The year started with a strong risk-on rally as declines in inflation prints in the United States and Europe fueled the narrative for “soft landing”—suggesting the economy could avoid a crash, while inflation continued to soften. Improving economic conditions in Europe and the reopening of China post-COVID provided additional cause for optimism.

On March 9, the buoyant sentiments abruptly gave way to great uncertainty reminiscent of the Great Financial Crisis (GFC), when Silicon Valley Bank’s (SVB’s) stock plummeted more than 60% after the bank surprised the market by announcing a capital raise of more than $2 billion to offset losses on a huge chunk of its bond portfolio consisting of unhedged government bonds and mortgage-backed securities, among other investments. The bank had been facing larger-than-expected deposit outflows and needed to sell the previously “held-to-maturity” investments to shore up its balance sheet. As concerns quickly piled up, depositors rushed to withdraw cash from SVB, prompting a classic run on the bank. The next day, it was placed under the conservatorship of the FDIC. In the subsequent two weeks, chaos ensued as Signature Bank—another mid-sized US bank—collapsed, and troubled Swiss behemoth Credit Suisse was forced by the Swiss government to be taken over by rival UBS to prevent a large-scale banking crisis. Central banks and regulators stepped in to quell the fears, taking extraordinary measures to ensure that the banking systems were sound. They were apparently effective, and by the end of the quarter, the markets had calmed down and ended with gains.

While market participants generally escaped unscathed, it seemed unlikely there would not be any casualties since events unraveled at such an unprecedented speed. Indeed, systematically driven, trend-following hedge funds, also known as CTAs, and some discretionary global macro funds stood out for getting caught wrong-footed amid the historic gyrations in sovereign bonds. These strategies had large bets against government bonds, and suffered big losses when the bank turmoil abruptly prompted a flight to safe-haven behavior, causing a sharp repricing of short-term bonds. Volatility was further exacerbated by the repositioning of CTAs and macro funds, which scrambled to cover their short positions.

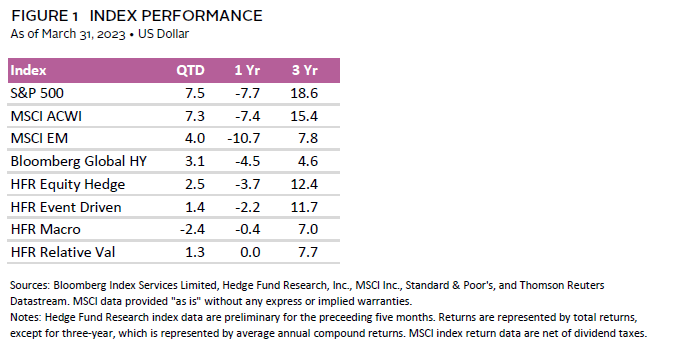

Macro hedge funds finished the quarter in negative territory, with the HFRI Macro (Total) Index down 2.4%. The sub-strategy Systematic Diversified, including CTAs, lost 4.3%, whereas another major subcategory, Macro Discretionary Thematic, lost 0.11% during the first quarter. Discretionary managers were less impacted than the media headlines suggested, as some of the managers had gradually reduced their short-duration bets seeing that the terminal rate was in view. Furthermore, the banking turmoil produced dislocations along the yield curves, which created profit for relative value managers that specialize in sovereign fixed income. Fixed income relative value hedge funds gained 1.0% as proxied by the HFRI Relative Value: Fixed Income Sovereign Index. While the first quarter performance of discretionary macro and CTA funds was disappointing, it was not out of line considering how their portfolios were positioned and the magnitude of the move. Notably, the US two-year Treasury yield experienced the biggest one-day drop since Black Monday in 1987, and the change in yield during the month represented a 15-standard deviation move. In addition, dispersion in manager returns suggests that some managers were more effective than others at managing risk and avoiding overcrowded trades.

Long/short equity funds generated positive returns for the second consecutive quarter, with the HFRI Equity Hedge (Total) Index gaining 2.5% during the quarter. Funds with meaningful exposure to growth-oriented sectors—such as information technology, communication services, and consumer discretionary—all generated robust, double-digit returns and posted strong results. However, value managers lagged as the Russell 1000® Value Index underperformed its growth counterpart by more than 1,300 basis points. Long/short equity managers emerged largely intact after March’s mayhem, with many benefiting from short exposure to the banking sector. Managers remain constructive on the stock-picking environment as performance dispersion has created an opportunity for alpha generation on both sides of the portfolio.

The HFRI Event-Driven (Total) Index ended the quarter up 1.4%, underperforming global equity and bond indexes as global bank runs and manic markets made for tricky sledding. Event-driven managers are optimistic about the opportunity set in merger arbitrage and credit. Merger arbitrage—which has historically performed better in higher rate environments—stands to benefit from the widest spreads since the GFC, due to rising rates and heightened regulatory scrutiny. Meanwhile, cracks are emerging in credit. Although most see traditional distressed as a 2024 event, managers envision a range of opportunities, including mispriced performing credit, as well as strategic financings and out-of-court restructurings.

Meisan Lim, Managing Director, Hedge Funds

Stephen Mancini and Tom Gormley also contributed to this publication.