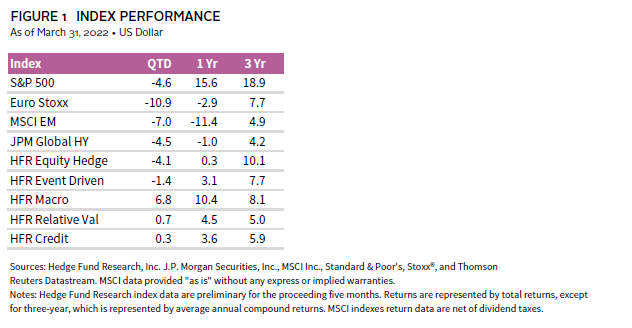

Continuing the trend seen in the second half of 2021, global equity markets remained volatile during first quarter 2022, as global indexes declined (Figure 1). Despite the market drawdown, broader indexes mask the relative performance among index constituents. Underlying volatility across sectors was more pronounced. Markets witnessed the continued large rotation out of high-growth, higher-multiple companies whose cash flows are longer dated in nature in favor of lower-multiple, value-oriented opportunities with nearer-term—albeit slower growing—cash flows. The Russell 1000® Value Index held up better than its growth counterpart, outperforming by 800 basis points (bps). Similarly, small-cap value shares, as defined by the Russell 2000® Value Index, fare better than its growth counterpart by more than 1,000 bps.

In aggregate, global macro managers generated solid gains in the first quarter. However, core hedge fund strategies’ returns were more muted in either direction except from long/short equity, which declined by mid-single digits during the period. That said, there was considerable dispersion among manager returns as some lower net value–oriented strategies delivered gains. Growth; technology, media, and telecom; healthcare; and hybrid long/short strategies were down considerably, many of which declined by double-digits. Long positioning in recent initial public offerings (IPOs) likely hampered results, as evidenced by the relative performance of the Renaissance IPO exchange-traded fund to the NASDAQ 100 and S&P 500 indexes (Figure 2).

Public/private hybrid managers noted that private market activity has stalled, particularly in late-stage growth, as investors are balking at elevated valuations. Meanwhile, companies anchoring to recent marks are reluctant to participate in a down-round relative to prior activity. This raises some questions: Is the late-stage growth market dead? No. Is it weakened or frozen in the near term? Likely, yes, until private markets catch up relative to public market peers. As a result, we will likely see markdowns on private holdings in the coming quarters barring any dramatic reversal in the investment climate.

The silver lining for hybrid-focused and traditional long/short equity investors is that the environment is setting up nicely for those that are truly selective. A targeted approach to private investing is likely to create attractive opportunities. Managers may be able to acquire stakes in higher quality, innovative, and growing private companies at more reasonable valuations, while pretenders or “copycat” companies may struggle to raise additional funds without considerable dilution.

On the public side, increased first quarter volatility has created opportunities for generating attractive long/short spreads. On the long side, quality public companies have sold off considerably amid the fears of higher interest rates, rising inflation, and greater geopolitical tensions (e.g., the war in Ukraine). There are likely to be long-term winners amid the turbulence, including companies with dominant competitive advantages, pricing power, and strong and efficient balance sheets that are on the right side of change and are poised for secular growth.

Meanwhile, on the short side, despite the sell-off in high-growth, high-multiple equities, many managers argue that shorting opportunities are abundant, provided investors can withstand the short-term, breathtaking “trash” rallies that these companies can endure amid a protracted, yet lumpy, decline. The presence of lower quality or flawed “story” stocks allow managers to capture alpha opportunities on both sides of the portfolio, even if multiples continue to contract amid their long portfolios. The changed macroeconomic environment is likely to favor managers with concerted efforts on the short side dedicated to identifying company-specific alpha opportunities and/or those managers with structurally lower net exposure.

Stephen Mancini, Senior Investment Director, Hedge Fund Research

Kristen Roesch also contributed to this publication.