themes. The US two-year rate rose by 43 bps; the 30-year rate, 74 bps; and the ten-year swap rate, 85 bps—representing overall increases in yields of 56%, 32%, and 53%, respectively. The two-year/ten-year spread steepened by 42 bps for the quarter. All of these shifts were based on the expectation that the Trump administration will increase debt issuance and the deficit. Further, alongside the rising yields, the US dollar rose dramatically to a 14-year peak, with the US Dollar Index (DXY) up 5.4% for the quarter. If the 2001 high is any guide, the dollar has more room to appreciate. The yen, euro, and pound fell 13%, 6%, and 5%, respectively, against the dollar in the fourth quarter. In the global hunt for yield, non-US investors are likely to become much heavier buyers of USD-denominated securities.

The November US election and ensuing volatility provided an opportunity for diversifier and discretionary macro managers to add long exposure to the US dollar, as well as to both rates and equity volatility. All paid off. While the average return for November was in the low single digits, some outlier discretionary global macro managers generated double-digit returns for the month. The most common themes were USD strength, steepening yield curves, “carry” trades, and an increase in yields. Systematic strategies’ returns were more mixed, as models adjusted to reversals, higher volatility, and, in some cases, the new market “regime” represented by the shifts previously described.

For some years, the primary complaints of many diversifier and macro managers were about the “financial repression” of central bank policies, a lack of volatility, and the convergence of asset class correlations. “Sovereign-bond yields have entered the Twilight Zone,” was a refrain commonly heard just over six months ago. The fourth quarter marked a turning point, and those concerns should now be much less relevant. The Fed is “on the move,” as evidenced by the December rate raise; the new administration, as noted, is widely expected to issue more debt; and there are nascent signs of inflation. Fed policy is clearly diverging from the accommodative policies of the European Central Bank, the Bank of Japan, and the People’s Bank of China. The trends in USD strength and rising rates, the latter of which could become global, have the potential to persist for some time.