Positive equity market performance masked the volatility of many assets during first quarter 2021. Early in the quarter, many investors were impacted by one of the most severe short squeezes in history. Social media fueled gains in GameStop Corporation, AMC Entertainment, and other highly shorted equities forced some hedge funds to cover short positions, realizing large losses in the process. As the quarter unfolded, inflation fears led longer-term interest rates to rise resulting in large losses for many fixed income investors. Rising rates also led to growth equity multiples derating. Many high-flying technology and biotechnology equites experienced losses of 30%–50% from their peak. Meanwhile, value and cyclical equities performed well as COVID-19 vaccinations ramped up and many global economies began to re-open. By quarter end, many Chinese equities experienced losses as the Chinese government promised to clamp down on mega-capitalization technology company monopolistic behavior. As a result, a very large and highly leveraged family office was forced to unwind putting more pressure on its largest holdings, including many American depository receipts of Chinese companies.

With that backdrop, broad equity markets still managed to produce gains. The S&P 500 Index gained 6.2% ending the quarter at an all-time high. The EuroStoxx 600 Index appreciated 3.9%, MSCI Emerging Markets produced 2.3%, and the JP Morgan Global High Yield Index added 1.2%. The Russell 2000® Value Index produced 21.2% versus the Russell 2000® Growth Index that added 4.9%. To illustrate the value/growth divide more clearly, S&P Energy and S&P Financials produced 30.1% and 16%, respectively, while S&P Healthcare and S&P Information Technology only gained 3.2% and 2.0.%, respectively.

Hedge fund indexes also performed well during first quarter 2021. HFRI Equity Hedge (Total) Index produced 7.4%, HFRI Event Driven (Total) Index gained 8.2%, HFRI Macro Index added 3.8%, HFRI Relative Value Index increased 3.9%, and HFRI Credit Index ended the quarter up 4.3%. These results are impressive, given the challenges managers faced in both public equity and fixed income markets.

The Long/Short Equity Index produced strong returns during the quarter, but underlying manager performance outcomes were wide ranging. Growth-oriented long/short equity managers investing in technology or biotechnology significantly underperformed their value/cyclical biased peers. Managers that were forced to cover the social media fueled “WallStreetBets” shorts compounded losses. Long/short equity managers produced outcomes of around ±25% during the quarter. This type of outcome is to be expected when a large factor rotation occurs and serves as a good reminder to constrain basis risk in long/short portfolios.

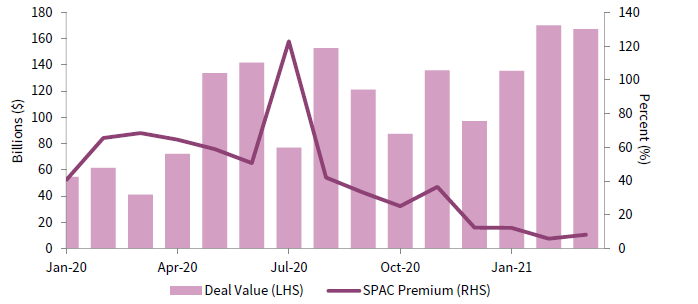

Event driven managers performed well during first quarter 2021. Given that event driven strategies tend to show more correlation to value factors this comes as no surprise. However, event driven managers with significant SPAC (special purpose acquisition company) exposure experienced losses in March as many SPACs declined along with other speculative equities. While SPAC premiums to net asset value built over the last 18 months deflated, new SPAC issuance remained strong. Private companies are seeking alternatives to the traditional IPO. Direct listing and SPACs will continue to provide that option. While we would expect SPAC premiums to shrink and new issuance to slow, SPACs will still provide event driven managers both long and short opportunities to profit from.

Source: Bloomberg L.P.

Notes: SPAC premium is the current price compared to the IPO price, as defined by Bloomberg. Data are as of April 29, 2021, and are based off the deal announcement date.

Similar to Long/Short Equity, uncorrelated hedge fund strategies, such as Global Macro and Fixed Income Relative Value, produced performance results that were wide ranging—we observed a range of outcomes of around ±10%. Performance was driven by interest rate positioning due to the large move in US fixed income. When rates gap quickly in either direction, performance outcomes will vary significantly in some fixed income relative value strategies. The outcomes will be magnified by leverage usage and risk management policies.

First quarter 2021 also marked the one-year anniversary of the COVID-19 pandemic and resulting economic lockdowns. Capital markets have recovered quickly, though Western economies are struggling to return to pre-pandemic output. In the first quarter 2020 edition of Hedge Fund Update, we wrote:

Sustained capital markets volatility should provide stable managers compelling opportunities to generate attractive returns without increasing leverage or allocating to illiquid securities. Talented bottom-up fundamental equity and credit hedge fund teams with the ability to identify and correctly position for the coming disruption should benefit, whereas quantitative-oriented strategies based on historical data may find the going more challenging.

The previous 12 months have been very positive for fundamental investors, as these managers have been able to identify the winners and losers as a result of lockdowns. We continue to believe hedge fund managers will be able to take advantage of the volatility presented by a choppy recovery, policy change by a newly elected US government, and permanent disruption within sectors as a result of COVID-19. Looking ahead, as economic activity recovers to pre–COVID-19 levels, quantitative strategies should also have an opportunity to generate improved returns.

Eric Costa, Global Head of Hedge Funds

Kristin Roesch also contributed to this publication.